As a dealer, figuring out one of the best crypto staking platforms saves you from losing time, locking funds in low yield swimming pools, or trusting platforms that don’t ship on rewards or safety. With so many choices promising excessive returns, it’s simple to really feel overwhelmed or make a expensive mistake. The best alternative may also help you develop passive revenue steadily, whereas the flawed one can eat into your earnings or restrict flexibility when the market shifts.

On this overview, we’ll clarify one of the best staking platforms to make use of in 2025, how they examine on rewards, ease of use, and security, and which of them make sense relying in your objectives, expertise stage, and most well-liked property. We’ll break every little thing down clearly so you may stake with confidence and maximize returns with out guesswork. Preserve studying

Finest Crypto Platforms for Staking Rewards in 2025

PlatformCryptocurrencies SupportedMaximum Reward RateFeesExchange TypeBinanceBTC, ETH, BNB, ADA, and so on.As much as 10%0%-3.75%CentralizedCrypto.comBTC, ETH, CRO, DOT, and so on.As much as 19%0%-4%CentralizedByBitBTC, ETH, USDT, XRP, and so on.As much as 10%0%-2%CentralizedCoinbaseBTC, ETH, SOL, ADA, and so on.As much as 13%0% – 3.99%CentralizedKuCoinBTC, ETH, KCS, DOT, and so on.As much as 13%0.1%CentralizedKrakenBTC, ETH, DOT, ADA, and so on.As much as 21%0-0.1%CentralizedLidoETHAs much as 8%10% of staking rewardsDecentralizedRocket PoolETHAs much as 3.27%15% of staking rewardsDecentralizedNexoBTC, ETH, USDT, and so on.As much as 15%No charges for stakingCentralizedStakelyETH, ADA, DOT, and so on.As much as 34%Validator charges differ (low)DecentralizedGeminiBTC, ETH, GUSD, and so on.As much as 8%No charges for stakingCentralizedMargexBTC, ETH, USDT, and so on.As much as 11%No infomCentralizedAaveETH, USDT, DAI, and so on.As much as 9%0.09%DecentralizedBakeBTC, ETH, DFI, and so on.As much as 20%0.1% – 0.2%CentralizedBabylon LabsETH, BTC, and so on.As much as 10%No informationDecentralized

15 Finest Crypto Staking Platforms Reviewed By Our Consultants

Relating to incomes passive revenue by way of cryptocurrency, selecting the best platform is essential. With quite a few choices accessible, discovering one of the best crypto platforms for staking rewards could be overwhelming. To make your choice simpler, we’ve reviewed the highest 15 platforms, highlighting their staking choices, key options, and what units them aside.

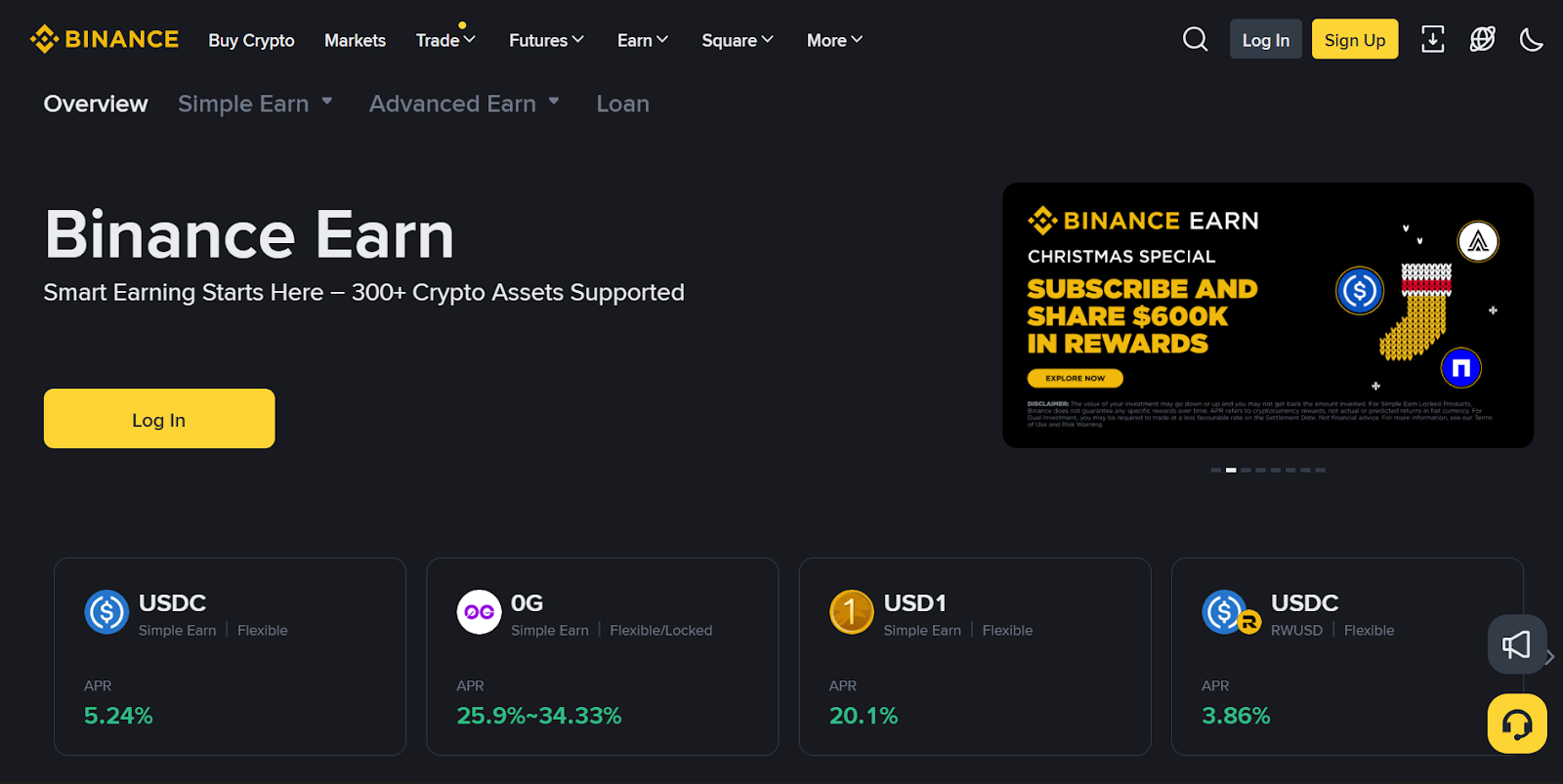

1. Binance

Binance stays one of the broadly used choices for staking come 2025, particularly if you need every little thing in a single place. You’ll be able to commerce, stake, and handle your portfolio with out transferring funds between platforms, saving time and lowering complexity. Supporting over 60 proof-of-stake cash, Binance offers each flexibility and management, making it a best choice for maximizing rewards. Its aggressive APY charges and strong safety measures guarantee a dependable and rewarding staking expertise. Whether or not you’re new to staking or a seasoned investor, Binance’s user-friendly interface makes it simple to get began.

Staking Choices

Binance gives each versatile and locked staking choices. Versatile staking lets you withdraw your funds anytime, whereas locked staking offers larger rewards for committing your property for a set interval. Standard cash like Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) can be found for staking.

Key Options

Clear reward charges and lockup intervals.Auto-invest plans for compounding returns.Business-leading safety with a number of safety layers.A user-friendly interface for simple navigation.

2. Crypto.com

Crypto.com simplifies staking by integrating it into its broader ecosystem, making it simple to handle alongside buying and selling and spending. With help for over 250 cryptocurrencies, it’s a flexible platform for incomes passive revenue. The platform’s concentrate on predictability and clear phrases makes it preferrred if you happen to choose stability over chasing high-risk returns. Its intuitive app design ensures that managing rewards, spending, and buying and selling feels easy, even for newbies.

Staking Choices

Crypto.com gives versatile and fixed-term staking choices. Fastened-term staking offers larger APY charges, whereas versatile staking lets you preserve liquidity. CRO token holders get pleasure from extra advantages, together with boosted rewards and unique perks.

Key Options

APY charges as much as 19% for choose property.Enhanced rewards for CRO token holders.Sturdy safety measures to guard your property.Clear phrases and a beginner-friendly interface.

