Alisa Davidson

Revealed: June 02, 2025 at 6:32 am Up to date: June 02, 2025 at 6:32 am

Edited and fact-checked:

June 02, 2025 at 6:32 am

In Transient

The final week of Might noticed the crypto market shift from euphoric highs to cautious consolidation, with Bitcoin and Ethereum pausing after robust rallies whereas Toncoin surged on main Telegram ecosystem developments.

The final week of Might has seen a noticeable shift in tone throughout the crypto market. We’re coming off a euphoric, headline-rich month – Bitcoin smashed by all-time highs, institutional ETF flows dominated the narrative, and altcoins had been starting to point out indicators of rotation. However this previous week was extra about digestion. Momentum slowed, value motion turned sideways or dipped, and sentiment cooled – not catastrophically, however sufficient to make merchants recalibrate. So let’s undergo the foremost strikes, coin by coin.

Bitcoin (BTC)

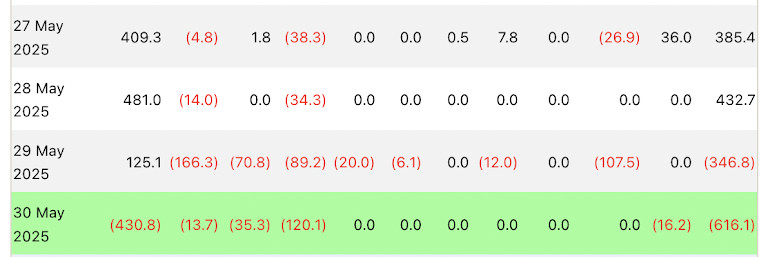

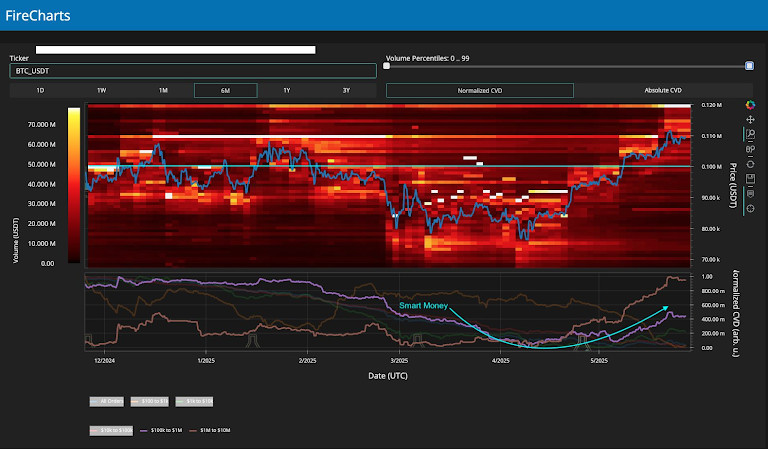

Bitcoin had a transparent directional shift this week. After topping out round $111,000 late final week, value steadily declined after which discovered a brief ground simply above $104,500 – a stage many technical analysts have flagged as a make-or-break space for sustaining bullish construction. We’re presently hovering round $105,000, and the candles are getting smaller. RSI on the 4H chart stays beneath 50, suggesting the bulls are, for now, out of breath.

So what modified? For starters, BlackRock’s IBIT ETF broke its 31-day influx streak, logging its greatest outflow ever. Naturally, this got here as a mood-killer for anybody watching institutional sentiment.

That was adopted by renewed macro uncertainty as Fed minutes quashed hopes for near-term price cuts. The post-conference profit-taking solely solidified the present consolidation temper.

However don’t mistake this for concern. Onchain knowledge exhibits whales are nonetheless including on dips, and long-term holders haven’t blinked.

