Alisa Davidson

Printed: August 28, 2025 at 10:25 am Up to date: August 28, 2025 at 10:30 am

Edited and fact-checked:

August 28, 2025 at 10:25 am

Ethereum Breaks Out

As chances are you’ll or could not know, August was a mic drop second for Ethereum. ETH marched proper up towards the fabled $4.9–5K line, nudged towards its previous highs, and for a couple of charged hours appeared prefer it would possibly lastly break by means of. Relying in your trade of alternative you both noticed a recent ATH or a near-miss — both method, it was shut sufficient to make the gang squint at their screens and surprise if historical past was being made.

However what actually gave the transfer texture was the backdrop. This wasn’t your typical momentum merchants pushing buttons on a sluggish day. Capital flows really tilted. Bitcoin funds, which had nonetheless been bleeding from mid-summer, appeared heavy, whereas ETH merchandise managed to carry their floor — even posting inflows right here and there when sentiment flickered inexperienced. Positive, it wasn’t the form of wholesale rotation that rewrites the playbook, however it was the form of shift you discover should you’ve been round lengthy sufficient.

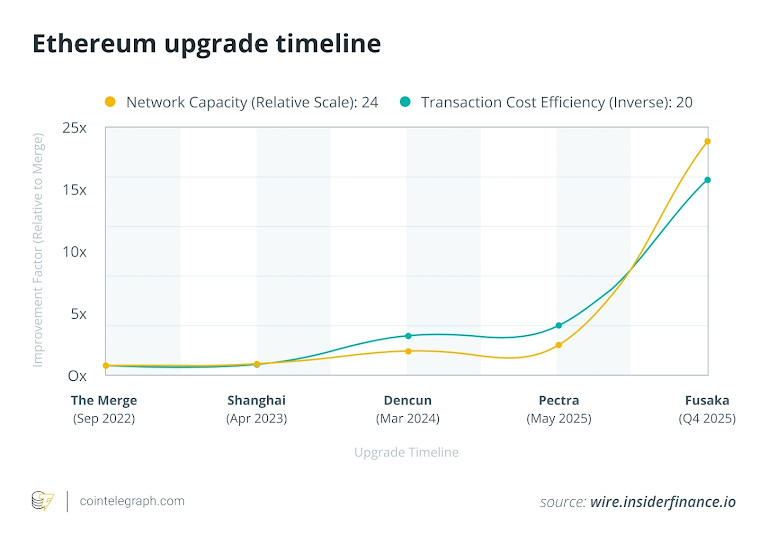

And whereas the market obsessed over charts and candles, the protocol’s engineers stored quietly laying rails. The Fusaka improve, pencilled in for later this yr, stored transferring by means of its check phases. On paper it’s really fairly dry stuff: EIP-7594 PeerDAS, tweaks to dam gasoline limits, extra environment friendly knowledge pruning, all that jazz. In follow, although, it’s sure to be the scaffolding that makes rollups cheaper, lightens the load on nodes, and nudges throughput greater. None of it landed in customers’ wallets in August, however the roadmap was buzzing within the background.

So if we sew all of it collectively, there’s nothing conclusive per se — September has an extended historical past of chopping events quick — however not less than for some time, Ethereum just like the frontman of the band.

Bitcoin: Lightning Grows Into the On a regular basis Chain

Yeah, Lightning per se isn’t new, however this August its upgrades actually began to indicate up within the numbers. Roughly one in six Bitcoin transactions now route by means of it, which is kind of a leap from the only digits simply a few years in the past. And it’s not simply capability charts to gawk at; the tech itself appears to be getting smoother. For one, Channel splicing went dwell, which might let customers resize their fee channels with out the effort of closing and reopening. In the meantime, BOLT-12 “provides” made invoicing much less clunky — now you can request and ship funds with much less back-and-forth QR code juggling.

What’s notable is that every one that truly counts for the typical person. Why? As a result of it’s the distinction between Bitcoin being a retailer of worth you maintain and a forex you really spend. Paying for a espresso or streaming sats to a podcaster could cease feeling like a geek trick. The charges are negligible, the settlement is close to prompt, and for the primary time in years, Bitcoin funds really feel, properly, informal.