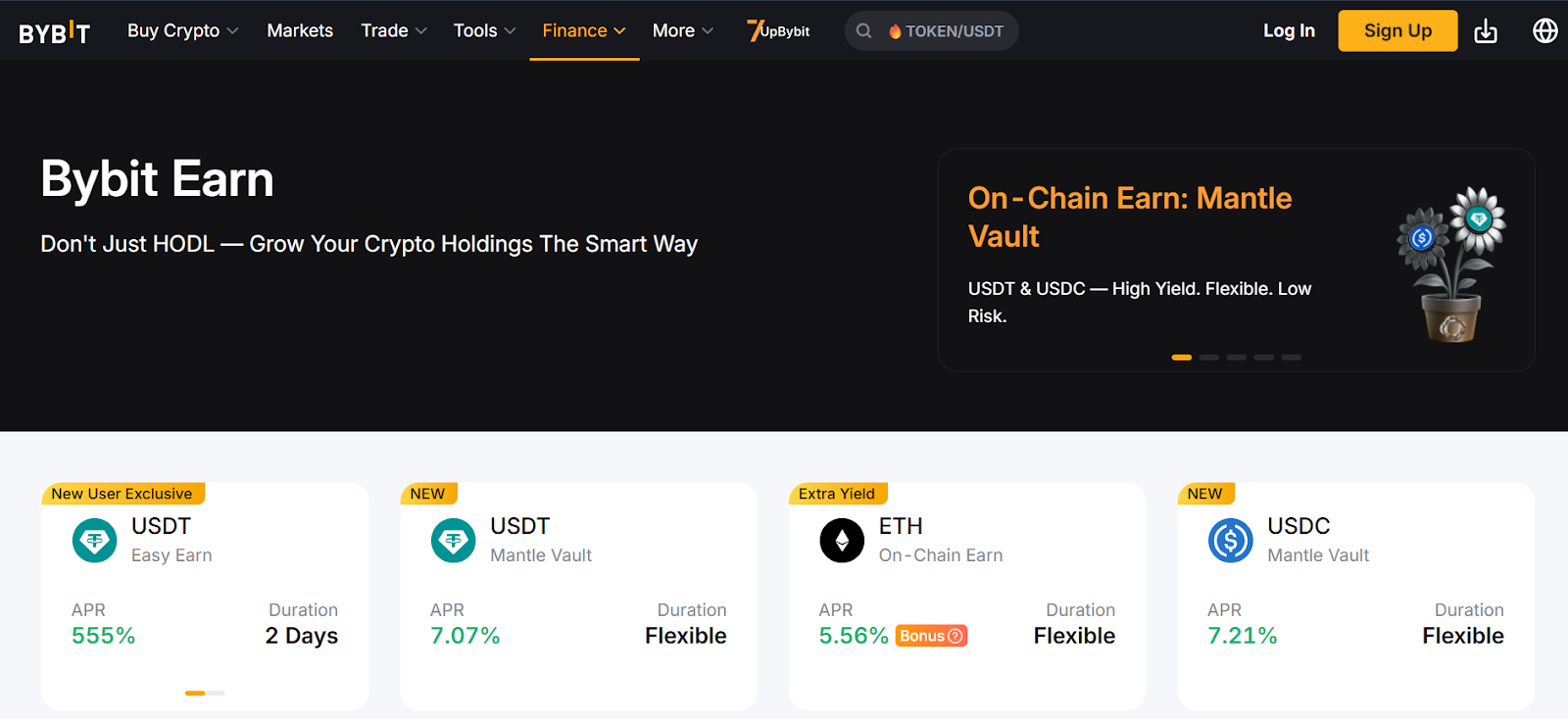

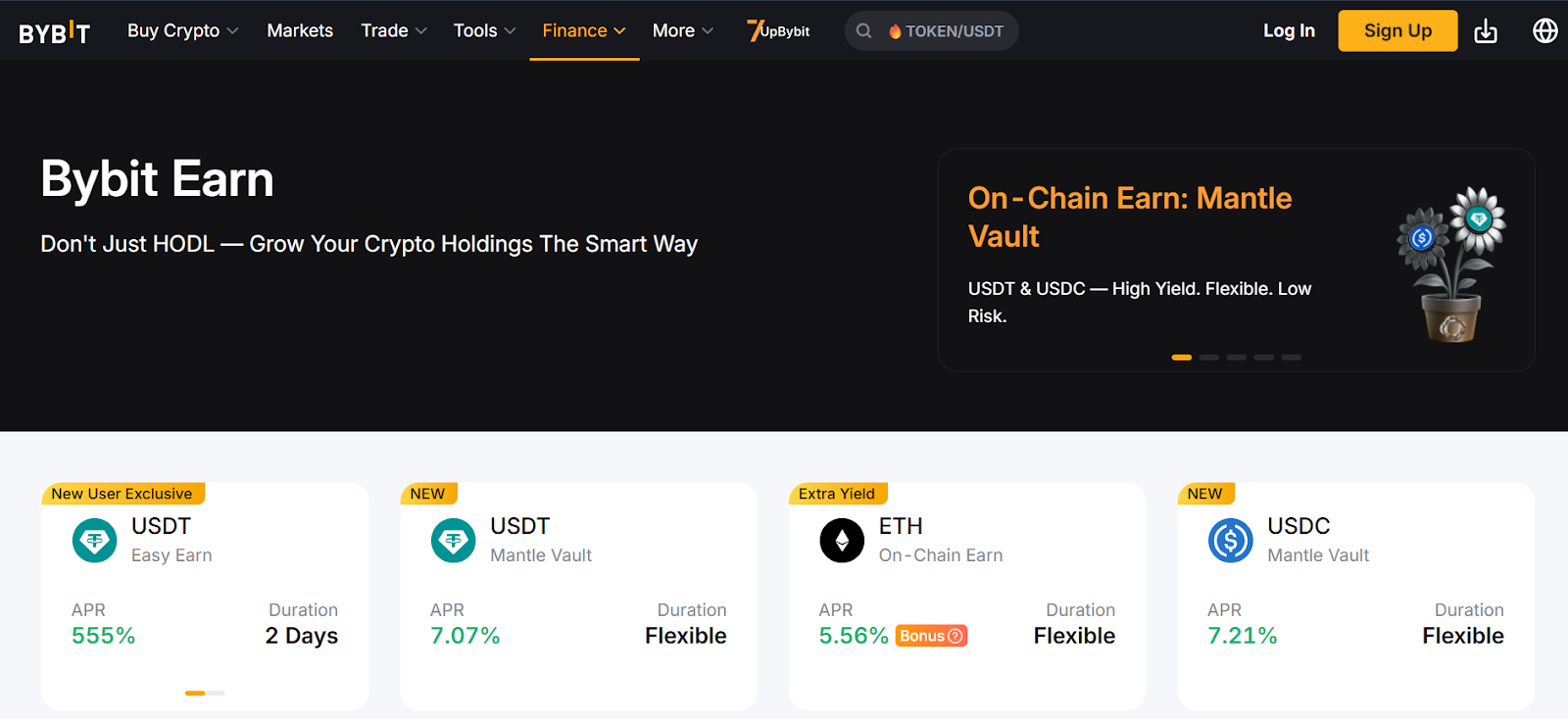

3. ByBit

ByBit is tailor-made for lively merchants who wish to earn staking rewards with out interrupting their buying and selling actions. Supporting over 650 cryptocurrencies, ByBit combines flexibility with high-yield alternatives. Its frequent limited-time promotions with boosted returns make it a dynamic alternative for maximizing rewards. ByBit’s concentrate on pace and adaptability ensures that you may transfer funds simply and monitor rewards in actual time.

Staking Choices

ByBit offers versatile staking merchandise, permitting you to withdraw funds anytime. It additionally gives promotional staking occasions with larger APY charges for a restricted interval. Standard property like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) can be found for staking.

Key Options

Actual-time monitoring of staking rewards.Seamless integration with buying and selling actions.Aggressive APY charges on a variety of property.A concentrate on pace and adaptability for lively traders.

