Victoria d’Este

Revealed: August 25, 2025 at 8:33 am Up to date: August 25, 2025 at 8:34 am

Edited and fact-checked:

August 25, 2025 at 8:33 am

In Temporary

Bitcoin slid below $112K amid ETF outflows and whale rotations into Ethereum, which surged to new highs as institutional demand and treasury accumulation drove flows, whereas TON stayed uneven regardless of billion-dollar backing and ecosystem strikes.

Bitcoin (BTC)

Alright, what did end-of August carry us? Let’s discover out. Bitcoin walked into the week a bit of hungover from that mid‑August blow‑off close to $124K. From Aug 18 to 25 it shuffled decrease, poked round, then lastly dipped below that early‑August swing low close to $112K. It felt dramatic within the second and possibly made everybody query their life selections for some time.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

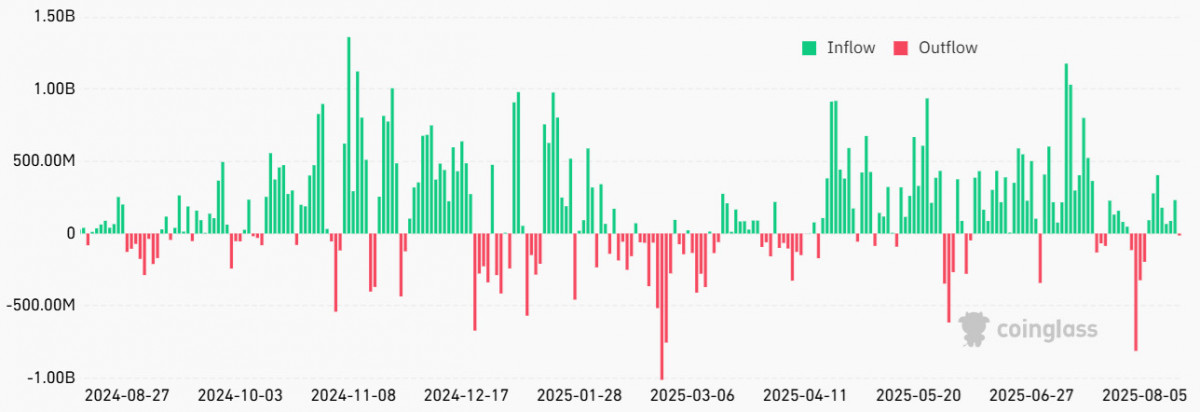

However what actually dragged it down? Analytics says — flows. Spot ETFs saved leaking and choices sellers had been sitting on that huge expiry mid‑week, so each nudge south slid a bit of farther than you’d anticipate.

Spot Bitcoin ETF internet flows, USD. Supply: CoinGlass

Then Fed’s Jackson Gap speech gave us the “perhaps we minimize in September” line — cue a reflex pop that ought to’ve caught. Besides the highlight immediately swung to Ether.

Whales rotated measurement from BTC into ETH, headlines piled on (miners fretting about tariff prices, Congress doing the CBDC‑ban dance, the SEC kicking a couple of ETF cans), and so the bounce misplaced steam.

So, what will we do now? If $110–112K holds, we base; if it doesn’t, properly, there’s nonetheless some summer time froth left to wring out. We wouldn’t advise you to behave heroic now. Simply let flows relax and watch whether or not ETFs flip again to internet buys.

Ethereum (ETH)

In the meantime, Ethereum fully stole the present. Whereas Bitcoin was grinding decrease, ETH managed to interrupt free and dash straight right into a recent all-time excessive close to that ~4.8–4.9K zone. It didn’t maintain the shut above it, however the truth that ETH made the transfer in any respect, whereas BTC was wobbling, says a lot about the place cash was flowing this week.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

An enormous a part of that power got here from spot ETF demand roaring again. After a shaky begin to the month, inflows surged, lifting complete ETF holdings previous 6.4 million ETH. That tightening provide kindled a pointy rally, and you possibly can really feel it as quickly because the tape began working scorching.

On the identical time, company treasuries had been hoovering provide. SharpLink Gaming, already the second-largest ETH treasury, signed off on one other billion-plus in inventory buybacks linked on to ETH holdings. Strikes like this undoubtedly reinforce Ethereum as an institutional asset.

