Planning to put money into crypto? On the lookout for an in depth information to get began within the crypto area? In that case, you’re on the right web page. Cryptocurrencies are digital currencies that leverage blockchain networks and cryptography to safe, confirm, and document transactions. Bitcoin is the pioneer cryptocurrency and the most important by market cap, whereas all different cryptocurrencies are collectively referred to as altcoins.

From selecting a reliable platform to storing your crypto securely, our information offers a step-by-step breakdown of the shopping for course of. We’ll additionally run you thru completely different fee strategies and customary errors to keep away from whereas buying digital currencies.

Learn how to Purchase Crypto: A Step-by-Step Information

Step 1: Select a Crypto Alternate

Based mostly in your preferences, choose an acceptable platform for getting, promoting, and buying and selling crypto. As exchanges differ broadly of their options, charges, safety, and rewards, evaluating a number of platforms is essential to creating knowledgeable selections. Merchants can select from three sorts of platforms for getting cryptocurrencies.

Centralized exchanges

They’re crypto platforms that allow customers to purchase and promote digital currencies. They function third-party intermediaries, facilitating cryptocurrency transactions between patrons and sellers.

Aside from a fast purchase/promote crypto performance, well-liked CEXs, like Binance, Bybit, and MEXC, allow derivatives buying and selling as nicely. Moreover, they provide superior instruments, staking merchandise, and early entry to new cryptocurrencies.

Furthermore, they’ve a clear payment construction, clearly stating the maker and taker prices throughout VIP tiers.

Concerning safety, most CEXs have applied sturdy security options like two-factor authentication (2FA), withdrawal whitelists, chilly storage, and anti-phishing codes.

Generally, select a good platform that options among the many high 20 centralized exchanges by buying and selling volumes.

Decentralized exchanges

They’re permissionless platforms that facilitate peer-to-peer buying and selling of crypto in a non-custodial and decentralized method. They make the most of good contracts to find out cryptocurrency costs and execute transactions, eliminating the necessity for order books and intermediaries.

Nonetheless, DEXs are extra conducive for superior merchants as they require in-depth technical data and understanding of decentralized protocols. Examples of well-known decentralized platforms embody PancakeSwap, Uniswap, and Orca.

Brokerage providers

If you wish to construct a diversified portfolio, comprising a great mixture of conventional and crypto property, think about on-line brokers. They permit you to purchase/promote cryptocurrencies and a various vary of typical devices like shares, ETFs, and index choices. Nonetheless, they supply a restricted coin choice and lack superior options like automated bots, making them much less appropriate for seasoned merchants. Robinhood, Webull, and eToro are examples of high crypto brokers.

Step 2: Set Up a Crypto Pockets

Whether or not you select a CEX, DEX, or brokerage agency, it’s essential to arrange a greatest crypto pockets to transact and retailer cryptocurrencies. Blockchain wallets may be categorized into the next sorts:

Scorching wallets

They’re device-agnostic on-line wallets that aid you ship, obtain, switch, retailer, and handle your digital property in a single place. Nonetheless, since these wallets are related to the web, they’re prone to cyber threats. Therefore, you need to maintain solely minimal quantities of cryptocurrency required for fast transactions in sizzling wallets. Examples of well-liked sizzling wallets embody Metamask, Phantom, and Belief Pockets.

Chilly wallets

They’re offline wallets or bodily {hardware} that aren’t related to the web. As they aren’t uncovered to on-line hacking dangers, they provide enhanced safety. Due to this fact, chilly wallets are perfect for storing personal keys. Nonetheless, they will’t be used for conducting transactions and are liable to bodily injury or mutilation. Essentially the most sought-after {hardware} wallets for storing crypto are Trezor and Ledger.