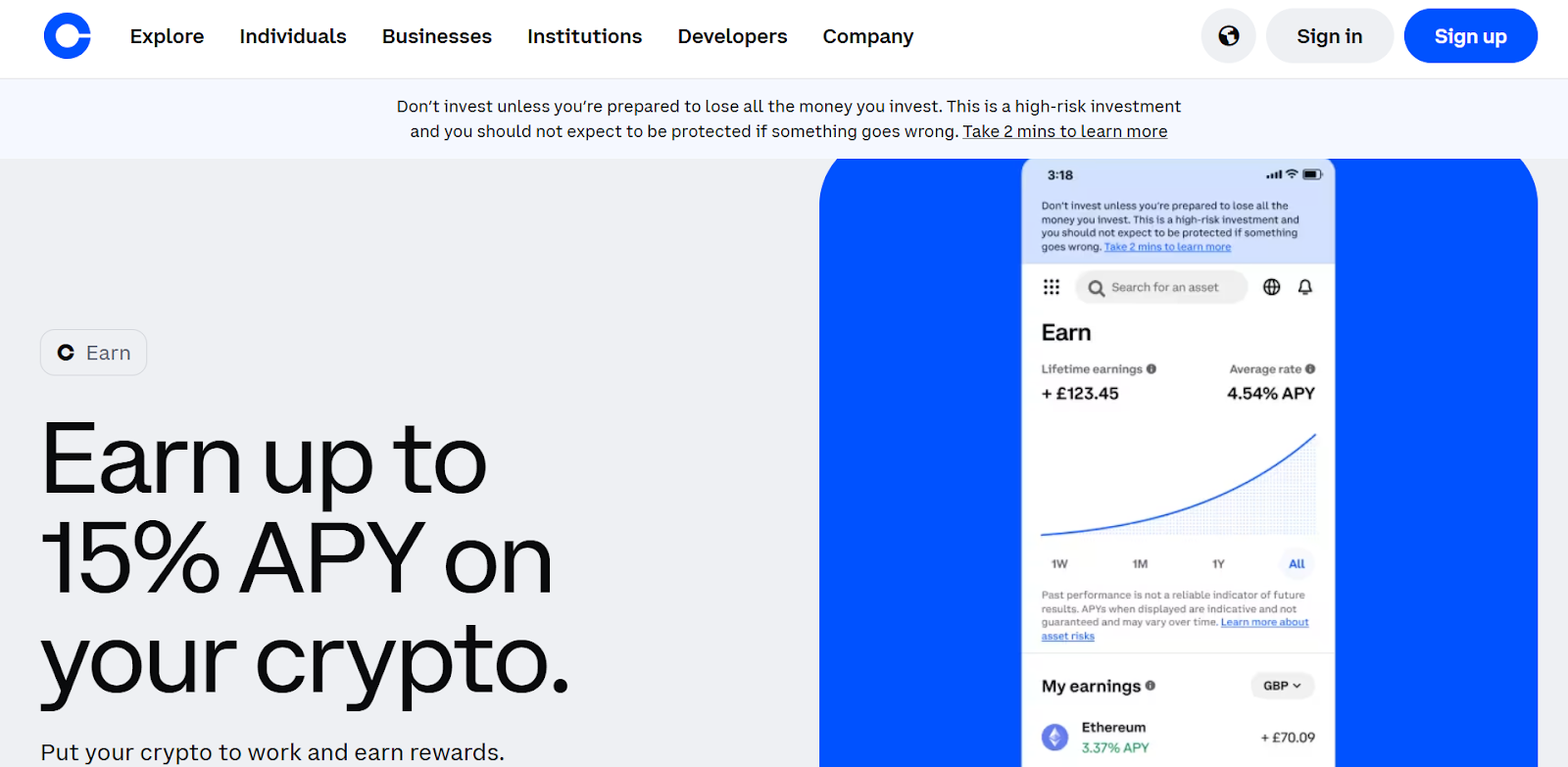

4. Coinbase

Coinbase is a trusted title within the crypto house, identified for its clear and controlled strategy to staking. It’s a wonderful alternative if you happen to worth simplicity and safety over maximizing yields. With help for six main cryptocurrencies, Coinbase ensures an easy staking expertise. Its repute as a safe and controlled trade provides an additional layer of belief, making it a favourite amongst long-term holders.

Staking Choices

Coinbase gives staking for Ethereum (ETH), Solana (SOL), and different common property. Most staking choices include no lockup intervals, offering flexibility for long-term holders. Rewards are calculated transparently, and payouts are constant.

Key Options

Clear explanations of reward calculations and payout schedules.No hidden phrases or advanced lockups.A safe and controlled setting for peace of thoughts.Consumer-friendly interface for newbies and skilled traders alike.

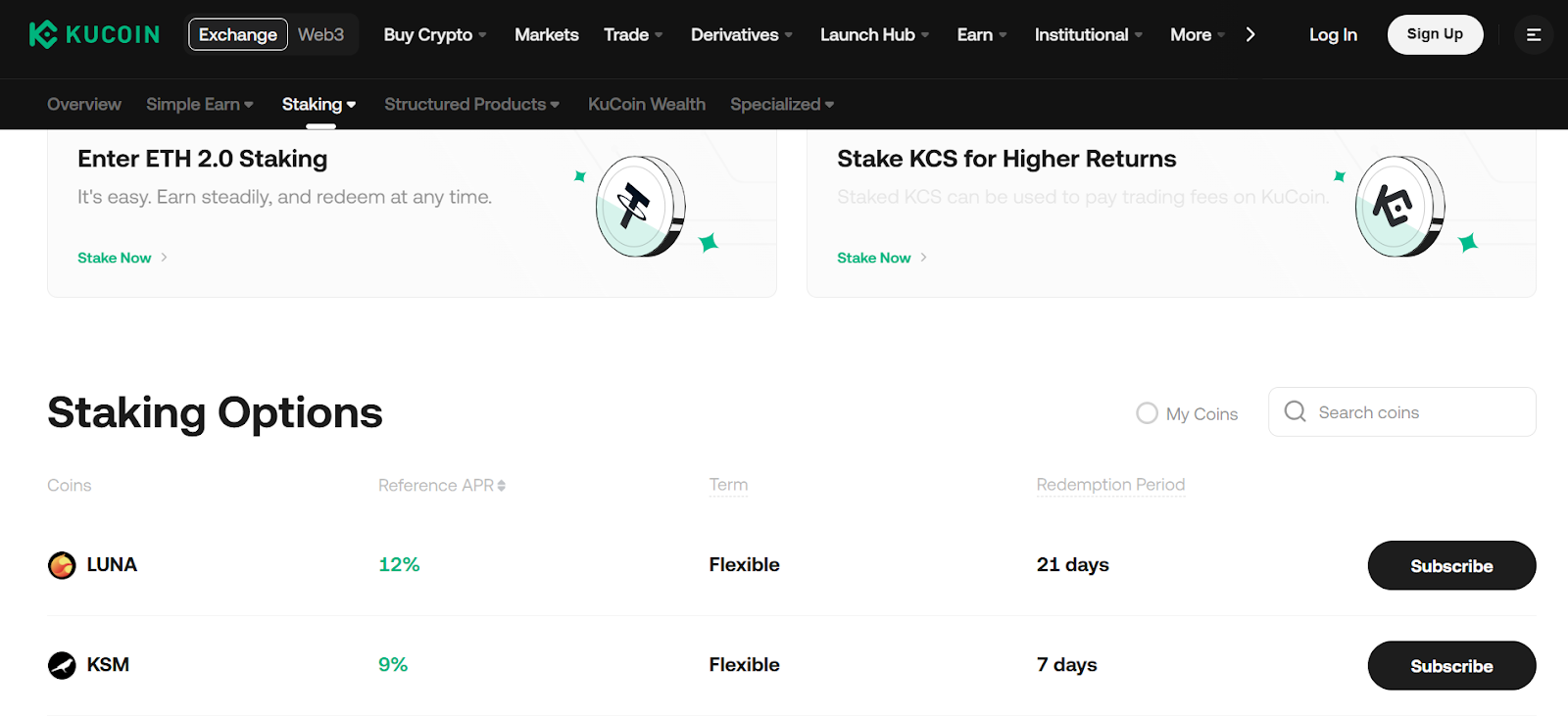

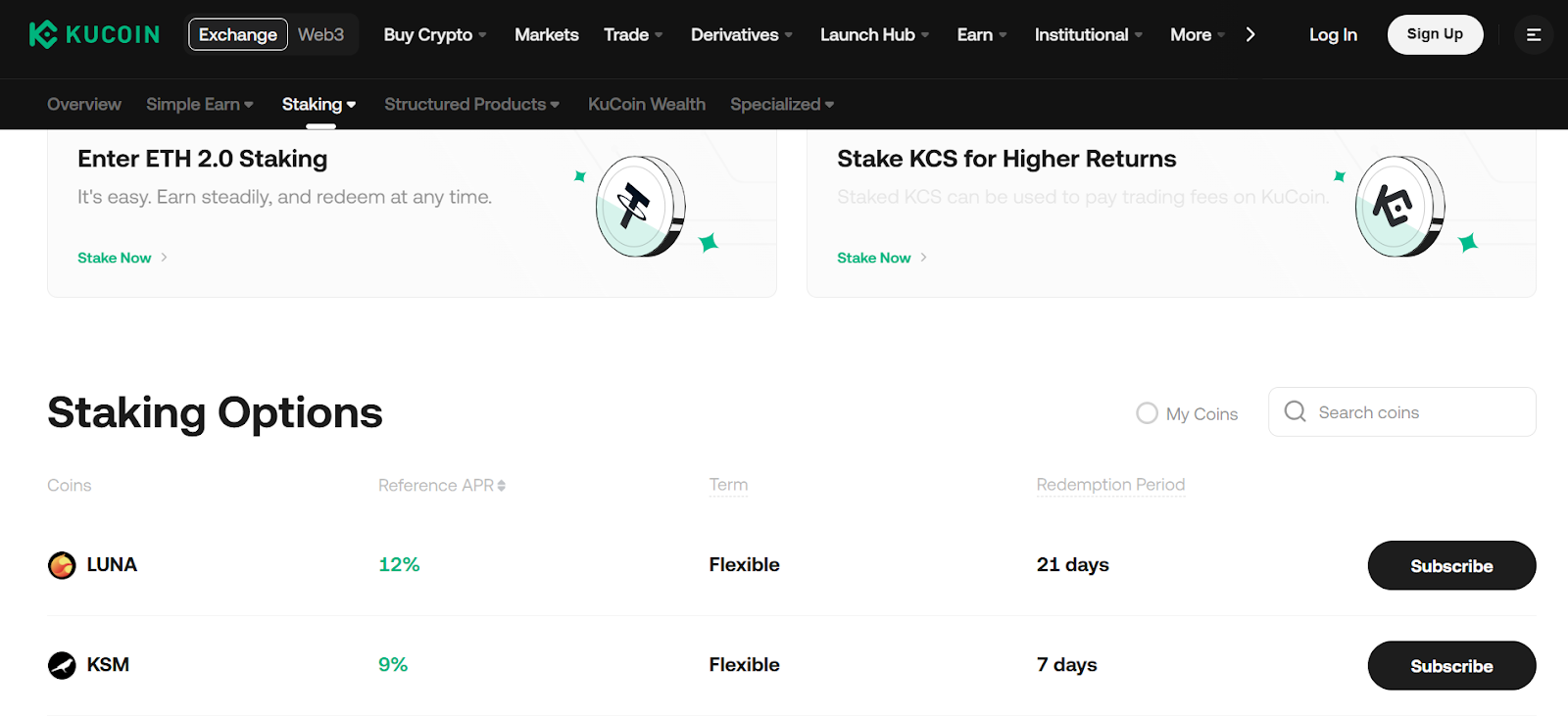

5. KuCoin

KuCoin is a go-to platform for many who get pleasure from exploring lesser-known cash. With help for over 50 cryptocurrencies, it gives a wide range of staking choices to swimsuit totally different funding methods. KuCoin’s promotional occasions and excessive APY charges on rising property make it a standout alternative. Its robust safety measures and international attain guarantee a protected and rewarding staking expertise.

