Victoria d’Este

Printed: March 03, 2025 at 12:05 pm Up to date: March 03, 2025 at 12:05 pm

Edited and fact-checked:

March 03, 2025 at 12:05 pm

In Temporary

Bitcoin dipped underneath $80K earlier than rebounding to $93K, fueled by Trump’s crypto reserve information and ETF inflows. Ethereum struggles with ETF delays, whereas TON sees USDT progress however faces a token unlock.

Alright, so the long-feared crash into the 80s DID occur. Bitcoin obtained completely smacked, dipping underneath $80K for a sizzling second earlier than rebounding like a boxer who took a nasty hit however refused to remain down.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

The bounce was violent – straight again to $93K – however then, shock shock, it hit a wall proper on the 50-period shifting common on the 4H chart (see the screenshot). RSI was first overbought, then cooling off. So now we’re at that awkward part: Was this only a lifeless cat bounce, or is Bitcoin gearing up for an additional run?

So what truly moved the market?

Trump’s Crypto Reserve Bombshell

This one got here out of nowhere. Trump – sure, the identical man who as soon as referred to as Bitcoin a “rip-off” – dropped the information {that a} U.S. crypto reserve might embody BTC, ETH, SOL, XRP, and ADA. And similar to that, Bitcoin shot up prefer it had a double espresso, dragging just a few altcoins alongside for the trip.

Supply: Donald J. Trump

The transfer liquidated a ton of shorts, making a traditional quick squeeze. However let’s be actual – political guarantees and market euphoria combine about in addition to oil and water. The query is, does this truly change something long-term?

ETF Flows Lastly Flip Optimistic

For weeks, Bitcoin spot ETFs had been bleeding out, making everybody surprise if institutional cash was shedding curiosity. However growth – ARK 21Shares and Constancy’s Bitcoin ETFs noticed a $369.7M internet influx, which lastly gave bulls one thing to work with.

Flows into the US spot Bitcoin ETFs since Feb. 18. Supply: Farside Traders

Is that this the beginning of a much bigger pattern? Possibly. However ETF consumers have been notoriously fickle, so let’s not pop the champagne simply but.

Swiss Nationwide Financial institution Dunks on Bitcoin

Whereas Trump was busy hyping BTC, the Swiss Nationwide Financial institution determined to kill the vibe, saying Bitcoin is simply too risky to be a reserve asset.

Supply: Bitcoin Initiative

Now, coming from a rustic recognized for its ultra-conservative monetary insurance policies, this wasn’t surprising. But it surely did inject some short-term FUD into the market. Not that it mattered a lot – Trump’s narrative was the louder one, and in markets, quantity wins.

