For a very long time, folks noticed cryptocurrency and regulation as opposites; innovation on one aspect and management on the opposite. However this black-and-white view misses a vital level: regulation doesn’t must be the dangerous man in crypto’s story. If guidelines are designed thoughtfully and may adapt, they’ll really information innovation and endurance. As an alternative of simply setting limits, good guidelines construct belief, appeal to long-term buyers, and assist entrepreneurs create lasting options. Nicely-crafted frameworks can remodel uncertainty into confidence and make oversight the driving power behind accountable development.

How Regulatory Frameworks Can Channel Innovation

For a very long time, the connection between cryptocurrency and regulation was framed as a battle. Regulators have been usually portrayed as roadblocks standing in the best way of progress. However that narrative ignores a deeper reality: when regulation is sensible and adaptable, it could actually act much less like a brake and extra like a steering wheel.

As an alternative of stopping innovation, regulation can channel it, pushing entrepreneurs and buyers towards safer, extra scalable, and reliable outcomes. Clear guidelines create a roadmap. They assist innovators know what’s allowed, what’s dangerous, and the place alternatives actually lie. When designed with collaboration slightly than confrontation in thoughts, regulation turns into a device for redirection slightly than restriction.

By setting outlined requirements, policymakers can exchange chaos with readability, appeal to institutional capital, and guarantee innovation prospers responsibly. The main target of the crypto-regulation story shouldn’t simply be about limiting danger but in addition about unlocking potential. If frameworks are constructed to information slightly than confine, blockchain expertise can evolve into one thing that strengthens monetary programs, expands inclusion, and protects customers with out dulling its artistic edge.

International Examples of Professional-Innovation Frameworks

Throughout the globe, many governments are starting to indicate that cryptocurrency and regulation can work collectively as an alternative of colliding. Quite than viewing guidelines as obstacles, they’re utilizing them as launchpads for innovation. Nations like Singapore, the United Arab Emirates (UAE), and Hong Kong have confirmed that readability and progress can coexist and even complement one another.

Take Singapore, as an example. Its central financial institution, the Financial Authority of Singapore (MAS), has taken a cautious however forward-thinking strategy. It believes innovation and supervision should develop collectively. The MAS launched its FinTech Regulatory Sandbox in 2016, giving startups room to experiment with new monetary applied sciences beneath managed circumstances. This setup lets innovators take a look at merchandise safely whereas defending customers and the broader system. Coupled with the Fee Providers Act (PSA) and Digital Fee Token (DPT) regime, Singapore has constructed a system that emphasizes compliance, transparency, and client safety.

Whereas this strategy could appear sluggish in comparison with less-regulated markets, it has earned Singapore a popularity as one of the trusted and secure crypto environments on the earth. By balancing experimentation with accountability, it reveals that cryptocurrency and regulation can coexist and even thrive.

The UAE, however, has taken a sooner and extra formidable route. Its Digital Belongings Regulatory Authority (VARA) in Dubai was among the many first companies globally to create a authorized framework devoted completely to digital belongings. The outcomes converse for themselves: between July 2023 and June 2024, the UAE reportedly attracted over $30 billion in crypto inflows, with DeFi participation rising 74% year-on-year and DEX exercise leaping from $6 billion to $11.3 billion, in accordance with Chainalysis. Clear and predictable regulation has made the UAE a magnet for each innovation and funding.

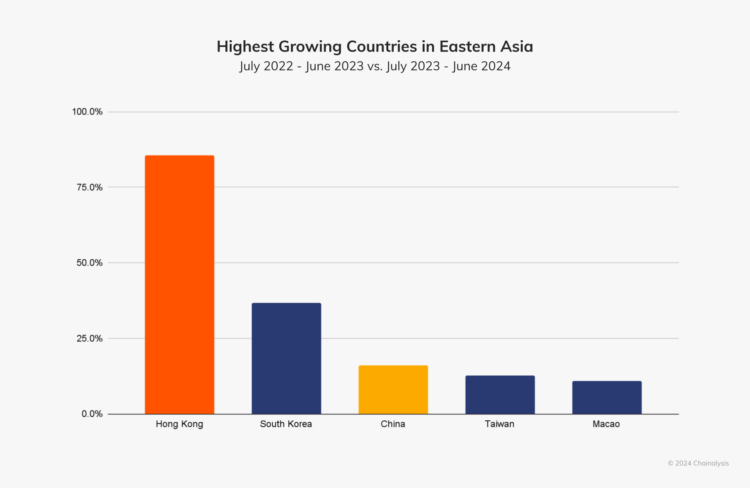

In the meantime, Hong Kong is making a powerful comeback as a world crypto hub by its ASPIRe roadmap, centered on Entry, Safeguards, Merchandise, Infrastructure, and Relationships. A 2024 Chainalysis report revealed that crypto exercise in Hong Kong soared by 85.6%, the quickest development fee in Jap Asia. By prioritizing construction over hypothesis, Hong Kong is proving that stability and innovation can go hand in hand.

Collectively, these circumstances spotlight a strong perception: the way forward for digital finance received’t be pushed by deregulation, however by considerate, cryptocurrency and regulation frameworks that promote innovation, construct belief, and create markets sturdy sufficient to final.

Additionally Learn: The International Crypto Hub Race: Who Will Dominate—Hong Kong, UAE, Or Singapore?

