Sui is gaining consideration for its distinctive object-centric mannequin and parallel transaction execution, supporting DeFi, NFT marketplaces, and Web3 gaming. It’s a layer 1 blockchain designed for high-speed, low-cost transactions, good contract deployment, and scalable functions.

On this information, you’ll study what Sui crypto is, how the SUI token works, the construction of its ecosystem, high initiatives and functions, and key concerns for buyers and builders exploring the community in 2026.

What’s Sui (SUI)?

Sui is a layer-1 blockchain designed to course of transactions rapidly, cheaply, and at scale, with out the same old trade-offs that many different blockchains face. Sui takes a distinct method to how blockchains deal with possession, good contract execution, and transaction processing, which is why it’s usually mentioned individually from conventional account-based networks.

The mission was developed by Mysten Labs, an organization based by former Meta (Fb) engineers who beforehand labored on the Diem and Novi initiatives. Names like Evan Cheng come up usually when folks discuss concerning the Sui group, primarily due to their background in large-scale distributed programs.

Not like most networks that depend on sequential transaction ordering, the Sui blockchain makes use of an object-centric mannequin. Property on Sui are handled as objects with clear possession guidelines, permitting the community to execute transactions in parallel when these transactions don’t contact the identical objects. This design allows parallel transaction execution, decrease transaction latency, and excessive throughput with out compromising efficiency.

What Downside Does Sui Remedy?

Sui exists as a result of many blockchains battle with the identical core points: congestion, rising transaction charges, and gradual finality during times of excessive demand. As utilization grows, networks usually hit scaling limits that negatively have an effect on person expertise and developer flexibility.

The Sui protocol tackles this by rethinking how blockchains course of transactions. As a substitute of forcing each transaction right into a single international order, Sui separates transactions involving impartial objects from people who depend on shared objects. When transactions don’t battle, they are often processed concurrently by way of parallel execution, considerably bettering transaction speeds and enabling sub-second transaction finality in lots of circumstances.

On conventional blockchains, excessive transaction quantity usually leads to larger gasoline charges and slower affirmation instances. On Sui, the structure is designed to deal with many transactions directly, protecting low-cost transactions potential at the same time as exercise will increase.

One other key concern Sui addresses is useful resource administration. The community introduces a storage fund that helps handle on-chain knowledge prices over time, relatively than pushing them solely onto customers. This method helps higher useful resource administration and makes prices extra predictable for each builders and Sui holders.

How Does Sui Work?

Sui works by treating on-chain belongings as objects relatively than balances tied to accounts. This object-centric mannequin permits the Sui blockchain to establish which transactions could be processed independently and which require coordination. Transactions involving impartial objects are executed in parallel, whereas these utilizing shared objects undergo a consensus protocol.

Sensible contracts on Sui are written within the Transfer programming language, a resource-oriented programming language designed for safer good contract execution. This construction allows environment friendly transaction processing, sub-second transaction finality, and excessive throughput with out overloading the Sui community.