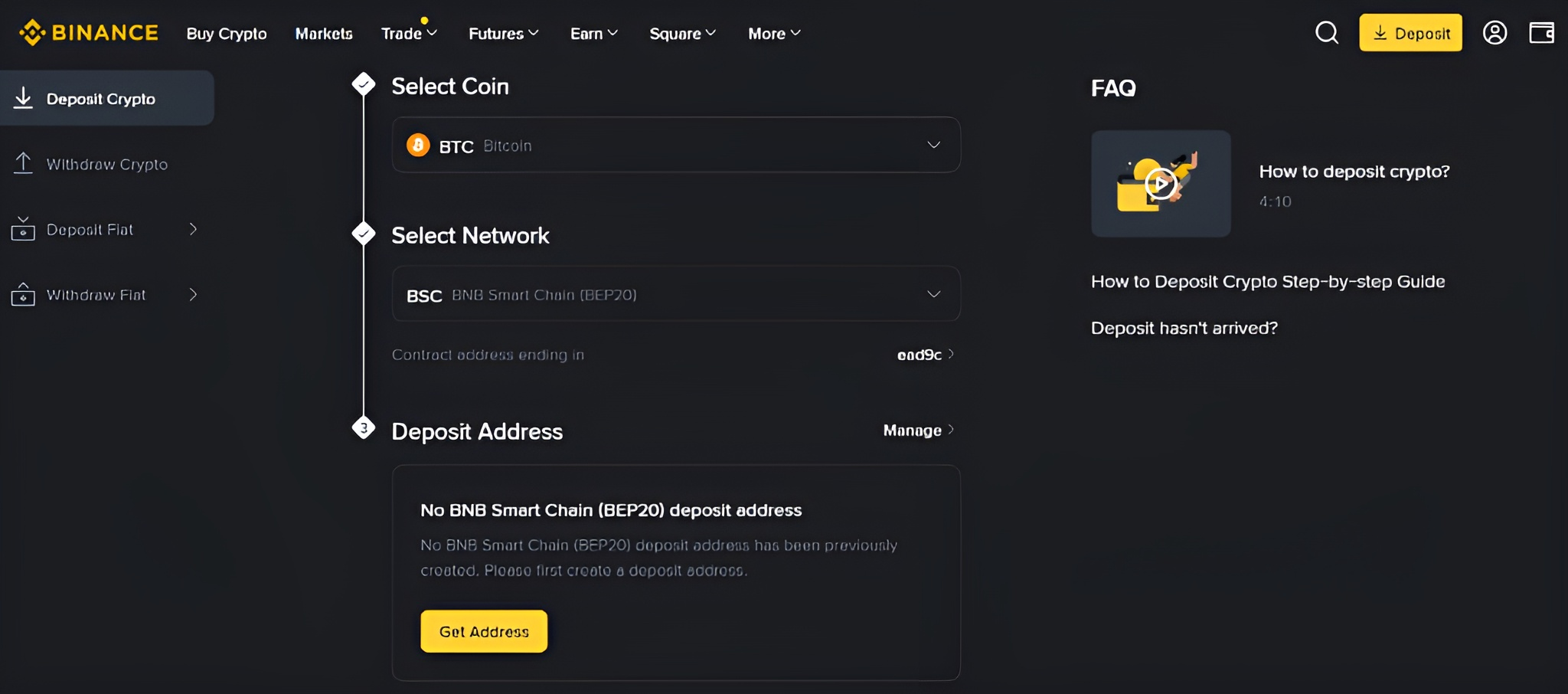

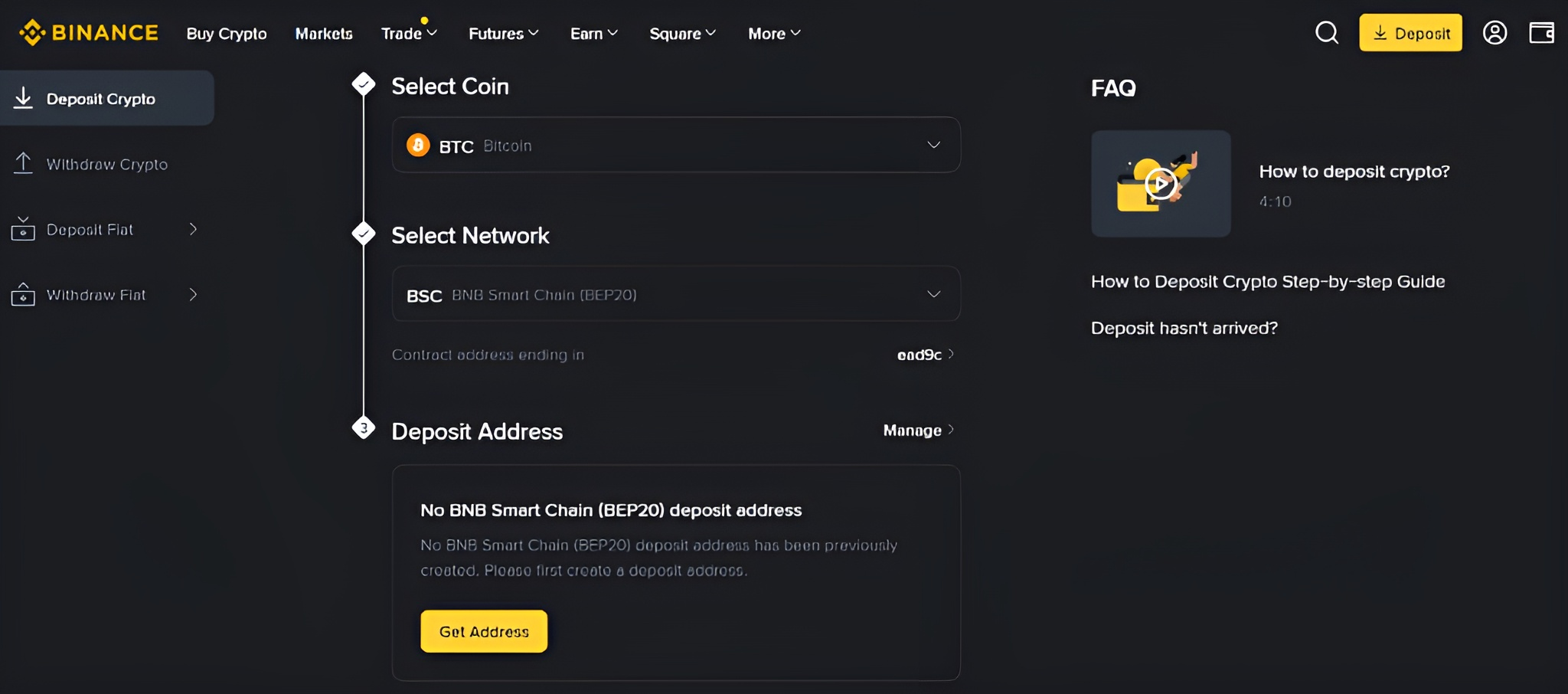

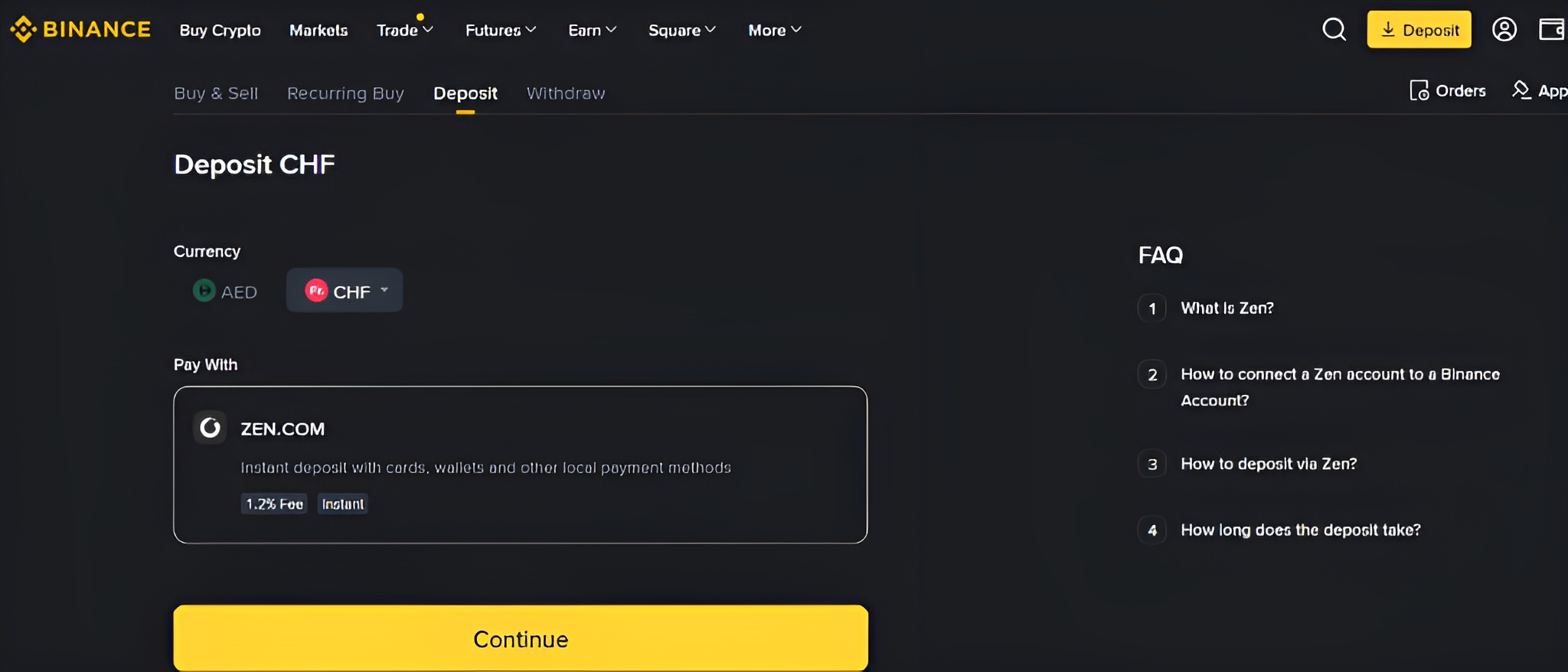

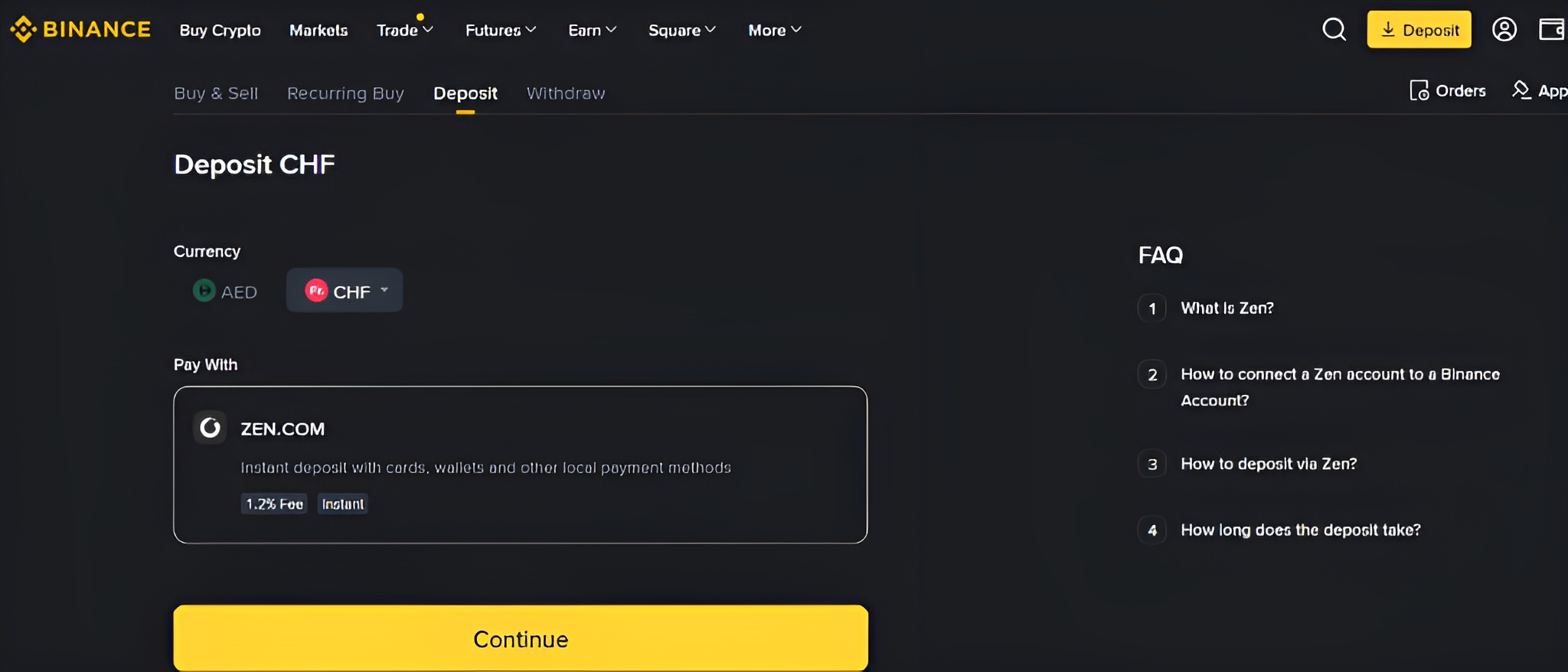

Step 3: Fund Your Account

When you register on an alternate and full the identification verification course of, that you must deposit funds to start out buying and selling. In the event you already personal cryptocurrencies, you possibly can switch them to your alternate account from an exterior digital pockets.

In the event you’re a first-time crypto purchaser, you possibly can deposit fiat currencies in your alternate pockets. Many platforms help fiat on-ramps, enabling you to purchase crypto utilizing conventional currencies just like the US Greenback and the Euro.

To make fiat or crypto deposits, you possibly can select any of the supported fee strategies. These embody wire transfers, debit/bank cards, Google/Apple/Samsung Pay, and third-party channels like Skrill, Neteller, Clever, MoonPay, and many others.

However earlier than signing up, make sure the chosen platform presents the fiat-to-crypto or crypto-to-crypto pairs you’re looking for. Not all fiat or digital currencies may be traded for each other on all on-line platforms.