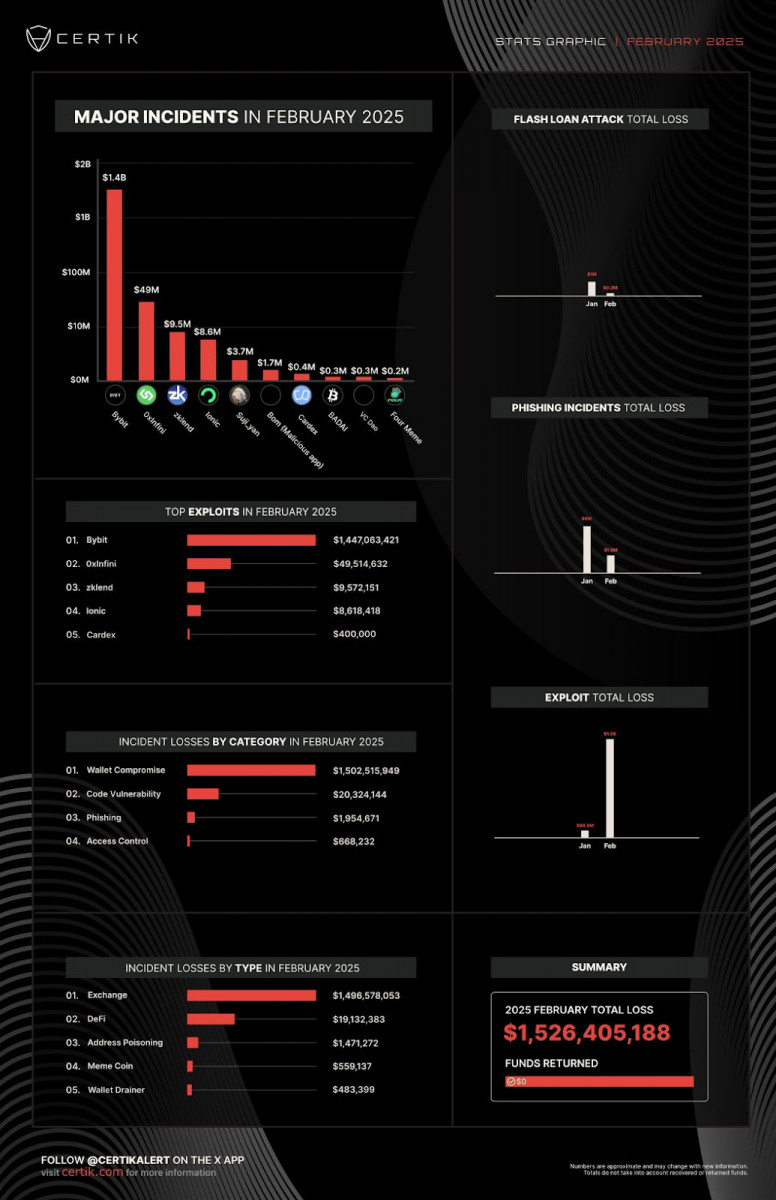

Bybit Hack: A $1.4B Catastrophe

As if the market didn’t have sufficient issues, the Bybit hack went down, with North Korean hackers allegedly laundering an enormous chunk of stolen crypto.

Bybit had the most important loss in February, adopted by stablecoin cost agency Infini after which the decentralized cash lending protocol ZkLend. Supply: CertiK

This was a brutal hit to sentiment, particularly because it reignited fears about trade safety. And if historical past tells us something, regulators are most likely sharpening their knives, on the brink of crack down even tougher.

Greatest CME Hole Ever (Yep, Ever)

Right here’s a enjoyable one: a $10K hole simply opened in Bitcoin CME futures – the largest ever.

CME futures gaps. Supply: Joe McCann

When you’ve been across the block, you realize BTC has a behavior of “filling the hole,” which means a retrace again towards $83K–$85K wouldn’t be surprising. Merchants are watching this like a hawk.

So the place does this go away Bitcoin?

Certain, Bitcoin’s restoration was spectacular, however let’s not fake we’re out of the woods but. The 50-SMA rejection isn’t a terrific signal, and if ETF consumers don’t maintain stepping in, we might simply see one other drop towards $85K. On the flip facet, if Trump retains pushing the crypto narrative and ETF demand picks up, we is likely to be one other try and crack $95K–$100K. Both means, count on volatility.

Ethereum (ETH)

Ethereum took an analogous beating to Bitcoin, plunging from highs close to $2,900 all the way down to the low $2,000s earlier than mounting a comeback. It briefly reclaimed $2,500, however, very like BTC, it bumped into bother on the 50-period shifting common on the 4-hour chart (see screenshot).

ETH/USD 4H Chart, Coinbase. Supply: TradingView

RSI shot up previous 60 earlier than cooling off, suggesting some exhaustion within the bounce. At $2,381, ETH is hovering in a precarious zone, and merchants are watching whether or not it may well set up help above $2,300 or if one other leg down is coming.

Now let’s dig into Ethereum’s personal drama. For one, the Ethereum Basis introduced a management shakeup after months of grumbling from the neighborhood.

Wang pictured left and Stańczak pictured proper. Supply: The Ethereum Basis

Whether or not this may carry recent momentum or simply extra infighting stays to be seen. In the meantime, the long-awaited Pectra improve is creeping nearer, promising main enhancements for scaling and MEV mitigation.

Supply: Nic Puckrin

However, as ordinary, regulatory uncertainty is weighing on ETH. The SEC as soon as once more delayed a choice on Ethereum ETF choices, and merchants are, as soon as once more, on edge.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

Ethereum’s short-term destiny continues to be tethered to Bitcoin, however these inner catalysts might give it some independence. If BTC stays steady above $90K, ETH would possibly get one other shot at $2,700 and even $3K. But when Bitcoin stumbles – or if regulators throw one other wrench into the combination – Ethereum might slip again towards $2,100 or decrease. Both means, count on extra turbulence forward.

