Alisa Davidson

Printed: September 22, 2025 at 8:26 am Up to date: September 22, 2025 at 8:26 am

Edited and fact-checked:

September 22, 2025 at 8:26 am

In Transient

Bitcoin broke beneath consolidation to the 112K vary, dragging Ethereum to oversold ranges close to 4.2K and Toncoin beneath its $3.0 ground, with all three displaying potential for short-term aid bounces if key helps maintain.

Bitcoin (BTC)

BTC seemed fairly composed for many of the week, holding that tight 115–117K hall prefer it was glued there. Then Monday the twenty second got here, and the ground collapsed into the low 112Ks in a single clear sweep. It’s a reasonably traditional transfer, as we all know that consolidations are nearly assured to be adopted by a robust impulse transfer.

Talking of the explanations, the primary domino can be the Fed’s charge minimize on September seventeenth. A 25 bps trim was broadly anticipated, and certain, BTC did its well mannered pump towards 117K. However Powell’s messaging wasn’t precisely champagne — he left steering mushy, so the market’s preliminary cheer shortly pale. What’s essential right here: Bitcoin didn’t crash on the minimize itself, however the seeds of indecision have been planted proper there.

Then got here the choices expiry across the nineteenth, which turned 115–118K right into a magnet all week. Merchants like to name this “max ache” as a result of value simply will get caught the place contracts damage the most individuals. As soon as these contracts rolled off, BTC was free to maneuver — and it did, violently, to the draw back.

Below the floor, miners really pushed community problem to a recent all-time excessive. Sounds bullish, proper? In the long term, certain. However within the quick run, that additionally means extra cash hitting the market from operators who have to cowl prices, which provides to promote strain precisely when liquidity is skinny. That’s not a crash set off by itself, however it’s yet another weight urgent down.

If 112–113K continues to carry on closing bases, we’d prefer to see a messy mean-reversion again towards 115.3K after which one other poke at 117–118K. Lose 112K with tempo and the market would possibly go price-shopping at 111K and 110K/109.8K.

Ethereum (ETH)

Ethereum spent Sept 15–22 chopping in that 4.4–4.6K band, hugging the 9-SMA (orange line), however momentum stored bleeding out. RSI rolled downhill all week, and when BTC cracked its personal shelf, ETH adopted go well with — plunging straight via helps and tagging ~4.21K. That wick additionally lined up neatly with the August twentieth low round 4.06K, which is now the main line within the sand. Structurally, ETH is oversold (RSI ~21), and the 4H candle appears to be like extra like a liquidation flush than a gradual development break. Now let’s break down the why’s.

One ‘stealthy-big’ piece of reports got here from Coinbase, which rolled out on-chain USDC yields immediately in-app. Which will sound area of interest, however it’s successfully a mainstream bridge into Ethereum’s DeFi plumbing. All of a sudden, grandma with a Coinbase account is one click on away from protocol yields with out figuring out what “liquidity pool” means.

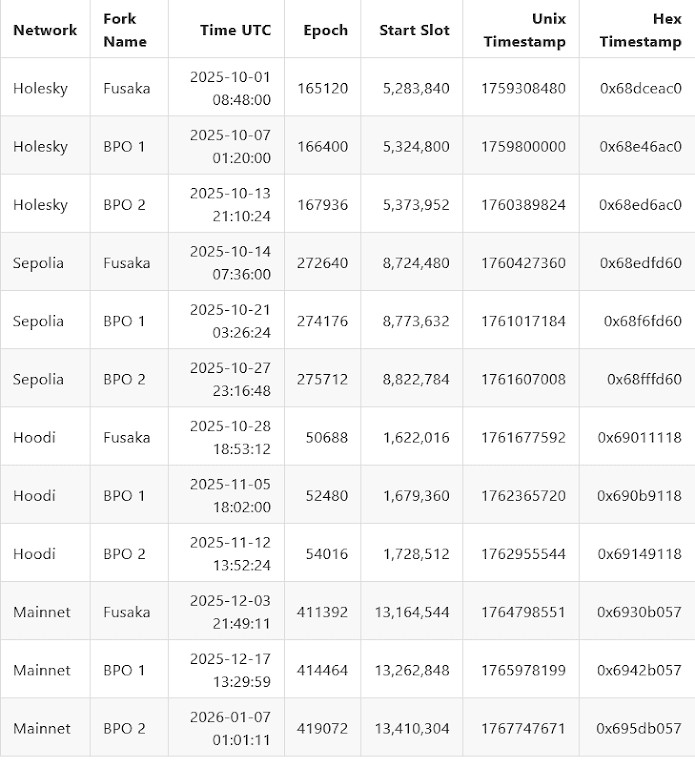

After which there’s Fusaka, the following arduous fork, formally locked in for December third. It’ll double blob throughput, minimize prices, and customarily grease Ethereum’s scaling machine. It’s the form of factor establishments quietly love, so keep tuned.

The irony is that every one this bullish ETH-specific momentum acquired fully drowned out by Bitcoin’s crash. Correlation nonetheless guidelines. When BTC breaks a variety, ETH doesn’t get to say “however fundamentals!” — it simply will get dragged, normally even tougher.

So the place does that depart it? If ETH can maintain above 4.18–4.20K on closing bases, the trail again to 4.36–4.42K (and ultimately the 4.5K deal with) is open as a aid bounce. But when 4.06K provides means with quantity, that may verify a deeper retrace, forcing the market to construct a brand new base decrease. We’re most likely taking a look at a messy chop, then a rebound try towards mid-4.3Ks, so long as Bitcoin doesn’t do a second leg down.

Toncoin (TON)

TON spent Sept 15–22 glued across the 3.0 deal with, proper on prime of its June low assist (~3.04). However as an alternative of lifting, it cracked — and the break was brutal. Value free-fell to ~2.60–2.70 earlier than catching a bounce, whereas RSI on the 4H collapsed to ~12, deep in oversold territory. It was a clear rejection of the three.0 ground that had held for months.

Imagine it or not, this week we haven’t really acquired any main information coming from the TON camp. Not like BTC and ETH, TON had no recent catalyst or narrative to draw dip consumers. So when the broader market flushed, liquidity simply wasn’t there. That’s why the transfer exaggerated — not as a result of TON was “damaged,” however as a result of it had nothing to face on.

So long as TON can reclaim the two.95–3.05 band shortly, it will seem like an unpleasant stop-hunt fairly than a real breakdown. Fail to get again above 3.0, and the market will doubtless deal with 2.6–2.7 as the brand new base, with draw back threat into the mid-2.5s. For now, TON appears to be like oversold sufficient for a aid bounce, however it wants both BTC stability or its personal catalyst to make that bounce stick.

Disclaimer

According to the Belief Challenge pointers, please notice that the knowledge supplied on this web page just isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.