Staking Choices

KuCoin offers each versatile and locked staking choices. Locked staking gives larger rewards, whereas versatile staking ensures liquidity. The platform additionally helps staking for newer and fewer frequent cash, providing you with entry to distinctive alternatives.

Key Options

Entry to a variety of staking property.Excessive APY charges on rising cryptocurrencies.KuCoin Earn for extra incomes alternatives.Sturdy safety measures to guard your investments.

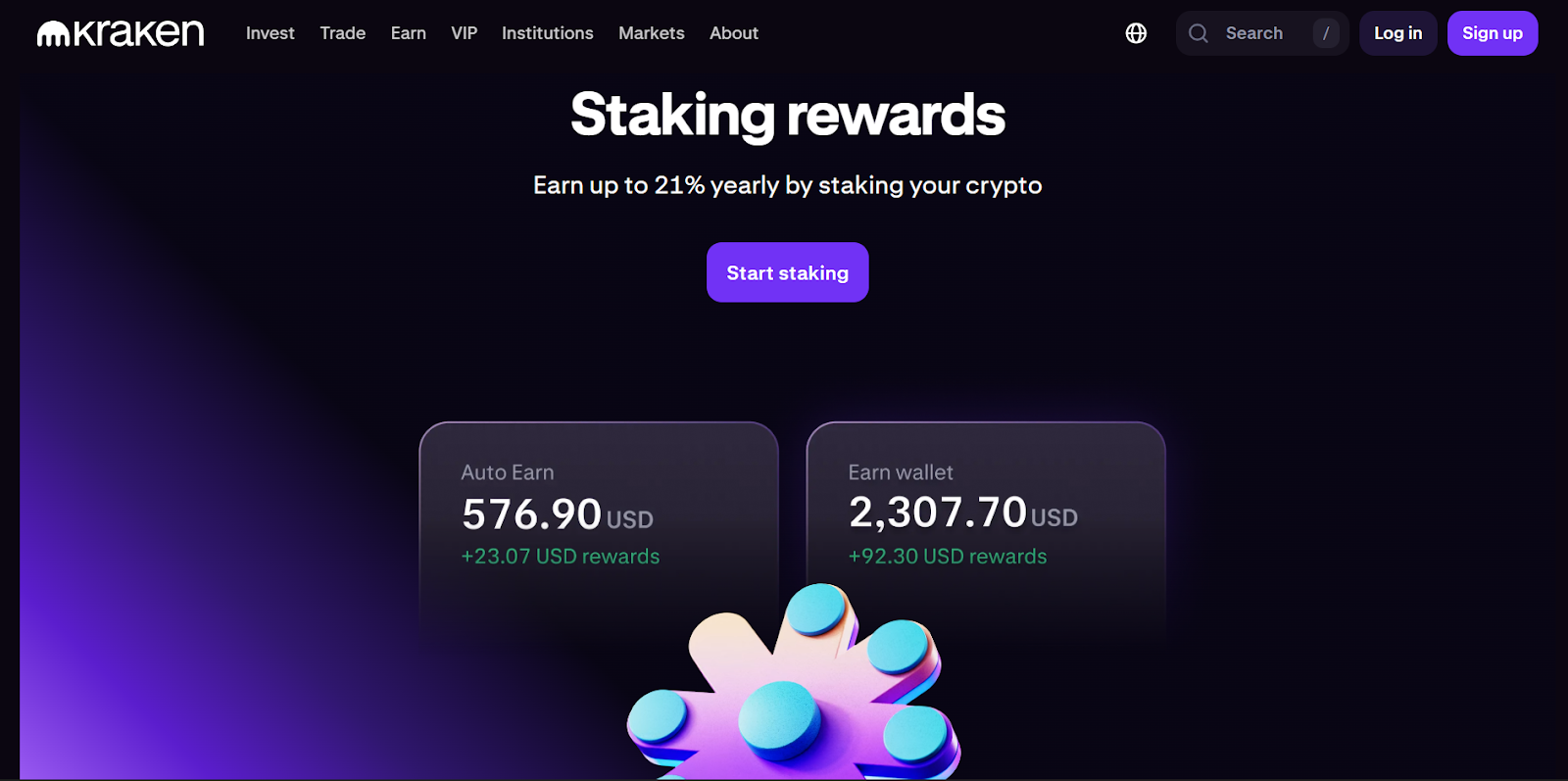

6. Kraken

Kraken focuses on stability and consistency, providing staking for over 200 cryptocurrencies with APY charges of as much as 21%. The platform’s clear reward schedules and punctiliously chosen property make it a dependable alternative if you happen to worth predictability. Kraken’s low charges and clear reward schedules add to its attraction, making it a trusted title within the crypto house.

Staking Choices

Kraken offers each versatile and bonded staking choices. Bonded staking gives larger rewards however requires an extended dedication interval. Supported property embody Ethereum (ETH), Polkadot (DOT), and Cardano (ADA).

Key Options

APY charges of as much as 21% on choose property.Low charges starting from 0% to 0.1%.A concentrate on safety and transparency.Detailed analytics to optimize your staking technique.

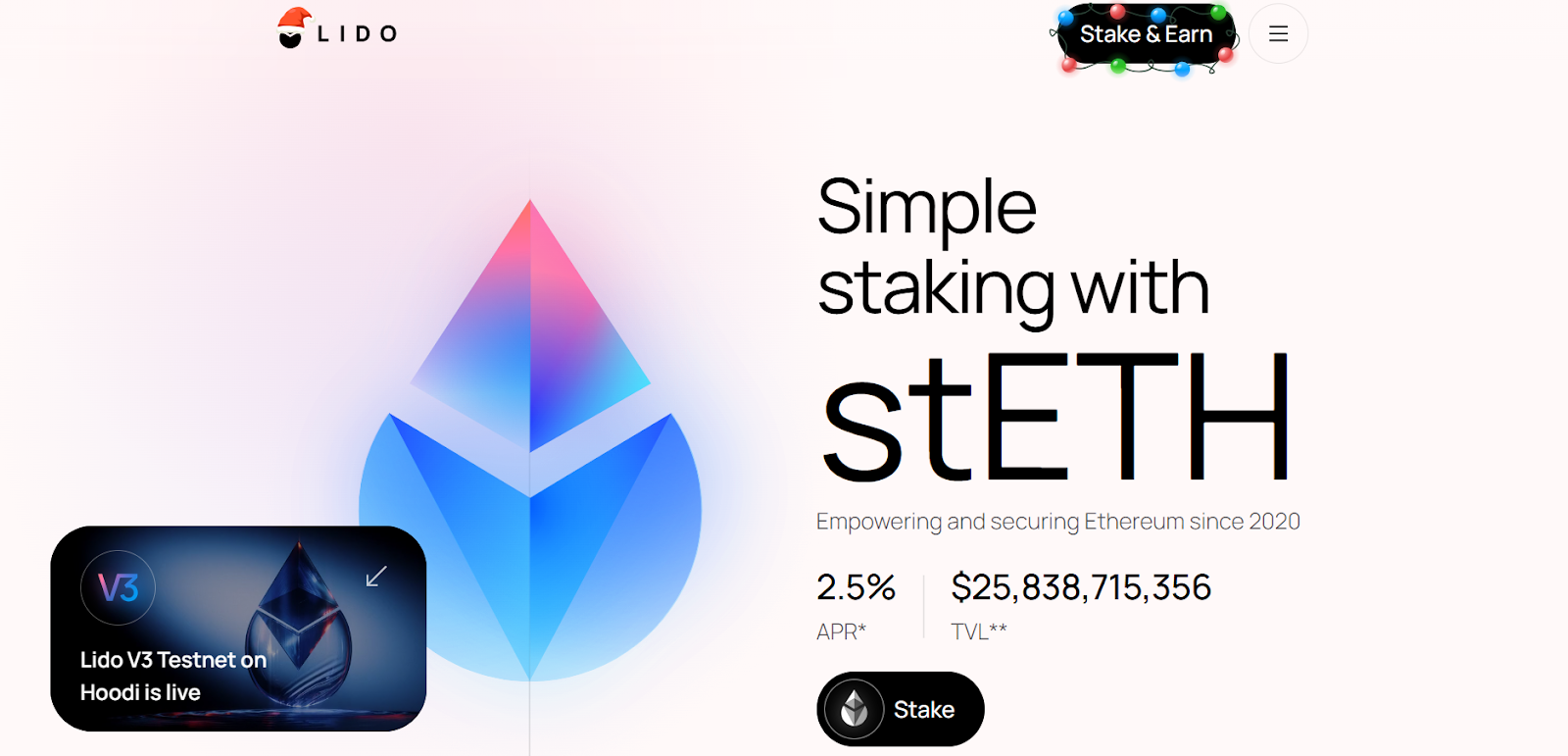

7. Lido

Lido is a decentralized platform specializing in liquid staking, notably for Ethereum. It lets you stake ETH whereas holding your property usable throughout decentralized functions. This distinctive strategy makes Lido a favourite amongst DeFi lovers. Its non-custodial nature ensures that you just retain management of your property, whereas its concentrate on safety and transparency has earned it a powerful repute.