What Makes SUI Engaging to Buyers

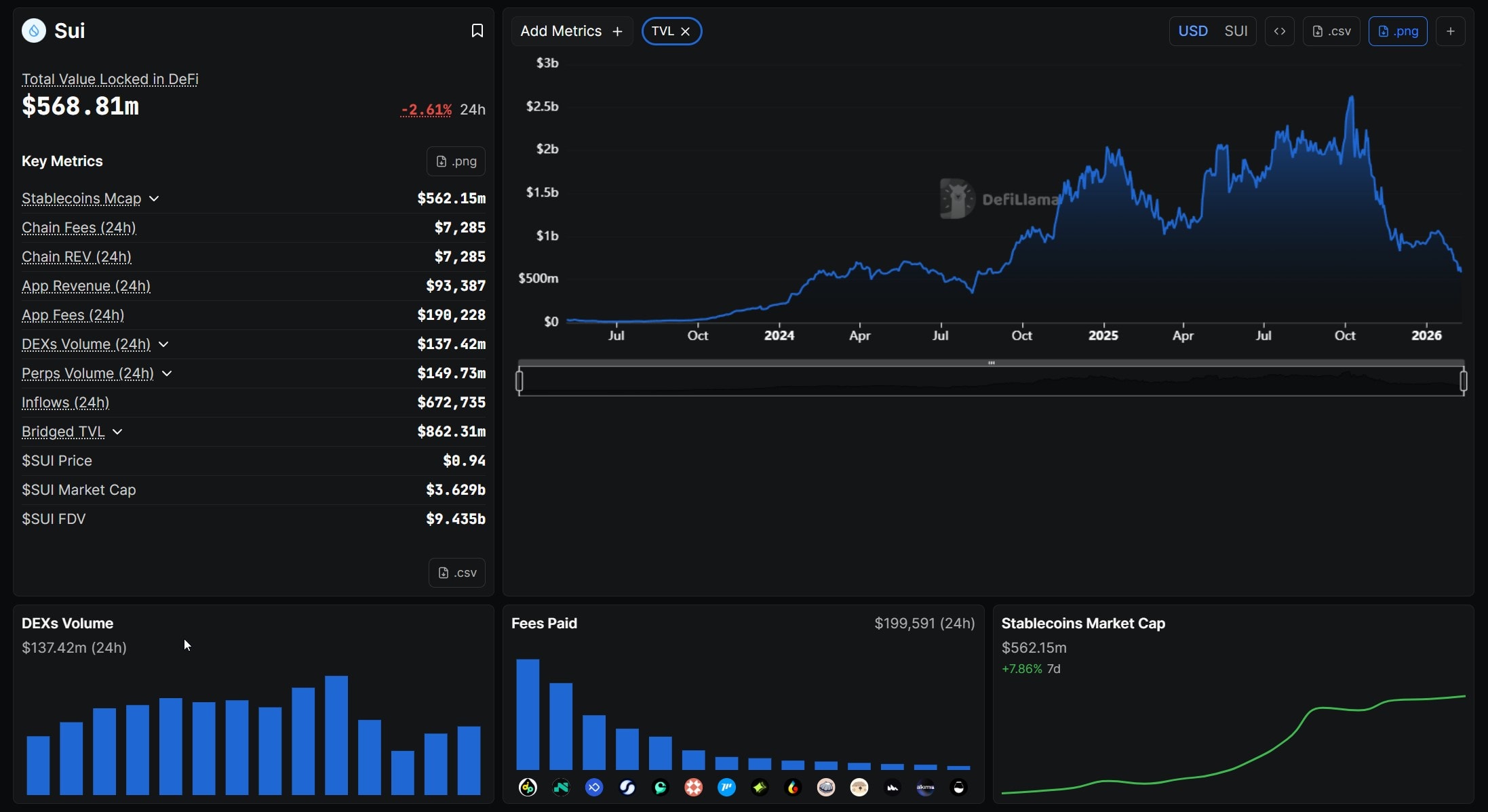

Sui attracts investor curiosity primarily due to its excessive scalability, low transaction charges, and rising ecosystem. The community’s potential to course of many transactions in parallel reduces congestion and helps constant efficiency as adoption will increase.

For SUI token holders, staking rewards and participation in community operations can present incentives past value appreciation. Backing from corporations like Coinbase Ventures and ongoing ecosystem development additionally contribute to investor confidence. Nonetheless, value efficiency doesn’t essentially mirror long-term worth, and anybody contemplating Sui ought to do their very own analysis earlier than treating it as a superb funding.

The Sui Token and Sui Airdrop

The SUI token is the community’s native token. It’s used to pay gasoline charges, take part in community consensus by way of staking, and assist important features like validator incentives and community operations. For Sui token holders, the token performs each a utility and a governance-adjacent position, though decision-making stays largely protocol-driven.

