Passive revenue is cash you earn with little to no day by day effort. Not like a standard job, the place you commerce time for cash, passive revenue means that you can construct wealth over time, even whilst you sleep. In as we speak’s financial system, the place inflation and job insecurity are actual issues, passive revenue has turn out to be a sensible method to increase monetary stability and freedom.

One rising methodology of incomes passive revenue is peer-to-peer (P2P) lending. This technique means that you can lend cryptocurrency on to people or small companies by on-line platforms, incomes curiosity in return, typically at charges larger than these of financial savings accounts or bonds.

This information explains how peer-to-peer lending works, the potential dangers concerned, and which beginner-friendly platforms can assist you get began safely and well.

What Is Peer-to-Peer Lending?

Peer-to-peer lending is a kind of financing that enables people to lend cryptocurrency on to different individuals or small companies. As an alternative of making use of for a mortgage at a financial institution, debtors request funds on P2P platforms, the place on a regular basis traders can select to fund these loans and earn curiosity in return.

Not like conventional banking techniques, the place banks use buyer deposits to concern loans and preserve a lot of the revenue, P2P lending removes the intermediary. Because of this each debtors and traders typically profit: debtors could receive higher rates of interest than they’d discover at a financial institution, whereas traders can earn larger returns than they’d from customary financial savings or funding accounts.

How P2P Lending Works

Peer-to-peer lending is designed to be easy for each debtors and traders. Right here’s the way it works step-by-step from either side:

The P2P Lending Course of for Buyers

Choose a Platform to Lend On

Earlier than you soar in, analysis a number of P2P platforms. Overview different lenders’ critiques, the platform’s borrower screening course of, and their charges. Additionally, test how typically debtors default and the way the platform handles collections.

Go to the platform’s website or app, click on “Signal Up,” and fill in your fundamental information. When you comply with the phrases, you’ll be prepared to begin funding loans.

Select Loans to Make investments In

You get to resolve which loans to fund. Platforms will present you information just like the borrower’s credit score rating, why they want the mortgage, the rate of interest, and the way lengthy the mortgage lasts. To scale back danger, it’s sensible to unfold your funding throughout completely different loans.

Observe Funds and Returns

Control your investments by checking your account commonly. You possibly can see which debtors are repaying on time, and which of them is perhaps falling behind. As you get repaid, you possibly can both reinvest your cash into new loans or withdraw it.

The P2P Lending Course of for Debtors

Apply on a P2P Lending Platform

Go to the web site or app of the P2P platform you need to use. Create an account and full a short software. You’ll be requested for private and monetary particulars like your identify, revenue, job, and the way a lot cash you need to borrow.

Anticipate Lenders to Overview Your Information

After you apply, lenders on the platform will check out your profile to resolve in the event that they need to lend to you. They’ll test your credit score rating, revenue, and different monetary information. You is perhaps requested to add paperwork or confirm your identification earlier than getting accredited.

In case your software will get accredited, you’ll obtain a number of mortgage provides. These will present the rate of interest, mortgage time period, and any charges. Take your time to learn by the provides and decide the one which works finest for you.

When you select a suggestion, it’s possible you’ll must signal a mortgage settlement. This outlines the mortgage phrases, like how a lot you’ll repay every month, how lengthy the mortgage lasts, and what occurs if you happen to miss a fee.

After signing, the cash is often despatched on to your crypto pockets. From there, merely comply with the compensation plan, make your funds on time to keep away from further charges, and keep an excellent credit score rating.

High Newbie-Pleasant P2P Crypto Lending Platforms

On-line platforms play a key function by matching debtors and traders and managing repayments. Common P2P platforms:

Aave

Aave is a DeFi platform the place you possibly can borrow and lend crypto. It runs on Ethereum. If you wish to borrow, you simply lock up your crypto as collateral, type of like placing down a safety deposit. When you’re a lender, you possibly can earn curiosity by letting others borrow your crypto.

Aave’s standout function is flash loans. These are loans you possibly can take with no collateral so long as you pay them again in the identical transaction. It sounds wild, however it opens up cool potentialities for quick buying and selling and arbitrage.

