Victoria d’Este

Printed: April 28, 2025 at 11:53 am Up to date: April 28, 2025 at 11:53 am

Edited and fact-checked:

April 28, 2025 at 11:53 am

In Temporary

April noticed a surge of blockchain tasks, with some pushing boundaries and others simply driving the wave. This in-depth have a look at the present panorama highlights 5 tasks price inspecting.

We’re deep into one other crypto spring, and the wave of contemporary hype hasn’t slowed. April introduced one other rush of blockchain tasks, with some pushing boundaries and others simply driving the wave. It’s simple to get caught up within the pleasure, however what’s really price being attentive to?

Right here, we break down 5 of essentially the most talked-about tasks in April – not simply those that hit your feed, however the ones with sufficient substance behind the hype to warrant a better look. From the most recent in Layer-2 scaling to DeFi-native infrastructure, let’s sift by means of what’s actual, what’s speculative, and the place issues may really go from right here.

Needless to say this isn’t funding recommendation or a advice – simply an in-depth have a look at the present panorama. With that out of the best way, let’s get digging!

BlockDAG (BDAG)

Raised $216M, dropped a testnet, and is pushing parallel block manufacturing arduous

Let’s not fake this one isn’t in every single place proper now. BlockDAG’s been unimaginable to overlook this month – $216M raised in presale, a public testnet up, and sufficient advertising noise to drown out smaller launches utterly. However guess what – when you scrape off the hype, it’s nonetheless price a better look.

Supply: BlockDAG

Their Primordial Testnet is up, displaying off a DAG-based Proof-of-Work chain that enables a number of blocks to be produced on the similar time. That’s not a brand-new concept – we’ve seen it in Kaspa and some different experiments – however it’s nonetheless uncommon at this degree of polish and advertising. BlockDAG claims 10ms block instances and a throughput ceiling means above what we’re used to, although proper now there aren’t any public benchmarks or utilization knowledge to again that up.

Supply: BlockDAG

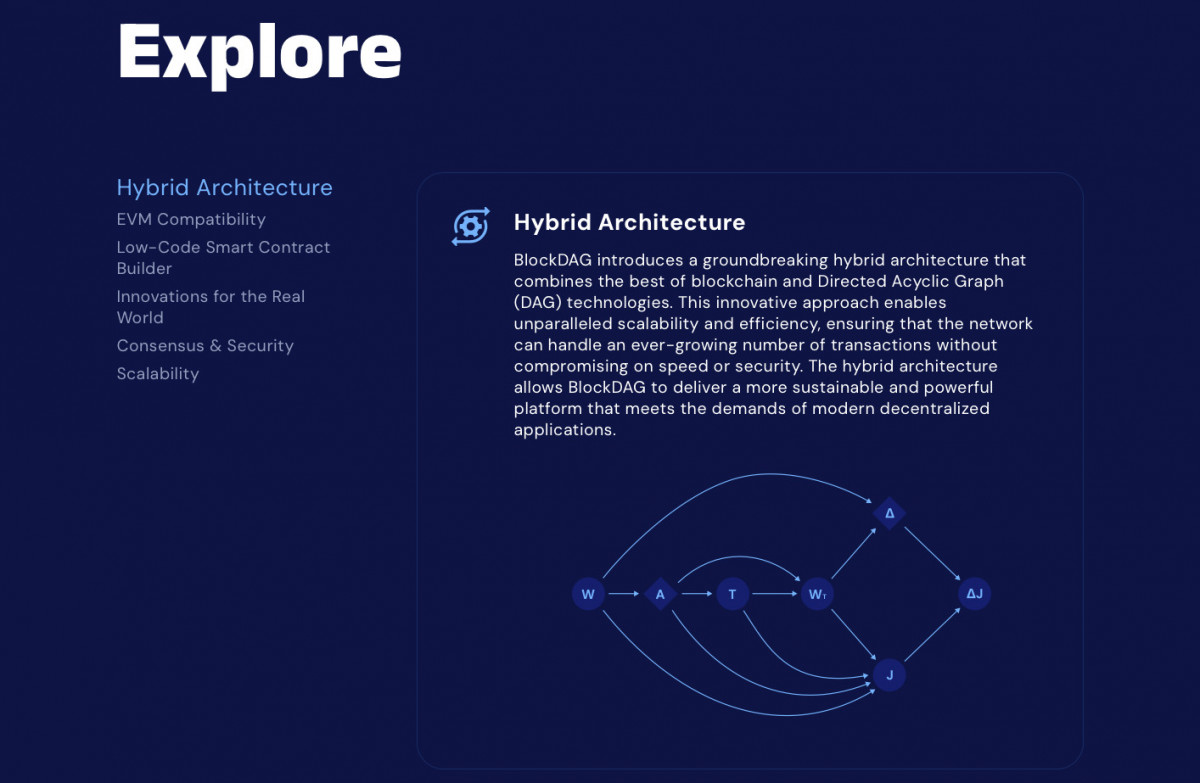

What’s attention-grabbing is the hybrid design: UTXO for funds (Bitcoin-style), and a separate EVM layer for contracts. That’s versatile, at the least on paper. They’ve additionally constructed out an SDK, assist for Truffle and Hardhat, and launched a cell mining app plus an entire line of ASIC miners – which feels retro, however perhaps that’s the purpose.