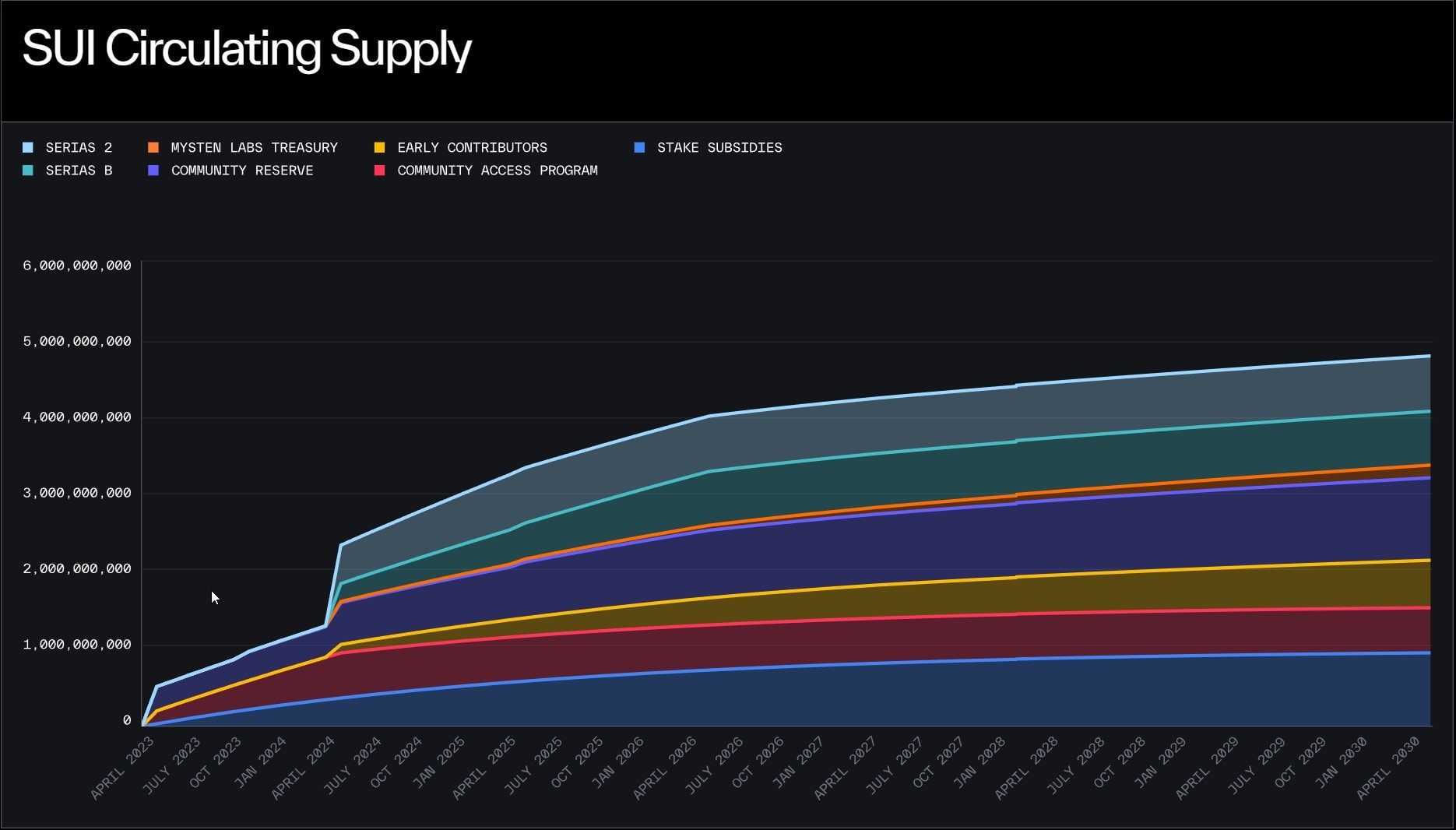

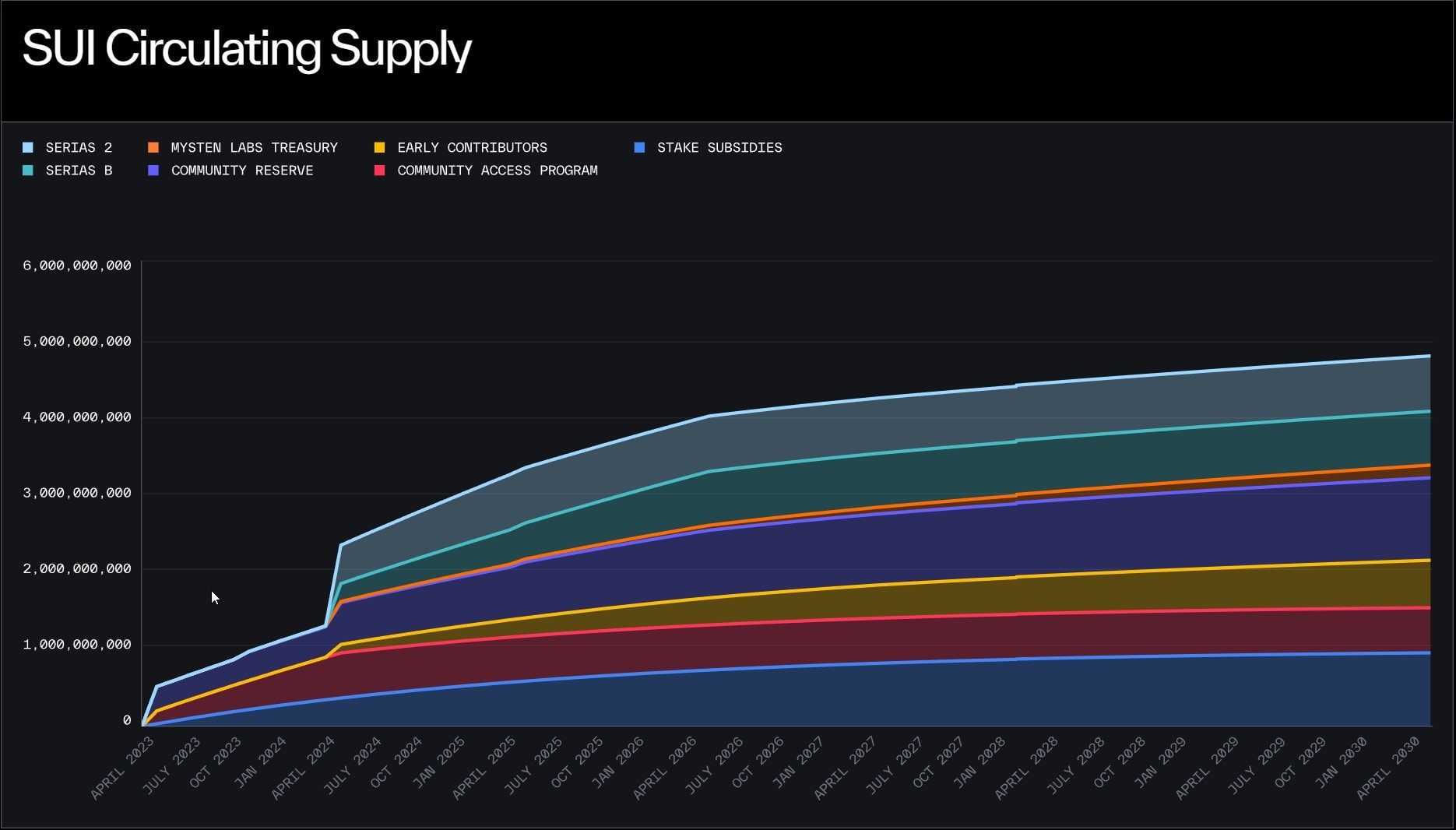

The full provide caps at 10 billion tokens, with gradual unlocks by way of vesting schedules to take care of stability. Current occasions embody a $60M unlock dealt with easily and a 43.35M SUI launch scheduled for March 1, 2026.

Sui didn’t distribute any mainnet airdrops at launch, deliberately avoiding them to stop scams, regulatory points, and short-term hype in favor of long-term development. Early testnet phases (2022-2023) supplied restricted rewards to testers, validators, and contributors by way of applications just like the Neighborhood Entry Program (CAP). Moreover, ecosystem initiatives, akin to Cetus and Sui Title Service (NS), have carried out smaller SUI airdrops, akin to 200,000 SUI for IDO contributors.