Step 4: Place Your Order and Purchase Crypto

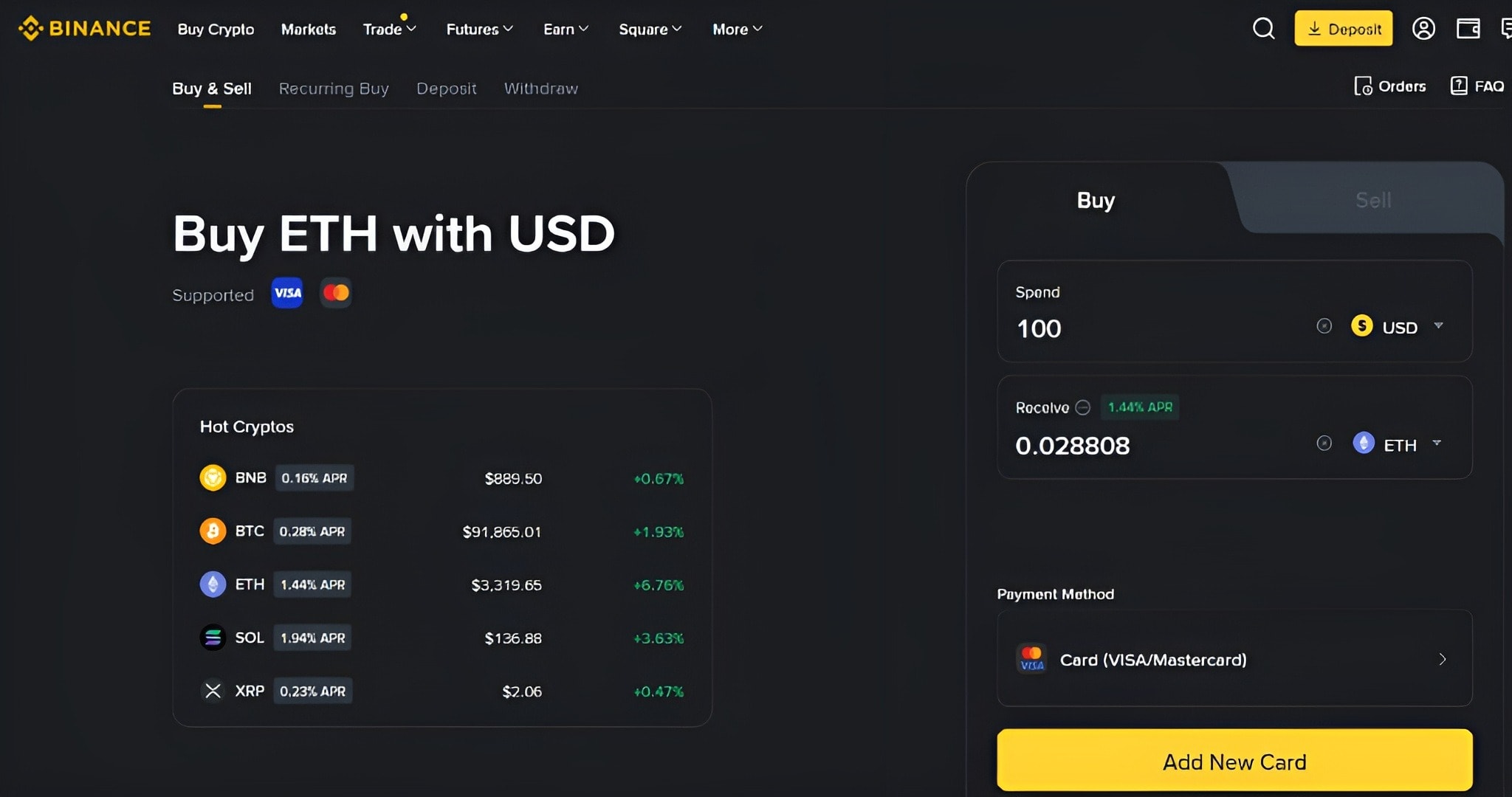

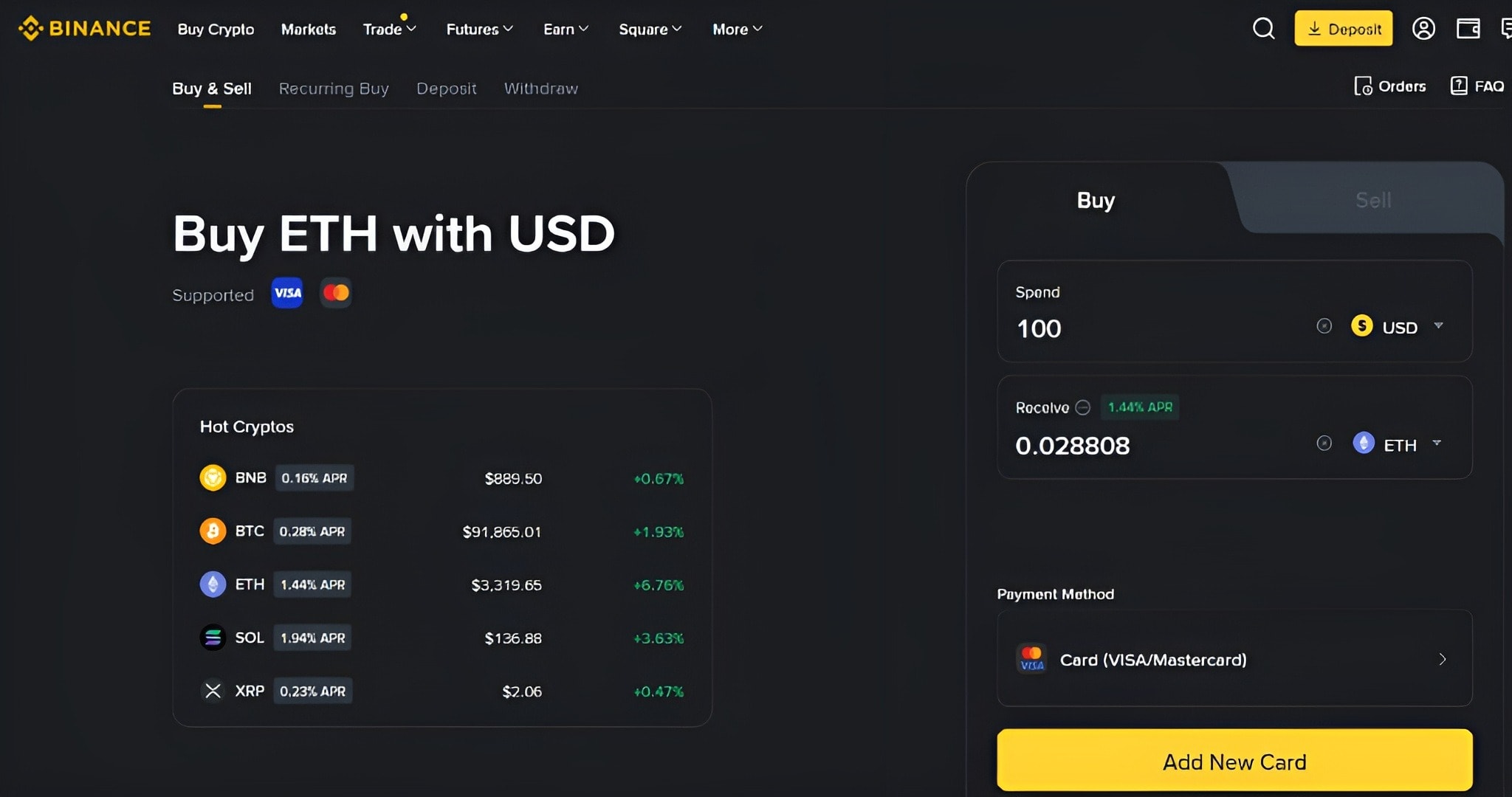

After funding your account, you possibly can place a purchase order for any cryptocurrency of your selection.

Most platforms supply a fast purchase/promote function, the place you merely must enter the spending and receiving currencies. You need to additionally specify the amount you wish to purchase and the fee possibility. When you refill these particulars, click on the “Purchase” button.

The crypto will likely be credited to your alternate pockets inside no time, supplied the transaction is accomplished efficiently. In the event you purchase cryptocurrencies on a DEX, it’ll be credited to your linked pockets instantly.

Moreover, customers must incur transaction charges whereas shopping for and promoting cryptocurrencies within the spot market. You need to pay maker charges once you place a restrict order. Your purchase order will likely be crammed provided that the cryptocurrency’s worth reaches your required worth or decrease. Conversely, it’s essential to pay taker charges once you place a market order. Your purchase order will likely be crammed at the very best out there worth, which might be greater/decrease than your specified worth.

Typically, as your commerce volumes improve, your transaction charges lower. Plus, the higher the liquidity of a platform, the quicker your market orders are crammed at aggressive costs, and vice versa. Even if you happen to submit a restrict order, your transaction will likely be executed promptly at particular costs on extremely liquid platforms.