We wouldn’t name it a reinvention — Bitcoin remains to be Bitcoin, nonetheless sluggish on its base layer. However August confirmed us that whereas the market frets about ETF flows and macro speeches, the community’s Layer-2 is quietly maturing into what Satoshi in all probability hoped for: cash you possibly can transfer with out oversight and friction.

Solana Rewrites Its Clock: “Alpenglow” and the Promise of Immediate Finality

If you happen to’ve adopted Solana for any size of time, you already know the lore: the well-known Proof-of-Historical past clock, the entire “it ticks, subsequently it scales” design. August marked the second that lore began to fade. The community’s huge Alpenglow improve swapped out the very rhythm part of the chain. Proof-of-Historical past plus Tower BFT, the combo that outlined Solana since day one, was retired in favor of a brand new consensus that guarantees finality in a blink — 100 to 150 milliseconds, relying on circumstances.

Even on paper that’s an enormous leap: from ready twelve seconds to understanding your transaction is finished in much less time than it takes to blink. For merchants, it may imply no extra anxious refreshes when the market’s transferring quick. For sport devs, it’s the distinction between “this seems like Web3” and “this seems like Web2.” However, most significantly, sub-second finality adjustments how individuals really feel concerning the chain. It makes transactions invisible, background noise, one thing you don’t even take into consideration anymore.

In fact, it’s not with out trade-offs. Validators are adjusting to a system that leans on quick off-chain vote exchanges — jargon names like Votor and Rotor flying round — and there are new financial levers, like validator charges, that can want cautious tuning. Solana has been right here earlier than, promising huge leaps solely to stumble below its personal weight. So yeah, we’re cautious. Nonetheless, watching a series intentionally shed its most well-known function in pursuit of one thing sleeker feels momentous. Whether or not that gamble pays off, properly — that’s the half we’ll be watching within the months forward.

Cardano: $71M for Scaling Goals

Cardano’s huge second in August wasn’t on a chart, it was on-chain. On the 4th, the group signed off on the most important treasury spend in its historical past: almost 97 million ADA, about $71 million on the time, earmarked for core upgrades. That’s not simply pocket change; it’s a vote of confidence in the place the chain needs to go.

And the place is that? Straight on the scaling ceiling. The funds are headed into three pillars: Ouroboros Leios, a brand new consensus variant meant to push throughput greater; Hydra, the Layer-2 venture that, in lab circumstances, can fling round one million transactions per second; and Mithril, which guarantees quicker syncs for nodes so wallets and apps can be a part of the occasion with out ready hours.

From our seat, what’s fascinating isn’t simply the tech wishlist however the governance second. Cardano has lengthy pitched itself because the “tutorial” chain, deliberate and heavy on peer overview. Right here, the group primarily wrote an enormous test for experimentation — saying, sure, let’s really construct the quick stuff, and sure, we’re keen to burn severe treasury reserves to do it. And that shifts the vibe quite a bit.

Will Hydra actually hit these sci-fi TPS numbers in follow? In all probability not tomorrow, possibly not ever within the wild. However even when the fact is extra modest, quicker nodes and cheaper transactions are the form of upgrades that customers will discover. August didn’t crown Cardano the quickest horse, however it confirmed the chain is keen to wager on itself.

Polkadot: Elastic Scaling Goes Stay

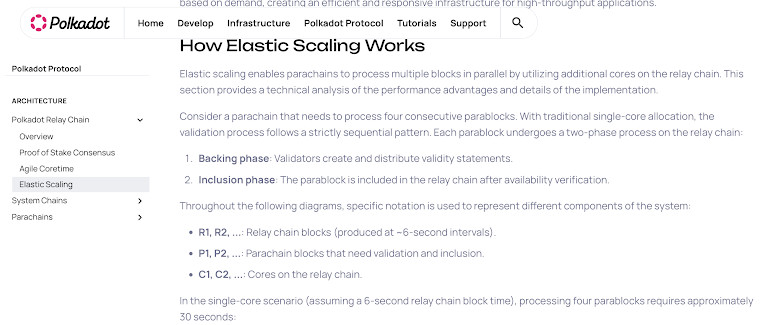

Polkadot’s August wasn’t flashy, however it was quietly intelligent. Early within the month, the community flipped the swap on elastic scaling, the ultimate piece of its long-teased 2.0 design. The concept is easy sufficient: as an alternative of each parachain renting a set slice of compute whether or not they want it or not, chains can now flex — grabbing additional cores throughout visitors spikes, then letting them go when demand cools.