Supply: BlockDAG

The workforce is partially doxxed and never completely nameless, which helps. They’ve received Marius Bock from Cardano, Antony Turner from Spirit Blockchain, and even a tutorial identify or two for credibility. Advisors don’t construct programs, however it’s higher than complete radio silence.

Supply: BlockDAG

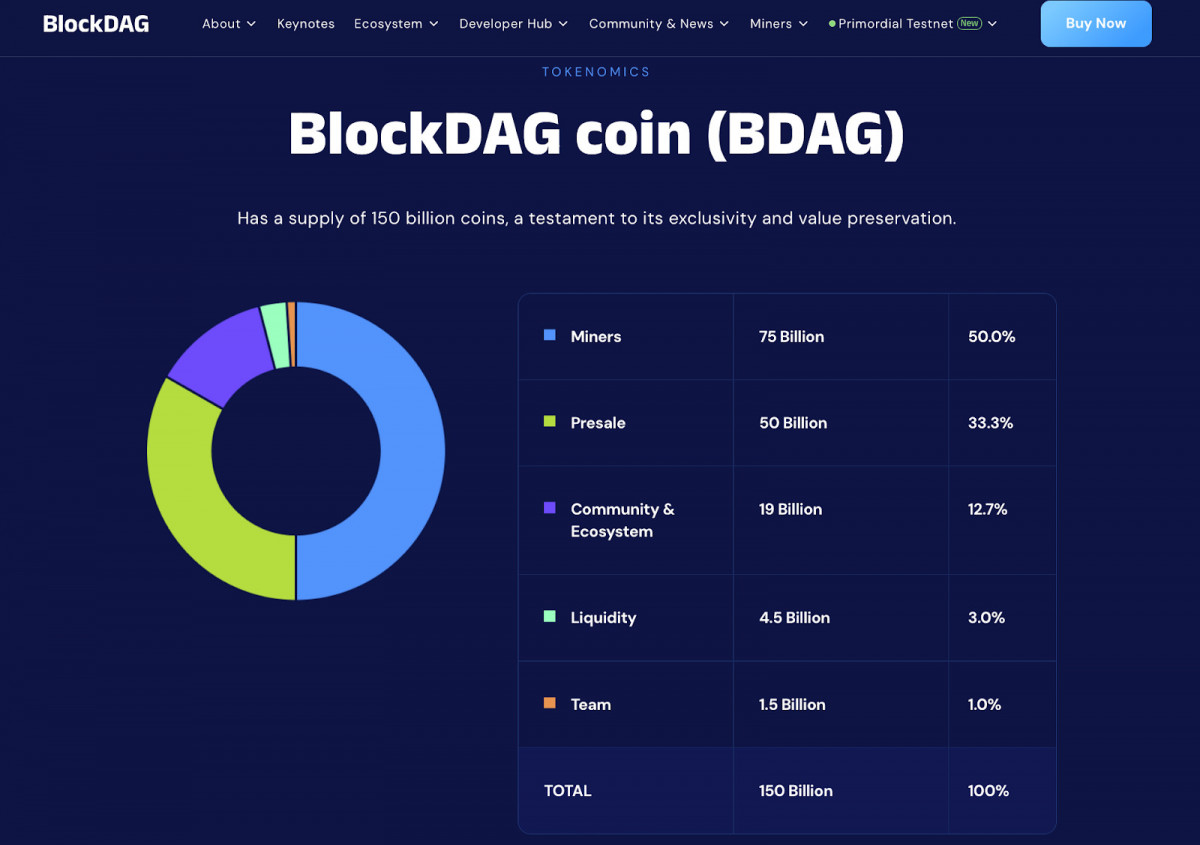

Tokenomics are heavy: 150 billion provide, half of it for miners, a 3rd already in presale fingers. That’s a variety of circulating strain as soon as listings go dwell – particularly if retail is dashing for exits. You’ll wish to watch how liquidity is dealt with within the first few months.

Backside line: They’ve received capital, a working testnet, and a transparent structure – however no arduous efficiency knowledge but. It’s promising, however nonetheless largely speculative. Positively price protecting in your radar, however for now, we wouldn’t purchase the excitement alone.

