In the summertime of 2024, Crowdstrike made the headlines however not for the explanations buyers would anticipate or hope. Whereas many seemed ahead to beginning their well-earned holidays, a serious IT disruption obtained the planes caught on land & many companies froze. The rationale? A routine software program replace which quickly escalated into a worldwide digital disaster. Which software program? You guessed it proper! CrowdStrike’s Falcon sensor program.

supply: IT outage – photograph from Wikipedia

Has the corporate collapsed after the incident? Not likely. Right this moment, its inventory listed on NASDAQ trades round an all-time excessive.

Is there a justification for the efficiency of the inventory?

Let’s dive in & discover! 🔍

What’s CrowdStrike?

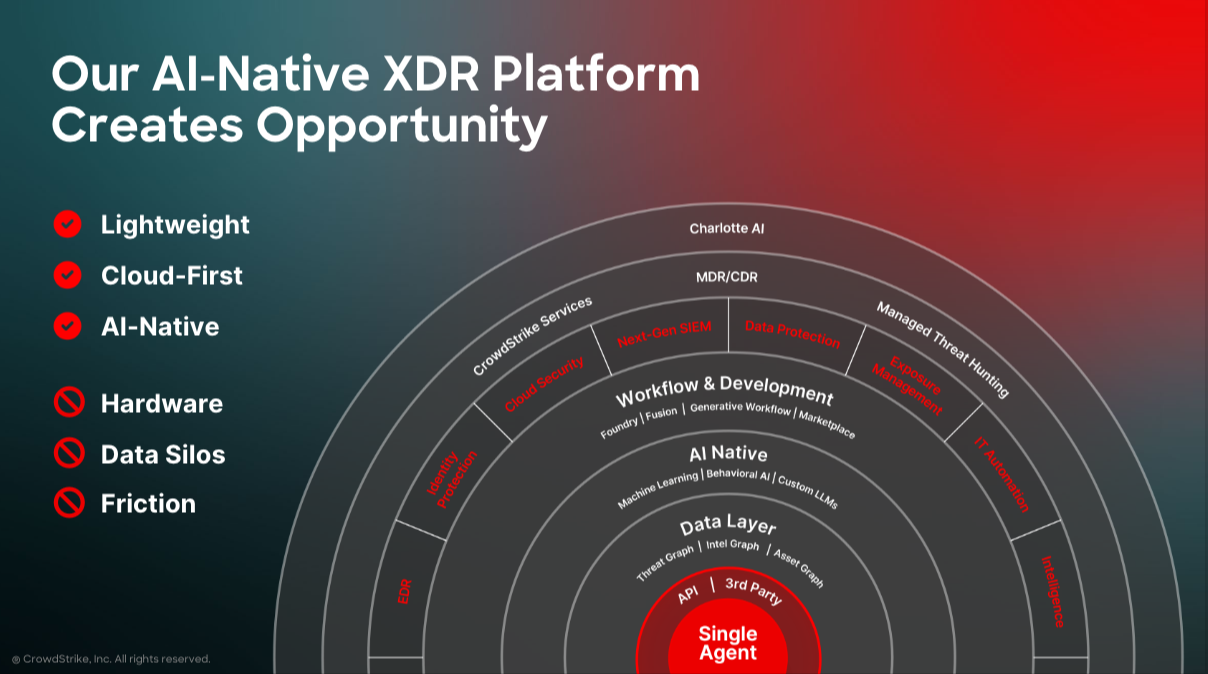

CrowdStrike Holdings, Inc. is an American cybersecurity know-how firm headquartered in Sunnyvale, California, and was based in 2011. Famend for its revolutionary strategy to cybersecurity, CrowdStrike makes a speciality of cloud-native endpoint safety, menace intelligence, and proactive incident response companies. The corporate is greatest identified for its Falcon platform, which leverages synthetic intelligence to detect and stop cyber threats in realtime. As a number one supplier of cloud-delivered endpoint safety, CrowdStrike’s latest earnings report and monetary metrics spotlight its sturdy market place and future progress potential.

supply: CrowdStrike firm presentation

Monetary Efficiency

CrowdStrike’s fiscal yr runs from February 1 to January 31 of the next yr. For instance, the fiscal yr 2024 ended on January 31, 2024.

In keeping with NASDAQ, CrowdStrike is estimated to report subsequent earnings on 03/04/2025. So we’ll dive into the final report.

