Bitcoin value jumped immediately after a wierd second for markets. The Federal Reserve discovered itself on the heart of a political storm, and the US greenback instantly felt the strain. Feedback from Fed Chair Jerome Powell a couple of attainable legal probe tied to the central financial institution’s headquarters renovation despatched us scrambling to reassess danger.

And boy, simply how rapidly confidence shifted. The Federal Reserve seemed susceptible, the US greenback softened, and traders leaned into belongings that sit outdoors direct political attain. On this setting, Bitcoin didn’t hesitate, pushing its value larger as uncertainty happened.

The specter of legal costs is a consequence of the Federal Reserve setting rates of interest primarily based on our greatest evaluation of what is going to serve the general public, reasonably than following the preferences of the President”

Federal Reserve in Hassle? Will Bitcoin Value Run Proceed?

Powell stated the specter of costs stems from the Federal Reserve selecting coverage primarily based on financial information, not presidential desire. Markets took that rationalization at face worth. The US greenback slid to round 0.2%, pulling the greenback index towards 99, whereas the Bitcoin value ran to above $92,000.

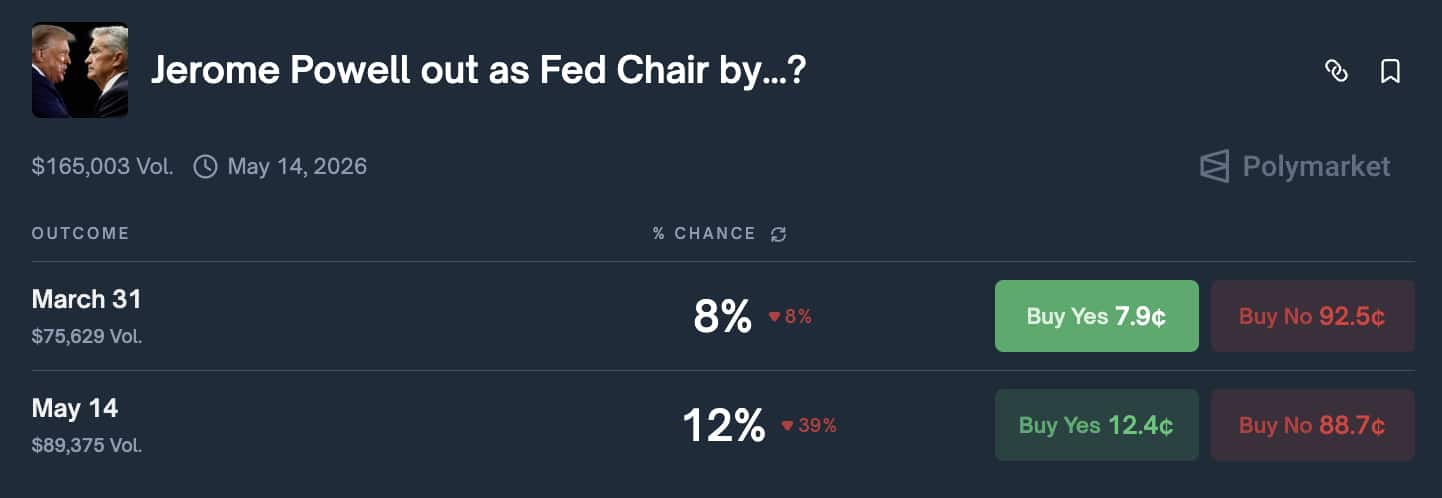

Political strain on the Federal Reserve has been constructing for a while. It’s identified that President Trump has repeatedly argued for decrease charges and quicker cash creation, and with speak rising round a attainable management change on the Fed later this 12 months, we’re starting to cost in instability. Betting markets now present a couple of 20% likelihood of Jerome Powell being out as Federal Reserve chair by March.

(supply – Polymarket)

From a chart perspective, Bitcoin value spent most of final week shifting sideways between $90,000 and $91,000, except for an excellent run to $94,000 on the sixth of January. Patrons have been stepping in persistently, and immediately’s break above $92,000 confirmed a technical breakout. Momentum indicators, together with an RSI close to 60, present that the transfer nonetheless has room with out trying stretched. And yeah, Michael Saylor’s Technique continues to be shopping for.

