Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin (BTC) continues to face large promoting strain, with costs dropping under the $85,000 mark, marking a 12% decline since final Friday. The latest downturn has fueled panic promoting and heightened worry, main many buyers to invest in regards to the potential begin of a bear market. As uncertainty grips the market, merchants stay cautious about Bitcoin’s subsequent main transfer.

Associated Studying

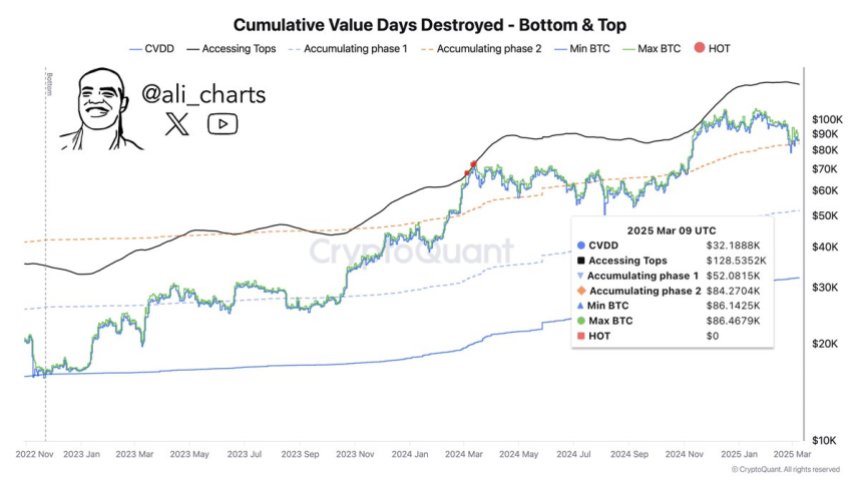

Nonetheless, regardless of the continuing sell-off, key on-chain knowledge from CryptoQuant means that Bitcoin might be establishing for a restoration rally. The Cumulative Worth Days Destroyed (CVDD) indicator, a metric that tracks long-term holder conduct and capital inflows, means that BTC may quickly enter a brand new uptrend. If Bitcoin stabilizes and reclaims key help ranges, it may pave the best way for a rally towards a brand new all-time excessive of $128,000.

With Bitcoin at a crucial inflection level, the following few buying and selling periods will likely be essential in figuring out whether or not BTC can regain momentum or if additional draw back is forward. Buyers are actually carefully watching whether or not promoting strain continues or if long-term holders step in to build up, signaling a possible market rebound.

Bitcoin Insights Give Hope To Bulls

Bitcoin is at a crucial juncture, going through a critical threat of continued correction as bearish sentiment grips the market. Many analysts now imagine that the Bitcoin bull cycle could also be over, as BTC struggles under $85,000 whereas barely holding above $80,000. With promoting strain intensifying, buyers expect one other leg down, doubtlessly pushing BTC into decrease demand zones.

Regardless of the destructive outlook, some analysts argue {that a} restoration remains to be attainable if Bitcoin can reclaim key ranges. High analyst Ali Martinez shared insights on X, stating that if BTC reclaims $84,000 as help, it may open the trail towards a rally to a brand new all-time excessive of $128,000. This means that whereas the market stays fragile, there’s nonetheless potential for Bitcoin to regain power if bulls step in at crucial worth factors.

The approaching weeks will likely be essential in figuring out the power or weak spot of this cycle. If BTC continues to battle under key resistance ranges, a deeper correction may observe, reinforcing bearish sentiment. Nonetheless, if bulls handle to push BTC again above $84K, it might point out a shift in momentum, doubtlessly reigniting the uptrend.

Associated Studying

With uncertainty dominating the market, merchants are carefully watching BTC’s subsequent transfer, as its means to carry or reclaim help ranges will decide whether or not this cycle is actually over or if one other rally remains to be on the horizon.

BTC Struggling Under $85K

Bitcoin has confronted large promoting strain, with probably the most vital drop occurring on Sunday, when the value plunged from $86,000 to $80,000, marking a 7% decline in simply hours. This sharp downturn has fueled panic promoting as buyers stay unsure about Bitcoin’s short-term route.

For bulls to regain management, BTC should reclaim the $86,000 degree and push above $90,000 to verify a possible restoration rally. A robust transfer previous these key resistance ranges may restore confidence available in the market, signaling that Bitcoin’s correction part could be nearing its finish.

Nonetheless, failure to interrupt above $86K may maintain Bitcoin underneath bearish management, growing the chance of one other leg down. If BTC drops under $80,000, it may take a look at the $78,000 low, a degree that, if breached, might result in additional draw back strain.

Associated Studying

With Bitcoin at a crucial turning level, the following few buying and selling periods will decide whether or not bulls can reclaim key ranges or if bears will proceed to dominate the market, pushing BTC into deeper correction territory.

Featured picture from Dall-E, chart from TradingView