How a lot is 0.46 Bitcoin to USD? Properly, because it stands, that’s $56221.89, virtually half a BTC. Why is “0.46 Bitcoin to USD” trending on Google? Who is aware of. The world is bizarre. However analyst Peter Brandt believes it’ll be a lot increased quickly.

The veteran chartist instructed Cointelegraph that, primarily based on historic cycle information, “it’s cheap to count on a bull market excessive any day now.”

Brandt, who appropriately referred to as

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

0.98%

Bitcoin

BTC

Worth

$121,876.51

0.98% /24h

Quantity in 24h

$51.73B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

2018 and 2021 market tops, says the present cycle stays remarkably in step with prior four-year patterns. His mannequin divides every cycle into equal pre-halving and post-halving phases, and by that rely, Bitcoin’s timing window for a brand new excessive simply arrived this week.

“Add 533 days to the April 2024 halving, and bingo, it’s this week,” Brandt stated, noting that Bitcoin set a brand new report above $126,000 on Monday.

Will Bitcoin Preserve Crashing? The Delayed Halving Cycle and What Comes Subsequent

7d

30d

1y

All Time

Bitcoin’s present cycle low occurred on Nov. 9, 2022, precisely 533 days earlier than the April 2024 halving. Brandt notes that each earlier bull run peaked an equal variety of days after the halving, suggesting that the sample stays intact. Nonetheless, he cautions that markets often break their very own guidelines.

“Developments that violate the prevailing cyclic nature of markets are usually essentially the most dramatic,” he stated. “Betting towards a sample with an ideal three-for-three report shouldn’t be executed with reckless abandon.”

I imagine I used to be the primary dealer to ID the parabolic chart development by title in Bitcoin on Oct 2017 $BTC right here: https://t.co/N5jSSGCUJMIf I’m fallacious, present X linkLet the counsel that I’m additionally first to ID and "coin" the phrase "Bitcoin Banana"

cc: @PeterLBrandt pic.twitter.com/TFzkpcqPas

— Peter Brandt (@PeterLBrandt) July 27, 2025

Brandt places the likelihood of a near-term high at 50/50. If Bitcoin avoids peaking within the coming days, he expects an prolonged transfer properly past $150,000, with potential upside as excessive as $185,000 earlier than the following correction.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Bitcoin ETF Flows and the “Debasement Commerce” Narrative: Will We Hit $150,000?