CrowdStrike’s monetary efficiency within the third quarter of fiscal yr 2025 caught the eyes of buyers, because it showcased important progress and operational effectivity. Listed below are some key highlights from the newest earnings name and monetary reviews:

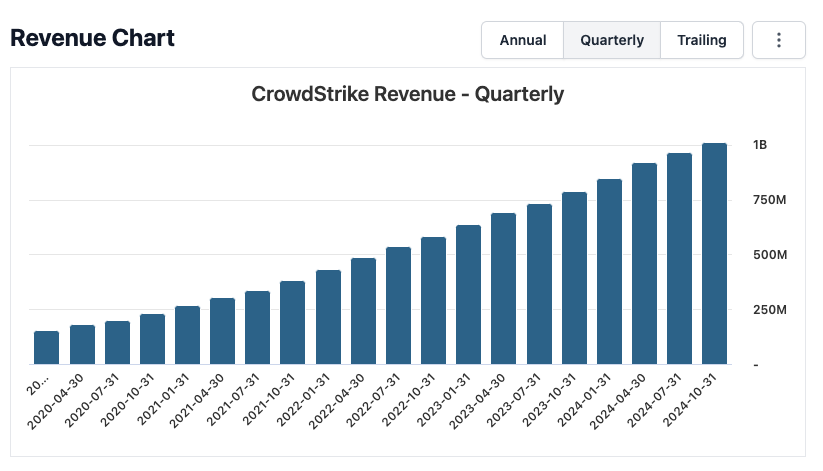

Income Development: CrowdStrike achieved a milestone by surpassing $1 billion in quarterly income for the primary time, marking a 28.5% year-over-year progress. The corporate’s whole income for the twelve months ending October 31, 2025, was $3.74 billion, reflecting a 31.4% progress fee.

Annual Recurring Income (ARR): The corporate reported an ARR exceeding $4 billion, rising 27% year-over-year, making it the quickest pure-play cybersecurity software program firm to succeed in this milestone.

Free Money Movement: CrowdStrike generated $231 million in free money circulate, representing 23% of its income, and achieved a Rule of 51 on a free money circulate foundation.

EPS: The earnings per share (EPS) for the quarter ending October 31, 2025, was reported at -$0.07. Nevertheless, for the twelve months ending the identical date, the EPS was $0.52, indicating a constructive pattern in profitability.

supply: CrowdStrike income progress by stockanalysis.com

Valuation Metrics

CrowdStrike’s valuation metrics present insights into its market notion and progress expectations:

Ahead P/E Ratio: in response to GuruFocus, CrowdStrike’s ahead P/E ratio was 95.99 (as of Feb. 08, 2025), reflecting excessive progress expectations from buyers.

Value to Gross sales Ratio: The corporate’s worth to gross sales ratio stood at 26.8 for the quarter ending October 31, 2025, indicating a premium valuation consistent with its progress prospects.

A ahead P/E ratio above 90 is extraordinarily excessive however not unusual. In keeping with GuruFocus, the very best $Meta traded previously 13 years was at 108.4.

Curiously, primarily based on varied metrics together with firm and business progress, Merely Wall Road states that CrowdStrike is traded at 16.9% beneath their estimated honest worth. SeekingAlpha additionally describes the corporate as a top quality one in a rising business.

Whereas these figures look staggering for worth buyers who’re searching undervalued companies, progress buyers usually are not shying away from the corporate!

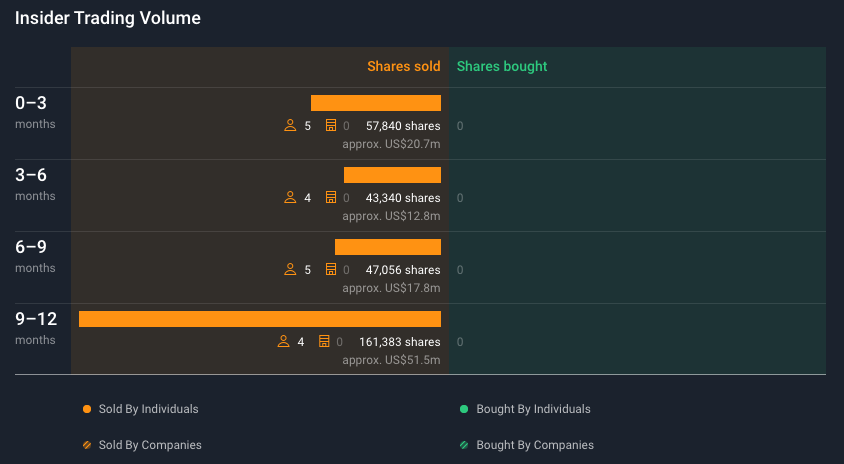

A have a look at insider buying and selling

Up to now six months, insider buying and selling at CrowdStrike Holdings, Inc. has been fairly dynamic, reflecting strategic selections by key stakeholders. Notably, George R. Kurtz, the Founder, CEO, and Director, offered 1.1 million shares, lowering his holdings by 14.5%. In keeping with him, final gross sales “have been made to cowl tax withholdings due on vesting of restricted inventory unit awards, as required underneath the Issuer’s administrative insurance policies”.

supply: CrowdStrike insider buying and selling quantity by Merely Wall St.

