LyondellBasell’s ($LYB) latest inventory efficiency highlights vital adjustments within the polymer large’s monetary fundamentals, market place, and strategic initiatives since I bought my complete place at $94.11 a couple of yr in the past. On this quick type weblog submit I need to present a solution as to whether present share value ranges replicate the modified enterprise (surroundings) sufficient, contemplating trade cycles, uncooked materials prices and naturally the latest commerce battle.

Enterprise profile

Within the case you’re unfamiliar with LyondellBasell (from right here on out I’ll reference it as LYB), which I might not blame you for because it’s not a shopper oriented firm, the corporate produces a variety of petrochemical merchandise together with polyethylene (PE), polypropylene (PP), oxyfuels and propylene oxide (PO) utilized in industries spanning from packaging to automotive and building. It’s one among and even the biggest on the planet in these segments.

It’s largely Europe and US centered and largely produces for home markets.

Determine 1: Provide community, Q1 2025 outcomes

Funding case

Initially I discovered LYB fascinating due to their shareholder pleasant administration, big top quality money stream technology and aggressive place.

So let’s discover these factors, to start with, administration. Bob Patel was changed by Peter Vanacker. Patel was extra centered on producing money from the prevailing core operations whereas Vanacker is reshaping the portfolio and divesting non core property.

Right here’s an summary of the selections administration has revamped the previous couple of years:

Administration Resolution

(Tentative) Final result

Portfolio Administration

Since 2023, LyondellBasell has lowered its annual fastened value expenditures by roughly $300 million, internet of one-time prices. This has been a constructive transfer in the direction of value effectivity.

Closure of Dutch PO JV

The choice to completely shut the Dutch PO JV with Covestro was made to make sure strategic asset alignment.

Flex-2 Challenge

The ultimate funding determination on the Flex-2 challenge is predicted to supply an EBITDA profit of roughly $150 million per yr post-startup.

Saudi Arabia Feedstock Allocation

LyondellBasell secured a brand new feedstock allocation in Saudi Arabia, enabling a joint challenge with Sipchem.

European Strategic Evaluate

Progress is being made on the European strategic overview, with updates anticipated by mid-2025.

Refinery Closure

The choice to shut the Houston Refinery, which was executed in February 2025 is predicted to have a internet money good thing about $175 million in 2025, however this estimate was at Brent Crude at $80

Superior Recycling Know-how

Investments in superior recycling expertise, together with the MoReTec plant in Germany, are a part of the technique to develop the Round & Low Carbon Options enterprise.

Divestment and Acquisitions

The divestment of the EO&D enterprise and acquisition of a stake within the NATPET three way partnership in Saudi Arabia are strategic strikes to concentrate on core companies and leverage value benefits.

Worth Enhancement Program

This program is on monitor to unlock vital recurring annual EBITDA enhancements, contributing to the corporate’s monetary energy.