SUI Tokenomics and Provide Distribution

SUI has a set most provide of 10 billion tokens and a complete provide of 10B SUI, designed for stability within the Sui Layer 1 blockchain. At mainnet launch in Might 2023, about 5% was circulating, with the remaining vesting progressively by way of a structured schedule to assist community development and decrease volatility.

SUI Allocation Breakdown

SUI tokenomics mannequin and 10 billion SUI tokens are distributed throughout key classes to steadiness incentives:

CategoryPercentageVesting NotesCommunity Reserve50%Used for ecosystem development, grants, validator subsidies, staking rewards, and future group initiatives.Early Contributors20%Allotted to builders and builders who labored on the Sui protocol and core infrastructure. 1-year cliff led to 2024.Buyers14%Distributed to early backers, together with enterprise corporations like Coinbase Ventures, are usually topic to vesting schedules.Mysten Labs Treasury10%Helps ongoing analysis, improvement, and long-term firm operations.Neighborhood Entry Applications & AirdropsSmall the restTokens allotted to early customers, testers, and ecosystem contributors.

Provide Schedule

Tokens unlock month-to-month, with previous occasions like Q2 2025’s 227 million SUI (2.27% of complete) already processed. Upcoming contains 43.35 million on March 1, 2026, and a serious cliff in Might 2030 (5.22 billion, managed rigorously). Circulating provide hovers round 35-36% as of early 2026, which you’ll be able to observe on crypto monitoring websites like CoinMarketCap.

SUI vs. Different Layer-1 Cryptocurrencies

FeatureSuiEthereumSolanaAptosTransaction VelocityParallel transaction execution allows excessive throughput and low latencyDecrease throughput; rollups deal with scalingExcessive throughput, however real-world congestedExcessive theoretical throughput with Transfer, actual utilization variesFuel ChargesLow and predictableTypically excessive throughout congestionVery low underneath most situationsLowExecution MannequinObject-centric mannequin, selective consensusAccount-based, common orderingProof of Historical past + PoSTransfer with parallel executionSensible Contract LanguageTransfer programming languageSolidity / EVMRust / CTransferEcosystem MaturityRising (DeFi, gaming, NFTs)Most matureVery massive and liquidNewer, smallerConsensus ProtocolDelegated PoS with parallel executionPoSPoH + PoSBFT variant

The Sui Ecosystem: Prime Initiatives and Purposes

The Sui ecosystem is increasing quickly, with initiatives spanning DEXs, bridges, DeFi, gaming, and NFT marketplaces. Builders leverage Sui’s low-cost transactions, Transfer programming language, and parallel execution to create sooner, scalable decentralized functions.

The Greatest DEX on Sui

Cetus: Cestus is a concentrated liquidity automated market maker (AMM) that permits environment friendly token swaps with minimal slippage. Its design helps Sui’s rising DeFi ecosystem, enabling quick, cost-effective trades.Bluefin: Targeted on stablecoin and token swaps, Bluefin prioritizes clean execution and low charges whereas enabling seamless person interactions on Sui.Momentum: Supplies an on-chain restrict order e book expertise, combining excessive throughput with parallel transaction execution for professional-style buying and selling.DeepBook: DeepBook is a professional-grade DEX with low-latency buying and selling and good contract deployment optimized for Sui’s high-speed community.Turbos Finance: Simplified AMM platform designed for high-speed swaps, permitting customers to execute transactions rapidly and effectively.

The Greatest Bridges on Sui

Sui Bridge (Native): Connects Sui with Ethereum and different networks, permitting seamless cross-chain token transfers whereas leveraging low-cost transaction processing.Portal (Wormhole): A multichain bridge enabling Sui interoperability with Solana, Ethereum, and different layer-1 blockchains, supporting each tokens and non-fungible tokens (NFTs).Celer cBridge: Affords quick, low-fee transfers throughout a number of chains, using Celer’s liquidity community to take care of excessive throughput and user-friendly transfers.