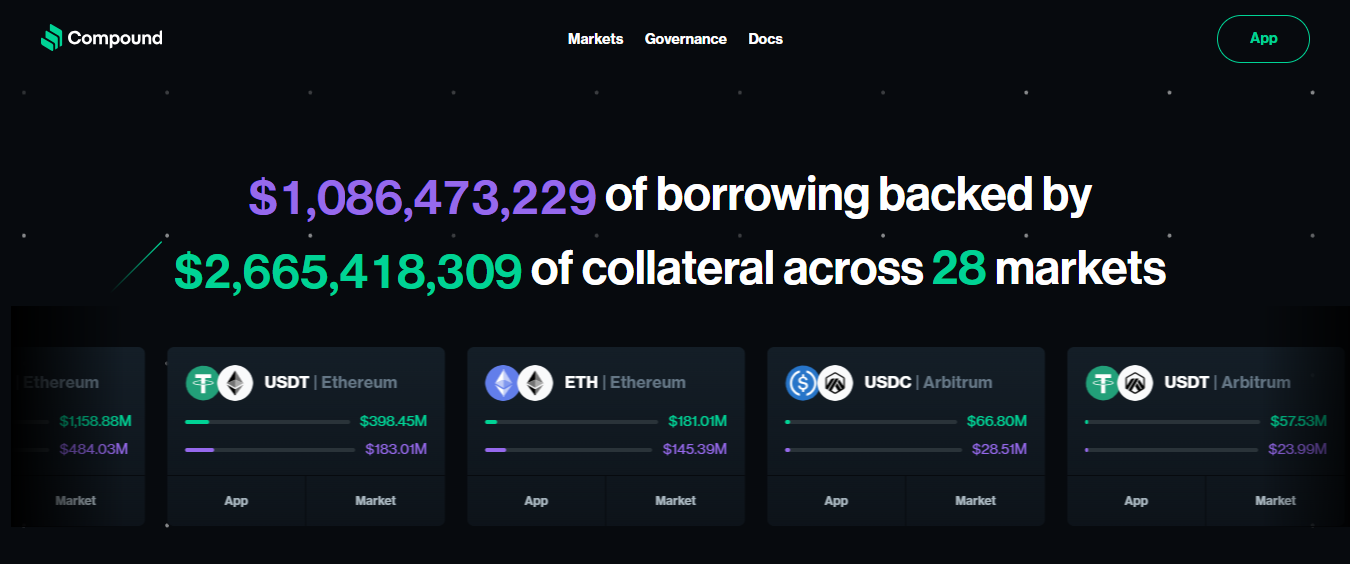

Compound

Compound is one other DeFi lending platform on Ethereum. It really works rather a lot like Aave. You deposit your crypto to earn curiosity, and debtors use it by offering collateral. Compound makes use of an algorithm that adjusts rates of interest in response to modifications in provide and demand.

If many individuals need to borrow a specific token, the rate of interest will increase. It additionally includes a voting system that enables customers to assist resolve on modifications to the platform, corresponding to which belongings to help or how charges are structured.

MakerDAO

MakerDAO is behind the DAI stablecoin, which is pegged to the U.S. greenback. It’s additionally constructed on Ethereum. You possibly can lock up crypto as collateral to generate DAI. So mainly, you’re making a dollar-pegged coin by placing your crypto to work. Lenders earn curiosity by one thing referred to as a “stability price.”

Its customers additionally govern MakerDAO. When you maintain the MKR token, you get to vote on large choices like which belongings can be utilized as collateral and the way the system ought to evolve.

dYdX

dYdX is a decentralized buying and selling platform the place you may also borrow and lend crypto. It’s recognized for its derivatives and superior buying and selling choices.

You should utilize your crypto as collateral to borrow extra belongings and commerce with leverage (utilizing borrowed cash to attempt to amplify earnings). When you’re a lender, you possibly can earn curiosity by offering liquidity to the platform. It helps a spread of belongings and markets and is constructed on Ethereum, just like the others.

