Este artículo también está disponible en español.

As 2024 nears its conclusion, Ethereum value fluctuations are being carefully monitored. The trajectory of the cryptocurrency is critically influenced by key resistance and help ranges, as indicated by latest evaluation from crypto specialists, which suggests a cautiously optimistic outlook.

Associated Studying

Necessary Worth Ranges To Monitor

Analyzing cryptocurrencies, Justin Bennett emphasised the significance of Ethereum recovering the $3,540 degree over the weekly interval on December 22. This pricing vary is thought to be essential to point out a possible change out there towards optimism.

Ought to Ethereum be unable to clear this barrier, it runs the hazard of sliding under the numerous help zone of $3,000, resulting in a drop towards $2,600. For buyers in addition to speculators, a drop of this diploma can be expensive.

As bullish as I’m turning with the general setup going into 2025, patrons nonetheless have work to do.

For instance, $ETH must get well $3,540 on the weekly time-frame to look bullish subsequent week.

Consumers have 33 hours to get it performed.#Ethereum pic.twitter.com/cAChCbJxjd

— Justin Bennett (@JustinBennettFX) December 21, 2024

Market Sentiment And Analyst Predictions

The evaluation by Titan of Crypto who utilized the Ichimoku cloud method to foretell possible restoration additional strengthens the optimism surrounding Ethereum.

The analyst famous that Ethereum has retested some essential ranges, which gives the look that the current correction cycle is about nearing its finish. The energy of Kumo Cloud’s help line signifies that Ethereum might effectively kind a base for greater strikes if it may well handle to carry on to the prevailing ranges.

Whales Ramp Up Accumulation

In the meantime, Ethereum whales have elevated their holdings and amassed about 340,000 ETH, which is price greater than $1 billion, in only a few days. This rise in accumulation reveals that huge buyers have gotten extra assured of the prospects of the altcoin.

Ethereum Whales Purchased $1 Billion ETH In The Previous 96 Hours – Particulars https://t.co/fZe8jWmQ3S

— Jose JM (@CryptoJoseJM) December 22, 2024

As well as, spot Ethereum ETFs have garnered inflows of over $2 billion since their introduction within the US market, which is indicative of the rising curiosity in these devices. If regulatory authorities allow staking yields inside these funds, analysts anticipate that this development might surpass Bitcoin ETFs by 2025.

Ethereum Worth Forecast

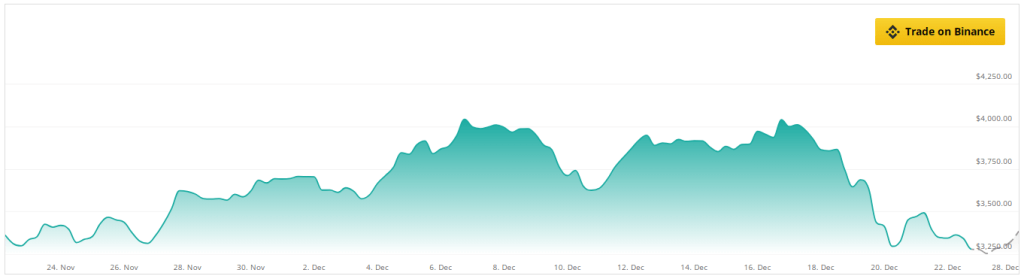

On the time of writing, Ether was buying and selling at $3,330, down 0.7% and 15.7% within the every day and weekly timeframes, information from Coingecko reveals.

Based mostly on how the Ethereum market is doing proper now, there’ll possible be a optimistic upward development throughout the subsequent week, regardless of Ether’s numbers flashing pink within the charts.

Analysts are hopeful about its probabilities of recovering, despite the fact that it’s promoting at a 21% low cost to what they assume it will likely be price in a month.

Supply: CoinCheckup

A possible breakout that would take a look at essential resistance ranges is being indicated by technical indicators such because the Relative Power Index (RSI) and Shifting Averages.

Ethereum is anticipated to expertise a strong growth trajectory within the medium to long run, with a 35% value enhance throughout the subsequent three months and a exceptional 100% development inside a yr, based on projections.

Featured picture from DALL-E, chart from TradingView