The Bitcoin market construction is believed to have undergone an enormous shift because the vital value downturn seen on October 10, 2025. Whereas the premier cryptocurrency has been on one thing resembling a restoration path because the market massacre, some sectors imagine that the bear season has already kicked off.

With BTC sitting beneath its opening value of 2025, it’s changing into more and more troublesome to make a bullish case for the world’s largest cryptocurrency. Furthermore, an fascinating knowledge level a couple of related class of Bitcoin traders has emerged, additional including credence to the start of a potential bear market.

Are Bitcoin Treasury Companies Offloading Their Cash?

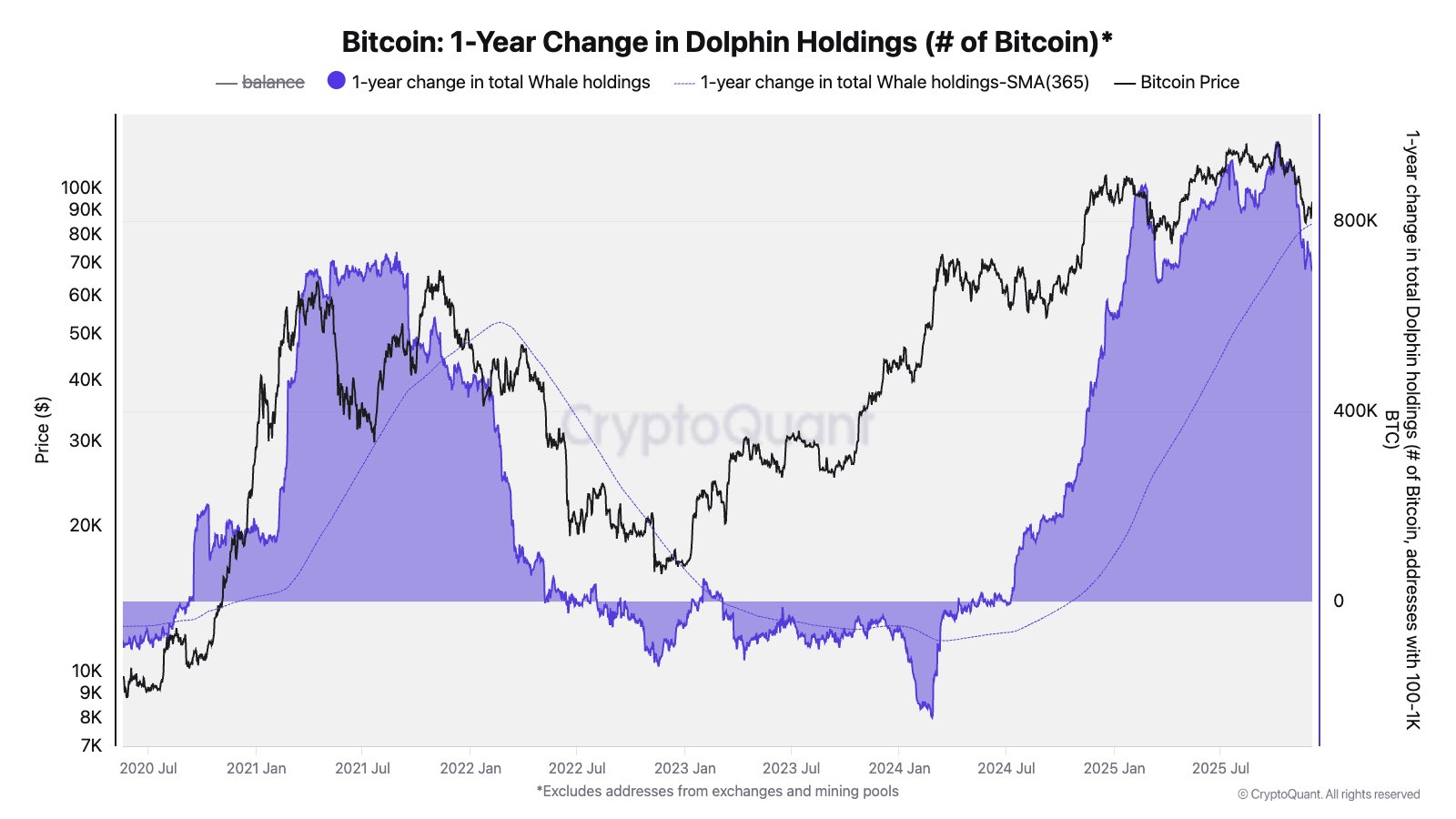

In a brand new put up on X, CryptoQuant’s Head of Analysis, Julio Moreno, shared an on-chain perception to help the speculation that the Bitcoin bear market has began. This conclusion is predicated on the Steadiness Development of an investor group referred to as the “dolphins.”

Dolphins check with a gaggle of crypto traders holding substantial quantities of a coin, inserting them between small traders (shrimps) and the most important traders (whales). Particularly, Moreno described dolphins as pockets addresses with vital BTC holdings between 100 – 1,000 cash.

In line with the most recent knowledge from CryptoQuant, the expansion within the Dolphins’ BTC holdings has slowed down previously 12 months and seems to be in a downward pattern. Moreno believes that this detrimental change factors to the emergence of a Bitcoin bear market.

Supply: @jjc_moreno on X

Moreno revealed that these Dolphin addresses had elevated year-over-year by roughly 965,000 BTC when the BTC value hit its present all-time excessive round $125,000. Now that the BTC value is almost 30% beneath its file excessive, the Bitcoin Dolphins’ stability stands at round 694,000 cash.

Moreno wrote on X:

This deal with cohort contains ETFs and Treasury corporations, which have additionally stopped shopping for.

Extra apparently, the CryptoQuant Head of Analysis revealed that this investor group consists of ETF issuers and Treasury corporations, which have stopped buying Bitcoin. In line with knowledge from SoSoValue, the US-based Bitcoin exchange-traded funds have posted web outflows in 5 out of the final six weeks.

In the meantime, BTC and crypto treasury corporations have struggled previously few months, with retail traders dropping tens of billions to the hype. Whereas there have been hardly ever experiences of crypto treasury sell-offs, this decline in these Dolphins’ holdings tells a completely completely different story.

Bitcoin Worth At A Look

As of this writing, the value of BTC stands at round $89,151, reflecting an over 3% decline previously 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.