Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum (ETH) is buying and selling at its lowest ranges since late 2023, struggling to regain momentum after an prolonged interval of promoting strain. Since December 2024, ETH has misplaced over 57% of its worth, failing to reclaim key resistance ranges. With the broader crypto market going through macroeconomic uncertainty and protracted volatility, Ethereum’s downtrend seems removed from over.

Associated Studying

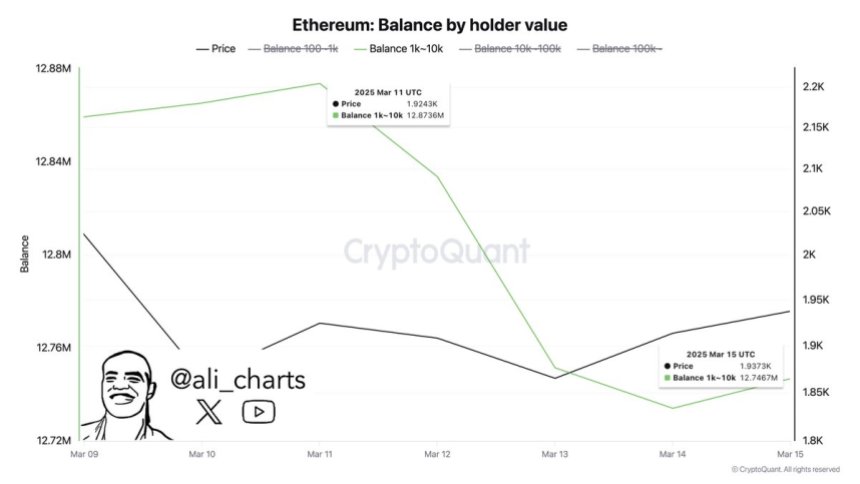

Regardless of the continued decline, on-chain information suggests that enormous traders could also be positioning for a restoration. In keeping with CryptoQuant, whales have moved over 130,000 ETH off exchanges previously week, signaling a rising accumulation pattern. This sample has been growing since Ethereum began trending downward, suggesting that institutional gamers and long-term holders are shopping for the dip in anticipation of future value appreciation.

Whereas short-term sentiment stays bearish, historic information reveals that enormous whale accumulations usually precede robust rebounds as soon as promoting strain fades. Nonetheless, ETH nonetheless faces important resistance, and bulls should reclaim key ranges to verify a possible pattern reversal. With market uncertainty nonetheless looming, the following few weeks will probably be vital in figuring out Ethereum’s subsequent main transfer.

Ethereum Whale Exercise Hints At Optimism

Ethereum has been underneath large promoting strain, struggling amid macroeconomic uncertainty and commerce struggle fears which have shaken each the crypto market and the U.S. inventory market. ETH is now buying and selling beneath a multi-year assist degree, which might act as a powerful resistance within the coming weeks. If bulls fail to reclaim key value ranges, the stage could possibly be set for a deeper correction.

Nonetheless, not all indicators are bearish. Regardless of the continued downtrend, some analysts stay optimistic about Ethereum’s long-term prospects. Prime analyst Ali Martinez shared insights on X, revealing that whales have moved over 130,000 ETH off exchanges previously week.

That is important as a result of giant traders sometimes transfer their holdings off exchanges after they plan to carry for the long run reasonably than promoting. When whales switch ETH into non-public wallets, it usually alerts accumulation reasonably than fast promoting strain. Traditionally, such tendencies have preceded market rebounds, as lowered alternate provide can contribute to cost stability and future upside potential.

Associated Studying

Whereas Ethereum nonetheless faces main hurdles, whale exercise means that sensible cash is positioning itself for the following transfer. The subsequent few weeks will probably be essential in figuring out whether or not ETH can reverse its downward pattern or if additional declines are forward.