Fast Breakdown

Crypto sanctions just like the Twister Money case expose the stress between monetary privateness and regulation, elevating questions on whether or not governments can censor open-source code and the way a lot accountability builders maintain.Sanctions can affect decentralized networks from inside, as validators and platforms start censoring sure transactions to keep away from authorized threat, threatening blockchain’s beliefs of openness and censorship resistance.The way forward for privateness and compliance will rely on new cryptographic options, clearer authorized frameworks, and group engagement, as regulation more and more shapes how customers, builders, and platforms work together in Web3.

Blockchain was invented to be open and clear, with each transaction recorded on public ledgers, seen to anybody with an web connection. This transparency helps hint the circulation of cash, however it additionally creates powerful questions when governments begin implementing crypto sanctions.

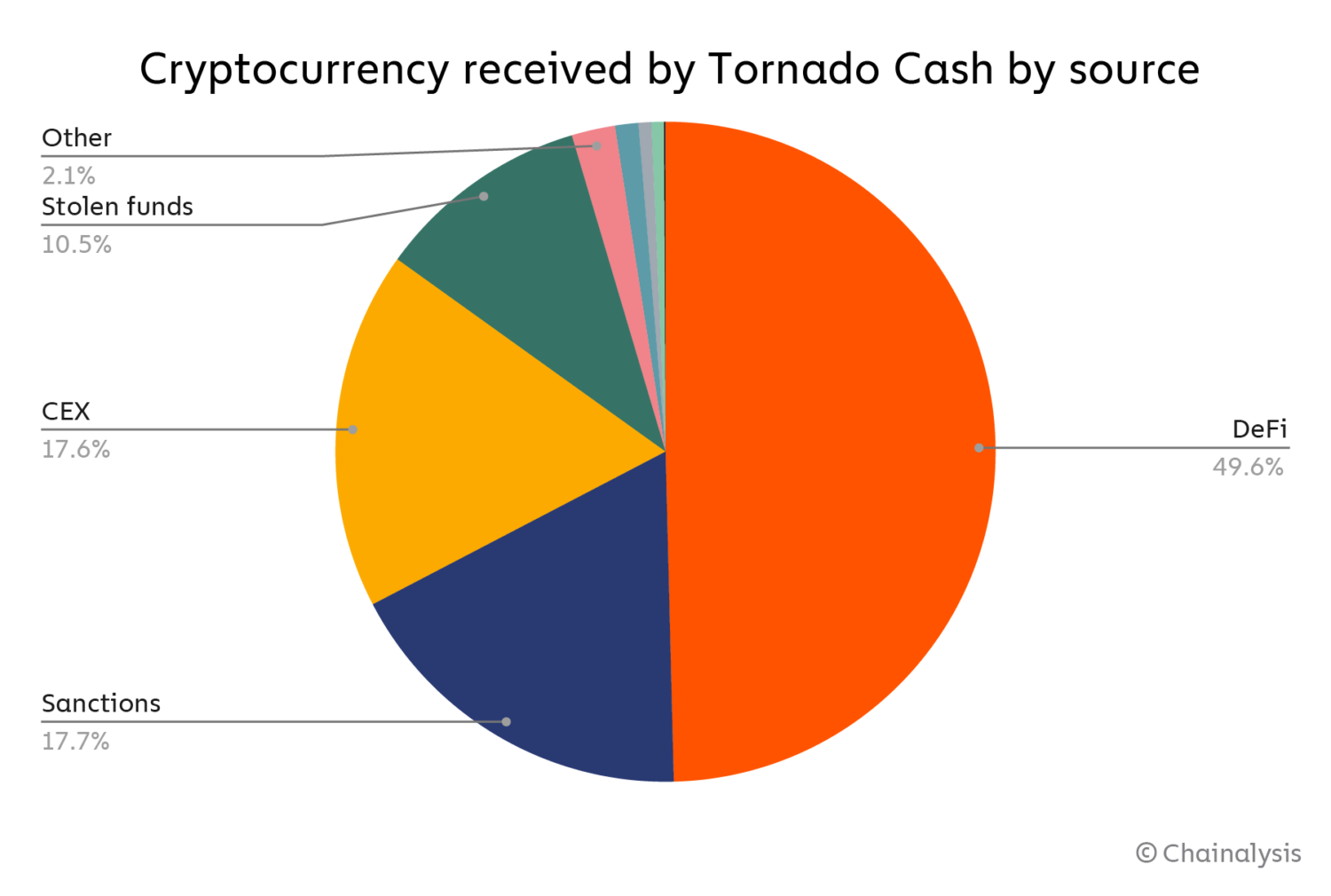

When the U.S. Treasury’s Workplace of International Property Management (OFAC) sanctioned Twister Money, it made nationwide headlines as a result of Twister Money, as a instrument, mixes funds to enhance monetary privateness. Nonetheless, regulators have mentioned it additionally permits criminals to cover the place the cash got here from. OFAC claimed the mixer had helped launder greater than $7 billion and blocked its addresses underneath Govt Order 13694. This sparked a significant debate, with some lawmakers seeing it as a victory within the combat towards crime and lots of within the blockchain group fearing it as a step towards blockchain censorship, by which public transaction data are restricted, and regulators successfully ban total providers.

😔💔 I’m Roman Storm. I poured my soul into Twister Money—software program that’s non-custodial, trustless, permissionless, immutable, unstoppable. In 31 days, I face trial. The DOJ needs to bury DeFi, saying I ought to’ve managed it, added KYC, by no means constructed it. SDNY is attempting to crush…

— Roman Storm 🇺🇸 🌪️ (@rstormsf) June 13, 2025

The Twister Money saga didn’t finish there, and its creators at the moment are on trial with Roman Storm, one of many founders, dealing with fees together with compliance violations, cash laundering conspiracy, and working an unlicensed money-transmitting enterprise. His defence argues he merely wrote open-source code and had no management over how individuals used it, a bit like a programmer who created a automobile however doesn’t drive it.

