Victoria d’Este

Revealed: December 30, 2024 at 6:55 am Up to date: December 30, 2024 at 6:55 am

Edited and fact-checked:

December 30, 2024 at 6:55 am

In Temporary

What a wild journey it’s been for crypto this yr – large wins, greater twists, and lots to maintain us all guessing. Bitcoin did smash by six figures in spite of everything, solidifying its spot as digital gold’s heavyweight champ. Ethereum took a unique route – it made waves midyear when the SEC greenlit spot Ether ETFs, pulling in heavyweights like BlackRock and Constancy. In the meantime, TON was largely flying below the radar however proving that quiet, constant progress can pack simply as a lot punch, particularly while you’ve obtained Telegram’s large attain in your facet.

Now, as we depend down the ultimate hours of December, the motion hasn’t let up. Bitcoin’s taken a breather after its historic excessive, Ethereum’s grappling with a troublesome resistance, and TON is busy mixing blockchain with on a regular basis life in methods which might be not possible to disregard. So, what’s the newest buzz as we wrap up 2024? Let’s break all of it down and see what could be ready across the nook in 2025.

Bitcoin

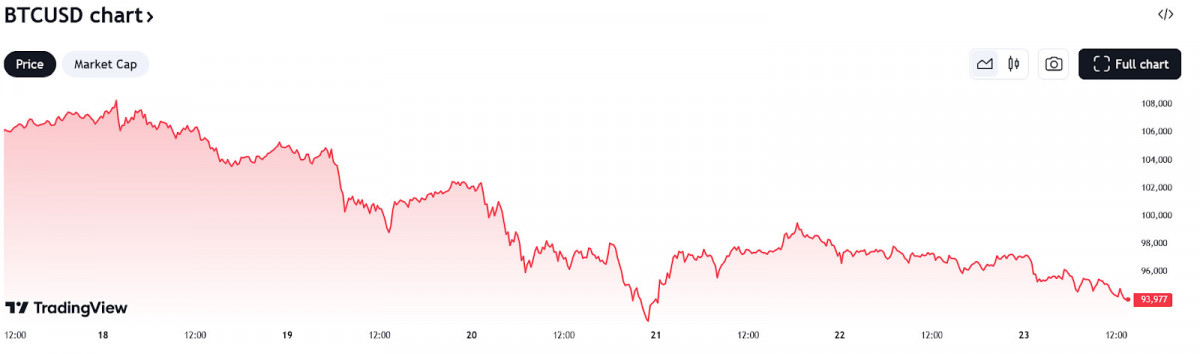

With New 12 months’s Eve simply hours away, Bitcoin is wrapping up 2024 with a mixture of triumph and tumult. Hitting the six-figure milestone earlier this month had the crypto world buzzing, however that pleasure has been tempered by a pointy correction that’s left the market holding its breath.

BTC/USD 1D Chart, Coinbase. Supply: TradingView

After peaking at $108,135, Bitcoin has slid roughly 10%, now hovering close to $92,500. Merchants are laser-focused on key help ranges, asking the million-dollar query: is that this only a wholesome pause, or may 2025 begin with a stumble?

Supply: TradingView

There’s nonetheless a flicker of vacation optimism. A short “Santa rally” earlier this week pushed Bitcoin again as much as $98,000, exhibiting that bullish momentum isn’t totally spent.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

Binance reserves, now at their lowest since January, have fueled cautious hope – in spite of everything, comparable ranges preceded a serious rally earlier this yr.

Supply: CryptoQuant

However yeah, the correction has dragged on lengthy sufficient to make even die-hard bulls pause and reassess.

Globally although, Bitcoin has nonetheless been flexing its muscle. For one, El Salvador made waves by surpassing 6,000 BTC in its holdings, putting it among the many prime sovereign Bitcoin house owners.