Solaxy (SOLX)

The primary actual Layer-2 for Solana – assuming it ever launches

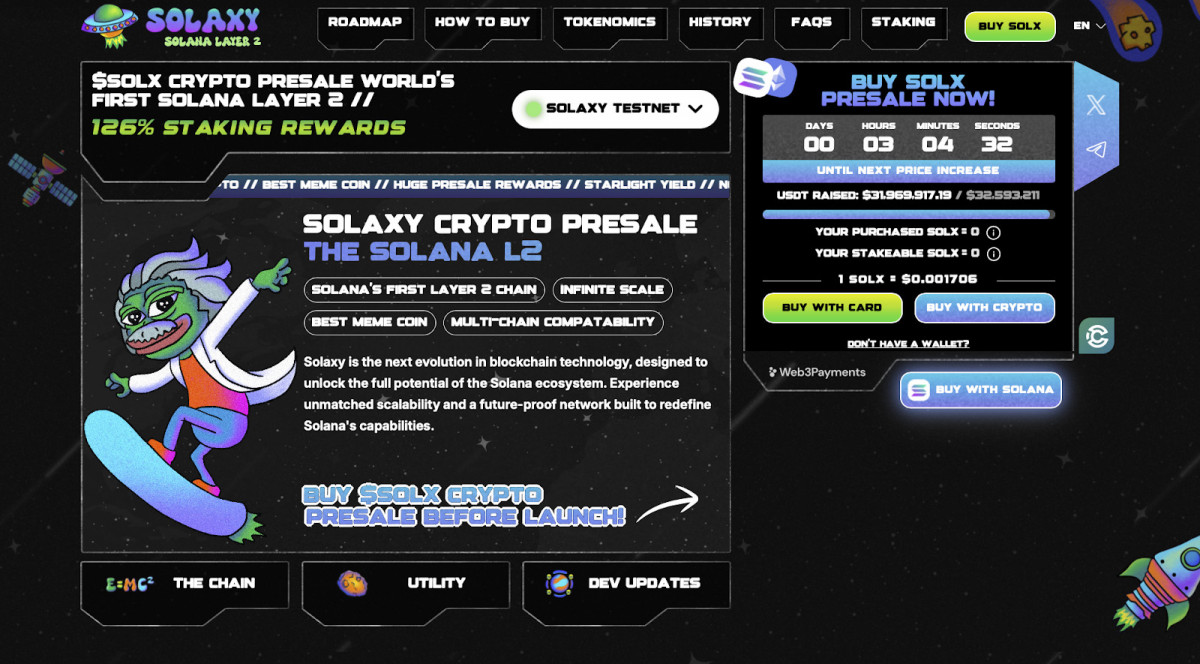

Solaxy popped up quick and loud: a public presale with no non-public rounds, over $31M raised, and a pitch that hit an actual ache level – Solana’s rising congestion points. So, it’s made sufficient noise for us to assume it deserved a better, calmer look earlier than assumptions take over.

Supply: Solaxy

In principle, it’s precisely what the ecosystem wants. Solana’s nice when it’s not overloaded – however we’ve all seen the cracks when memecoin buying and selling or NFT launches flood the community. Solaxy plans to deal with transactions off-chain, batch them up, and settle them again onto Solana mainnet. Acquainted in case you’ve used Arbitrum or Optimism.

The thought is simple sufficient. What’s much less clear is how briskly they’ll really get it dwell.

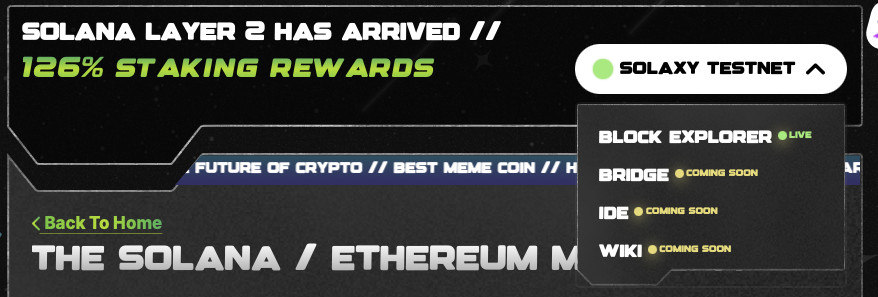

Supply: Solaxy

Proper now, a lot of the infrastructure continues to be pending. There’s a staking portal up – customers can already lock up SOLX at an marketed 128% APY – however that’s the one piece you possibly can work together with immediately. The testnet toggle is there, however doesn’t really do something but. The Ethereum bridge is marked as “coming quickly,” and the developer instruments, together with the IDE and SDK, haven’t been made public both. So whereas the frontend appears polished, the underlying programs nonetheless really feel early.

