Analyst Weekly, September 1, 2025

Tariffs in Limbo

The US Courtroom of Appeals simply clipped US’s tariff wings. On Friday, the Federal Circuit dominated that the president can’t use emergency powers (IEEPA) to impose tariffs, saying the legislation doesn’t truly give him that authority. The court docket let the tariffs keep in place till October 14 so the administration can enchantment to the Supreme Courtroom. The administration will possible enchantment to the Supreme Courtroom and search a keep, which might hold tariffs in place till the case is determined. If a keep is denied, tariffs would instantly cease being collected, successfully delivering fiscal stimulus.

Why it issues: Practically 90% of Trump’s tariffs had been enacted underneath IEEPA, protecting greater than $300B in items. Whereas tariffs on autos, metal, aluminum, and copper (underneath Part 232) aren’t touched, this determination nonetheless strikes on the core of Trump’s commerce playbook.

Investor angle:

The true kicker isn’t whether or not tariffs stick long-term: the White Home has a Plan B to reimpose them via different channels.

The near-term drama is whether or not current tariffs will should be refunded. If the Supreme Courtroom guidelines in opposition to the administration, about $100B in rebates may circulate again to corporations.

Layer that on prime of the Fed’s fee cuts, $150B in client support, and new enterprise tax incentives and also you’ve acquired a contemporary dose of fiscal stimulus hitting the economic system.

Corporations most levered to China, Brazil, India, Switzerland, and Vietnam would see the most important reduction rally if tariffs are struck down.

Tariffs at present decrease US deficits by about $4 trillion over the subsequent decade, per the CBO. If tariffs are struck down, deficits rise, which may push bond yields increased. Treasuries could dump on deficit considerations, even when equities rally on tariff reduction.

Traders shouldn’t assume tariff reduction is everlasting. But when rebates are compelled via, it may hand company America an sudden windfall simply as financial and financial coverage are already easing. That cocktail would increase progress and will hold markets buzzing.

Low Correlations Increase Inventory-Selecting Potential However Thoughts the Imply Reversion Threat

With the S&P 500 buying and selling at file highs, rolling 90-day correlations amongst its constituents stay close to traditionally low ranges (see beneath). For traders, this often creates an surroundings the place diversification advantages are strongest as particular person shares are much less more likely to transfer in tandem, permitting portfolios to unfold threat extra successfully.

For energetic managers, this backdrop is especially constructive. When company-specific fundamentals drive returns relatively than macro components, inventory pickers have extra scope to generate alpha. In distinction, throughout high-correlation regimes, inventory choice tends to matter much less since “every little thing strikes collectively.”

However historical past suggests this calm not often persists. Correlations are mean-reverting, and prolonged intervals of low correlation, and better dispersion that comes with it, have usually been adopted by sharp spikes, usually triggered by stress occasions comparable to Fed coverage shifts, geopolitical shocks, or earnings disappointments. The problem is that correlations will not be secure: they spike rapidly in selloffs, decreasing diversification advantages on the very second traders want them most.

The implication for traders is twofold. Right this moment, low correlations assist diversification and reward selective positioning. However wanting forward, historical past cautions in opposition to extrapolating present circumstances into burdened markets.

Information as of September 1, 2025. Supply: Bloomberg.

When Bonds Push Again: Washington’s Actual Test on Energy

The bond market is the place Washington’s financial selections get stress-tested. When Treasury yields rise, the ripple results affect key cornerstones of the economic system, specifically mortgages, bank cards, and enterprise loans all get costlier, while fairness valuations, notably in rate-sensitive sectors, come underneath stress. For on a regular basis traders, that makes bond market strikes simply as consequential as inventory earnings.

The current headlines surrounding the dismissal of Fed Governor Lisa Cook dinner are actually about testing presidential energy over the central financial institution. But, we predict the bond market holds the true leverage. If traders lose confidence that the Fed will defend worth stability, or if fiscal deficits balloon regardless of tariffs, the bond market can punish Washington with increased yields. That transfer successfully constrains the White Home, as costlier borrowing makes fiscal growth more durable to maintain, as increased yields can derail progress by tightening monetary circumstances.

We noticed the same episode of ‘exhausting stress’ earlier than. In 2020-2021, disclosures of hawkish Fed officers’ trades led a number of governors to resign simply as inflation dangers had been constructing. That contributed to the Fed staying looser for longer, and inflation surged to its highest in many years. Markets then compelled the Fed into aggressive tightening. The lesson is easy: political maneuvering can tilt coverage within the quick run, but when bond traders push again, coverage has to vary.