Supply: El Salvador Bitcoin Workplace

In Japan, Metaplanet capitalized on the dip with its largest Bitcoin buy but – $60 million price – whereas Russia made headlines by permitting Bitcoin for international commerce. These strikes converse volumes to Bitcoin’s evolving function on the geopolitical stage.

Supply: Metaplanet

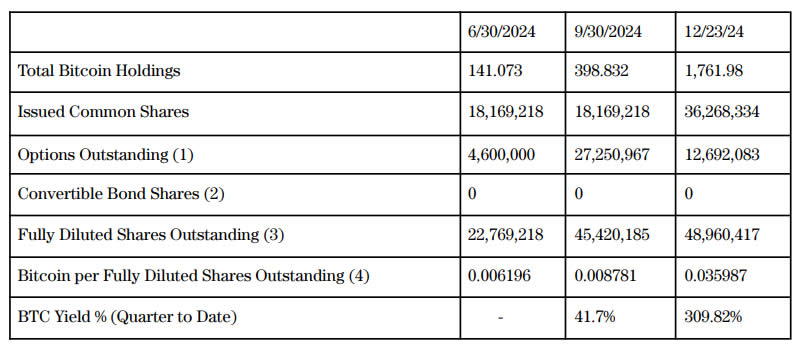

Stateside, the Bitcoin story has been simply as eventful. MicroStrategy ended the yr by including 5,200 BTC to its holdings, bringing its whole to a jaw-dropping 439,000 BTC, price over $41 billion.

Supply: Michael Saylor

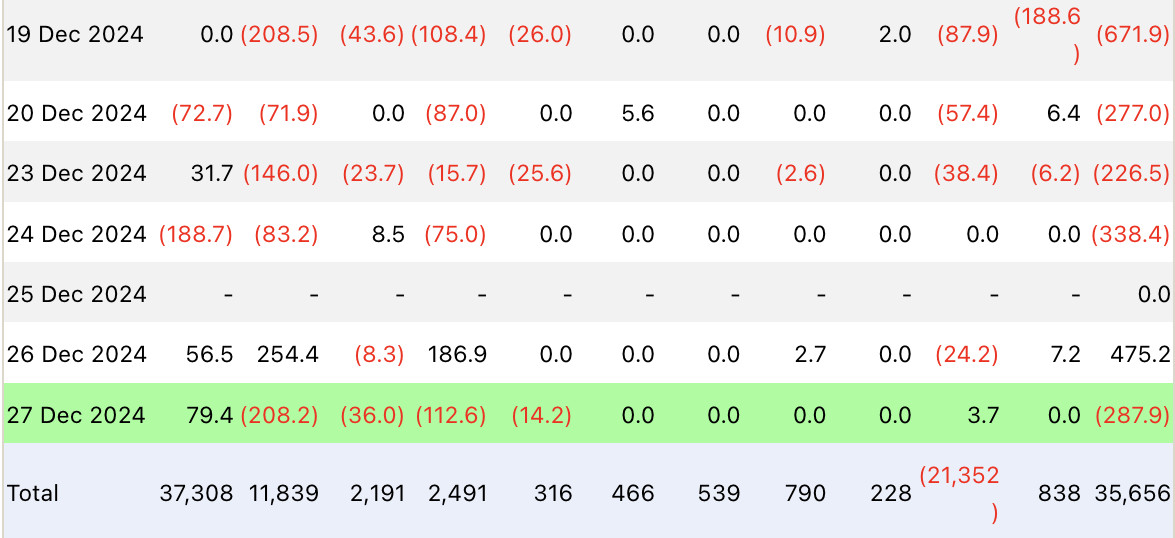

In the meantime, U.S. Bitcoin ETFs had a rocky near the yr – BlackRock’s fund is bleeding $1.5 billion over 4 days earlier than inflows began to trickle again after Christmas.