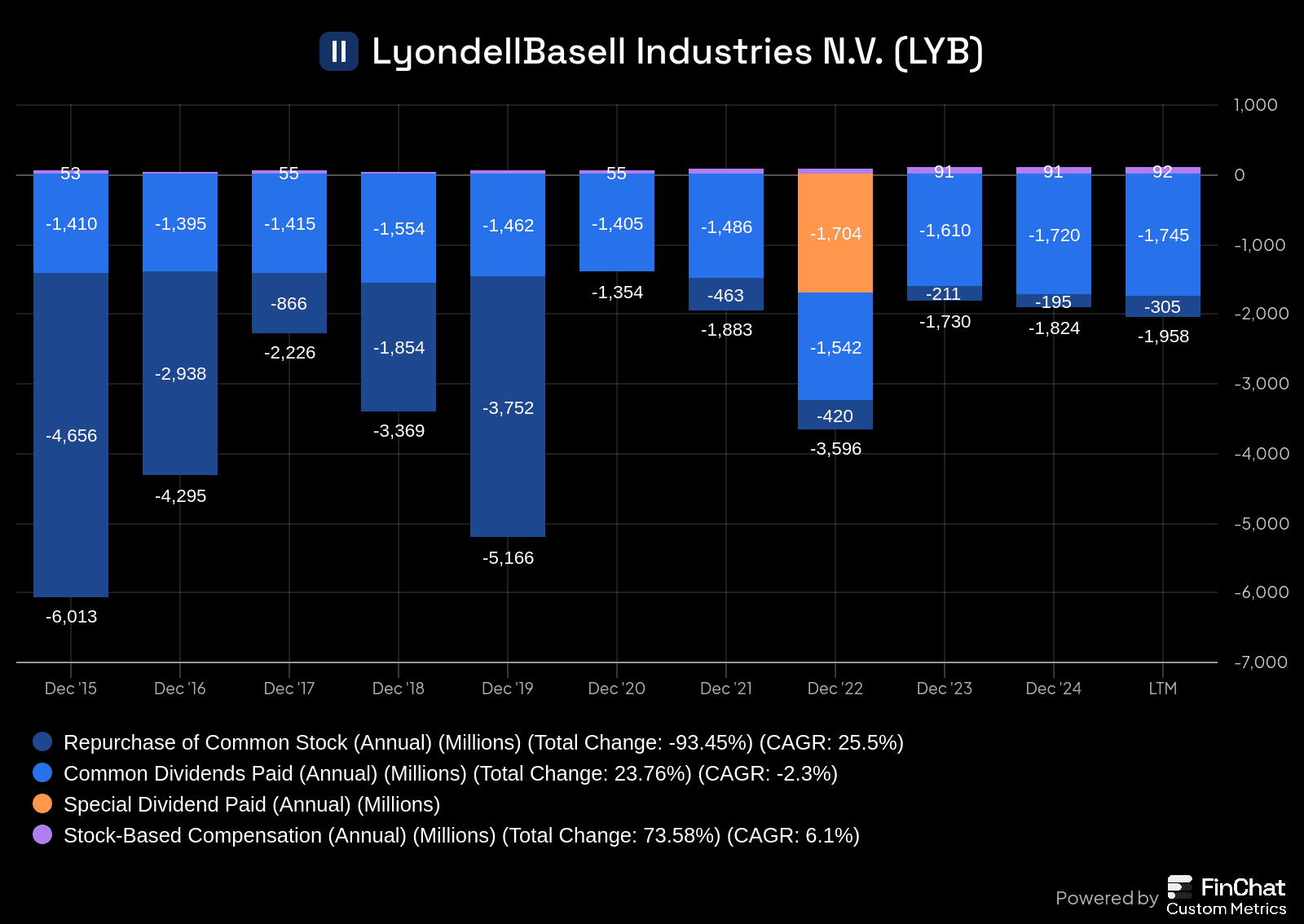

Moreover LYB has all the time had robust shareholder return insurance policies focussing on dividends and share repurchases during the last decade. As illustrated by the place their financing money stream ended up:

Determine 2: Financing money stream and SBC, from FinChat

Most earnings generated by the enterprise find yourself as usable money stream, which is also why in instances of upper earnings money distributions observe so rapidly. LYB operates steam crackers that primarily use pure gasoline liquids, primarily ethane and propane, as feedstocks, whereas many opponents use naphtha. When oil costs rise relative to pure gasoline costs, LYB advantages from decrease feedstock prices. Nevertheless, when oil costs fall or pure gasoline costs rise, this value benefit diminishes and even turns into a drawback, as has occurred lately.

From the demand aspect pricing follows naphtha manufacturing. Though European naphtha crackers are shutting down. The trade has reversed its technique of beforehand constructing vegetation close to prospects, now finding them close to inexpensive feedstock as an alternative. All of this places LYB in a tough place.

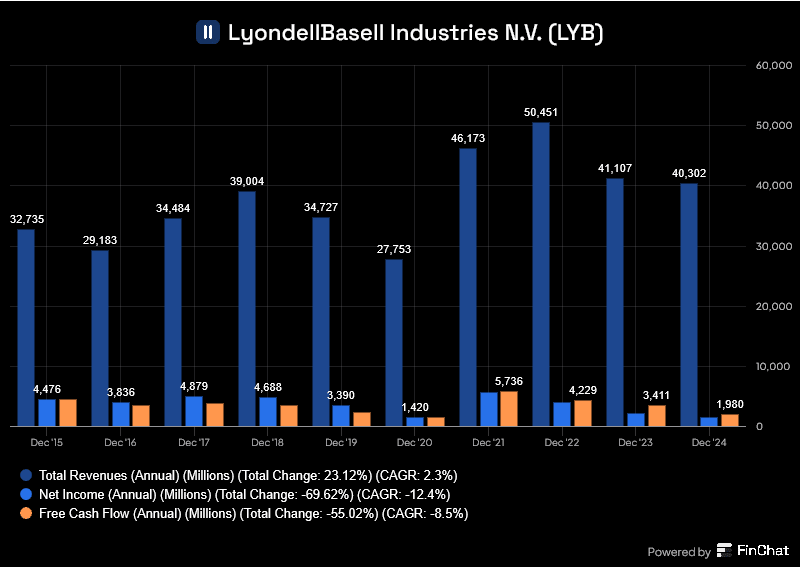

In Latest years provide and demand mismatches (2021 and 2022) have supplied nice short-term ups for LYB however long run their fundamentals are worsening.

Determine 3: Income, internet revenue and FCF, from FinChat

Dangers

In abstract LYB is reliant on macro financial elements deciding demand. That is an inherent threat to the corporate which they haven’t been in a position to transition away from by chopping prices or investing extra in round options. Any recession will influence them significantly.

Moreover the aforementioned oil and gasoline value adjustments can actually change the margins, that is already occurring.

Conclusion

Total whereas LyondellBasell is sort of 40% cheaper value clever I might nonetheless be very hesitant of really including onto or beginning a place now. The outlook for oil and gasoline might in fact grow to be extra constructive (and in case you solely purchase after such information you in fact may have already got missed the boat) however I personally don’t anticipate a greater oil and gasoline value relation in the long run based mostly on world vitality transition developments, and the rising competitiveness of different feedstocks and manufacturing strategies. As such, regardless of the enticing valuation, the structural headwinds might proceed to weigh on LYB’s value benefit and profitability. The corporate itself nonetheless is properly run however the enterprise surroundings is altering. If something adjustments with feedstock developments this may very well be a really enticing firm which tends to shell out money to shareholders in such instances.

This evaluation is for informational functions solely and shouldn’t be thought-about monetary

recommendation. The writer of this evaluation doesn’t maintain shares in LyondellBasell on the time of writing, which can affect the attitude supplied. Please conduct your individual analysis or seek the advice of with a monetary advisor earlier than making any funding choices.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.