Staking Choices

Lido helps liquid staking for Ethereum, the place you obtain stETH tokens representing your staked ETH. These tokens can be utilized in DeFi protocols for extra incomes alternatives.

Key Options

Non-custodial staking for enhanced safety.APY charges of as much as 8% for Ethereum staking.Flexibility to make use of staked property in DeFi functions.A robust repute for transparency and innovation.

8. Rocket Pool

Rocket Pool is a community-driven platform that emphasizes decentralization and community well being. It’s a wonderful alternative if you wish to take part in Ethereum staking with out operating your individual infrastructure. Rocket Pool’s concentrate on decentralization and safety makes it a standout alternative among the many finest DeFi staking platforms.

Staking Choices

Rocket Pool gives liquid staking and node operation choices. You’ll be able to stake ETH and obtain rETH tokens, which can be utilized throughout DeFi platforms. Node operators earn extra incentives, including worth to the staking course of.

Key Options

Decentralized staking with group involvement.Extra incentives for node operators.APY charges of as much as 3.27% for Ethereum staking.A concentrate on safety and decentralization.

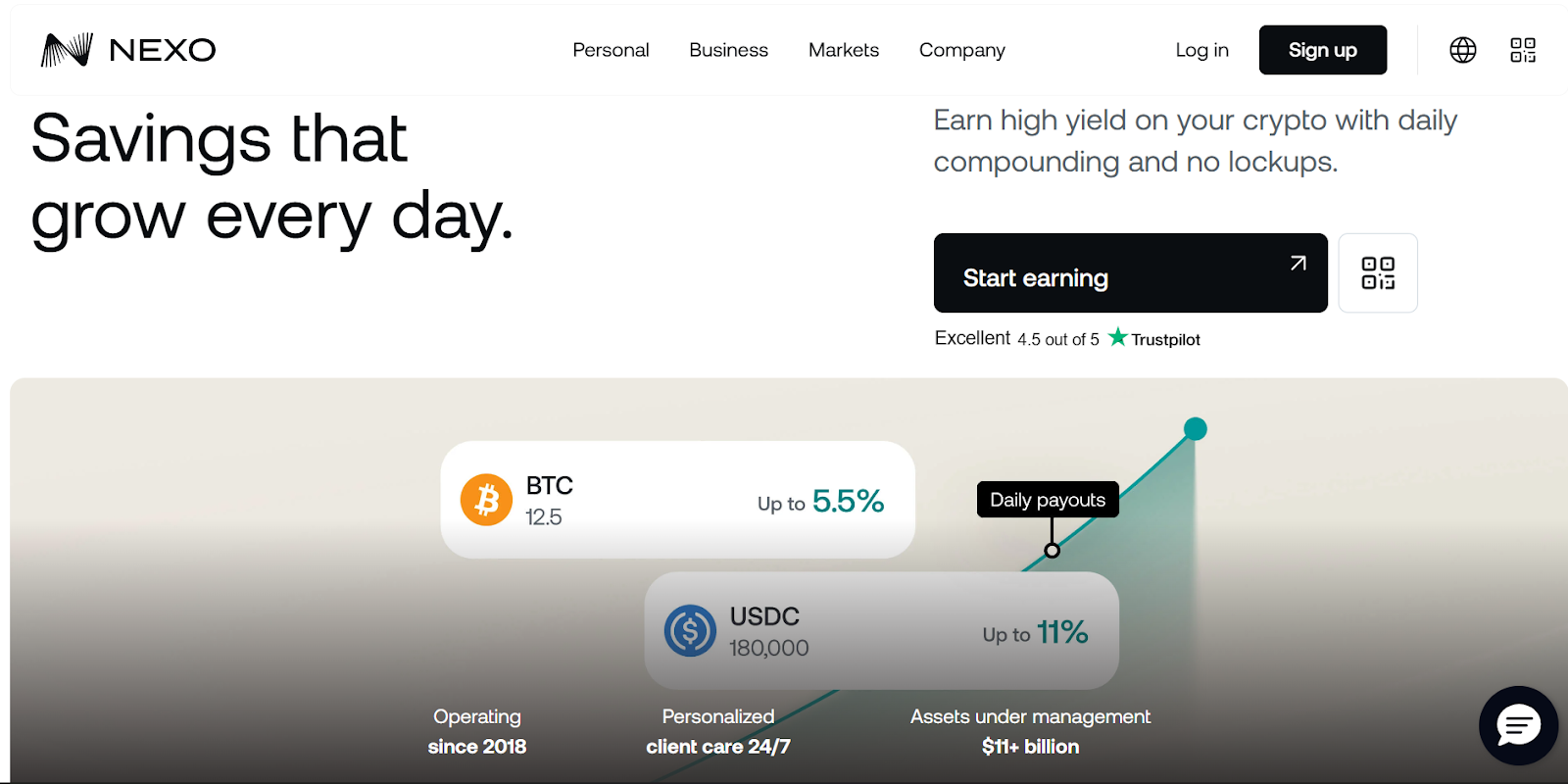

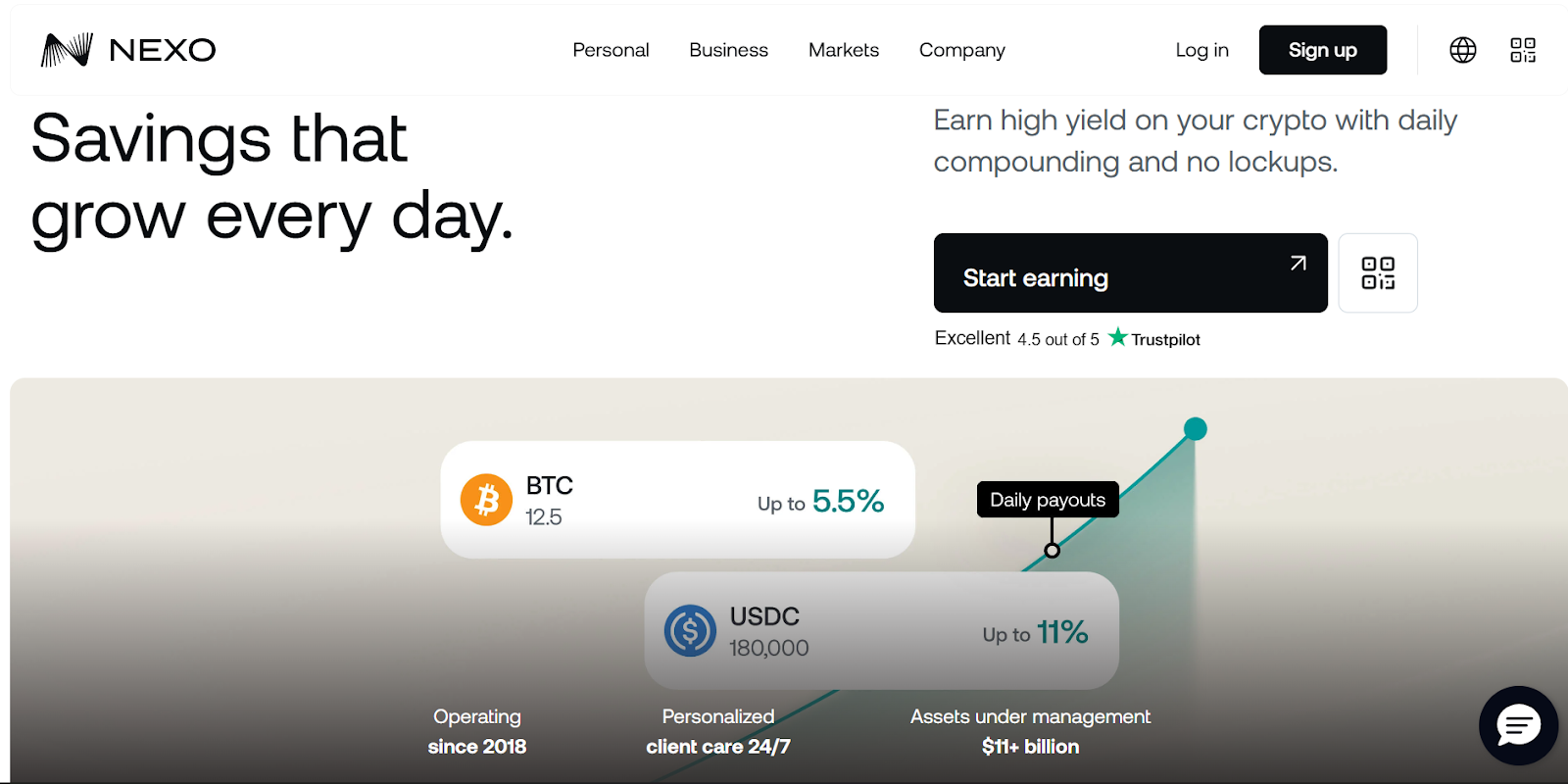

9. Nexo

Nexo combines staking with broader incomes options, making it a handy choice for passive revenue. With frequent payouts and clearly outlined reward tiers, Nexo simplifies the staking course of. Its user-friendly interface and powerful safety measures guarantee a seamless staking expertise.