Supply: Farside Traders

We’re dwelling by some fairly legendary occasions, aren’t we? Bear in mind when $100,000 for Bitcoin felt like a pipe dream? Now it’s within the books, a milestone that’s cemented its place in crypto historical past. However as the ultimate days of 2024 slip away, the joy has been tempered by a correction that’s run deep sufficient to make even essentially the most bullish take a step again. The large query now could be whether or not 2025 kicks off with a roaring comeback or one other bout of turbulence. Both manner, the following chapter in Bitcoin’s wild story is simply across the nook, and it’s certain to maintain us on the sting of our seats.

Ethereum

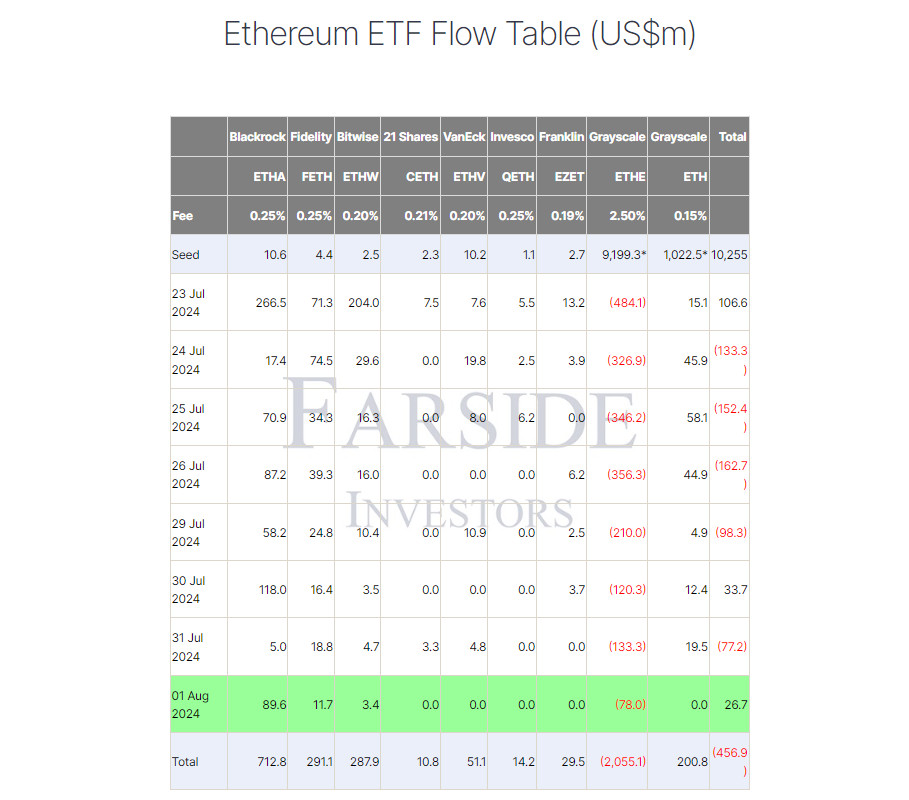

In the meantime, Ethereum has been quietly making its mark, significantly within the ETF market. December alone noticed inflows into Ether ETFs greater than double, bringing the yearly whole previous $2.5 billion.