Greatest DApps on Sui

Scallop Lend: A lending and borrowing platform with built-in staking rewards and environment friendly capital utilization for SUI holders.Suilend: DeFi lending protocol utilizing mushy liquidation mechanics, serving to customers keep positions with out pointless losses whereas supporting excessive transaction volumes.Typus Finance: Gamified DeFi app combining prediction markets, staking, and tokenized rewards, demonstrating Sui’s potential to assist interactive decentralized functions.Suia: Social Web3 platform that permits customers to create, share, and monetize content material straight on-chain, integrating with Sui’s infrastructure for persistence and scalability.

If you’re new to the decentralized financial system, it’s advisable to study what decentralized functions (dApps) are and the way they work earlier than you begin investing.

Prime NFT Marketplaces on Sui

BlueMove: All-in-one NFT platform for minting, buying and selling, and AMM-enabled market options, showcasing Sui’s object-centric mannequin for digital belongings.TradePort: Market optimized for gas-efficient listings and clean transaction execution, supporting each collectors and creators.Sui Gallery: Creator-focused NFT market offering instruments for minting, buying and selling, and interacting with on-chain utilities.Clutchy: Gaming NFT market and launchpad that includes interactive collectibles, gamified mechanics, and seamless integration with Sui’s ecosystem.

For players and collectors, you may also uncover which Sui gaming NFTs are price watching to see probably the most promising initiatives shaping the ecosystem.

Web3 Gaming Initiatives on Sui

Starbots: A sci-fi technique sport the place gamers gather and battle programmable NFT robots. Every Starbot is an impartial object on Sui, permitting dynamic upgrades and evolutions over time.Suiverse: A play-to-earn ecosystem combining NFTs, DeFi mechanics, and in-game belongings. Gamers can commerce, stake, and improve objects straight on-chain, highlighting Sui’s parallel transaction execution.Monsters & Markets: A gamified NFT platform the place creatures are programmable objects with evolving traits. The sport leverages Sui’s object-centric mannequin to permit steady upgrades and interactions.DragonVerse: Fantasy journey sport that includes collectible dragons as non-fungible tokens (NFTs). Every dragon could be educated, leveled, and mixed, demonstrating Sui’s assist for interactive, evolving gaming belongings.

Find out how to Purchase Sui: Step-by-Step Information

Select a cryptocurrency trade: Choose a good trade that lists SUI, helps your area, and provides low transaction charges. Search for platforms with sturdy safety features and good liquidity.Create and confirm your account: Enroll, full KYC verification, and allow two-factor authentication on the trade you select.Deposit funds: Add fiat (like USD, EUR, or NGN) or one other cryptocurrency to your trade account. This would be the fund you’ll use to purchase SUI tokens.Purchase SUI Tokens: Navigate to the SUI buying and selling pair (e.g., SUI/USD or SUI/USDT) and place your order. You may select a market order for fast execution or a restrict order to manage your entry value.Retailer your SUI in a safe pockets: As soon as you purchase SUI, switch your SUI to a pockets you management. {Hardware} wallets or respected software program wallets assist guarantee your tokens stay safe and underneath your management, avoiding extended custody with exchanges.

Find out how to use the Sui Pockets?

Set up the SUI pockets: Obtain the official Sui Pockets extension or cellular app from trusted sources.Create a brand new pockets: Arrange a pockets by producing a brand new seed phrase. Write it down safely as a result of it’s the one technique to get better your funds should you change your system.Import an present pockets: In case you already maintain SUI or different Transfer-based belongings, import your pockets utilizing your seed phrase or personal key.Ship and obtain SUI: Use your pockets to ship SUI tokens or obtain them from exchanges, different wallets, or dApps. At all times double-check addresses to keep away from errors.Work together with dApps: Join your pockets to Sui-based decentralized functions (dApps) on SUI, together with DeFi platforms, NFT marketplaces, and video games to execute transactions straight on the community.Staking SUI (non-obligatory): Take part in community operations and earn rewards by staking your SUI tokens straight from the pockets interface.