Staking Choices

Nexo helps staking for over 20 cryptocurrencies, together with Ethereum (ETH) and Bitcoin (BTC). Rewards are primarily based on loyalty ranges, with larger tiers providing higher returns.

Key Options

APY charges of as much as 15% on choose property.Day by day payouts for constant earnings.A user-friendly interface for easy administration.Sturdy safety measures to guard your funds.

10. Stakely

Stakely is a validator service that stands out among the many finest crypto trade platforms for its concentrate on reliability and transparency. It’s a wonderful alternative if you wish to take part immediately in community validation with out the trouble of technical setup. Supporting over 30 blockchains, Stakely offers a safe and user-friendly staking expertise. Its emphasis on infrastructure-focused participation makes it a trusted title within the staking group.

Staking Choices

Stakely helps staking for a variety of blockchains, together with Ethereum (ETH), Polkadot (DOT), and Cosmos (ATOM). Rewards differ by chain, with some providing the very best APY crypto staking charges, reaching as much as 34%.

Key Options

Non-custodial staking for enhanced management.Staking insurance coverage to guard in opposition to slashing occasions.A concentrate on reliability and transparency.Help for over 30 blockchains, making it among the finest platforms for crypto staking.

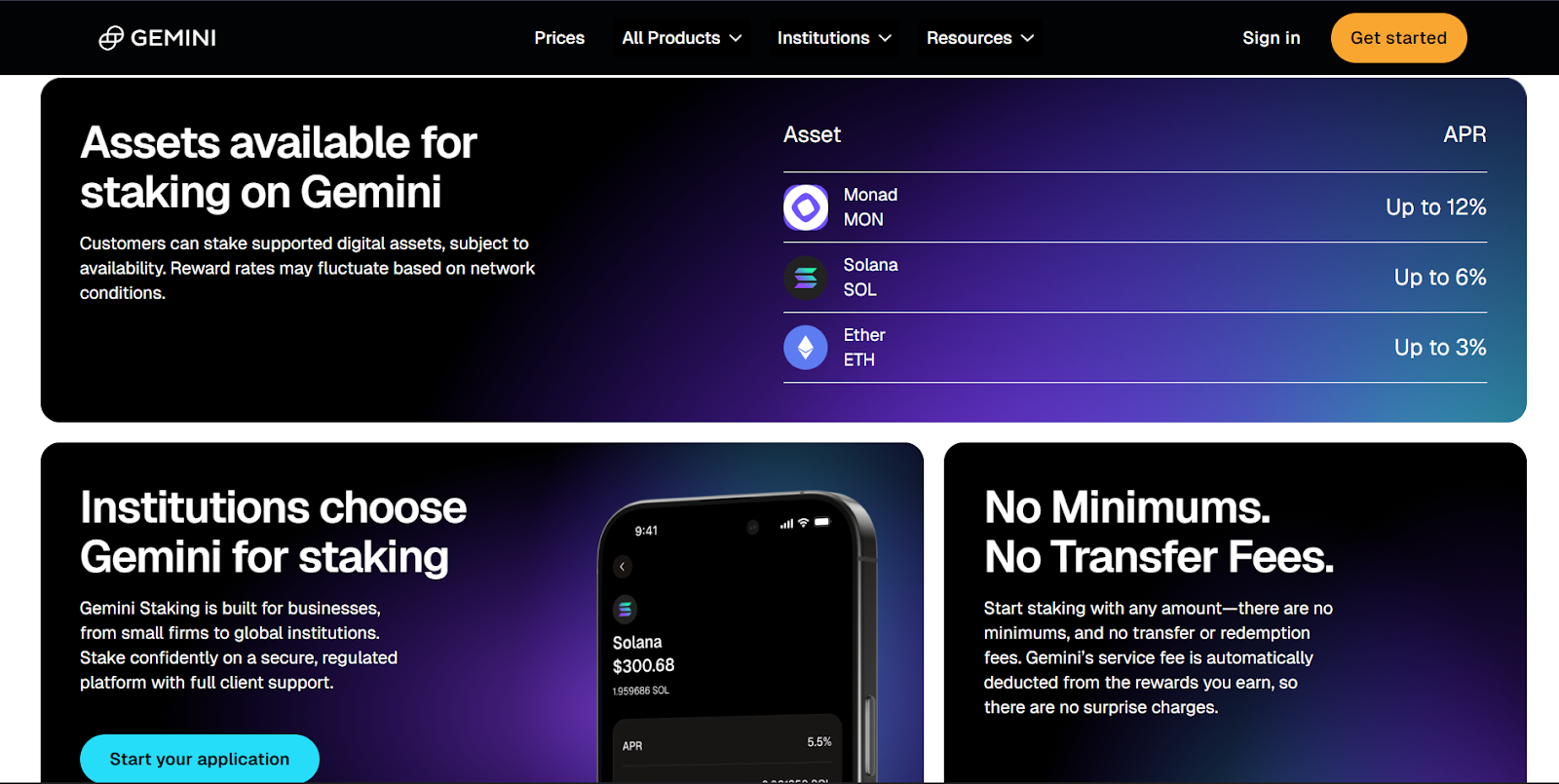

11. Gemini

Gemini is a regulated platform that prioritizes safety and compliance, making it a best choice for conservative traders. Whereas its staking choices are restricted, Gemini’s concentrate on person safety and transparency ensures an easy and safe expertise. If you happen to’re searching for a platform that balances simplicity with belief, Gemini earns its place among the many finest staking suppliers.

Staking Choices

Gemini helps staking for Ethereum (ETH), Solana (SOL), and some different cryptocurrencies. With APY charges of as much as 8%, it’s a dependable choice for long-term methods.

Key Options

A safe and controlled setting.Clear reward calculations and payout schedules.Consumer-friendly interface for an easy expertise.A robust concentrate on compliance, making it among the finest crypto platforms for staking rewards.

12. Margex

Margex is a flexible platform that integrates staking-style incomes instruments alongside buying and selling options. It’s an awesome choice if you wish to earn passive rewards with out leaving an lively buying and selling setting. Margex’s simplicity and concentrate on comfort make it a related alternative among the many finest crypto staking platforms.

Staking Choices

Margex helps staking for over 55 cryptocurrencies, together with Bitcoin (BTC) and Ethereum (ETH). With APY charges of as much as 11%, it gives aggressive rewards for merchants who worth flexibility.

Key Options

Seamless integration with buying and selling actions.Aggressive APY charges on choose property.An easy and user-friendly interface.A concentrate on comfort for lively merchants, making it among the finest platforms for crypto staking.