Step 5: Retailer Your Crypto Safely

Whereas many CEXs like Coinbase supply custodial and switch providers, storing your crypto on an alternate has some disadvantages. If the platform is hacked or somebody will get maintain of your login credentials, your crypto could also be stolen. On-platform storage is right just for customers who wish to take part in reward packages or stake/commerce their cryptocurrencies instantly.

For all different functions, crypto wallets are a safer possibility for storing cryptocurrencies. Furthermore, they’re self-custody wallets, which means you’ve full management over your personal keys and property.

Personal keys show possession of crypto property and are needed for conducting transactions. In the event that they’re misplaced/compromised, you’ll lose entry to your crypto. Due to this fact, protect your seed phrases and personal keys in chilly storage/wallets, as they’re much less liable to on-line hacks.

In the event you aren’t assured of managing property your self or have minimal data of cybersecurity, select brokerage companies for storing/buying and selling crypto. Moreover, as an alternative of storing your cryptocurrencies, you possibly can stake/lend them to earn engaging APRs. Nonetheless, each staking and lending entail important dangers. If the platform closes or crashes, you’ll lose your locked-up property.

Totally different Strategies to Purchase Cryptocurrency

1. Shopping for Crypto with Credit score Card or Debit Card

Main crypto exchanges and third-party suppliers like MoonPay mean you can purchase cryptocurrencies utilizing a Visa/Mastercard debit or bank card. It’s a quicker and extra handy technique than financial institution/wire transfers for buying digital property. It’s also possible to save your card particulars in fee settings for future transactions when you full KYC verification.

Nonetheless, card transactions might entail hidden prices equivalent to chargebacks, conversion charges, and processing charges. In the event you use a bank card, you’ll incur greater charges as money advances are handled as debt, triggering curiosity.

Moreover, you need to perceive your credit score or debit card’s phrases, circumstances, and insurance policies concerning crypto transactions. Whereas some issuing banks block or flag crypto buys outright, others impose stricter limits and extreme charges.

You additionally want to pick out a crypto platform that accepts your card. The provision of a fee possibility additionally varies throughout places. When you end the required checks, enter the crypto you wish to purchase and specify the quantity in fiat. Choose a credit score/debit card because the fee technique and click on the “Purchase” button. The crypto will mirror in your alternate account inside minutes. From there, you possibly can switch your property to your crypto pockets.

2. Shopping for Crypto with Financial institution Switch

To buy crypto through financial institution transfers, it’s essential to first full ID verification and hyperlink your checking account. Then, that you must deposit a supported fiat forex into your alternate account utilizing native/worldwide strategies like SEPA, SWIFT, FAST, and many others. As soon as finished, you need to use the funds to purchase digital property. Payment-wise, financial institution transfers are often cheaper than different fee strategies.

3. Peer-to-Peer Crypto Exchanges

Peer-to-peer platforms allow you to purchase cryptocurrencies instantly from different merchants. Sometimes, they’re decentralized, permissionless, non-custodial, and non-KYC platforms, the place property are instantly credited to your related pockets.

At no time limit, P2P platforms maintain your property. To make sure transaction safety, they lock crypto in escrow accounts until each events affirm fee. They’re greatest suited to skilled merchants searching for enhanced anonymity and privateness. Bisq is a top-notch P2P community for buying and selling Bitcoin, whereas LocalCoinSwap is a superb peer-to-peer market for getting/promoting Ethereum.

Many CEXs, like Bitget and BingX, additionally supply P2P marketplaces. In contrast to standalone peer-to-peer platforms, they mandate identification verification and have highly effective safety features. They supply deeper liquidity and a bigger variety of fee choices, minimizing dangers.

Nonetheless, P2P transactions carry inherent dangers, no matter the kind of platform you select. They’re extremely liable to safety threats equivalent to phishing scams, chargeback fraud, faux fee proofs, or man-in-the-middle assaults.