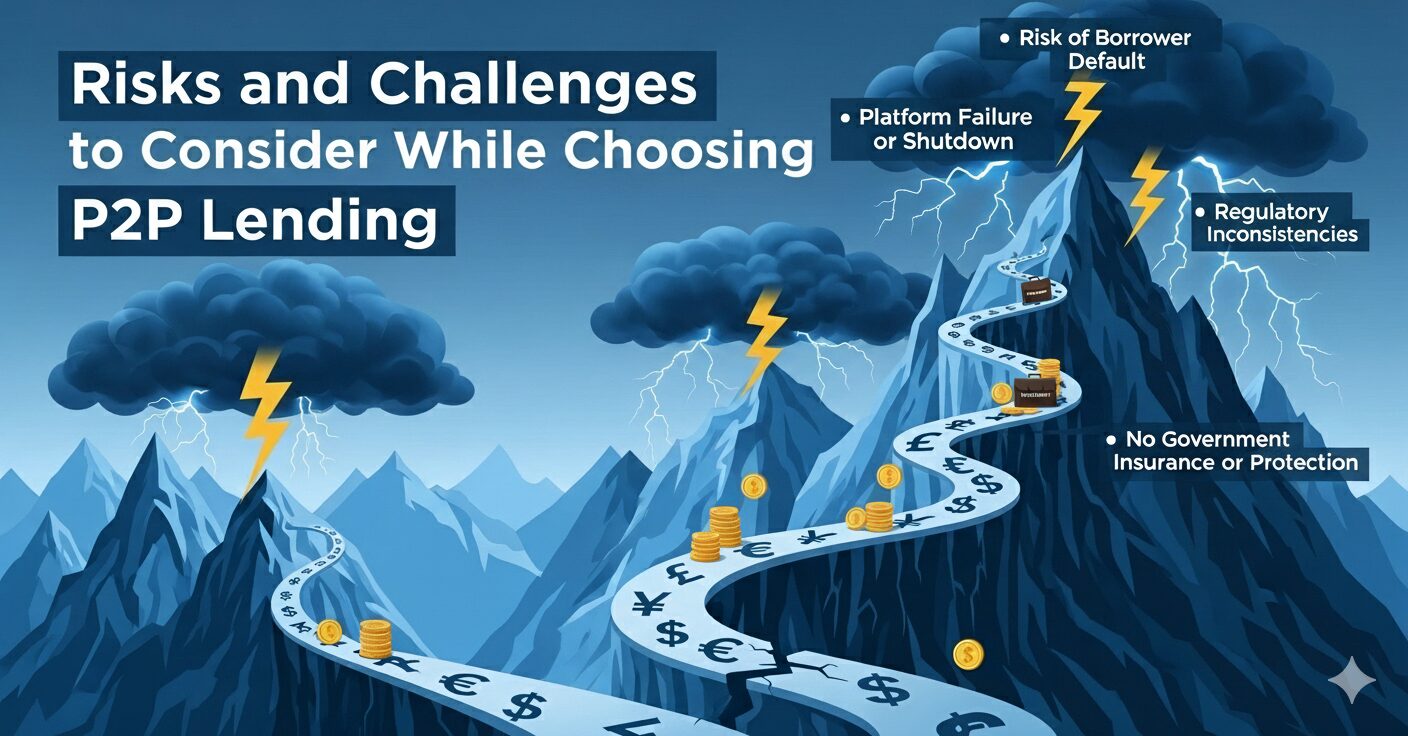

Dangers and Challenges to Contemplate

Whereas peer-to-peer (P2P) lending provides engaging returns, it’s essential to know the dangers concerned earlier than investing. Listed here are the important thing challenges to think about:

The largest danger in P2P lending is that debtors could not repay their loans. Not like a financial institution, you’re not insured in opposition to default. Platforms attempt to assess creditworthiness, however some loans nonetheless go dangerous, particularly in riskier mortgage grades.

Platform Failure or Shutdown

Your funding depends upon the soundness of the platform you employ. If the corporate managing your loans goes out of enterprise or shuts down unexpectedly, recovering your cash could possibly be tough or delayed.

P2P lending just isn’t like buying and selling shares; you possibly can’t simply withdraw your cash early. Most loans have fastened phrases, and your capital is tied up till the borrower repays in full. Some platforms supply secondary markets to promote loans, however liquidity just isn’t assured.

Regulatory Inconsistencies

P2P lending just isn’t regulated the identical approach in all places. Guidelines fluctuate considerably by nation and even by state. This may have an effect on investor protections, platform operations, and tax reporting necessities.

No Authorities Insurance coverage or Safety

Not like cash in a checking account, P2P investments are usually not protected by the FDIC or related companies elsewhere. If a borrower defaults or a platform fails, you could possibly lose all or a part of your funding.

Ideas for New P2P Lenders

When you’re new to peer-to-peer lending, it’s essential to strategy it with a considerate technique. Listed here are some suggestions that will help you get began correctly:

Begin Small and Diversify Throughout A number of Loans

Relatively than placing a big quantity into one mortgage, unfold your funding throughout many smaller loans. This helps scale back the danger; if one borrower defaults, it gained’t considerably influence your general returns.

Use Auto-Make investments Options Cautiously

Auto-invest instruments can save time by routinely reinvesting your funds primarily based in your preferences. Nevertheless, be sure that to know how the algorithm selects loans. Overview your settings and test that the loans match your danger tolerance and return targets.

Learn Borrower Profiles and Mortgage Phrases Rigorously

Every mortgage comes with essential details about the borrower’s credit score rating, revenue, mortgage function, and compensation historical past. Don’t skip this. Reviewing these particulars can assist you make extra knowledgeable funding selections.

Reinvest Repayments to Maximize Compounding

As debtors repay their loans every month, you’ll obtain principal and curiosity. As an alternative of withdrawing the funds, contemplate reinvesting them into new loans. This boosts your incomes potential over time by the ability of compound curiosity.

Ultimate Ideas

Peer-to-peer lending can supply larger returns than conventional financial savings accounts or bonds, particularly if you happen to decide the precise platform and debtors. However like several funding, it comes with dangers, corresponding to borrower defaults or modifications in market situations.

That’s why it’s essential to have a look at each the upside and the draw back. With the precise analysis and danger administration, P2P lending generally is a stable a part of your portfolio, however it shouldn’t be your solely funding.

Take the time to know how the platform works, who you’re lending to, and what protections are in place. Do your homework, keep diversified, and consider P2P lending as only one piece of your greater funding puzzle.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”