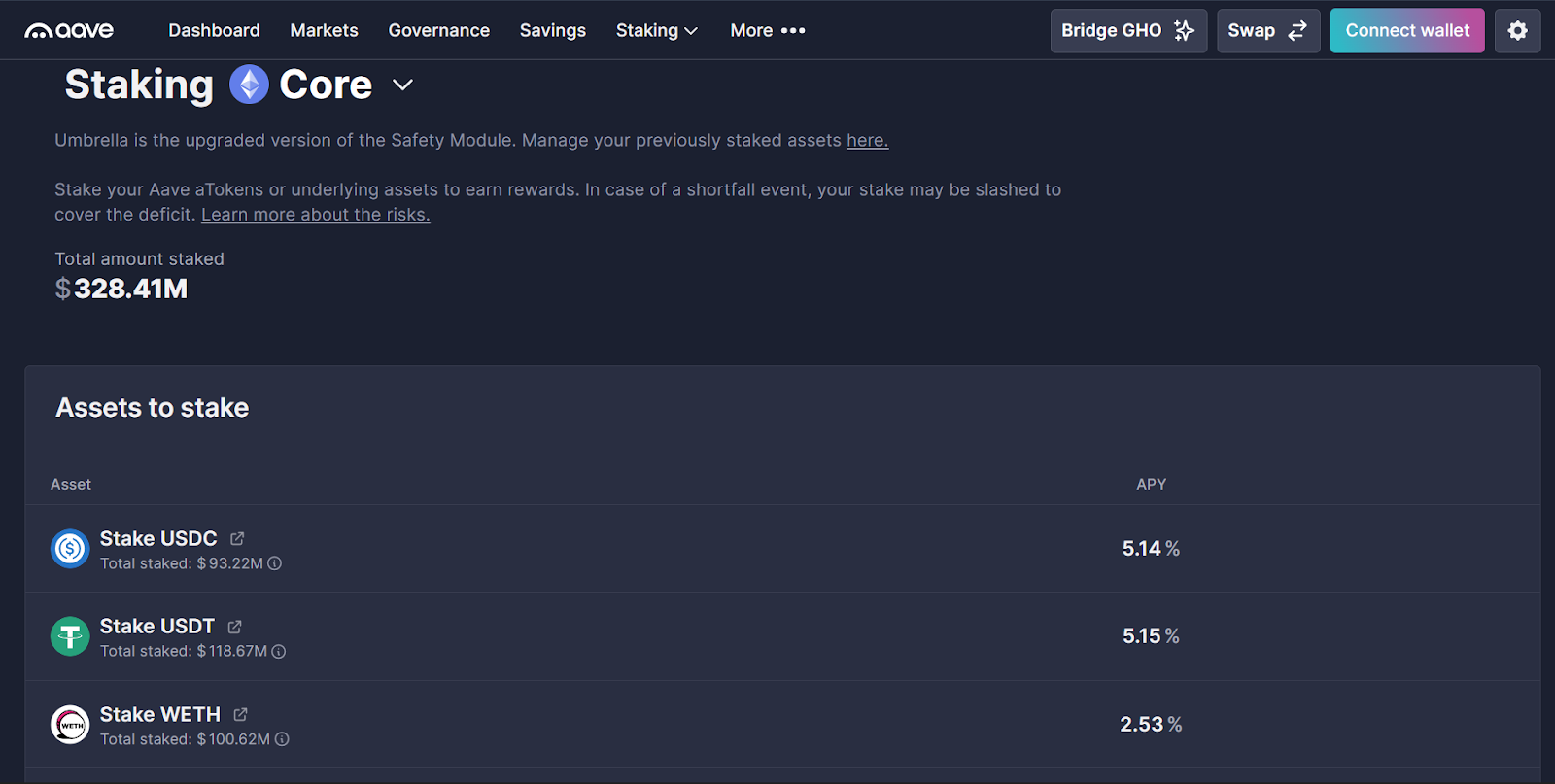

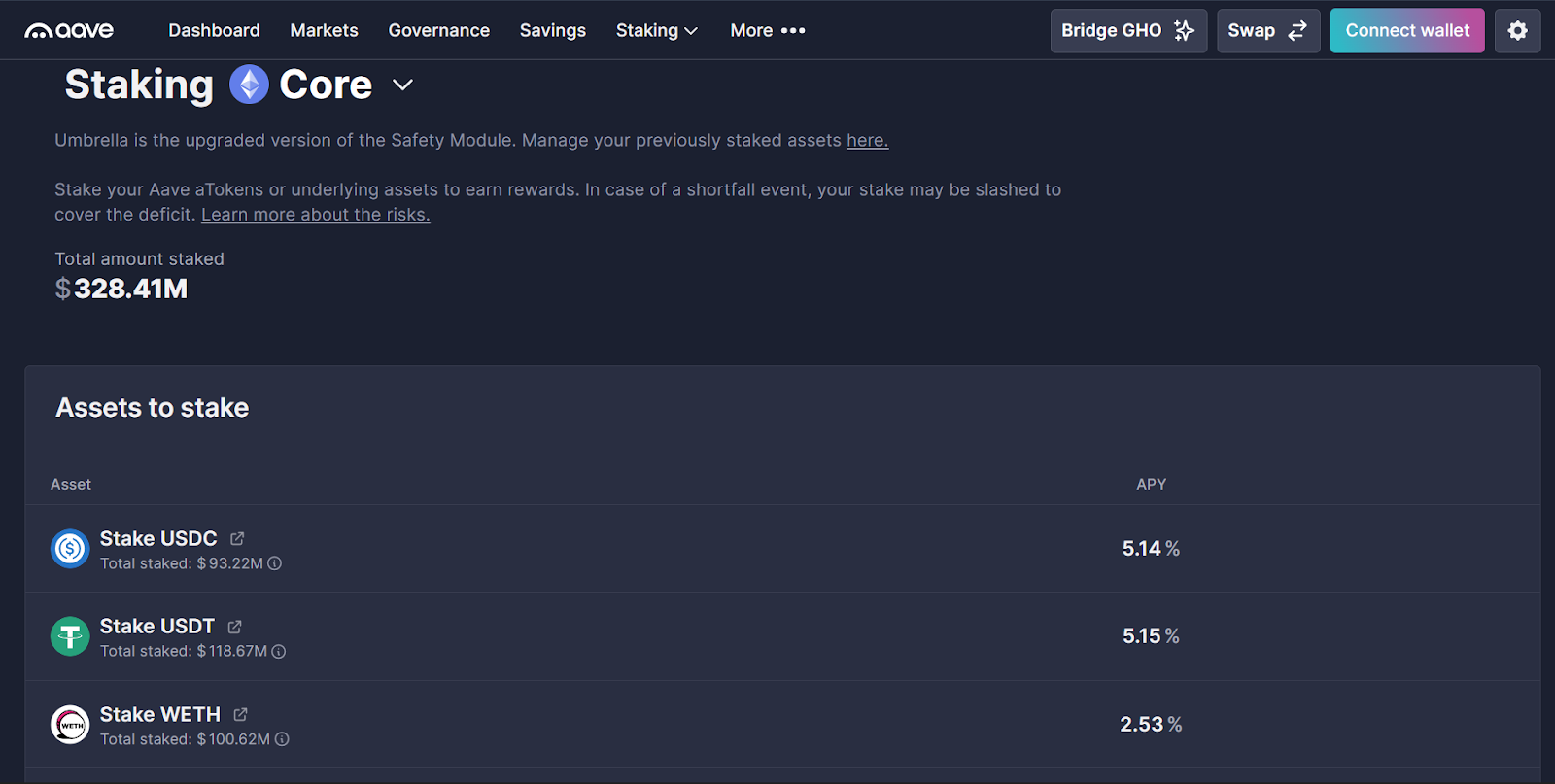

13. Aave

Aave is a decentralized finance (DeFi) protocol that provides staking and lending providers, making it among the finest DeFi staking platforms. It’s a powerful alternative if you happen to’re comfy with DeFi mechanics and need extra management over your investments. Aave’s concentrate on transparency and innovation ensures a rewarding expertise for superior traders.

Staking Choices

Aave helps staking for over 30 cryptocurrencies, together with stablecoins and Ethereum (ETH). Rewards rely on market demand and liquidity utilization, with APY charges reaching as much as 12.22%.

Key Options

Clear reward buildings and payout schedules.A concentrate on innovation and person empowerment.Superior options for knowledgeable DeFi traders.Acknowledged as among the finest Ethereum staking platforms for its flexibility and management.

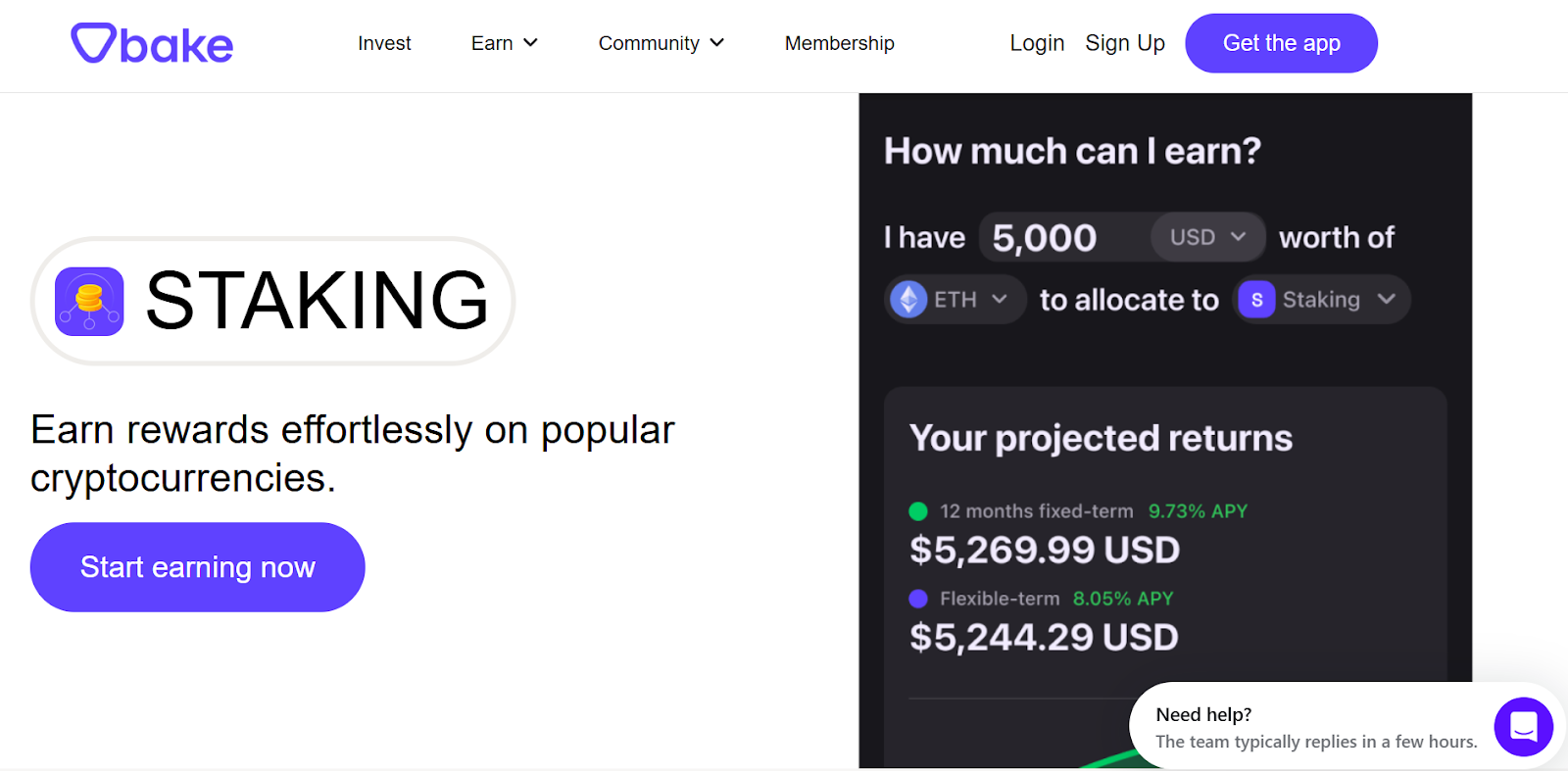

14. Bake

Bake simplifies decentralized incomes with a beginner-friendly design and clear explanations. It’s a wonderful platform if you happen to’re transitioning from centralized platforms into DeFi. The platform emphasizes transparency by displaying reward calculations and permitting customers to confirm exercise on-chain.