Supply: Solaxy

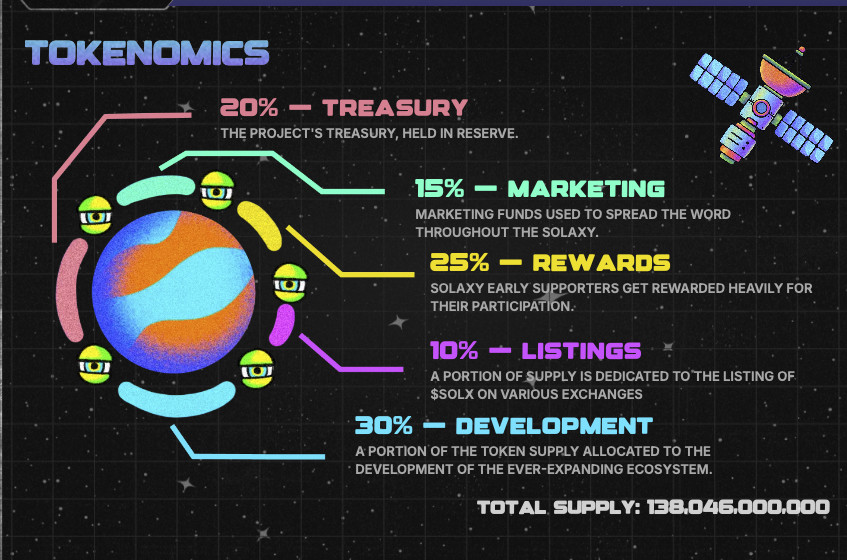

As for tokenomics, it’s a 138 billion SOLX provide. Most of it’s break up between improvement, staking rewards, advertising, and liquidity listings. No non-public sale – the entire increase has been public, they usually’ve already pulled in over $31M. That’s a variety of early capital from retail, not VCs.

And that’s one thing to consider. On one hand, no non-public allocations imply much less behind-the-scenes promote strain later. Alternatively, it means you’re not getting the sluggish vesting curves or strategic backing that may generally stabilize a brand new community.

The large query is timing. They’re promising a bridge, rollup deployments, and full Layer-2 companies inside months. However till the mainnet goes dwell and transactions begin flowing, it’s arduous to inform whether or not Solaxy will really resolve Solana’s congestion issues – or simply find yourself including one other layer of complexity.

Backside line:Solaxy’s aiming at an actual drawback, and the construction they’re constructing is smart. Nevertheless it’s nonetheless largely a plan on paper. In the event that they ship what they promise, it’ll be a crucial piece of Solana’s future scaling. In the event that they stall, the hype will transfer on rapidly. Value monitoring – however perhaps not chasing – till extra of the infrastructure is in place.

Berachain (BERA)

A DeFi-first Layer 1 that rewards liquidity – not simply staking

For those who’ve been anyplace close to DeFi Twitter this month, you’ve seen Berachain getting severe consideration – not for a flashy presale, however as a result of it’s one of many few L1s that’s really dwell, operating, and making an attempt one thing structurally completely different.

