Alisa Davidson

Revealed: February 12, 2026 at 9:00 am Up to date: February 12, 2026 at 6:41 am

Edited and fact-checked:

February 12, 2026 at 9:00 am

In Transient

Solus Companions’ new research gives a complete evaluation of Canton Community’s evolution from early pilots to rising market infrastructure, detailing its institutional use circumstances, community traction, architectural design, and lengthy‑time period scalability outlook.

Analysis and advisory agency Solus Companions introduced that it has launched the “Canton Community 2026 Report” which examines Canton Community’s growth throughout 2024–2026, tracing its evolution from early institutional pilots to its rising place as market infrastructure.

The evaluation attracts on main Canton Community documentation—together with whitepapers, construct supplies, and tokenomics papers—alongside on‑chain information, companion bulletins, and third‑occasion reporting on pilot outcomes.

The analysis explores the core institutional issues Canton Community is constructed to deal with, the traction seen throughout reside platforms and pilots, the roles of key ecosystem contributors, the affect of institutional use circumstances on adoption, and the way architectural and financial design selections form the community’s scalability and lengthy‑time period sustainability.

Let’s take a more in-depth have a look at key findings:

Canton Community Overview And Traction

Canton Community operates as a public‑permissioned “community of networks” for sensible‑contract‑primarily based functions, designed for multi‑occasion workflows the place privateness and entry management are important, significantly in regulated monetary environments.

Reported Traction

• 153.92M complete transactions• 278,045 recorded events• 18.09M transactions over 14 days (1.01M common per day)• 13.37B CC distributed as rewards

Validator participation contains 819 validators in complete, with 737 lively and 80 inactive, leading to an lively share of 89.9 p.c. The community dashboard signifies that public exercise represents the vast majority of utilization and has trended upward over the previous month. Public updates have ranged between 6,000 and seven,500 per day, with a noticeable enhance round mid‑January. Personal updates peaked between 2,000 and a pair of,400 per day earlier than moderating to roughly 1,800–2,500 per day, representing round 20 p.c of exercise.

Further metrics embrace 37.89B CC in complete circulation, 1.39M transfers recorded in a 24‑hour interval, and 66,330 lively addresses throughout the identical timeframe, indicating a excessive focus of transfers amongst a comparatively targeted set of lively contributors. The report additionally covers tokenomics, product design, architectural concerns, and the burn‑and‑mint equilibrium mannequin.

The report additional presents an in‑depth examination of Canton Community’s product design and technical structure, detailing how its modular parts assist regulated, multi‑occasion workflows. It additionally gives a complete have a look at Polyglot, the community’s EVM‑compatibility layer that permits Solidity‑primarily based functions to function inside Canton’s privateness‑preserving atmosphere. As well as, the evaluation covers the community’s tokenomics framework, the mechanics of its burn‑and‑mint equilibrium, and different operational information factors that illustrate how the system is structured for lengthy‑time period sustainability and institutional‑grade efficiency.

Roadmap And Growth Priorities

In response to the research, the community roadmap’s close to‑time period priorities embrace transitioning DTCC tokenization from pilot to manufacturing. The minimal viable product for Treasury tokenization is focused for the primary half of 2026, with broader deployment deliberate for the second half. Growth to further DTC‑ and Fed‑eligible property will comply with primarily based on consumer demand.

JPMorgan has introduced phased JPM Coin deployment all through 2026, with potential integration of blockchain‑primarily based deposit accounts. Technical upgrades scheduled for early 2026 embrace enhancements to dynamic worth feeds, streamlined incentive constructions, and expanded institutional‑grade validator onboarding. A latest halving occasion diminished emissions and considerably lowered the share allotted to Tremendous Validators.

Growth Initiatives

• Finalizing Polyglot for EVM compatibility• Deepening institutional actual‑world‑asset markets• Onboarding further validators• Enabling cross‑chain interoperability• Optimizing token economics towards sustainable equilibrium• Extending platform assist to tokenized equities and commodities

Market Influence And Observations

Regulated Interoperability

The report highlights that Canton’s mannequin allows multi‑occasion workflows with out requiring a single world public ledger, permitting establishments to take care of permissions and privateness whereas nonetheless attaining atomic settlement.

Measurable Traction

Community exercise is already at scale, with excessive validator participation supporting manufacturing‑oriented experimentation.