However maybe probably the most telltale signal was whale rotations out of Bitcoin and into Ether. A couple of high-profile shifts, together with a billion-plus switch from a BTC whale right into a monster ETH lengthy, stole the headlines and fed into the narrative that sensible cash was tilting away from Bitcoin’s post-ATH hangover. When these flows hit the tape, ETH lit up with a kind of so-called “god candles” that flip sentiment in a day.

ETH/USD one-hour chart. Supply: Cointelegraph/TradingView

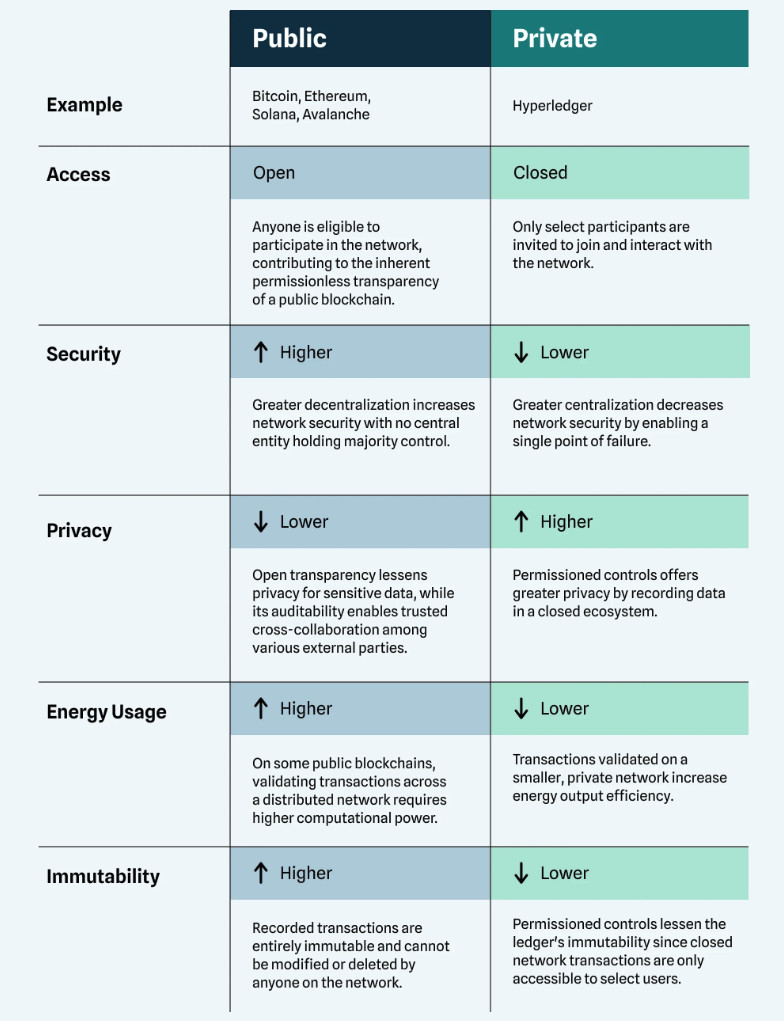

Even policymakers added gas, albeit not directly. Stories surfaced that the EU is exploring Ethereum as a part of its digital-euro growth, placing ETH alongside Solana on the shortlist. Whether or not or not that results in adoption, simply being named in that dialog helps reinforce the notion that Ethereum is the default alternative when governments or corporates go searching for public-chain infrastructure.

Public blockchains versus personal blockchains. Supply: Chia

Does it make ETH invincible? After all not. Tagging a brand new ATH after which pausing just under resistance is just about textbook conduct. Our learn is that, if ETF demand and treasury accumulation hold buzzing, $5K seems like solely a matter of persistence. But when flows stumble — and September has a method of doing that — then the $4.3–4.5K pocket is the plain place to check nerves.

The ethical of the week, although, is obvious: when Bitcoin hesitates, huge capital now feels completely comfy sprinting into Ether. And that intermarket rotation might form the following leg of this cycle.

Toncoin (TON)

In the meantime, TON was simply being TON. On the chart, it was the identical outdated uneven back-and-forth that finally leaned decrease between Aug 18 and 25. Underneath the floor, nonetheless, TON did see some developments that might finally matter for worth.

TON/USD 4H Chart. Supply: TradingView

The largest headline was from Verb Expertise, which isn’t precisely a small fry. The corporate revealed a plan to pivot into “TON Technique” and went so far as shopping for roughly $713 million value of TON, with an ambition to scoop up as a lot as 5% of complete provide. Fairly a press release if you happen to ask us. In the event that they comply with by means of, it vegetation TON firmly within the corporate-treasury sport that Bitcoin and Ether have dominated, and that might be an enormous credibility bridge for establishments trying previous the majors.