Dangers and Challenges of Investing in SUI

Market volatility: Like most crypto belongings, SUI costs can swing dramatically in brief intervals, affecting each short-term and long-term buyers. As an illustration, SUI has not too long ago fallen 56% from its peak regardless of its tech strengths.Ecosystem maturity: Sui is a comparatively younger layer 1 blockchain. Some initiatives and dApps are nonetheless in improvement, which may have an effect on adoption and utility.Token unlock stress: Ongoing vesting releases (e.g., 43.35M SUI in March 2026) create sell-off danger for insiders holding 15% of the provision, probably diluting worth and inflicting value drops.Sensible Contract Dangers: Bugs or exploits in good contracts on Sui can result in lack of funds or safety vulnerabilities.Regulatory uncertainty: Cryptocurrency rules differ by nation, which can affect buying and selling, staking, or cross-border transfers of SUI.Community adoption: SUI’s worth partly is determined by ecosystem development and lively addresses. Restricted adoption or gradual mission launches could cut back investor confidence.

The Way forward for Sui Blockchain

Sui is evolving from a layer-1 blockchain right into a full-stack developer platform by 2026, with an emphasis on privateness, stablecoins, DeFi, and AI brokers. This roadmap goals to place Sui as a unified “Sui Stack” (S2), enabling seamless app constructing amid tendencies like on-chain automation and gaming.

Key SUI upgrades to look at:

Protocol-level privateness transactions: Launching in 2026, examined at 866 TPS with out compromising velocity, permitting safe, personal transfers.USDsui stablecoin: Integrates for fee-free transfers, anchoring DeFi exercise and funds inside the ecosystem.DeepBook enhancements: Provides margin buying and selling and revenue-sharing options to spice up liquidity and buying and selling depth.DeFi Moonshot Fund: Helps modern monetary initiatives, whereas Bitcoin scaling initiatives and Parasol gaming partnerships drive ecosystem adoption.

