Bitcoin is presently hovering round $97,000 inside the previous 24 hours, which is an extension between its vary buying and selling between $98,600 and $95,000 all through final week. Amidst these forwards and backwards movement, knowledge exhibits a adverse pattern amongst Bitcoin merchants, which might intensify a worth drop.

In keeping with knowledge from on-chain analytics platform IntoTheBlock, Bitcoin noticed round $1.4 billion web inflows into crypto exchanges within the just-concluded week.

Bitcoin Alternate Inflows Spike Amid Market Uncertainty

IntoTheBlock’s knowledge, shared on social media platform X, highlighted that $1.04 billion had been despatched into crypto exchanges final week. Unsurprisingly, this run of inflows erased the outflows within the earlier three weeks. As famous by IntoTheBlock, this shift in capital motion suggests rising hesitancy amongst Bitcoin holders, largely pushed by prevailing world political and financial uncertainties.

Including to issues, the Bitcoin community noticed a notable drop in transaction charges. On-chain knowledge exhibits that charges declined by 10.74% in comparison with the prior week. This decline in charges alerts decrease community exercise, which is commonly a bearish indicator. An increase in transaction charges usually suggests growing demand and better market engagement, whereas a drop implies diminished curiosity and weaker momentum for Bitcoin’s worth.

Picture From X: IntoTheBlock

Spot Bitcoin ETFs May Be Driving Alternate Inflows

A significant component behind the surge in Bitcoin change inflows may very well be outflows from Spot Bitcoin ETFs. US-based Spot Bitcoin ETFs have been a serious explanation for Bitcoin’s bull run this 12 months, with constant inflows fueling upward momentum. Nevertheless, final week performed out very otherwise for these Spot Bitcoin ETFs.

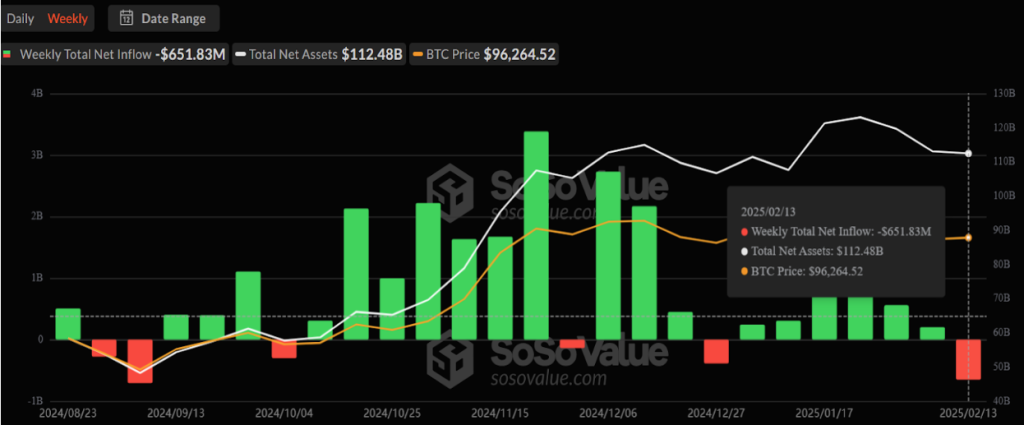

Notably, knowledge from SosoValue reveals that US-based Spot Bitcoin ETFs recorded $651.83 million in web outflows over the previous week. Apparently, that is the most important weekly outflow recorded in these Spot Bitcoin ETFs for the reason that first week of September 2024. This implies that some institutional buyers have been offloading Bitcoin, both to safe earnings or in response to lingering uncertainty after the drastic worth crash firstly of February.

Picture From SosoValue

The Bitcoin inflows into crypto exchanges open up a bearish case for Bitcoin, particularly because it creates a promoting stress on exchanges. Technical evaluation exhibits that Bitcoin is presently trapped between key provide and demand ranges. In keeping with crypto analyst Ali Martinez, there’s a important 1.43 million BTC demand wall between $94,660 and $97,540, whereas a 1.16 million BTC provide wall sits between $97,650 and $99,470. A breakout in both route will doubtlessly set the pattern for the following main transfer.

If Bitcoin breaks above the $99,470 resistance, it might set off contemporary shopping for momentum and push the value considerably above the $100,000 mark once more. Nevertheless, a extra prolonged correction might unfold if promoting stress intensifies and BTC falls beneath the $94,660 assist.

Picture From X: Ali_Charts

On the time of writing, Bitcoin is buying and selling at $97,504.

Featured picture from KITCO, chart from TradingView