Small Caps Are Significantly Price-Delicate

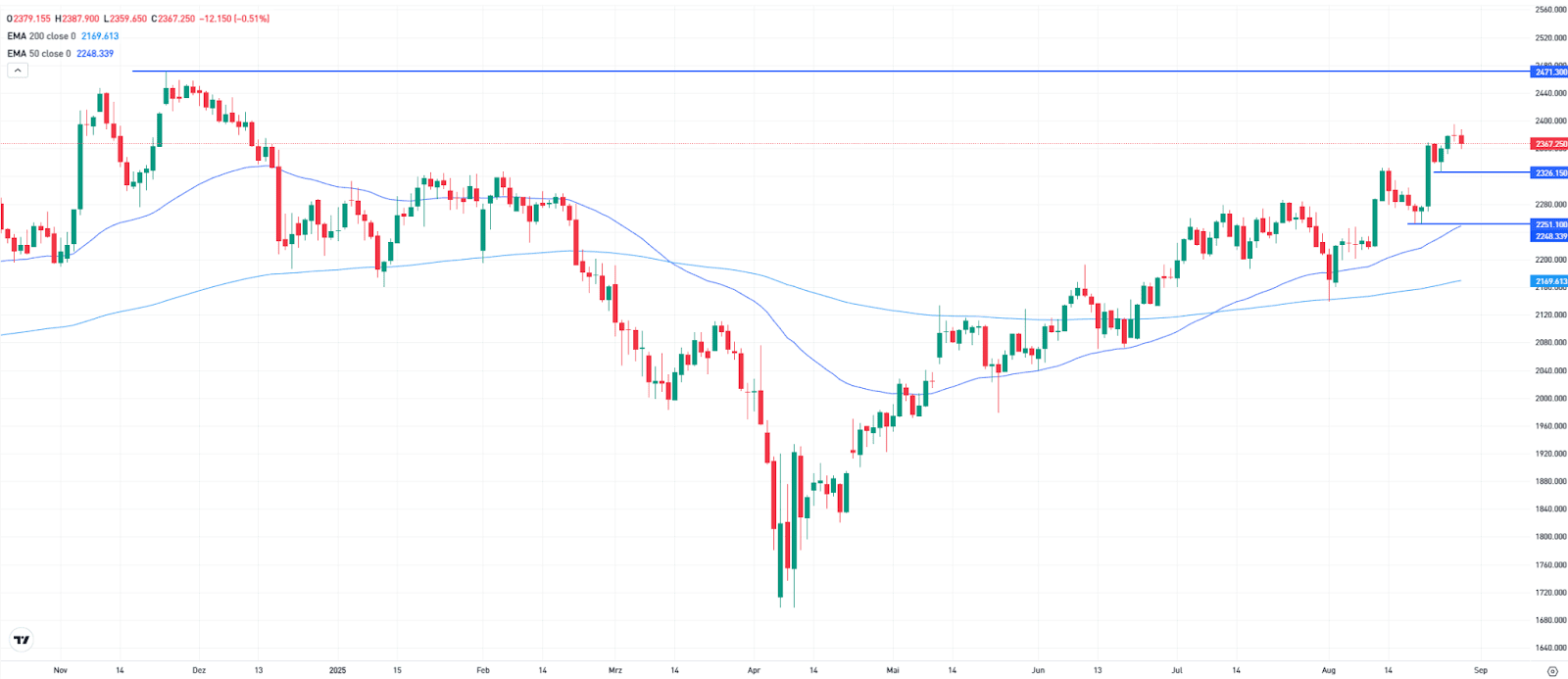

Small caps have obtained little consideration lately however could possibly be on the verge of a comeback, particularly if the possibilities of additional fee cuts improve. Whereas the S&P 500 has gained 60.2% over the previous three years, the Russell 2000 has lagged behind with a rise of simply 25.2%. Since its April low, the index has been transferring in a secure upward pattern with out main setbacks and is now approaching its file excessive. That file excessive stands at 2,471 factors and is at present solely 4 to five% away. Key assist ranges are at 2,326 and a pair of,251 factors, with the latter aligning with the 50-day transferring common.

Russell 2000 within the each day chart. Supply: eToro

Weak spot In The US Labor Market Probably To Persist

Markets are firmly anticipating a Fed fee minimize in September, with the likelihood estimated at round 86%. What stays unsure is the trail past that. Whether or not the subsequent minimize is available in October or not till December remains to be unclear, it’s extra of a coin toss. The primary motive behind the anticipated easing is the weakening labor market.

The subsequent knowledge replace is scheduled for Friday at 2:30 p.m. In August, solely 78,000 jobs are anticipated to have been created. Weak spot has already continued for a while. In July, expectations had been missed by 37,000 jobs, and figures for Might and June had been revised down by a mixed 258,000. The unemployment fee is predicted to have risen from 4.2% to 4.3%.

The ISM Manufacturing PMI (knowledge due Tuesday) has been beneath the 50 mark since March. For August, a rise from 48.0 to 48.6 is forecast. The longer the index stays beneath 50 and the deeper it falls, the higher the danger of recession. The ISM Companies PMI (knowledge due Thursday) is predicted to stay above 50, with a slight improve from 50.1 to 50.5 projected.

Traders wish to know whether or not that is merely a brief weak point within the financial knowledge or one thing extra important. The bigger the deviation from the anticipated values, the stronger the market response could possibly be. The labor market report is a glance within the rearview mirror, whereas the PMI knowledge function necessary main indicators.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

![[LIVE] Crypto News Today, September 1 – Bitcoin Price Holds Above $108K, And Trump’s WLFI Launches On Major Exchanges – Best Crypto to Buy? [LIVE] Crypto News Today, September 1 – Bitcoin Price Holds Above $108K, And Trump’s WLFI Launches On Major Exchanges – Best Crypto to Buy?](https://dgp.news/wp-content/themes/jnews/assets/img/jeg-empty.png)