Whereas it’s important to contemplate the broader context of insider buying and selling actions (there might be many causes for insiders to promote impartial of the corporate efficiency), it’s value maintaining a tally of such developments. As a normal rule, seeing insiders promoting at a considerably increased worth than market worth or considerably shopping for shares may be seen as constructive indicators. Then again, after we see a number of insiders promoting huge chunks of their shares, particularly if underneath market worth, then we should always rapidly examine as an investor. This can be a potential pink flag!

Future Prospects

CrowdStrike’s future appears to be like promising, pushed by its revolutionary platform and strategic initiatives:

Falcon Flex Mannequin: The Falcon Flex subscription mannequin is enhancing platform adoption, rising each the share of pockets and enterprise actual property. This mannequin is anticipated to drive sooner and bigger ARR uplift over time.

Product Innovation: CrowdStrike continues to steer in innovation throughout cloud safety, identification safety, and next-gen SIEM, disrupting legacy markets and creating new classes.

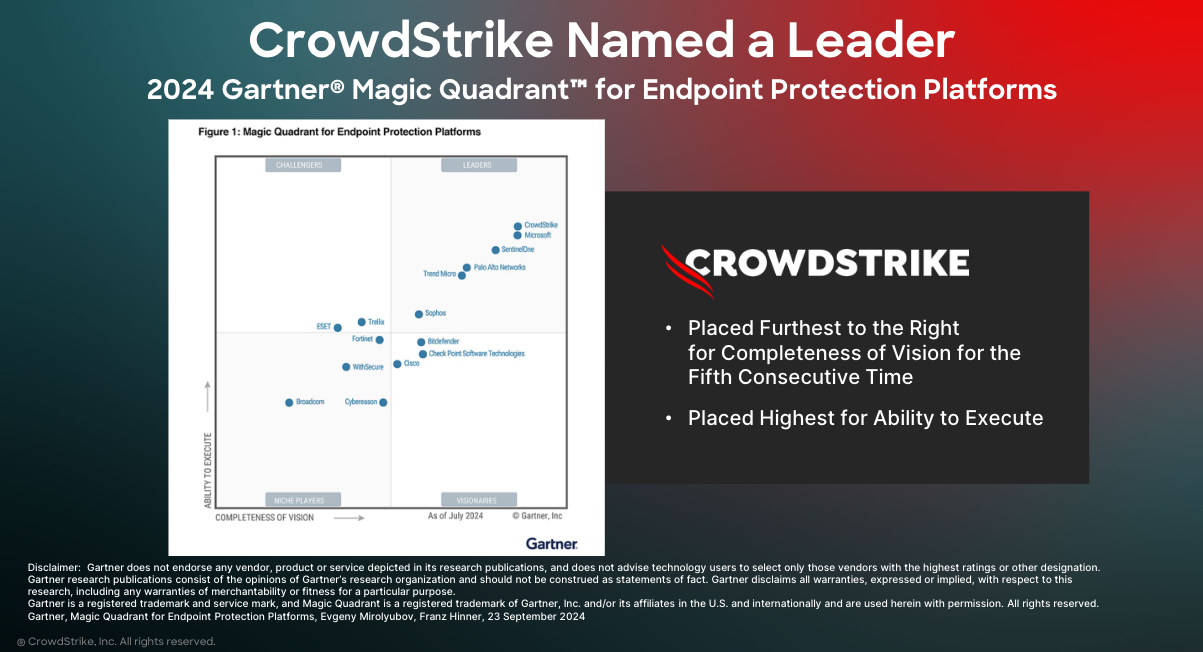

CrowdStrike was named chief for five occasions in a row within the Endpoint Safety Platforms by Gartner, forward of Microsoft.

Strategic Acquisitions: The acquisition of Adaptive Defend provides SaaS posture administration to CrowdStrike’s portfolio, additional strengthening its market place.

Lengthy-term Objectives: CrowdStrike stays dedicated to attaining $10 billion in ending ARR by the top of fiscal yr 2031 and its goal non-GAAP working mannequin by fiscal yr 2029.

supply: CrowdStrike firm presentation

Conclusion

CrowdStrike Holdings, Inc. stands out as a number one participant within the cybersecurity panorama, with its sturdy monetary efficiency, revolutionary options, and strategic progress initiatives. Whereas the corporate’s premium valuation displays excessive investor expectations, its sturdy progress trajectory and market management place it nicely for continued success within the evolving cybersecurity market.

The inventory is an affordable one to carry in a portfolio for buyers serious about investing in progress, innovation and know-how. With such a excessive ahead P/E it’s possible you’ll nonetheless brace your self for potential excessive volatility and attainable dips alongside the way in which.

Whether or not you determine to spend money on the inventory or not, cyber safety must be a high precedence for everybody. And us, customers, shall be the primary line of protection towards attackers. So should you learn this and consider your ‘qwerty’ or birthday date password, it’s possible you’ll wish to change it now and add a two-factor authentication. 😉

Sources:

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.