Staking Choices

Bake helps staking for a number of Proof-of-Stake property, together with ETH, MATIC, DFI, and others. Relying on the asset, customers might have entry to versatile staking choices that permit unstaking with out lengthy lock-up intervals.

Key Options

Clear reward calculations and payout schedules.Newbie-friendly interface for simple navigation.A concentrate on person training and group engagement.Aggressive APY charges, making it among the finest staking platforms for brand spanking new DeFi customers.

15. Babylon Labs

Babylon Labs is an rising platform that focuses on safety and innovation in staking infrastructure. Whereas nonetheless creating, it reveals robust potential for progress and is gaining recognition as among the finest crypto staking platforms to look at in 2025.

Staking Choices

Babylon Labs helps staking for over 10 cryptocurrencies, with a concentrate on rising networks. Particular APY charges and charges are but to be disclosed, however the platform emphasizes decentralization and community well being.

Key Options

A concentrate on decentralization and community well being.Modern staking options for rising networks.Sturdy emphasis on safety and transparency.A promising platform for forward-thinking traders, making it among the finest platforms for crypto staking rewards.

What’s a Crypto Staking Platform?

A crypto staking platform is a service or software that lets you earn rewards by collaborating within the validation of blockchain transactions. In easier phrases, it’s a approach to put your cryptocurrency to work and generate passive revenue. These platforms help proof-of-stake (PoS) blockchains, the place you may lock up your property, a course of often called staking to assist safe the community and validate transactions. In return, you earn rewards, usually within the type of extra cryptocurrency.

If you happen to’re questioning what’s staking crypto, it’s the method of committing your digital property to a blockchain community for a set interval. This helps preserve the community’s operations and safety. Staking platforms simplify this course of by offering user-friendly interfaces, clear reward buildings, and extra options like versatile or locked staking choices. Whether or not you’re a newbie or an skilled investor, these platforms make it simple to take part in staking and earn rewards with no need technical experience.

Learn how to Select the Finest Staking Platform

Choosing the proper staking platform is essential to maximizing your rewards and making certain the protection of your property. With so many choices accessible, it’s necessary to judge platforms primarily based on particular standards. Listed below are six key elements to think about when selecting one of the best staking platform in your wants:

1. Search for the Highest APY Crypto Staking Choices

One of many first issues to examine is the APY or Annual Proportion Yield provided by the platform. The best APY crypto staking choices can considerably enhance your earnings, particularly if you’re staking for the long run. Nonetheless, be cautious of platforms providing unrealistically excessive returns, as they might include hidden dangers. At all times steadiness excessive rewards with platform reliability.

2. Consider Safety and Popularity

Safety must be a high precedence when selecting a staking platform. Search for platforms with a powerful repute, strong safety measures, and a historical past of defending person funds. Options like two-factor authentication, chilly storage, and insurance coverage in opposition to slashing occasions can present an added layer of safety.

3. Examine for Ethereum Staking Help

In case you are concerned about staking Ethereum, make sure the platform helps it. Ethereum is likely one of the hottest property for staking, and platforms like Lido and Rocket Pool are sometimes acknowledged as one of the best Ethereum staking platforms. Moreover, understanding what’s Ethereum and its position in decentralized finance may also help you make knowledgeable choices about staking this asset.

4. Take into account Flexibility and Lockup Durations

Completely different platforms supply various ranges of flexibility. Some help you withdraw your funds anytime by way of versatile staking, whereas others require you to lock up your property for a set interval by way of locked staking. If you happen to want liquidity, go for platforms with versatile staking choices. For larger rewards, locked staking could also be a better option.

5. Assess Consumer Expertise and Interface

A user-friendly interface could make a giant distinction, particularly if you’re new to staking. Platforms like Crypto.com and Binance are identified for his or her intuitive designs, making it simple to trace rewards, handle property, and navigate the staking course of. Select a platform that simplifies the expertise with out compromising on options.

6. Examine Charges and Extra Options

Charges can eat into your staking rewards, so you will need to examine the prices throughout platforms. Some platforms cost minimal charges, whereas others might have larger prices for sure providers. Moreover, search for further options like auto-compounding, staking insurance coverage, or integration with decentralized finance protocols, which may improve your staking expertise.

Are Crypto Staking Platforms Secure?

Cryptocurrency staking platforms are typically thought-about protected, particularly if you select well-established and respected choices. These platforms function on blockchain know-how, which ensures transparency and safety by way of decentralized networks. The protection of staking depends upon a number of elements, together with the platform’s repute, the safety measures in place, and the precise cryptocurrency being staked. Platforms like Binance and Kraken are sometimes thought to be among the finest platforms for crypto staking as a result of their strong safety protocols and long-standing belief within the crypto group.

When exploring one of the best DeFi staking platforms, perceive the dangers related to decentralized finance. Not like centralized platforms, DeFi staking entails interacting with good contracts, which could be susceptible to bugs or exploits. Staking rewards are sometimes expressed in APY, your earnings are tied to the token’s worth. If the token’s value drops considerably, your rewards might not offset the loss. Comprehending what’s a blockchain and the way it underpins staking platforms may also help you decrease dangers.

Advantages of Staking on Crypto Platforms

Passive revenue with out lively buying and selling. Staking permits rewards to construct over time with out fixed shopping for and promoting. As soon as property are staked, rewards accumulate robotically, which makes it interesting for long run methods.Helps preserve blockchain networks operating. By staking, crypto property are used to validate transactions and help community operations. This helps preserve safety and stability whereas rewards are earned for participation.Decrease entry barrier in comparison with mining. Staking doesn’t require costly tools or excessive power use. Most platforms permit participation with comparatively small quantities, making it extra accessible.Compounding can enhance long run returns. Some platforms permit earned rewards to be restaked. Over time, this may enhance whole holdings quicker by way of compounding.Power environment friendly participation.Proof of stake networks devour considerably much less power than conventional mining methods, making staking a extra sustainable approach to earn rewards.

Dangers of Staking on Crypto Platforms

Market value fluctuations. Even when rewards are earned, the honest market worth of the staked asset can drop. A value decline might outweigh staking positive aspects, particularly throughout unstable market circumstances.Funds could also be quickly inaccessible.Many staking applications require lockup or bonding intervals. Throughout this time, crypto property can’t be bought or moved, which limits flexibility.Reward inflation influence Some networks subject new tokens as staking rewards. If provide grows quicker than demand,total token worth might lower.Platform or validator publicity.Utilizing third get together platforms introduces danger associated to safety, technical points, or poor administration. Charges and repair high quality also can have an effect on last returns. Unstaking delays.Even after staking ends, many networks implement a ready interval earlier than funds are launched. This delay could make it troublesome to react shortly to market adjustments.

Conclusion

Selecting the best staking platform entails evaluating elements like safety, flexibility, and reward potential. Every platform caters to totally different wants, providing options for each newbies and skilled traders. Whenever you assess g your choices and perceive the related dangers, you may choose a platform that aligns together with your funding objectives. Staking continues to be a worthwhile technique for rising cryptocurrency holdings whereas supporting

FAQs

What’s the finest platform to stake crypto?

One of the best platform to stake crypto depends upon your priorities, akin to excessive rewards, safety, or ease of use. Platforms like Binance, Kraken, and Lido are common selections for his or her reliability and options.

How lengthy do you could lock up your funds for staking?

The length for locking up funds for staking varies by platform and cryptocurrency. Some platforms supply versatile staking with no lock-up, whereas others require intervals starting from a number of days to a number of months.

Are you able to stake crypto within the US?

Sure, you may stake crypto within the US. Many platforms, together with Coinbase and Kraken, permit US-based customers to stake cryptocurrencies, although availability might differ by state and regulation.

What’s liquid staking?

Liquid staking lets you stake your crypto whereas nonetheless sustaining liquidity. You obtain tokens representing your staked property, which can be utilized in different transactions or DeFi actions.

Are staking rewards taxed?

Sure, staking rewards are sometimes taxed as revenue in most jurisdictions, together with the US. The precise tax remedy depends upon native rules and the way the rewards are labeled.

What’s the distinction between PoS staking and DeFi staking?

The distinction between PoS staking and DeFi staking lies of their goal and mechanism. PoS staking secures blockchain networks, whereas DeFi staking entails locking property in decentralized protocols to earn rewards.

What’s the distinction between centralized and non-custodial staking?

The distinction between centralized and non-custodial staking is management. Centralized staking entails platforms managing your property, whereas non-custodial staking helps you to retain full management of your non-public keys and funds.