Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum has confronted large promoting strain and volatility over the previous month as your complete crypto market tendencies downward, pushing ETH towards essential demand ranges. With uncertainty dominating the market, merchants stay cautious as Ethereum struggles to reclaim misplaced floor.

Associated Studying

Analysts anticipate much more volatility following US President Trump’s government order on Thursday, which established a Strategic Bitcoin Reserve. Whereas the announcement was anticipated to spice up market sentiment, it launched extra uncertainty, leaving buyers uncertain of its long-term influence on the crypto house.

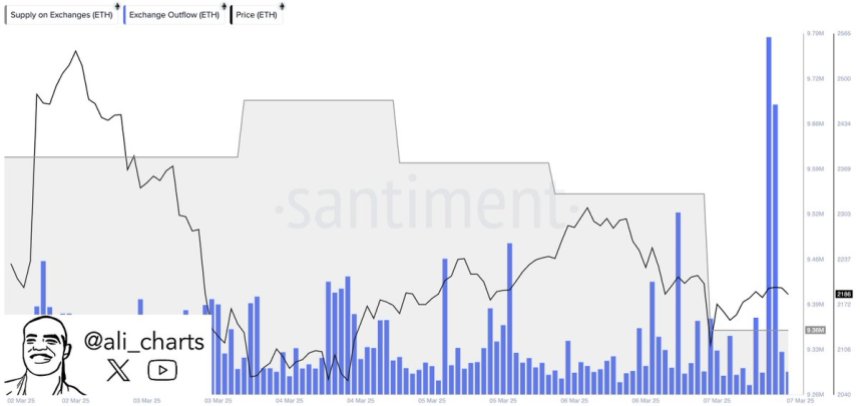

Regardless of the continued decline, on-chain information from Santiment reveals a bullish sign—330,000 Ethereum have been withdrawn from exchanges previously 72 hours. Such massive outflows usually point out buyers shifting ETH into personal wallets, suggesting diminished promoting strain and attainable long-term accumulation.

With Ethereum hovering at key assist ranges, the approaching days will probably be important in figuring out whether or not ETH stabilizes or faces additional draw back. If market sentiment improves and change outflows proceed, Ethereum may see a robust restoration. Nevertheless, if promoting strain persists, one other leg down stays a chance, protecting merchants on excessive alert.

Ethereum Faces A Important Check

Ethereum has misplaced over 50% of its worth since late December, triggering large worry and panic promoting throughout the market. As soon as a number one power in crypto rallies, ETH is now struggling to regain momentum, leaving buyers questioning whether or not the long-awaited altseason will materialize this yr. Many analysts speculate that it gained’t, as Ethereum and most altcoins proceed to battle, unable to reclaim bullish settings or set up a transparent restoration pattern.

Regardless of the bearish sentiment, there may be nonetheless hope for a rebound, as on-chain information suggests potential bullish catalysts. Ali Martinez shared Santiment information, revealing that 330,000 Ethereum have been withdrawn from exchanges previously 72 hours. This vital outflow may point out that buyers are shifting ETH into personal wallets, lowering quick promoting strain and doubtlessly setting the stage for a provide squeeze.

A provide squeeze happens when the obtainable provide of an asset on exchanges decreases, making it tougher for sellers to push costs decrease. If Ethereum continues to carry key demand zones and shopping for strain will increase, the diminished change provide may drive a robust restoration towards larger value ranges.

Associated Studying

For now, merchants are watching whether or not ETH can stabilize and reclaim important resistance ranges. If bulls regain momentum, Ethereum may begin a restoration pattern within the coming weeks. Nevertheless, if promoting strain persists, one other wave of downward motion stays a chance, protecting the market on edge. The subsequent few days will probably be essential in figuring out Ethereum’s short-term route and whether or not the current change withdrawals sign a turning level for ETH.