Supply: Berachain

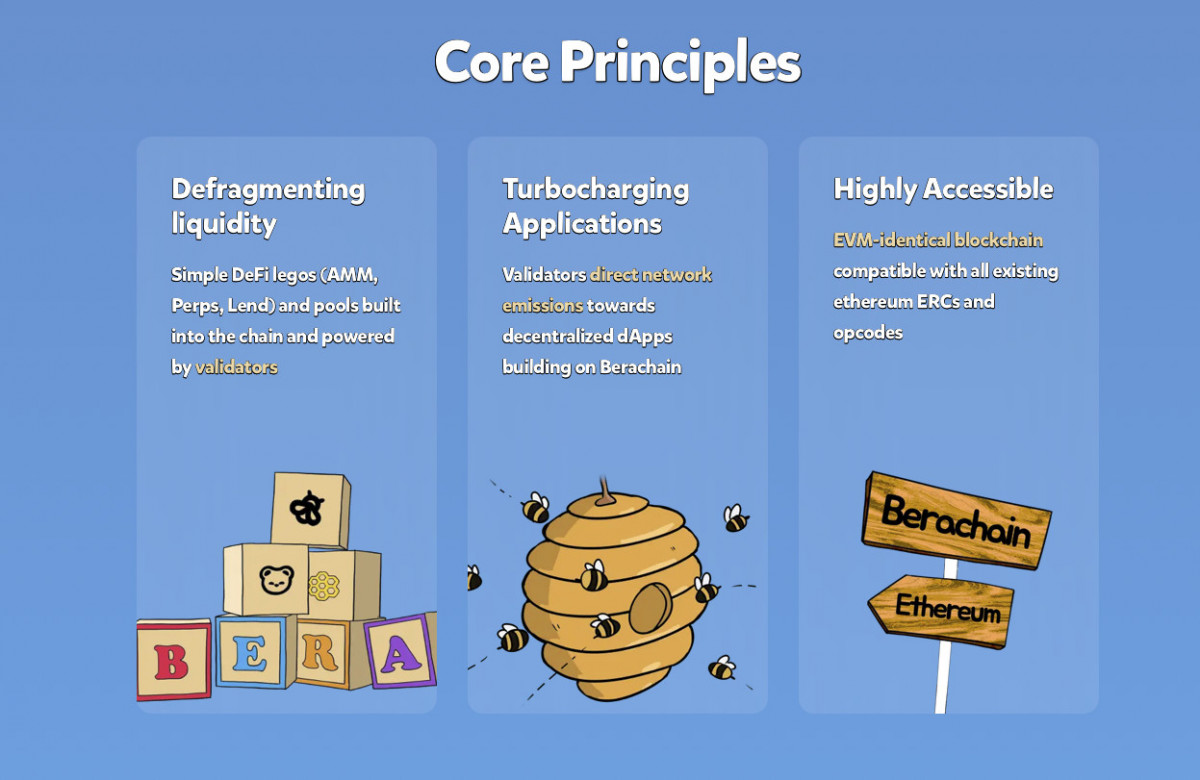

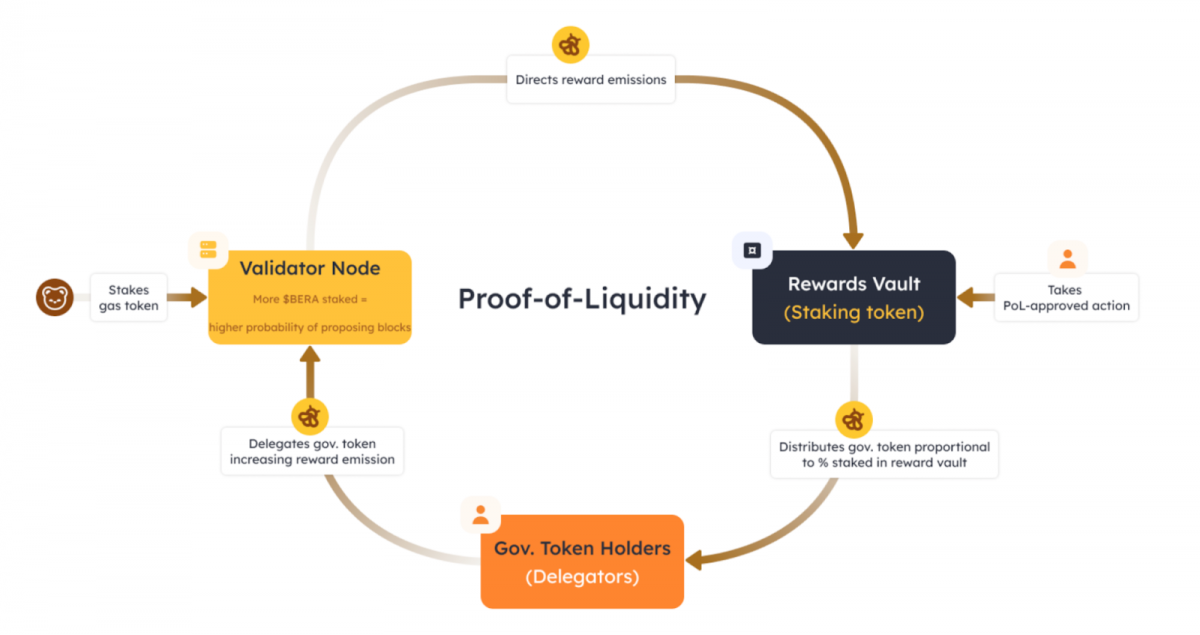

Berachain’s not making an attempt to be the quickest chain or the most cost effective chain. It’s positioning itself as a DeFi-native Layer 1 – structured from the bottom as much as align capital with utilization. That’s the place the headline characteristic is available in: Proof-of-Liquidity.

Supply: Binance

On this mannequin, validators don’t stake the native token. They stake LP tokens – that means, they’ve to really take part within the on-chain economic system to assist safe the community. It’s an try to repair what we’ve seen in conventional PoS chains: tons of idle capital incomes yield, however not doing a lot else.

Supply: Binance

On the floor, it is smart. If liquidity is the lifeblood of DeFi, why shouldn’t it additionally assist consensus? However you need to marvel what occurs when protocols begin competing for that very same liquidity. Will individuals hold it on Berachain, or chase larger yields elsewhere?