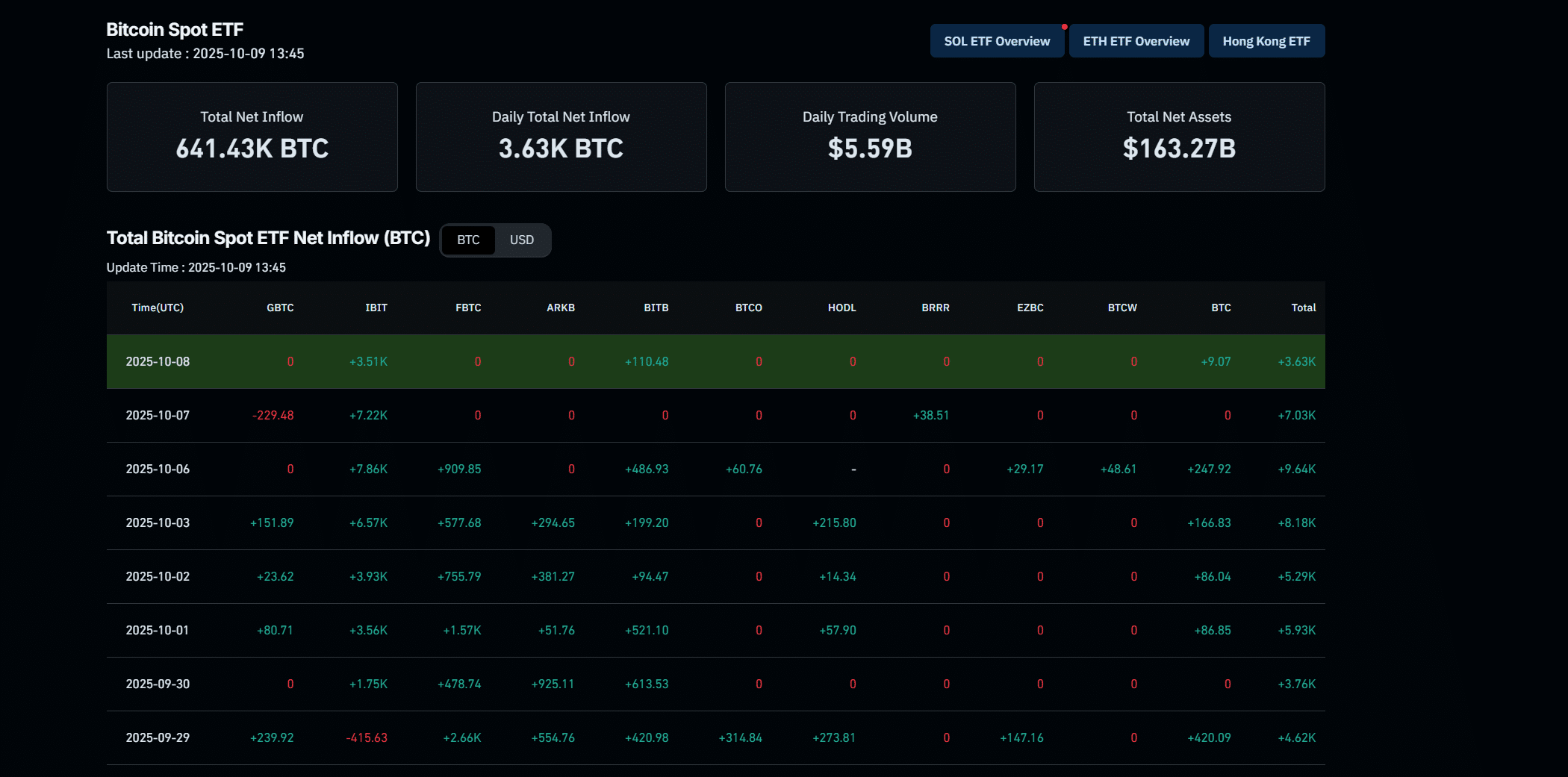

Even when a short-term pullback hits, ETF inflows proceed to color a structurally bullish backdrop. Based on Bitwise CIO Matt Hougan, spot Bitcoin ETFs are on monitor to surpass final 12 months’s $36 Bn report, fueled by a wave of late-year capital rotation.

He highlighted three catalysts for the surge: 1) Bitcoin’s distinctive value efficiency, mounting institutional adoption, and what Wall Road now calls the “debasement commerce” (AKA investing in belongings that lose buying energy)

Bitcoin Vs Gold

A as soon as in a era breakout is coming. pic.twitter.com/Ss2N2uddkW

— The ₿itcoin Therapist (@TheBTCTherapist) October 9, 2025

Gold and Bitcoin stay the best-performing main belongings of 2025. Since 2020, the US cash provide has expanded by 44%, a pattern that’s now driving even conventional corporations, corresponding to Morgan Stanley, to suggest allocations of as much as 4% in BTC for risk-tolerant portfolios.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Information Confirms Institutional Demand and Market Power

Economist Timothy Peterson estimates a 50% probability that Bitcoin will finish the month above $140,000, primarily based on decade-long simulations. In the meantime, Arthur Hayes and Joe Burnett preserve much more aggressive forecasts that we’ll hit $250,000 BTC by the tip of 2025.

Brandt’s mannequin says the highest might be imminent. However on-chain information, ETF flows, and institutional adoption all trace the other: Bitcoin could be warming up.

EXPLORE: Sanae Takaichi Turns into Japan’s First Feminine Prime Minister – What Her Fiscal Insurance policies May Imply for Crypto

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

The clock is ticking on one in all crypto’s longest authorized dramas and the XRP value might be able to rocket.

Economist Timothy Peterson estimates a 50% probability Bitcoin ends the month above $140,000, primarily based on decade-long simulations.

The submit 0.46 Bitcoin to USD: Veteran Dealer Peter Brandt Says Bitcoin’s Bull Market Peak May Arrive Any Day appeared first on 99Bitcoins.