This case raises huge questions: if somebody can get in authorized bother only for writing code, might different blockchain builders be subsequent? And if OFAC can ban a decentralized instrument by identify, is blockchain nonetheless actually open?

Blockchains are supposed to be impartial as they don’t care who’s sending or receiving cash, however when governments impose crypto sanctions, they drive platforms and customers to censor transactions with particular addresses or providers.

With Twister Money, OFAC demanded that U.S. firms block any interplay with its sensible contracts with validators, nodes, and wallets having to reject these transactions or threat punishment, an obvious affront to cryptoprivacy. This implies community operators should select between following blockchain’s open guidelines or obeying authorities orders, making a battle for builders and customers. Do you construct for complete openness, or observe the regulation? As privateness advocates put it, monetary privateness is a proper, but governments say it helps criminals. That is why Twister Money’s court docket battle has develop into a severe speaking level in conversations round blockchain ethics and censorship.

Twister Money: Privateness Instrument or Illicit Mixer?

Twister Money launched in 2019 as a option to restore transaction privateness on Ethereum, the place it randomizes public ledger entries in order that cash can’t be traced again to their homeowners. However as governments investigated, they argued that it had “acted as a large washer” for illegally obtained crypto, together with funds from the North Korean Lazarus Group and numerous scams.

This was then adopted by the authorized hammer, the place Twister Money was sanctioned in August 2022, which means Individuals have been barred from utilizing or supporting it and in March 2025, a court docket dominated that OFAC overstepped its authority by sanctioning pure code, that’s, the sensible contracts themselves. The sanctions have been lifted, however the combat was removed from over. Now, a felony trial is exploring whether or not a developer could be held legally accountable for how another person used their code.

Censorship Creep in a Permissionless World

One in every of blockchain’s largest strengths is its censorship resistance, permitting anybody to construct or use decentralized methods freely. However forcing instruments like Twister Money offline challenges the very core of this concept.

