Alisa Davidson

Printed: October 06, 2025 at 10:04 am Up to date: October 06, 2025 at 10:04 am

Edited and fact-checked:

October 06, 2025 at 10:04 am

In Temporary

Bitcoin rebounded from early-September lows to a brand new all-time excessive round $125K, pushed by ETF inflows, institutional shopping for, and provide constraints, whereas Ethereum and Toncoin adopted with steadier positive aspects.

Bitcoin (BTC)

What a turnaround. Bitcoin spent September flirting with catastrophe, sliding all the best way down close to 108K. Then, out of nowhere, it kicked again into gear and shot to a contemporary all-time excessive round 125K. Proper now it’s caught in suspense — neither persevering with the rally nor rejecting it. So merchants, preserve your eyes peeled and your danger appetites in test.

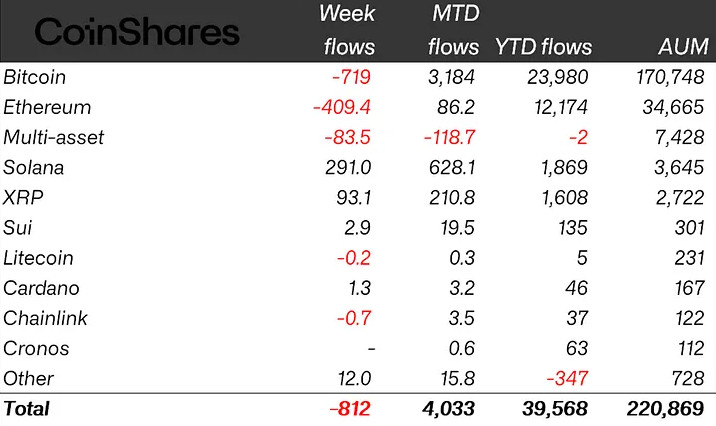

So, what triggered the rally? Let’s begin with the ETF flows. They roared again to life after a sluggish month, pushing billions in contemporary capital into spot funds. It’s nearly humorous how rapidly that dynamic adjustments the tone — one week of sturdy inflows and all of a sudden everybody’s bullish once more, pretending they by no means panicked.

Company patrons stayed within the image too. Technique added to its pile, due to course it did. Japan’s Metaplanet saved stacking as effectively. And these aren’t ‘flashy headlines’ anymore — institutional strikes like these have gotten a sort of background heartbeat for Bitcoin.

And the alternate information backed it up. Cash saved draining off exchanges, heading into custody or long-term chilly wallets. Meaning fewer liquid cash to promote, and each little dip finds patrons quicker than earlier than. Mainly a provide squeeze.

And macro added its personal unusual seasoning. The U.S. authorities stumbled by means of yet one more shutdown scare, injecting a dose of uncertainty that markets by no means love. Then the greenback softened — just a bit — sufficient to make danger belongings breathe simpler. Gold began rallying once more too, reclaiming its safe-haven aura. Every of those by itself doesn’t imply a lot, however collectively they constructed an atmosphere the place Bitcoin all of a sudden appeared sort of affordable.

The leverage, although, is unimaginable to disregard. Open curiosity in futures hit new highs, and everybody is aware of how that film ends. All it takes is a single spook — a foul headline, an ETF outflow, a macro shock — and also you get a type of nasty, ten-minute flushes. The present setup’s bullish, certain, nevertheless it’s additionally fragile.

Proper now, Bitcoin’s simply sitting between 120K and 125K prefer it owns the place. It doesn’t really feel like euphoria but, extra like coiled stress. The market’s ready for one thing — perhaps affirmation, perhaps permission — to determine whether or not that is one other leg larger or a entice for the latecomers.

Ethereum (ETH)

Ethereum moved later, as traditional. It spent most of September dragging its toes, then adopted Bitcoin’s lead and rallied about fifteen p.c. By week’s finish, it was hanging across the mid-$4Ks — shut sufficient to style the outdated highs, however yeah, nonetheless not fairly there.

Regardless of the rally, the tone was extra cautious right here. ETF inflows picked up once more, although not with the identical depth as Bitcoin’s.

Then got here some contemporary validation from the TradFi aspect. Analysts began speaking about Ether once more, and analysis desks started together with it in portfolio fashions. It’s refined, nevertheless it issues as a result of the dialog’s basically shifting from hypothesis to allocation.

In the meantime, on the infrastructure entrance, the SWIFT–Linea connection lastly received formalized. That’s a type of headlines that doesn’t set off alarms on buying and selling desks however retains echoing by means of enterprise circles.

Up to now, Ethereum’s shadowing Bitcoin however with much less emotional baggage. If BTC consolidates, ETH might really look cleaner — much less overextended, extra symmetrical. And if Bitcoin rips once more, ETH has each motive to chase it towards $5K. For now, it’s a sluggish construct, not a rush.

Toncoin (TON)

TON’s story final week felt completely different although. As a substitute of any explosions — or collapses — it confirmed a gradual, deliberate climb after weeks of doing subsequent to nothing. It began pushing again towards that $2.9 vary, and you might inform the tone shifted from “forgotten alt” to “price one other look.”

The explanations, other than the plain Bitcoin winds, are Telegram’s critical under-the-bonnet strikes. For one, the @pockets undertaking began prepping tokenized shares and ETFs instantly contained in the app. It’s a fairly radical transfer that’s meant to offer lots of of thousands and thousands of Telegram customers entry to funding merchandise with out leaving their chats. It’s nonetheless early, nevertheless it’s precisely the sort of experiment that would make TON matter outdoors of crypto.

Then Telegram introduced a brand new AI lab in Kazakhstan, and the statements popping out of it made clear that blockchain can also be a part of the plan. They’re speaking about integrating TON infrastructure into AI instruments, which might finally blur the road between messaging, finance, and machine studying.

And there was additionally a company shake-up. TON employed a advertising and marketing lead who beforehand labored at Apple and Nike — a transparent sign that the undertaking needs to develop past its tech-geek viewers. On the similar time, AlphaTON moved to accumulate a majority stake in Animoca’s Gamee, pulling gaming nearer into the ecosystem. All issues mixed, you’ll be able to see the skeleton of a consumer-grade technique forming.

However the monetary construction retains evolving too. TON Technique went heavy into staking, locking up tens of thousands and thousands of tokens and hinting at potential buybacks down the street. That’s not the sort of transfer that pumps value in a single day, nevertheless it does form the availability curve over time.

Value-wise, TON nonetheless reacts to Bitcoin’s moods. However beneath the floor, there’s precise progress — actual large partnerships, new infrastructure, an general stronger sense of path. This sort of momentum could really feel sluggish till sooner or later it doesn’t.

Disclaimer

In keeping with the Belief Venture pointers, please word that the data supplied on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.