Supply: BusinessWire

In the meantime, the TON ecosystem itself was busy laying down cultural hooks. Telegram rolled out $1 sign-ups in some international locations, a transfer that’s extra symbolic than monetary, however symbolically it’s a reminder: the app and the chain are more and more welded collectively.

Supply: @gift_news

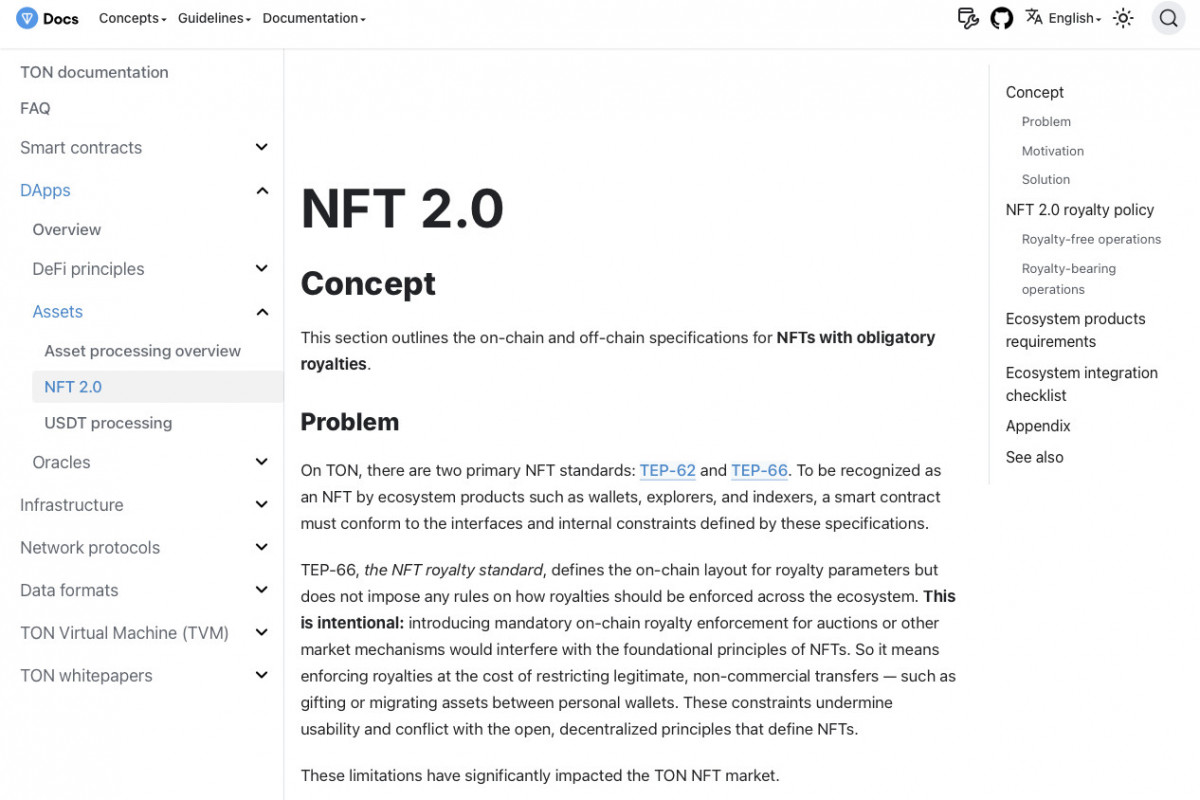

Additionally, control the upcoming NFT 2.0 normal, which primarily enforces royalty safety by blurring non-compliant tokens. We get the sense that TON is experimenting with mechanics different chains principally left for lifeless.

Supply: TON

Okay, with all that in thoughts why no worth fireworks but? Most likely as a result of flows nonetheless dominate, and proper now the firehose is pointed at BTC and ETH. With no sustained rotation of liquidity, even billion-dollar treasury information takes time to indicate up on the chart. However right here’s the factor: if ETH cools after its ATH flirt, and BTC simply chops sideways, market eyes may begin wandering once more. And once they do, TON gained’t seem like “simply one other alt.”

Disclaimer

Consistent with the Belief Mission tips, please notice that the knowledge offered on this web page isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. It is very important solely make investments what you may afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Victoria is a author on a wide range of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.