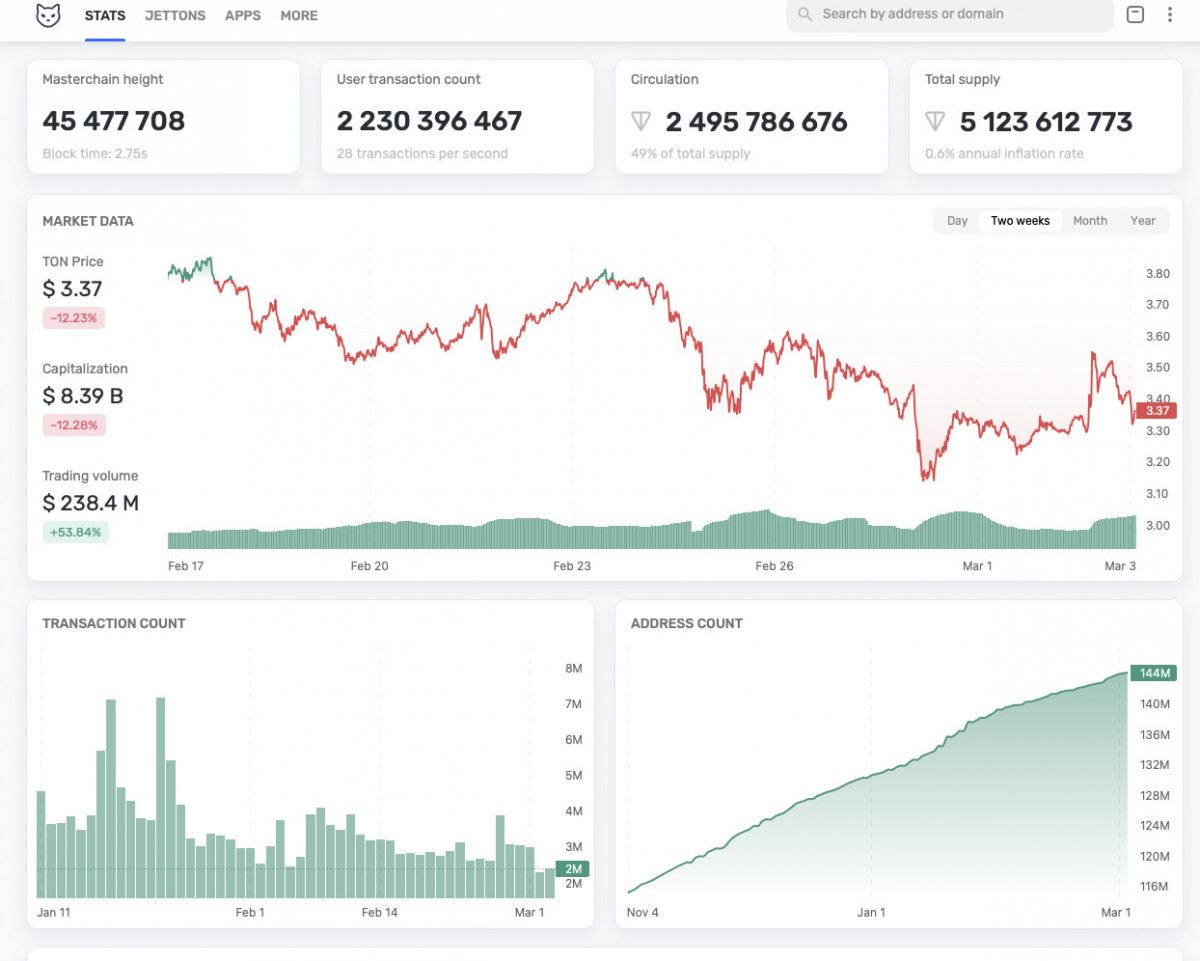

Toncoin (TON)

TON has been doing its personal factor, principally underneath the radar. Certain, it dipped with the remainder of the market, nevertheless it held up higher than most, bouncing off the $3.10 zone and pushing previous $3.50 earlier than smacking into resistance on the 50-SMA (see chart). Traditional. The RSI sat at 47.42 – principally in limbo, neither overbought nor oversold, which is sensible given the dearth of utmost strikes.

TON/USD 4H Chart. Supply: TradingView

For one, let’s discuss ‘actual’ adoption. Over the past 10 months, 1.5 billion USDT has been issued on TON, which is definitely a liquidity game-changer.

Supply: Artemis

Extra USDT on a blockchain means higher buying and selling situations, deeper order books, and a sturdier basis for DeFi. Add to that MyTonWallet launching a Telegram mini-app, in order that TON wallets are ridiculously straightforward to make use of.

Supply: Telegram

Then there’s the upcoming March 2 token unlock – 5 million TON is about to hit the market.

Supply: Tronscan

Now, relying on who’s holding and what they plan to do, this might both be a minor bump within the street or a short-term headache. However given how resilient TON has been, any dips would possibly simply be buy-the-dip alternatives.

Zooming Out

Quick time period, there’s volatility forward – no means round that. The BTC rally would possibly decelerate, and TON’s unlock might add some turbulence. However, on a broader scale, crypto is again within the mainstream dialog, and whether or not you’re keen on him or hate him, Trump’s subsequent soundbite is prone to shake up the market over again.

Disclaimer

In keeping with the Belief Venture tips, please notice that the data supplied on this web page shouldn’t be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation when you’ve got any doubts. For additional data, we propose referring to the phrases and situations in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover.

About The Writer

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.