Frequent Errors to Keep away from When Shopping for Crypto

Lack of analysis: By no means observe the suggestions of fellow merchants or consultants blindly. You must also keep away from investing in trending cash with out doing your personal analysis. Analyze each mission totally. Perceive its imaginative and prescient, mission, core options, professionals, cons, know-how, crew, and neighborhood energy earlier than placing your cash into it. Investing with out researching is akin to playing and might result in important losses.Falling for hypes, faux information, and scams: Social media platforms are inundated with information, messages, or discussions, projecting quite a few low-quality tokens as the following large factor. Many of those cryptocurrencies carry no actual price or could also be a pump-and-dump scheme in disguise. Therefore, stick with well-established cryptocurrencies like Bitcoin, Solana, or Ethereum, particularly if you happen to’re a beginner. Keep away from suspicious hyperlinks, shady web sites, and unverified information sources.Preserving funds in alternate wallets: Crypto exchanges aren’t hack-proof. Many main platforms, together with Binance, have fallen prey to main safety breaches that resulted in important losses. Therefore, you need to by no means depart your crypto holdings on exchanges and switch them ideally into a chilly storage/pockets.Emotional investments: Keep away from shopping for crypto throughout market upturns on account of concern of lacking out (FOMO). Equally, don’t panic-sell throughout pullbacks. Emotional selections with out in-depth market analysis typically end in substantial losses. No or restricted studying: Earlier than you put money into crypto, you need to have a great grasp of how good contracts, encryption mechanisms, and blockchain know-how work. You must also perceive at the least the fundamentals of cryptocurrencies, decentralized finance, and buying and selling methods. Fixed studying is the important thing to creating positive aspects from cryptocurrency investments.Assuming extreme danger: Overextending your self financially by investing greater than you possibly can afford to lose is a giant NO-NO. Moreover, it’s essential to use leverage prudently, ideally no more than 5x, particularly if you happen to’re a newcomer. Apart from, you need to keep away from taking loans and at all times set cease losses when buying and selling.

Ought to You Spend money on Cryptocurrency?

Crypto investing includes dangers as cryptocurrencies are a extremely unstable asset class. They’re susceptible to cost manipulations, scams, and cyber threats.

Furthermore, the worldwide crypto market is affected by regulatory uncertainties. Whereas some international locations, like El Salvador, have adopted Bitcoin as authorized tender, others, equivalent to China, have imposed bans or restrictions on its use. Additionally, crypto tax insurance policies are ambiguous throughout areas. Many crypto platforms are additionally going through regulatory compliance points in a number of jurisdictions.

Total, crypto investments usually are not backed by central banks or authorities authorities just like the Federal Deposit Insurance coverage Company. You’ll additionally don’t have any authorized recourse within the occasion of any mishap. Therefore, solely those that have a excessive danger tolerance ought to commerce crypto. Newcomers should make investments a minor portion of their whole financial savings and chorus from transacting giant quantities until they achieve experience.

Conclusion

Cryptocurrency markets are extremely unstable. Therefore, thorough analysis and understanding of crypto ideas and market volatilities are important. You need to at all times examine the charges, options, and reward charges provided by completely different platforms whereas prioritizing safety and regulatory compliance. You must also use dependable fee strategies and safeguard your confidential knowledge.

In the event you’re a newbie, begin with small quantities as you hone your investing expertise. For enhanced effectivity, you possibly can even use digital assistants to conduct in-depth analysis and compile stories.

In essence, by staying abreast of crypto market occasions, studying repeatedly, and evaluating dangers, you possibly can maximize your earnings.

FAQs

What’s the easiest way to purchase crypto?

There is no such thing as a single greatest means to purchase cryptocurrencies. Nonetheless, it’s higher to make purchases through respected and licensed platforms like Binance, Coinbase, KuCoin, and OKX. They possess sturdy safety features like 2FA, chilly storage, withdrawal whitelists, proof-of-reserves, and a safety fund to safeguard person property. Additionally they have a clear payment construction, a number of fee choices, an extended observe document, and superior options. Thus, they’re appropriate for each newbies {and professional} merchants alike.

Can I purchase crypto with my checking account?

Sure. Widespread exchanges like Bitget, MEXC, and Kraken mean you can purchase Bitcoin and different cryptocurrencies utilizing financial institution accounts. Nonetheless, it’s essential to verify whether or not the chosen platform presents this fee possibility in your jurisdiction.

How do I do know if I’m shopping for crypto safely?

Select famend platforms with potent safety measures like withdrawal allowlisting, multi-factor authentication, and an insurance coverage fund to purchase/promote cryptocurrencies. Additionally, entry the alternate from the official web site or cell app solely to attenuate fraud and phishing dangers. As soon as cryptocurrencies are credited to your alternate account, transfer them into safe offline wallets to guard them from cyber assaults.

Can I purchase cryptocurrencies with out an alternate?

You should purchase crypto through on-line brokers licensed by respected organizations just like the New York State Division of Monetary Providers. It’s also possible to purchase cryptocurrencies utilizing your credit score/debit card from Bitcoin automated teller machines (ATMs). Moreover, you possibly can discover P2P platforms like Peach Bitcoin. If you wish to make cryptocurrency transfers or purchases in just some faucets, think about cell fee providers like Money App.