Bitcoin is presently buying and selling 7% beneath its all-time excessive of $112,000, going through elevated promoting strain as all the crypto market cools down. Whereas some analysts consider additional draw back may observe, others level to shifting international dynamics which will quickly favor Bitcoin. Rising US bond yields and protracted geopolitical tensions are reshaping threat sentiment throughout monetary markets, probably positioning BTC as a hedge in unsure occasions.

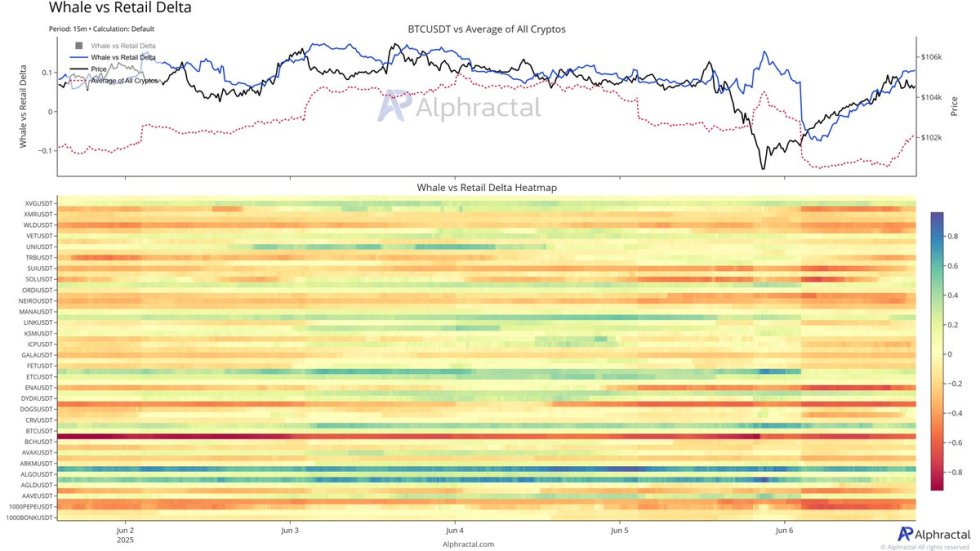

One key sign comes from whale exercise. In keeping with new information from Alphractal, the Whale vs. Retail Ratio has began rising once more, suggesting massive traders are taking up extra threat whereas retail individuals stay cautious. Traditionally, rising whale urge for food has preceded main value rallies, as institutional gamers are likely to act early during times of uncertainty. This divergence between whales and retail merchants might trace at an accumulation part taking part in out beneath the floor, regardless of the present value pullback.

The approaching days can be important. If Bitcoin holds above key help ranges, the presence of robust arms may help a reversal or consolidation earlier than one other try at value discovery. For now, whale conviction is rising — and that would show pivotal if sentiment shifts bullish once more.

Whale Exercise Rises Amid Systemic Uncertainty

Bitcoin continues to commerce above the essential $100,000 degree, at the same time as international markets stay rattled by systemic threat, rising inflation, and deteriorating macroeconomic indicators. Whereas equities and commodities mirror growing volatility, Bitcoin seems to be coming into a part of resilience, typically seen when traders seek for alternate options in occasions of uncertainty.

Inflation stays persistent throughout developed economies, and bond yields proceed to rise, inserting strain on conventional markets. Amid this backdrop, Bitcoin’s positioning as a hedge in opposition to financial instability is gaining renewed consideration. Nevertheless, sentiment throughout the crypto market stays cut up, with many retail merchants taking a cautious stance as volatility will increase.

In keeping with recent information from Alphractal, a notable divergence is forming between whale and retail habits. The Whale vs. Retail Ratio, which measures the positioning of huge traders in comparison with smaller ones, has began to climb. This indicators that whales are going lengthy as soon as once more, whereas retail individuals stay risk-averse.

Traditionally, spikes on this ratio have preceded main value rallies, as whales typically accumulate forward of broader market shifts. “Threat urge for food is again,” Alphractal notes — a probably bullish sign amid present bearish sentiment.

This quiet accumulation from massive gamers may lay the inspiration for a powerful transfer if macro situations align and BTC holds key help. Because the market seems for course, whale confidence could possibly be the catalyst that suggestions the size.

Bitcoin Consolidates Above Key Assist Stage

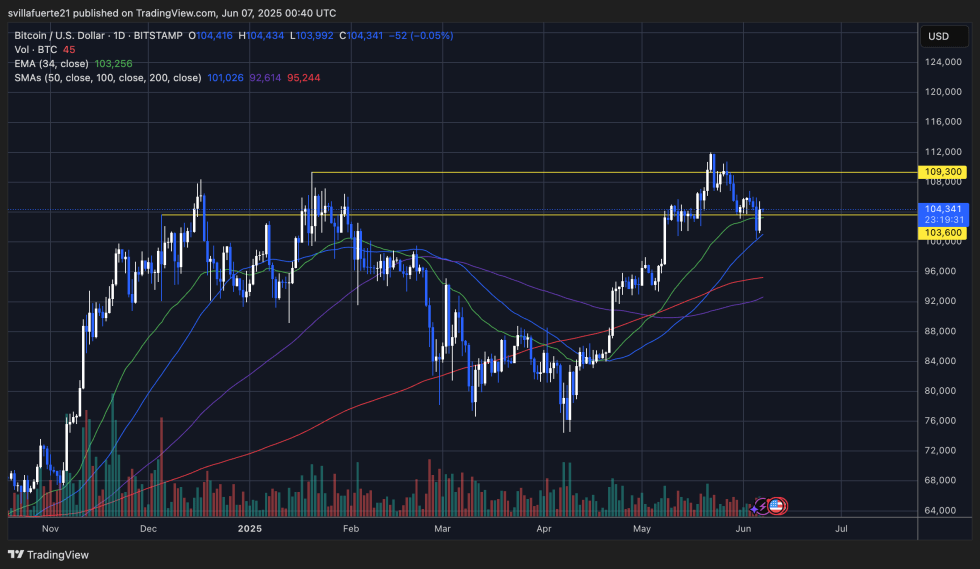

Bitcoin (BTC) continues to consolidate simply above the essential $103,600 help degree, after briefly dipping beneath this line throughout latest market volatility. The every day chart exhibits BTC presently buying and selling at $104,341, forming a possible increased low construction that would help a restoration if demand sustains.

Value motion stays squeezed between the 34-day exponential shifting common (EMA) at $103,256 and overhead resistance at $109,300, which marks the latest native prime. Holding above the 50-day easy shifting common (SMA), presently at $101,026, is essential for preserving the broader uptrend.

Quantity has decreased barely, suggesting a cooldown in momentum following the sharp 5% pullback earlier within the week. This low-volume atmosphere may open the door for bigger gamers to build up earlier than one other breakout try. The market is now ready to see if bulls can push BTC again towards the $108,000-$109,000 resistance zone to check for a potential retake of the all-time excessive.

A breakdown beneath $103,600 would sign weak spot and certain drive BTC towards the 100-day SMA close to $92,600. For now, Bitcoin is holding robust, however any main macro developments or shifts in sentiment will decide whether or not the present consolidation turns into a launchpad or a reversal.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.