Supply: Messari

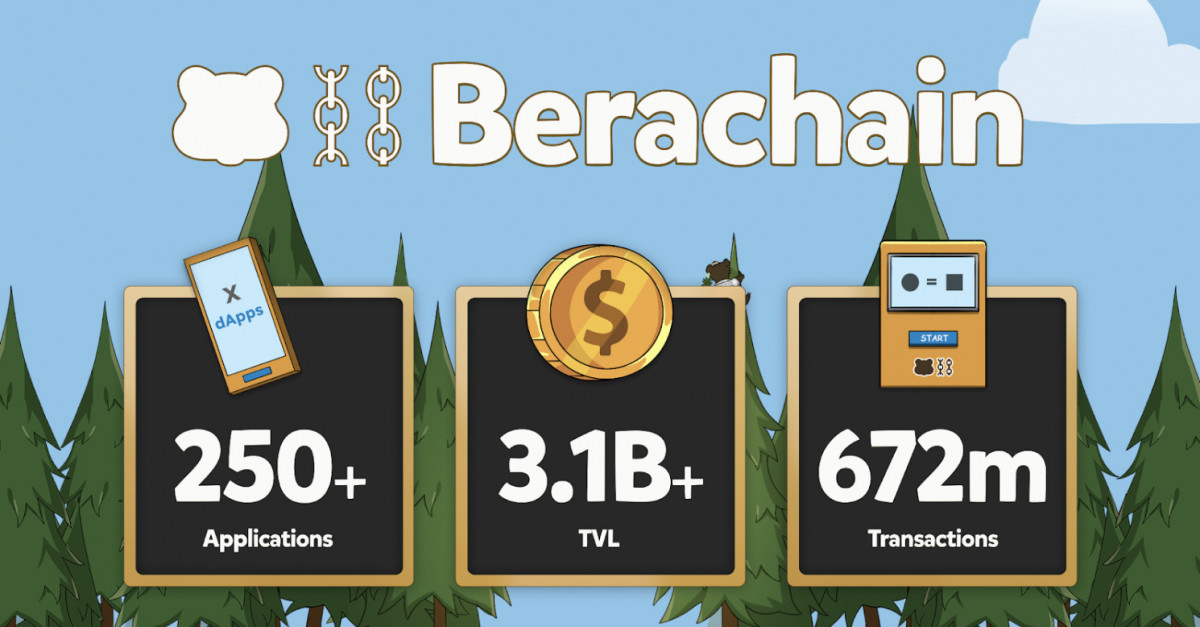

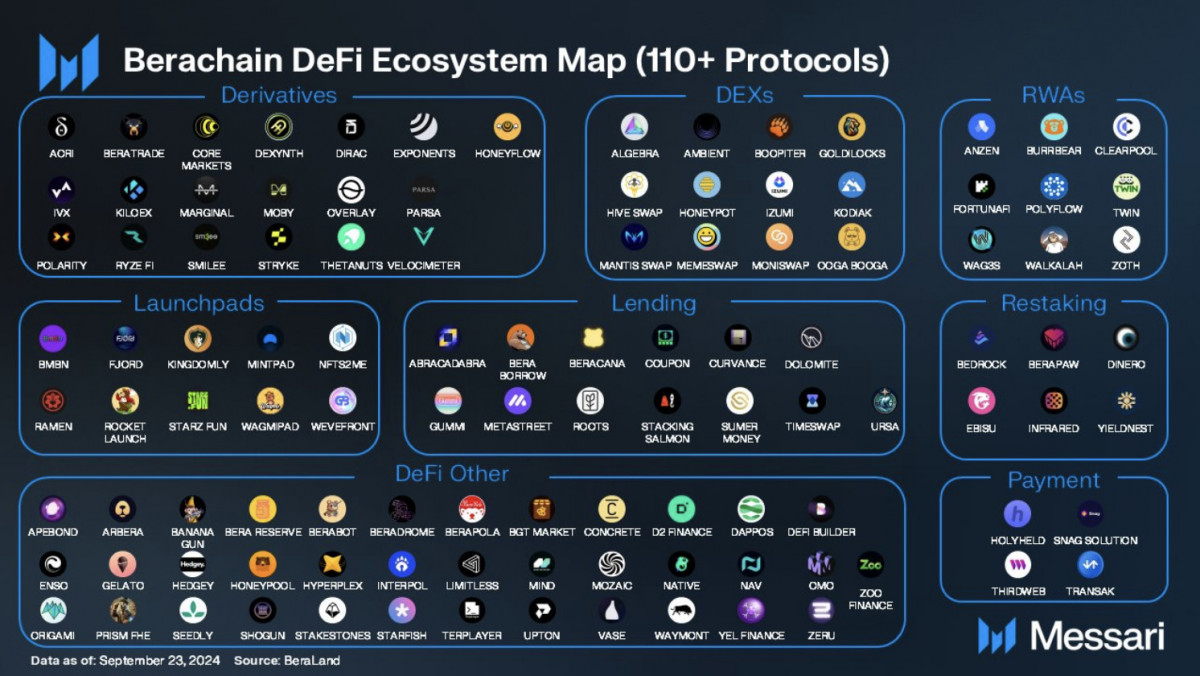

Technically, it’s EVM-compatible, constructed on the Cosmos SDK, with its personal full validator stack. The core apps – BeraHub, Honey minting, bridges – are already dwell. So it’s not simply planning to be a liquidity chain; it’s working as one already.

Funding’s not an issue. They pulled in $42M from Polychain, then one other $100M from Brevan Howard – each severe traders, not momentum chasers. There’s no token itemizing but, however the in-ecosystem token, Honey, is already usable in Berachain’s dApps. Full tokenomics are nonetheless to be revealed.

Supply: Berachain

It’s early, sure – however not speculative in the identical means as Solaxy or different pre launch chains. There’s code, there’s utilization, there’s danger.

Abstract: Berachain is making an attempt one thing structurally completely different – turning liquidity into the inspiration of community safety. Whether or not that works long-term is dependent upon how sticky the ecosystem turns into as soon as actual capital and actual danger present up. Nevertheless it’s already past the pitch stage, and that counts for one thing.

EigenLayer (EIGEN)

Restaking is dwell – however do we all know what we’re actually securing?

