Analyst Weekly, February 9, 2026

Early 2026 has been unstable, however it has additionally made one factor clear: there’s multiple approach to keep risk-on. Current market actions sign that efficiency is not depending on a slim group of mega-cap names and that incremental capital is being deployed extra selectively.

Breadth Over Focus

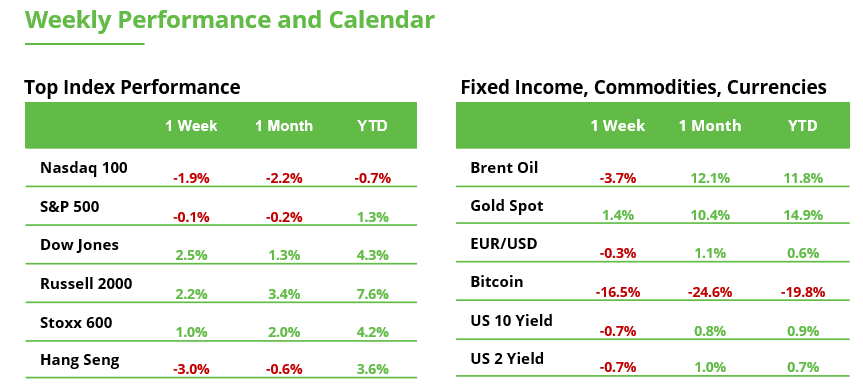

Move knowledge helps this shift. Since late 2025, allocations have rotated towards Rising Markets, ex AI thematic exposures, and cyclicals, whereas crypto-linked merchandise have seen outflows. Traders stay risk-on, however with larger emphasis on diversification, valuation self-discipline, and earnings supply.

EM Equities Transfer From Commerce To Allocation

Rising market equities sit on the middle of this adjustment. After posting a 31% return in 2025, EM has prolonged its outperformance into 2026, beating developed markets by roughly 5% YTD in USD phrases. This power displays earnings momentum, supportive coverage settings, and a weaker greenback, and importantly, not crowded positioning, which stays properly under historic norms.

From a portfolio perspective, we expect that EM could provide a number of methods to specific core macro themes whereas enhancing diversification.

AI Publicity With out US Mega-Cap Valuations

One of many clearest EM expressions is sustained AI momentum at decrease valuations. Korea, Taiwan, and China are central to the worldwide AI provide chain, significantly in superior semiconductors and reminiscence. Korea stands out. It’s robust 2025 efficiency continues to guide in 2026, anchored by the reminiscence sector.

Earnings revisions have been materials. Consensus 2026 tech EPS in Korea has been revised up by roughly 130%, with reminiscence leaders anticipated to ship earnings properly above present consensus and maintain robust progress into 2027. There aren’t sufficient high-density reminiscence chips to fulfill that demand proper now, so costs have risen rapidly. Some long-term contracts haven’t absolutely caught up but, which implies corporations are nonetheless promoting a part of their output at older, decrease costs, however that hole is closing. In consequence, pricing is prone to keep favorable by 2026, supporting robust earnings progress even because the market regularly normalizes.

Valuations reinforce the case. Korean tech trades at a significant low cost to US friends, regardless of enhancing market breadth, robust earnings momentum, and supportive structural reforms. The Korea Worth Up programme which is targeted on governance, shareholder returns, and transparency, offers an extra catalyst for re-rating over time.

Weaker USD and Uneven EM Easing

A second EM pillar is publicity to a softer US greenback. Financial coverage throughout EMs are diverging, with a majority of EM central banks nonetheless anticipated to chop charges. On this atmosphere, high-yielding markets akin to Brazil, Mexico, and South Africa could provide engaging carry alongside fairness upside.

A weaker greenback improves monetary circumstances, helps capital flows, and enhances the relative attraction of EM belongings, reinforcing the diversification case.

Gold As A Structural Diversifier

Gold stays an vital portfolio element. Whereas the latest correction has lowered near-term momentum, structural help stays intact, pushed by central financial institution accumulation, investor diversification, and powerful bodily demand.

South African equities are significantly leveraged to this theme. Miners now account for roughly 37% of the Top40 index, and earnings momentum stays intently tied to gold costs above $2,000 per ounce. Increased valuable metallic costs proceed to help phrases of commerce, fiscal revenues, and the forex, feeding by to fairness efficiency.

US: Broadening Past The Mag7

Within the US, we expect that because the macro restoration broadens, returns have gotten much less concentrated. This creates room for the equal-weighted S&P 500 to outperform the Mag7, with out undermining the longer-term AI supercycle.

The main focus shouldn’t be on exiting large-cap tech, however on capturing enhancing breadth and extra balanced earnings supply throughout sectors.