The Function of Sandbox Environments and Licensing Readability

Probably the most sensible methods regulation can gasoline innovation is thru sandbox environments. These are managed areas the place firms can take a look at new enterprise concepts with much less strict oversight. Sandboxes let new gamers check out issues like token launches, decentralized apps, and new methods to retailer belongings with out dealing with all the same old guidelines. This versatile setup lowers each the price and uncertainty of beginning new crypto merchandise.

Equally very important is licensing readability, which ensures that entrepreneurs perceive from the outset what compliance entails. When licensing classes and obligations are clearly outlined, the worry of regulatory ambiguity diminishes, empowering companies to innovate with higher confidence. Singapore’s MAS Sandbox programmes: Specific, Common, and Plus, are sturdy examples of this strategy in motion. They permit firms to check stay merchandise with actual customers, obtain direct regulatory suggestions, after which scale efficiently inside a guided framework.

These sorts of packages are essential within the fast-changing world of crypto. The business strikes so shortly that legal guidelines usually can not sustain. Builders who launch new tokens or DeFi tasks usually have no idea if their work counts as a safety, a commodity, or a cost token. Sandbox and licensing packages assist by giving clear course and legitimacy to new concepts.

Nonetheless, efficient sandbox design requires stability. If activation prices or compliance necessities are extreme, these packages danger changing into obstacles slightly than enablers. The objective, subsequently, is a streamlined and adaptive sandbox mannequin, one that provides clear exit routes towards full licensing and lifelike timeframes, making certain that innovation can thrive whereas sustaining regulatory integrity.

Balancing Investor Safety and Entrepreneurial Freedom

It’s laborious to stability defending buyers and giving entrepreneurs room to take dangers. Regulators want to guard folks from scams, hacks, and market manipulation, however not a lot that they cease new concepts. An excessive amount of safety can restrict creativity, whereas too little can break belief.

The collapse of massive exchanges like FTX made it clear that investor safety isn’t optionally available; it’s important. Clear guidelines on asset custody, licensing, AML/KYC compliance, and loss disclosure are essential to rebuild confidence. When buyers really feel safe, institutional cash follows, adoption accelerates, and innovation positive aspects credibility.

But, defending buyers doesn’t imply punishing creators. Startups shouldn’t be buried beneath sky-high entry prices or ambiguous authorized classifications. They want respiratory room to check new concepts, be it new token fashions, interoperability options, or DeFi platforms, with out fearing sudden bans or complicated authorized shifts.

The reply lies in stability: a versatile cryptocurrency and regulation framework that scales primarily based on danger. Smaller tasks might face lighter guidelines, whereas bigger, systemically vital corporations face tighter scrutiny. Such proportional oversight ensures that each belief and creativity thrive. When regulation focuses on danger slightly than restriction, the crypto business evolves responsibly with out dropping its modern spirit.

Additionally Learn: We Should Stability Innovation and Regulation for Crypto to Actually Thrive

Why is Crypto so Onerous to Regulate?

What are the challenges that regulators face in regulating the crypto business? The principle problem is its very construction: decentralisation and anonymity. In contrast to conventional finance, crypto has no single authority; transactions occur throughout numerous nodes and borders, usually anonymously. That makes accountability extremely troublesome.

The cross-border nature of crypto provides one other layer of complexity. Digital belongings move freely throughout nations, permitting companies to relocate to friendlier jurisdictions, a follow often called regulatory arbitrage. This makes international coordination almost not possible, as one nation’s strict coverage may be simply bypassed by one other’s leniency.

Then there’s the technology-speed hole. Blockchain innovation strikes sooner than most regulators can sustain with. New sensible contracts, token requirements, and DeFi protocols emerge each few months, leaving legal guidelines struggling to catch up. Many regulators nonetheless face the essential query: is a crypto asset a safety, a commodity, or one thing completely new? These blurred traces enhance authorized danger for firms and buyers alike.

Even when guidelines exist, imposing them may be powerful. Restricted entry to on-chain knowledge means regulators usually find out about fraud or collapse after the actual fact, not earlier than. Many companies additionally lack the technical experience wanted to know complicated blockchain programs deeply sufficient to control them successfully.

In brief, the challenges that regulators face in regulating the crypto business stem from its decentralised, international, and quickly evolving nature. To maintain up, regulatory approaches should shift from inflexible and reactive fashions to adaptive, data-driven programs that perceive innovation as an ally, not an adversary.

Turning Regulation Into the Engine of Accountable Innovation

The true debate about cryptocurrency and regulation shouldn’t be about management or freedom, however about course. Singapore, the UAE, and Hong Kong present that when guidelines information as an alternative of prohibit, innovation can develop.

Regulatory sandboxes and clear licensing guidelines flip uncertainty into confidence, serving to each innovators and buyers belief the system. Investor safety and entrepreneurial freedom can coexist if frameworks are versatile, risk-based, and clear.

It’s true that decentralization, international attain, and speedy change make crypto laborious to control. However these similar options additionally provide probabilities for higher guidelines. Versatile, data-driven programs can convey collectively compliance and creativity, making regulation a device for progress as an alternative of a barrier.

The way forward for cryptocurrency and regulation will depend on this partnership. If executed proper, it would form a crypto economic system that’s not solely modern but in addition secure, inclusive, and sustainable.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

Loved this piece? Bookmark DeFi Planet, discover associated subjects, and observe us on Twitter, LinkedIn, Fb, Instagram, Threads, and CoinMarketCap Neighborhood for seamless entry to high-quality business insights.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”