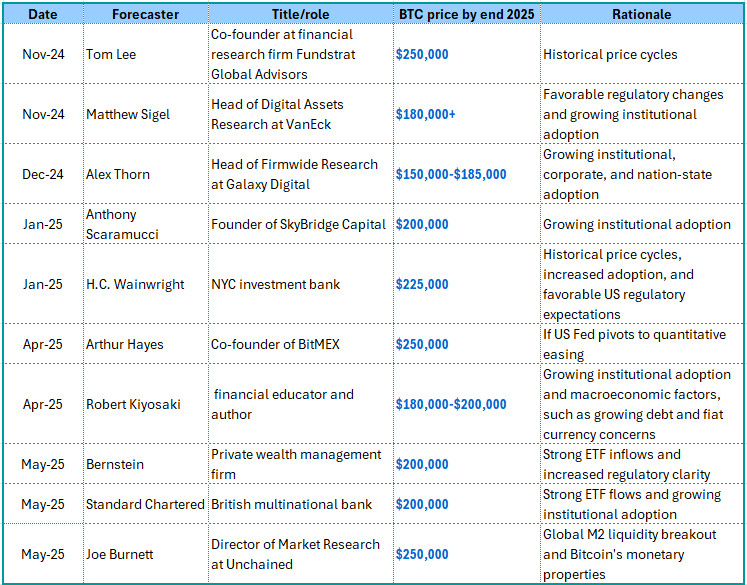

The prevailing tone is extra “let’s wait and see” than “run for the exits.” Analysts are nonetheless calling for $180K, $200K, even $250K by cycle high – however the consensus now appears to be: it’s going to take longer than some had been hoping two weeks in the past.

Should you’re buying and selling short-term, control that $104.5K weekly shut stage. If that’s decisively misplaced, we’re in all probability testing $100K once more. But when it holds, the present dynamics turns into a wholesome pause earlier than one other leg up.

Ethereum (ETH)

Ethereum, in the meantime, has had a considerably irritating finish of month. After a robust begin to Might, ETH cooled off alongside BTC, slipping from its $2.7K excessive right down to round $2,495. It’s tried to bounce a couple of occasions (RSI flirts with restoration) however for now, nothing’s caught. Why? Effectively, that’s principally collateral harm. Even with all its post-Pectra momentum in thoughts, Ethereum continues to imitate Bitcoin’s main strikes.

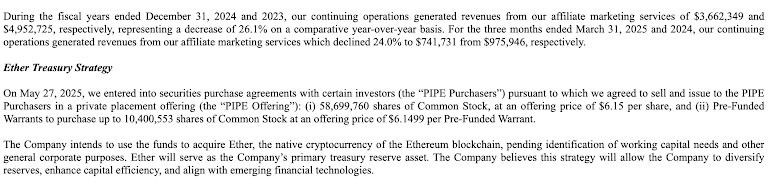

That mentioned, the underlying ETH story stays robust. The massive one this week was that SharpLink Gaming unveiled plans for a $1 billion Ethereum treasury. Just about the reflection of Michael Saylor’s Bitcoin technique – however for ETH. However the best way, after the announcement, SharpLink Gaming’s inventory surged a whopping 400%.

We additionally noticed indicators that ETH and SOL staking ETFs may launch quickly, with bullish commentary from ETF analysts saying the approval course of seems to be “imminent.” These developments didn’t transfer value this week, however they’re accumulating within the background.

Technically, ETH remains to be in its vary. It hasn’t damaged down ($2.44K is the extent to carry) and if Bitcoin regains momentum, Ethereum may shortly discover itself again within the $2.6–$2.7K zone. Don’t sleep on it.

Toncoin (TON)

If Bitcoin and Ethereum spent the week exhaling, TON held its breath – after which burst upward like loopy. On Might 28, TON spiked to $3.70 with an enormous up candle that may be traced again to a whole flood of Telegram ecosystem information.

First, TON celebrated its 4th birthday, then the fireworks began: Telegram introduced a $1.5B bond sale, which later swelled to $1.7B through convertible debt, with BlackRock, Citadel, and Mubadala named as patrons.

Not stopping there, Pavel Durov revealed a strategic partnership with Elon Musk’s xAI, integrating Grok into Telegram and bringing $300M in upfront funding plus 50% of subscription income. That’s a fairly momentous alliance when you ask us.

However there was extra: Arkham launched its app inside Telegram, USDe from Ethena built-in into the TON pockets, a former Visa exec joined TON, and Telegram Premium hit 15 million customers.

So yeah, no surprise the value popped. And simply as shortly, it pulled again, touchdown close to $3.14, the place it appears to be digesting. However that rally didn’t appear to be pure hypothesis – it packed a critical ecosystem punch. TON is now firmly positioned because the transactional spine of Telegram’s rising fintech and AI suite.

From a technical perspective, $3.00 is vital help to observe. If value holds above that, one other breakout isn’t off the desk – particularly if Telegram delivers on Durov’s teased “excellent news in June.”

Disclaimer

According to the Belief Challenge pointers, please notice that the knowledge offered on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. It is very important solely make investments what you may afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.