US Tech: A number of Compression Has Been Fast and Materials

Within the US, latest expertise sector weak spot has been pushed primarily by valuation compression quite than earnings deterioration. Ahead P/E multiples have fallen from roughly 28x to ~23x in two months, a ~20% contraction, inserting valuations close to ranges seen throughout prior market corrections. By comparability, throughout 2022, tech multiples declined from ~27x to ~18x, whereas the 2024 pullback noticed compression from ~27x to ~21x.

Earnings expectations, nonetheless, have remained broadly secure, and large-cap expertise continues to generate substantial free money stream. This implies threat is more and more company-specific, favouring corporations with clear earnings visibility and balance-sheet power quite than broad sector publicity.

Funding Takeaway: We expect that the important thing shift driving allocations will contain shifting the identical threat price range away from focus and towards breadth, earnings supply, and valuation help. General, rising market equities have a beautiful mixture of valuation help, earnings momentum, and macro alignment, buying and selling at roughly 14x ahead earnings versus 20x for developed markets. Inside EM, AI-linked expertise leaders in Korea, Taiwan, and China, alongside high-yielding markets could profit from a weaker greenback. Within the US, we expect that the broader fairness publicity by way of equal-weighted indices affords higher risk-reward as management widens. Diversification is more and more the place returns are being generated.

Stabilization As a substitute of Panic: First Consumers Return to the Crypto Market

The crypto market continued its downward transfer final week. Nonetheless, not like the earlier two weeks, the selloff misplaced momentum. From Thursday onward, consumers turned energetic once more. On the weekly chart, Bitcoin and Ethereum shaped candles with lengthy decrease wicks. Key help ranges have been revered.

This isn’t but a pattern reversal, however such stabilization is usually step one. The important thing query now’s whether or not this may grow to be renewed upward momentum.

Bitcoin

Bitcoin quickly fell to round $60,000 final week, its lowest stage since October 2024. From the all-time excessive, the value had greater than halved. A brief-term rebound adopted, with consumers pushing the value again above a Truthful Worth Hole, which is performing as help within the $63,800–$64,500 zone.

On the upside, the important thing resistance on the weekly chart stays at $98,000, the place the earlier selloff started. So long as this stage shouldn’t be reclaimed, additional promoting waves can’t be dominated out. In that case, the subsequent main help zone lies between $52,500 and $58,400, which already absorbed a number of sharp declines in 2024.

. Supply: eToro

Ethereum

Ethereum’s value motion intently mirrors Bitcoin’s, however ETH was hit more durable. At its worst, the space from the all-time excessive reached round 65%. Right here too, a technical rebound adopted, permitting a part of the earlier week’s losses to be recovered.

The primary key help zone is a broad Truthful Worth Hole between $1,855 and $2,299. The decrease zone between $1,674 and $1,715 was not reached, as promoting stress light earlier than that stage. The primary resistance presently stands at $3,402.

ETH, weekly chart. Supply: eToro

What Issues Now

For each Bitcoin and Ethereum, an important resistance ranges stay properly above present costs. Traders can due to this fact look to decrease timeframes to evaluate whether or not a brand new pattern is rising from this stabilization. Typical alerts could be a sequence of upper highs and better lows.

As an extra affirmation, a transfer again above the 20-day shifting common could possibly be used. This stage presently sits at round $78,900 for Bitcoin and $2,488 for Ethereum.

What to Anticipate Now from Bitcoin (and the Crypto Market)

After the previous few weeks, the market shouldn’t be signaling a structural breakdown, however quite a part of adjustment and cleaning. The decline has been pushed primarily by derivatives deleveraging, pressured liquidations, and episodic institutional outflows, not by a deterioration in Bitcoin’s fundamentals or within the broader crypto ecosystem.

Bitcoin is presently buying and selling in a zone of technical and macro stress, the place value has converged towards key reference ranges such because the market’s common price foundation (55K USD) and traditionally related capitulation areas. On this atmosphere, volatility tends to stay elevated, narratives grow to be louder, and short-term visibility is proscribed. That doesn’t essentially indicate increased structural threat, it implies increased timing threat.

Within the close to time period, the market wants time quite than route: time to soak up pressured promoting, normalize liquidity circumstances, and permit leverage to reset. Worth motion could stay erratic, with sharp rebounds and pullbacks, typical of markets nonetheless dominated by derivatives quite than spot flows.

Wanting barely additional out, and assuming no escalation in macro or liquidity shocks, the bottom case factors towards gradual stabilization quite than collapse. Traditionally, these phases have favored traders who prioritize threat administration, place sizing, and endurance, over these making an attempt to foretell the subsequent short-term transfer.

In crypto, as usually occurs, the principle threat at this stage shouldn’t be that “all the pieces breaks,” however mistaking volatility for a regime change.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.