The Each day Breakdown digs into the upcoming jobs report, in addition to treasured metals as silver units up for a significant breakout to multi-year highs.

Earlier than we dive in, let’s be sure to’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all you should do is log in to your eToro account.

Thursday’s TLDR

Silver hits 13-year excessive

Jobs report in focus

TSLA hits a velocity bump

What’s Taking place?

If the S&P 500 rallied 3%, it will hit new file highs. That’s a fairly beautiful actuality given the volatility traders endured in March and April. And at the very least within the brief time period, the roles market may very well be a key catalyst as to if we get to these highs — or not.

Tuesday’s JOLTS (job openings) report was stronger than anticipated, a welcome improvement for nervous traders. Nonetheless, the ADP report was notably weaker than anticipated. This report is nowhere close to as important because the one we’ll get tomorrow, which is the month-to-month non-farm payrolls report.

Recognized extra casually because the “month-to-month jobs report,” it’ll make clear the unemployment fee (presently 4.2%) and inform us what number of jobs had been added or misplaced in Could. Presently, economists anticipate about 125K jobs had been added final month. It’ll additionally replace the prior report (for April) for a extra correct image of the labor market.

However earlier than we get these figures, we’ll obtain the weekly jobless claims report, which measures the variety of people who filed for unemployment advantages for the primary time throughout the earlier week, serving as a well timed indicator of labor market well being.

This determine confirmed an uptick final week to 240K, however fortunately, spikes to this space have typically been short-lived outlier weeks over the previous 12 months (as proven above). In that sense, it will be good to see it lose some momentum this week.

By the way in which, 5 extra cryptocurrencies simply grew to become out there for buying and selling on eToro. Discover them right here or click on the banner beneath.

Need to obtain these insights straight to your inbox?

Enroll right here

The Setup — Silver

We’ve talked about gold loads currently, and I even posted about it on the eToro feed this morning. However silver is the one making an enormous transfer in pre-market buying and selling.

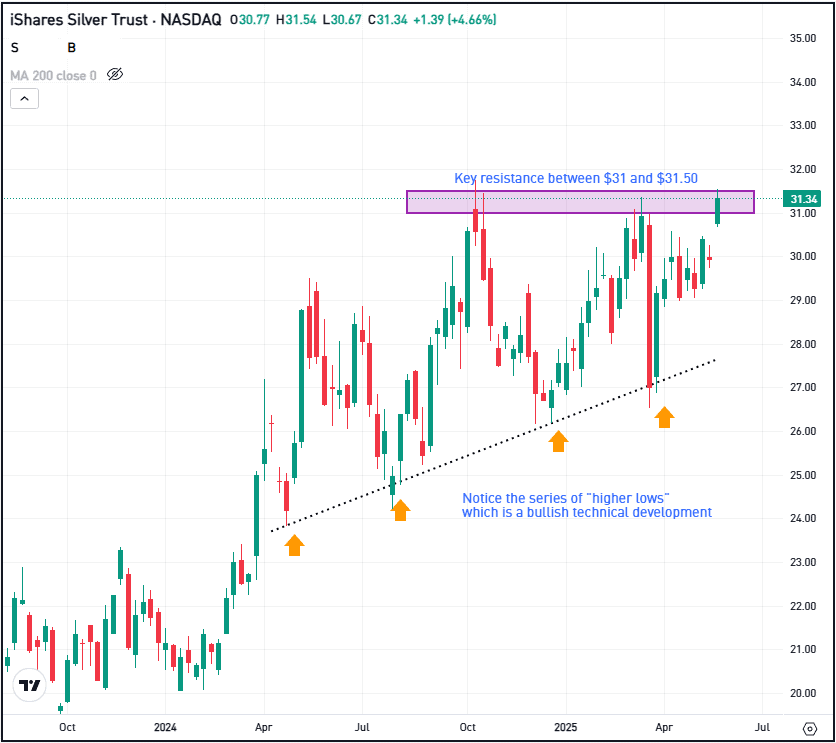

Whereas the GLD ETF is up modestly this morning, the SLV ETF, the most important silver-based ETF, is up nearly 4%. If it opens close to present ranges, it is going to be nicely above its present 52-week excessive of $31.80 and can mark the fund’s highest value in additional than a decade.

As of 8:00 a.m. ET, the SLV ETF is buying and selling close to $32.50 in pre-market buying and selling. If these beneficial properties maintain into the open, it is going to be nicely above the important thing resistance space of $31 to $31.50. If at the moment’s rally holds up, bulls will need to see this former resistance stage change into help.

If that occurs, it might act as a significant technical catalyst, serving to establishing for the subsequent potential leg greater in silver. Nonetheless, if SLV breaks again down beneath $31, it might lose fairly a little bit of its present momentum and will commerce decrease within the brief to intermediate time period.

Choices

For some traders, choices may very well be one various to take a position on SLV. Keep in mind, the chance for choices patrons is tied to the premium paid for the choice — and dropping the premium is the complete threat.

Bulls can make the most of calls or name spreads to take a position on additional upside, whereas bears can use places or put spreads to take a position on the beneficial properties truly fizzling out and SLV rolling over.

For these seeking to be taught extra about choices, contemplate visiting the eToro Academy.

What Wall Avenue is Watching

TSLA

Shares of Tesla fell 3.6% yesterday and are down once more in pre-market buying and selling. European gross sales stay pressured for Tesla, at the same time as total EV gross sales proceed to leap. Additional, there’s a fear that Musk’s public criticism of the present Republican-led tax invoice might create political rifts. Observe the information on Tesla proper right here.

CRWV

Shares of CoreWeave — an organization that Nvidia owns a 7% stake in — have been on hearth. Whereas the inventory jumped greater than 8% yesterday, CRWV is up greater than 40% to date for the week. And from its April twenty first low, the inventory is up nearly 400%. Be happy to trace the chart for CRWV.

MDB

MongoDB inventory is flying greater this morning, up greater than 15% in pre-market buying and selling after the agency reported earnings. Earnings of $1 per share got here in nicely forward of analysts’ expectations of 67 cents a share, whereas income of $549 million topped estimates for $528 million. It’s value declaring that MDB shares tumbled greater than 25% in March following a disappointing report.

Disclaimer:

Please observe that because of market volatility, among the costs might have already been reached and eventualities performed out.