The New York Fed discovered that after Twister Money was sanctioned, many Ethereum validators grew to become hesitant to incorporate its transactions, although the community itself operates overtly. A examine revealed by employees on the Federal Reserve Financial institution of New York documented intimately a rising unwillingness by members in Ethereum’s settlement chain to course of transactions made via the Twister Money privateness utility. This demonstrates how crypto sanctions can affect decentralized networks from the within, even with out direct authorized management.

If members begin censoring transactions to keep away from regulatory threat, the blockchain stops feeling actually open, and that may be a slippery slope for anybody who values blockchain’s core qualities.

Balancing Privateness and Compliance

Privateness is vital, and similar to a locked checking account protects your monetary info, privateness on blockchains may help shield customers, particularly in oppressive locations or for whistleblowers. Nonetheless, the obvious draw back is that privateness also can protect criminals.

Specialists are wanting into cryptography options like zero-knowledge proofs, as a few of these instruments purpose to maintain transaction particulars non-public whereas nonetheless permitting authorities to examine who’s sending or receiving massive quantities, balancing monetary privateness with compliance wants. Such applied sciences might let regulators confirm suspicious behaviour with out undermining privateness basically, a typical center floor that is perhaps essential for blockchain’s future privateness.

The place Regulation Would possibly Be Headed

Crypto sanctions are increasing, and regulators are vigorously looking for out the way to apply guidelines designed for banks and cash providers to decentralized methods, however this raises powerful questions like :

Can governments legally ban or censor open-source code?Who will get held accountable: the creator, platform, or consumer?How a lot compliance ought to crypto firms construct into their methods?Can blockchain nonetheless be absolutely open with these guidelines?

Some consider we’ll see extra guidelines, particularly round public ledgers and blockchain analytics. Others hope for revolutionary authorized frameworks that respect each decentralization and public security.

Why This Issues to You

You would possibly assume this debate doesn’t have an effect on you. Nonetheless, it most likely does, and if you happen to care about utilizing crypto freely, whether or not for investing, supporting open-source tasks, or defending your privateness, you is perhaps affected by guidelines that restrict what you may construct or entry.

If sensible contracts begin getting censored, or if sure crypto instruments develop into unlawful, the open nature of Web3 might shrink, and that would change every thing from how DAOs function to how common individuals work together with cash methods. Think about not with the ability to use a DeFi lending platform simply because it wasn’t permitted in your nation, or getting blocked from a crypto pockets as a result of it was linked to a instrument like Twister Money.

Even builders might discover themselves in bother for writing code that’s seen as too non-public or too free as a result of the road between innovation and regulation is getting thinner. Meaning the way forward for monetary privateness won’t be as much as tech alone; it’s going to additionally rely on authorized methods, politics, and the crypto group’s response.

On the flip aspect, stronger privateness protections might open new doorways to freedom and use circumstances. Nonetheless, in addition they threat misuse by criminals hiding behind them, thereby making governments extra desperate to clamp down. It’s fairly a tough stability: construct instruments that shield good individuals with out by accident serving to unhealthy actors, and that’s the reason conversations round compliance and regulation are so advanced.

The way forward for public ledgers, monetary privateness, and blockchain censorship will most probably be formed by on a regular basis customers as a lot as by lawmakers, and it’s a path we should all stroll collectively. And so the extra we perceive what’s at stake, the higher likelihood we’ve got of shaping a good, open, and safe Web3 future.

In Conclusion,

The Twister Money scenario reveals that whereas public ledgers create transparency by giving each transaction visibility, they don’t resolve the deeper rigidity between monetary privateness and regulation. Crypto sanctions would possibly shield safety, however they will additionally trigger blockchain censorship and threaten decentralized beliefs.

The long run could lie in intelligent expertise, higher legal guidelines, and sensible design, however it’s additionally a reminder that regulation doesn’t all the time cease on the code; it usually reaches behind it, connecting digital freedoms to real-world management.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”