Supply: Farside Traders

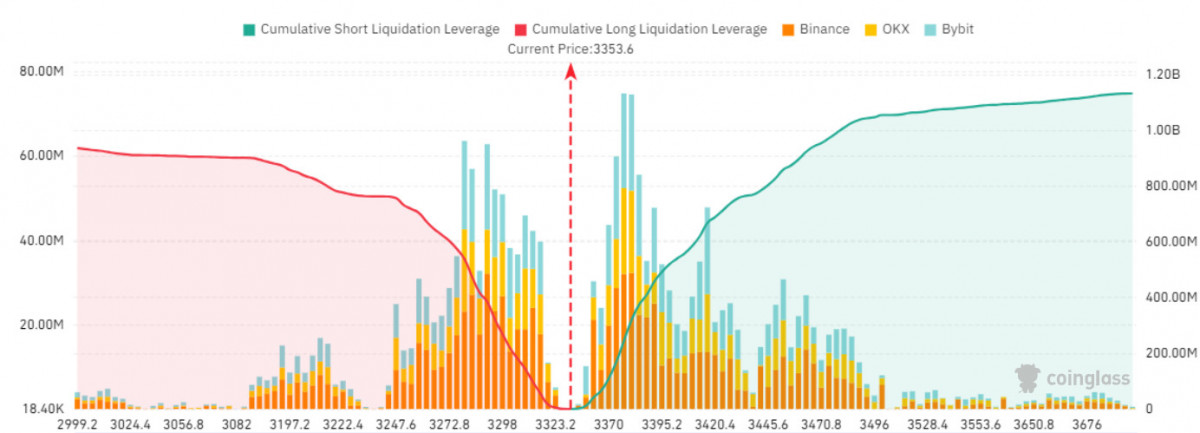

Regardless of this spectacular momentum, Ethereum has struggled to interrupt by the $3,500 resistance, a degree that might unlock over $1 billion in liquidations if breached. For now, although, it stays a troublesome barrier.

Supply: CoinGlass

Ethereum hasn’t escaped the broader market pullback, shedding roughly 10% in current weeks.

ETH/USD 1D Chart, Coinbase. Supply: TradingView

Nonetheless, its function because the spine of decentralized finance and good contracts continues to underpin its long-term attraction. Analysts counsel this versatility might be essential as adoption accelerates in 2025, significantly as Ethereum’s ecosystem grows and altcoin markets put together for what could possibly be a robust yr.

Supply: Eric Balchunas

The surge in ETF curiosity is a testomony to Ethereum’s rising prominence. Along with Bitcoin, crypto ETFs introduced in $38.3 billion in 2024, with retail traders main the cost. Wanting forward, institutional traders are anticipated to play a much bigger function, drawn by Ethereum’s rising utility and robust fundamentals.

Because the clock winds down on 2024, Ethereum feels prefer it’s gearing up for a show-stopping 2025. Heavy hitters like VanEck are already tossing round daring targets – $6,000, anybody? – on the again of Ethereum’s relentless push to increase its utility and fortify its community.

Supply: VanEck

The street forward for Ethereum isn’t with out its bumps – its ongoing battle to interrupt previous that $3,500 resistance makes that crystal clear. However as we shut the ebook on 2024, Ethereum’s knack for combining innovation with scalability is pulling in additional institutional curiosity and strengthening its foothold in decentralized finance. With rising momentum round ETFs, stablecoin adoption, and crosschain growth, Ethereum is shaping the very route of the ecosystem. As the brand new yr approaches, it’s clear Ethereum’s story continues to be price taking note of.

TON

Whereas Bitcoin and Ethereum duke it out for dominance, TON is over right here enjoying it cool, quietly carving out its area of interest by weaving blockchain tech into Telegram’s large ecosystem. And as we step into 2025, it’s doing so with a mixture of innovation, creativity, and a contact of enjoyable. Telegram simply dropped some large information – turning worthwhile for the primary time ever, raking in over $1 billion in income this yr.

Supply: Du Rove’s Channel

And whereas TON’s not included in that determine, the connection is not possible to overlook. With Telegram increasing into new markets, like its current push for a license in Malaysia, TON’s credibility is climbing proper together with it.