₿ig Orange. pic.twitter.com/VmFz8nI1uq

— Michael Saylor (@saylor) January 11, 2026

DISCOVER: 10+ Subsequent Crypto to 100X In 2026

Liquidity, FED’s Coverage, and The Weakening of the US Greenback to Form Markets?

Away from the headlines, liquidity stays a robust drive. World liquidity is sitting at report highs because the Federal Reserve continues Treasury invoice purchases and quietly expands its stability sheet. Extra stimulus measures, together with massive mortgage bond applications, have solely added strain on the US greenback.

World Liquidity is skyrocketing.

Bitcoin will observe! pic.twitter.com/oQOsajXbss

— Mister Crypto (@misterrcrypto) January 11, 2026

Regulatory tone has additionally shifted. Progress towards clearer crypto guidelines and expectations of future Federal Reserve fee cuts have helped assist sentiment. Because the US greenback loses floor, Bitcoin is more and more considered as a sensible different, and the worth will observe.

Altcoins nonetheless adopted Bitcoin’s transfer, although erratically. Ethereum hovered at $3,200, whereas Solana pushed above $140. Though the market continues to be, in the intervening time, targeted firmly on the Bitcoin value, which, prefer it or not, mirrors investor confidence.

DISCOVER:

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Skilled Market Evaluation.

Hyperliquid HYPE Grabs +69% of Perp Merchants as Rivals Fade

Crypto belongings are unstable, which implies alternatives for many who are prepared. After years of centralized trade (CEX) dominance led by Binance and Coinbase, the buying and selling scene is altering quick. Lower than three years after launching, Hyperliquid is giving Binance and high CEXs a run for his or her cash.

Latest on-chain information exhibits that Hyperliquid now controls about +69% of all each day lively customers buying and selling perpetual futures on decentralized exchanges (DEXes).

HYPERLIQUID CONTROLS 69% OF PERP DAILY ACTIVE USERS

Hyperliquid now accounts for 69% of all each day lively customers buying and selling perpetual futures, underscoring its dominant place within the onchain derivatives market and rising dealer migration towards its platform. pic.twitter.com/LVKUXblBBI

— Crypto City Corridor (@Crypto_TownHall) January 12, 2026

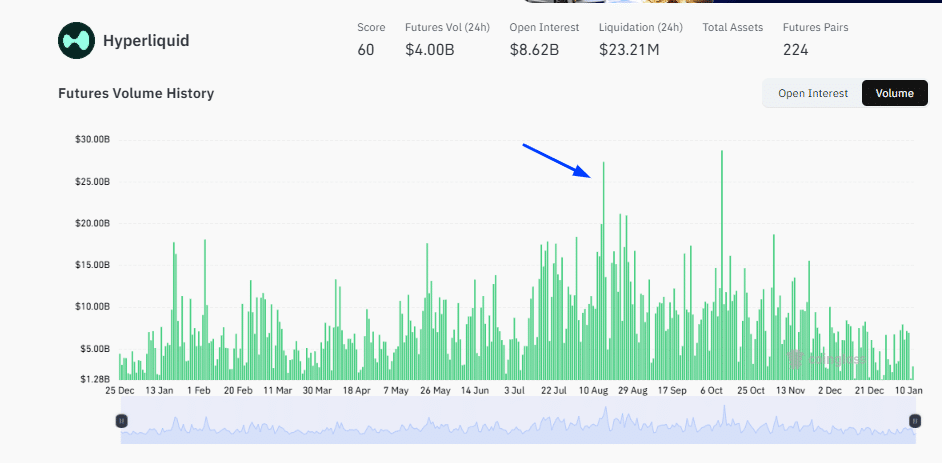

That dominance exhibits up in quantity too, with each day buying and selling quantity pushing previous $27Bn on August 15.

(Supply: Coinglass)

The shift matches a wider DeFi pattern the place merchants chase velocity, tight spreads, and acquainted instruments. Because the scene shifts, HYPE, the native token of Hyperliquid, can also be driving the wave. At spot charges,

2.64%

crypto is regular, hovering round $25, up almost +3% within the final 24 hours.

Learn the complete story right here.

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now