Manufacturing‑Aligned Deployments

Canton Community has secured participation from main monetary market infrastructure suppliers, together with DTCC and Euroclear, marking a shift from exploratory pilots to manufacturing‑aligned deployments.

Institutional Ecosystem Development

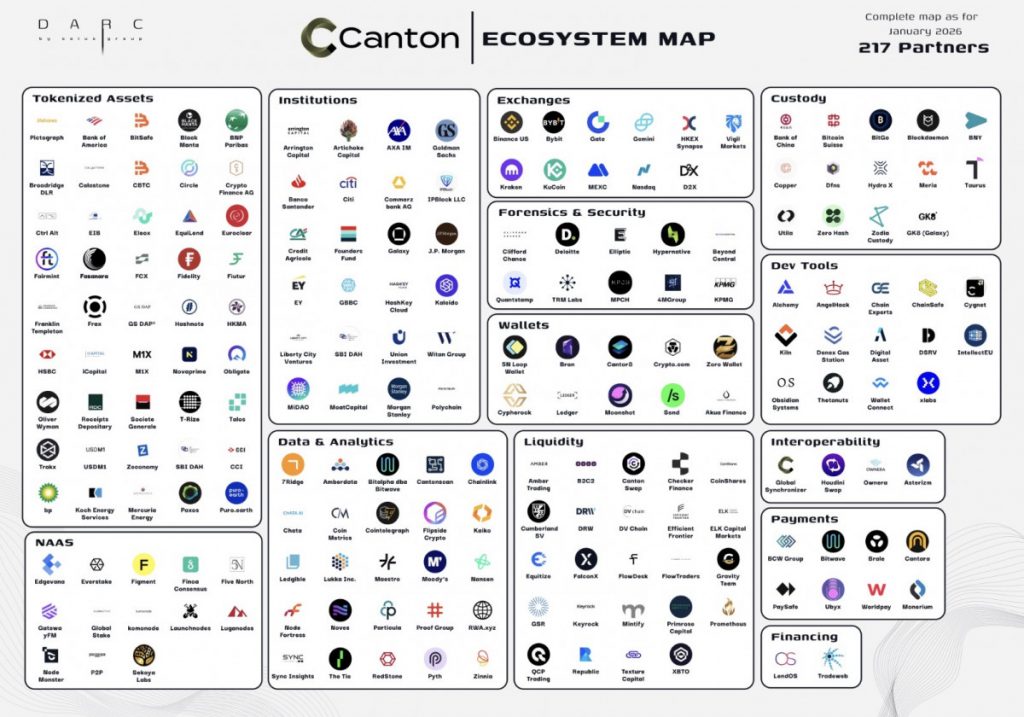

World tier‑one establishments referenced within the ecosystem embrace Nasdaq, NYS, BNP Paribas, Financial institution of China, HSBC, Goldman Sachs, HKFMI, and Moody’s Scores.

Remaining Uncertainties

• The burn‑and‑mint equilibrium stays untested at scale• Sure community metrics are troublesome to independently confirm because of privateness structure• The Daml developer ecosystem is smaller in comparison with Solidity.

Polyglot as a Catalyst for Adoption

In response to the research, Polyglot is positioned as a key accelerator, aiming to cut back migration prices by introducing EVM/Solidity compatibility—whether or not by way of Solidity‑to‑Wasm, EVM‑in‑Wasm, or a parallel EVM digital machine—whereas preserving Canton’s privateness and multi‑occasion workflow mannequin. This strategy is meant to permit current DeFi and enterprise Solidity groups to port methods moderately than rebuild them.

Strategic Positioning

Analysts conclude that Canton will not be trying to exchange public blockchains. As an alternative, it’s constructing the layer the place regulated capital can transfer with out friction. If that foundational layer succeeds, the construction of exercise constructed above it could shift accordingly.

Please discover the complete report right here: https://docsend.com/view/ggkscdmmq3sst9im

Amongst authors and contributors are Canton, Tradias. Everstake, mufettis, AltCryptoGems, YashasEdu, DeFi Warhol, and Ronin.

Disclaimer

In keeping with the Belief Challenge tips, please notice that the data supplied on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you may afford to lose and to hunt impartial monetary recommendation when you’ve got any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.