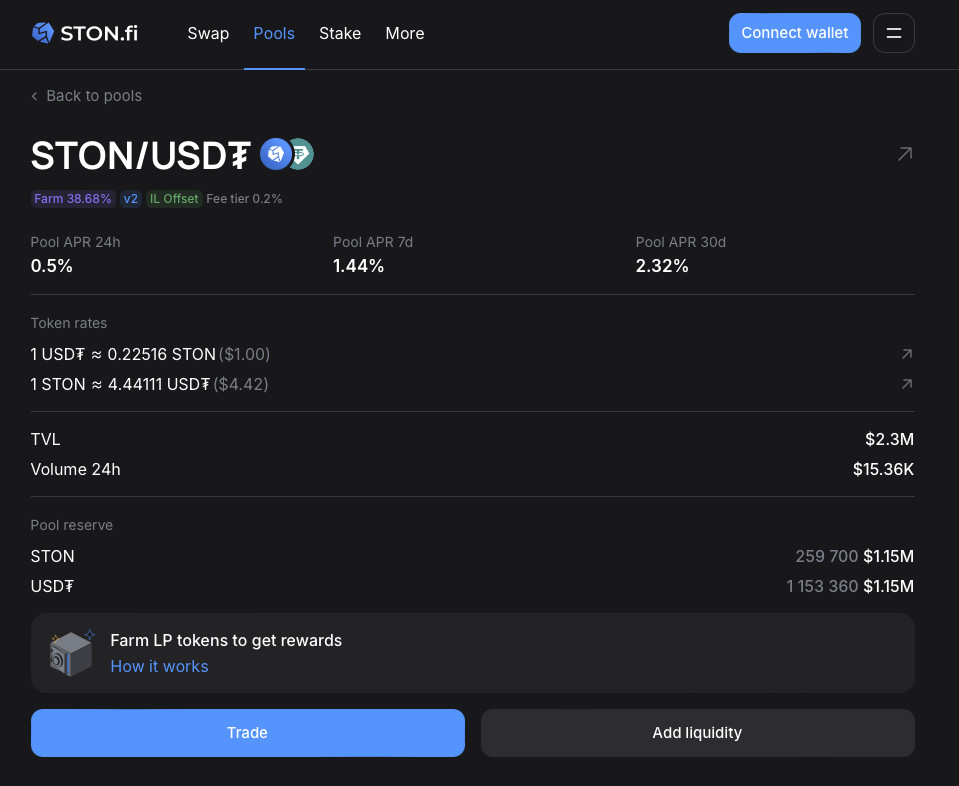

Supply: STON.fi

TON isn’t simply using on Telegram’s coattails, although – it’s making its personal strikes. STON.fi has introduced partial impermanent loss safety for its STON/USDT V2 liquidity pool, kicking off in January. It’s a sensible step ahead for DeFi customers on the lookout for safer methods to play the liquidity sport. After which there’s Hamster Fight – sure, it’s actual – a sport launching its personal Layer 2 community on TON. It’s proof that TON isn’t nearly critical blockchain infrastructure; it’s a canvas for artistic, quirky tasks that deliver a bit of character to the area.

2024 has been a breakout yr for The Open Community (TON), full of milestones which have pushed it into the highlight. Its tight integration with Telegram has been a game-changer, driving a jaw-dropping 5000% surge in pockets creation and fueling a quickly rising person base. The ecosystem hasn’t simply expanded – it’s flourished, with new tasks, purposes, and over 20 world occasions bringing builders and communities collectively to innovate and collaborate. Available on the market facet, Toncoin (TON) closed the yr buying and selling at $5.90, with a market cap surpassing $13.7 billion, touchdown it among the many prime 10 cryptocurrencies.

TON/USD 1D Chart. Supply: TradingView

It’s secure to say TON is flourishing, every new replace setting the stage for a fair greater presence within the blockchain world.

So, as 2024 wraps up, TON feels just like the blockchain equal of a well-kept secret – doing its personal factor whereas the giants battle it out. With Telegram’s attain and TON’s rising ecosystem of instruments, video games, and DeFi options, 2025 could possibly be the yr this quiet contender makes some critical noise.

Disclaimer

In step with the Belief Mission pointers, please notice that the data offered on this web page shouldn’t be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation you probably have any doubts. For additional data, we recommend referring to the phrases and situations in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover.

About The Creator

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.