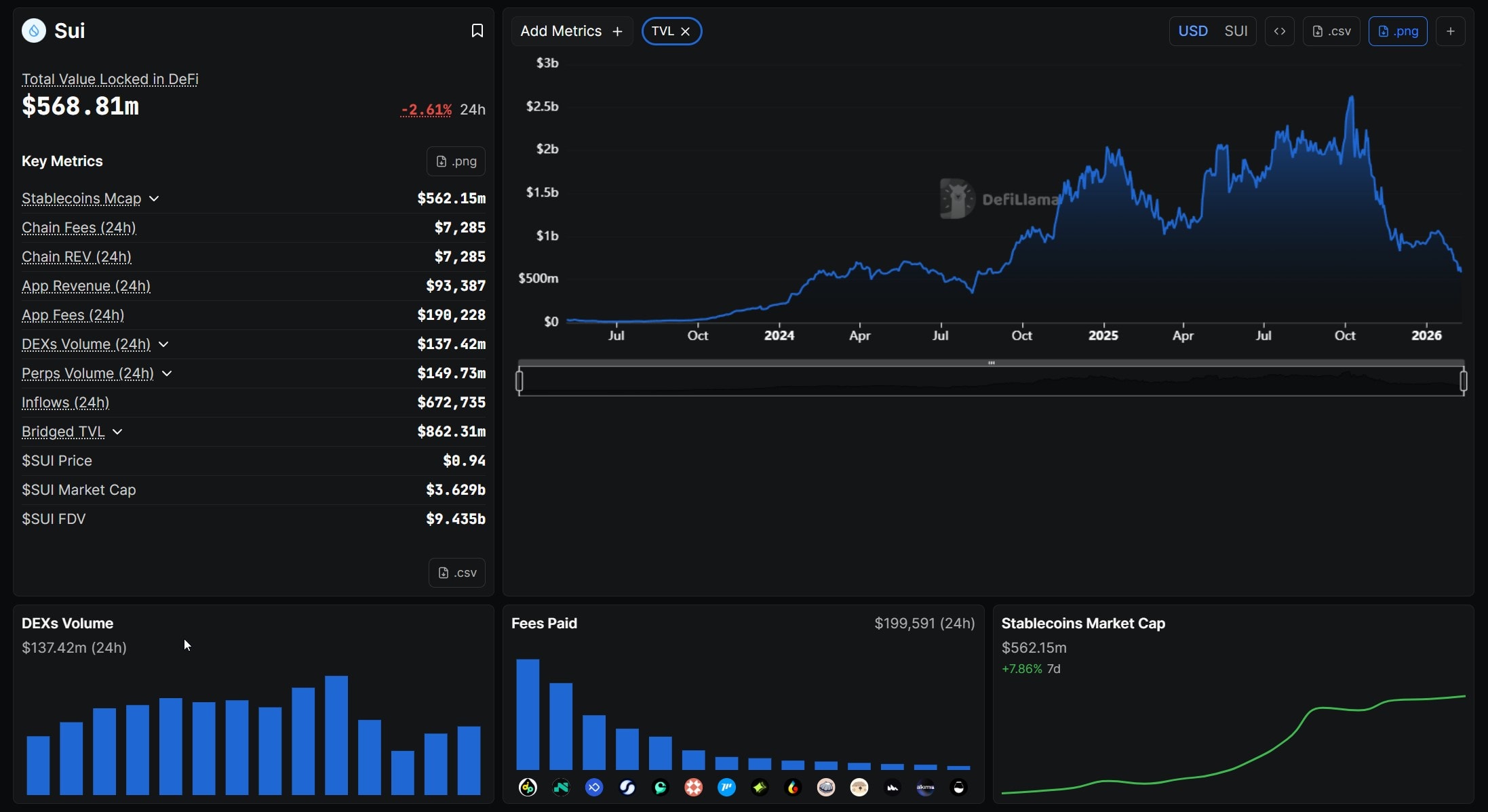

SUI value prediction by analysts forecast base-case SUI costs of $1.50 – $1.61 by the tip of 2026, with potential upside to $10 by 2030 in a bullish market tied to ecosystem enlargement. Development will hinge on metrics like ecosystem TVL, developer exercise, and interoperability, with AI brokers additional enhancing Sui’s competitiveness.

Conclusion

Sui has grown quickly right into a Layer-1 blockchain with sturdy technical improvements, together with parallel transaction execution, an object-centric mannequin, and the Transfer programming language. Its ecosystem now spans DEXs, bridges, dApps, gaming, and NFT marketplaces, providing quick, low-cost transactions and actual utility for customers and builders alike.

Whereas Sui faces challenges akin to token unlocks stress and competitors from different blockchains, its roadmap towards a full Sui Stack and integrations like USDsui and DeepBook sign sturdy ecosystem development and institutional potential. For merchants, buyers, and builders, staying knowledgeable about adoption tendencies, transaction speeds, and ecosystem enlargement can be key to evaluating Sui’s long-term prospects.

FAQs

Is SUI crypto a superb funding?

SUI has sturdy technical foundations, together with parallel transaction execution and an object-centric mannequin, in addition to a rising ecosystem of dApps, NFTs, and DeFi. Whereas it exhibits promising adoption and potential upside, contemplate volatility, competitors, and token unlock schedules earlier than you determine.

What’s the utility of the SUI token?

The SUI token is used to pay gasoline charges, take part in staking, and work together with Sui-based dApps and DeFi platforms. It additionally performs a job in governance choices and is crucial for securing the community, making it greater than only a speculative asset.

Is Sui higher than Solana?

Sui and Solana each supply high-speed, low-cost transactions, however Sui’s object-centric design and parallel transaction execution allow extra environment friendly processing for complicated DeFi, NFT, and gaming functions. Solana has a bigger ecosystem, however Sui provides distinctive technical benefits for scalable and interactive functions.

Can I stake SUI tokens?

Sure, SUI holders can stake tokens to assist safe the community and take part in consensus. Staking additionally gives rewards, helps community operations, and helps keep Sui’s excessive throughput and low transaction charges, making it a sensible method for holders to contribute to ecosystem development.