In follow, which means the ecosystem simply obtained loads much less brittle. If a brand new sport instantly takes off or a DeFi app goes parabolic, the parachain beneath doesn’t must choke or jack up charges; it may well stretch to suit the second. Later, when issues settle down, it shrinks again with out losing assets. Consider it like cloud auto-scaling, however for blockchains.

For customers, the advantages are refined however actual. Transactions ought to preserve flowing easily even when the gang exhibits up, and costs are much less prone to swing wildly when one parachain will get sizzling. For builders, it lowers the psychological barrier of “will my chain collapse if I succeed too quick?” That’s no small factor.

We wouldn’t name it a reinvention — Polkadot remains to be very a lot the parachain hub it got down to be — however elastic scaling does change the feel of the community. August confirmed that it may well adapt assets dynamically, which makes the entire ecosystem really feel extra alive, much less inflexible. And in a month when different chains had been making huge bets on velocity, Polkadot’s wager was on flexibility.

Cosmos: Osmosis v30 and the Swimming pools Go Permissionless

Cosmos had its personal headline in August, courtesy of Osmosis, the interchain DEX that mainly acts because the ecosystem’s liquidity hub. On August 5, the community rolled out its v30 improve, and whereas exchanges briefly froze OSMO deposits and withdrawals to maintain issues clear, the true change was easy: anybody can now spin up a liquidity pool.

Till now, including a brand new buying and selling pair on Osmosis meant ready for governance to offer a nod. That gate stored issues orderly, however it additionally slowed the tempo. With v30, the gates got here down. New tokens might be listed and not using a proposal, which implies quicker bootstrapping for tasks and fewer friction for communities that simply wish to get their coin buying and selling.

From the person’s facet, this interprets into extra pairs, extra shortly. If a brand new Cosmos venture launches, odds are you’ll see liquidity on Osmosis at once. And since the improve additionally folded typically efficiency and safety enhancements — together with a mid-month bug patch that was dealt with quietly however successfully — the decks really feel smoother to commerce on.

The larger image? Osmosis simply leaned tougher into being a real permissionless market, in keeping with the ethos of Cosmos itself. It doesn’t make headlines like “prompt finality” or “new ATH,” however should you dwell on this ecosystem, it issues. August was when the DEX at Cosmos’ core stopped asking permission and began transferring on the velocity of its customers.

Polygon: POL Migration and a Snappier Chain

And there’s some huge reviews from Polygon. By the twentieth, almost each MATIC token — 97.8% of them — had already been slipped into its new outfit: POL. It might look like a mere ticker change, however the level is kind of a bit larger. POL is Polygon’s try to stitch collectively its patchwork of chains into one material. PoS sidechain, zk rollups, supernets — all of them are actually presupposed to orbit the identical token, the identical financial system.

Let’s face it: for many of us, the swap barely raised an eyebrow. Your pockets confirmed POL the place MATIC used to sit down, and your favourite dApps carried on as typical. However beneath that clean rollout, a severe level was being made: Polygon doesn’t wish to really feel like a group of experiments anymore. It needs to really feel like a single community with a single heartbeat.

And talking of heartbeat — keep in mind when Polygon confirmations used to really feel like watching paint dry? That little pause, the “is it closing but?” shuffle? Nicely, Heimdall v2, which landed in July however actually flexed its muscle groups by means of August, lower that nonsense down to 5 seconds flat. This proves an enormous aid for bridges, video games, and DeFi total.

Positive, the replace wasn’t as dramatic as Solana tearing out its well-known clock, and never as costly as Cardano writing itself a $71M test. Nevertheless it’s nonetheless significant. Polygon now poses itself a series that lastly is aware of the way it needs to indicate up.

Disclaimer

According to the Belief Venture pointers, please observe that the knowledge supplied on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation you probably have any doubts. For additional data, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.