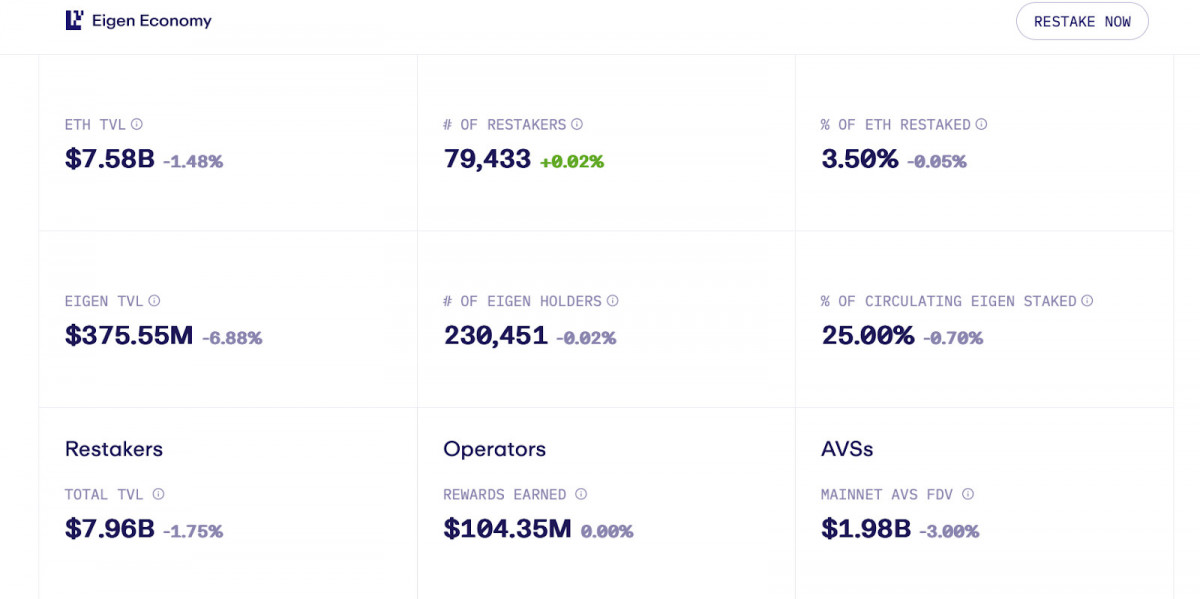

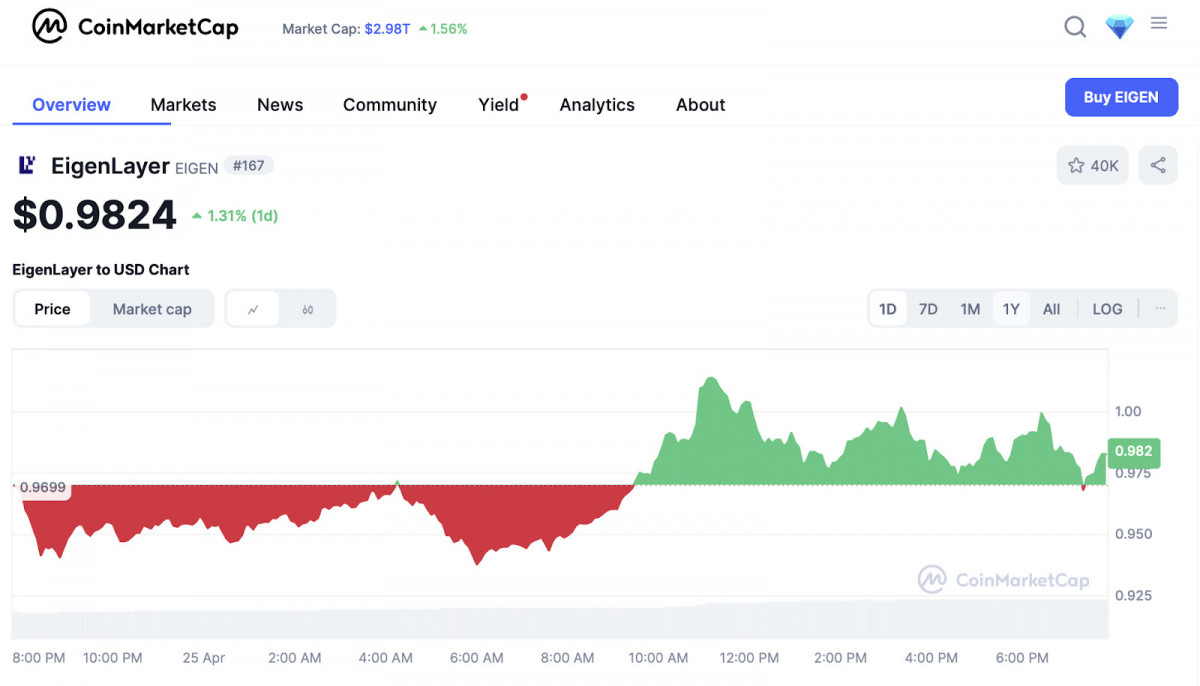

EigenLayer isn’t new, however it hit a brand new degree of consideration this month with the EIGEN token rollout and billions in restaked ETH piling up. It’s not a quiet infrastructure play – it’s changing into a pillar in Ethereum’s modular ecosystem, whether or not individuals totally understand it or not.

Supply: EigenLayer

Let’s be sincere – most individuals nonetheless don’t totally perceive what EigenLayer does. And that’s an issue, as a result of it’s already holding billions in restaked ETH, and it’s quietly changing into one of the necessary items of Ethereum infrastructure.

Supply: EigenLayer

The idea sounds easy sufficient: in case you’ve already staked ETH (or LSTs like stETH), EigenLayer enables you to reuse that stake to safe different companies – or AVSs (Actively Validated Providers) – in return for further yield. In different phrases, it’s a modular safety layer. As a substitute of each new chain or oracle or DA layer bootstrapping its personal validator set, they only lease Ethereum’s. Appears environment friendly sufficient, proper?

However right here’s the half individuals gloss over: you’re including publicity. Extra yield means extra danger. If one thing you restake into fails or will get slashed, you could possibly lose a part of your base stake – even when that AVS has nothing to do with Ethereum itself.

Is that manageable? In all probability. The workforce’s rolling out slashing slowly, and you’ve got some management over what you decide into. However nonetheless – what number of customers really perceive what they’re backing? And the way lengthy till one thing goes flawed?

Supply: CoinMarketCap

The token, EIGEN, is now dwell – type of. It’s non-transferable for now, with no change listings and restricted performance. That’s intentional, meant to give attention to protocol alignment earlier than liquidity hits. Nevertheless it additionally makes it arduous to cost or place – particularly in case you’re making an attempt to determine whether or not restaking is price the additional reward.

Proper now, over $5 billion is already restaked – largely ETH and LSTs – which places EigenLayer means forward of the rest on this class. And with AVSs slowly onboarding (beginning with knowledge layers like EigenDA), that quantity’s more likely to develop. However there’s nonetheless little or no visibility into how these AVSs will behave at scale, and what occurs if they begin competing for a similar stake.

We’ve seen early LST protocols like Lido undergo comparable rising pains – an excessive amount of dominance, unclear incentives, governance dangers. If EigenLayer turns into the belief layer for Ethereum’s whole modular stack, we’re going to must be simply as cautious right here.

To sum up, EigenLayer is already taking part in a structural position in Ethereum’s future. However restaking isn’t free yield – it’s rehypothecation. For those who’re placing capital in, that you must know what companies you’re securing, and why.

Otherside (Yuga Labs)

Yuga’s constructing an MMO. The land is actual, the world is dwell – however who’s going to stay round?

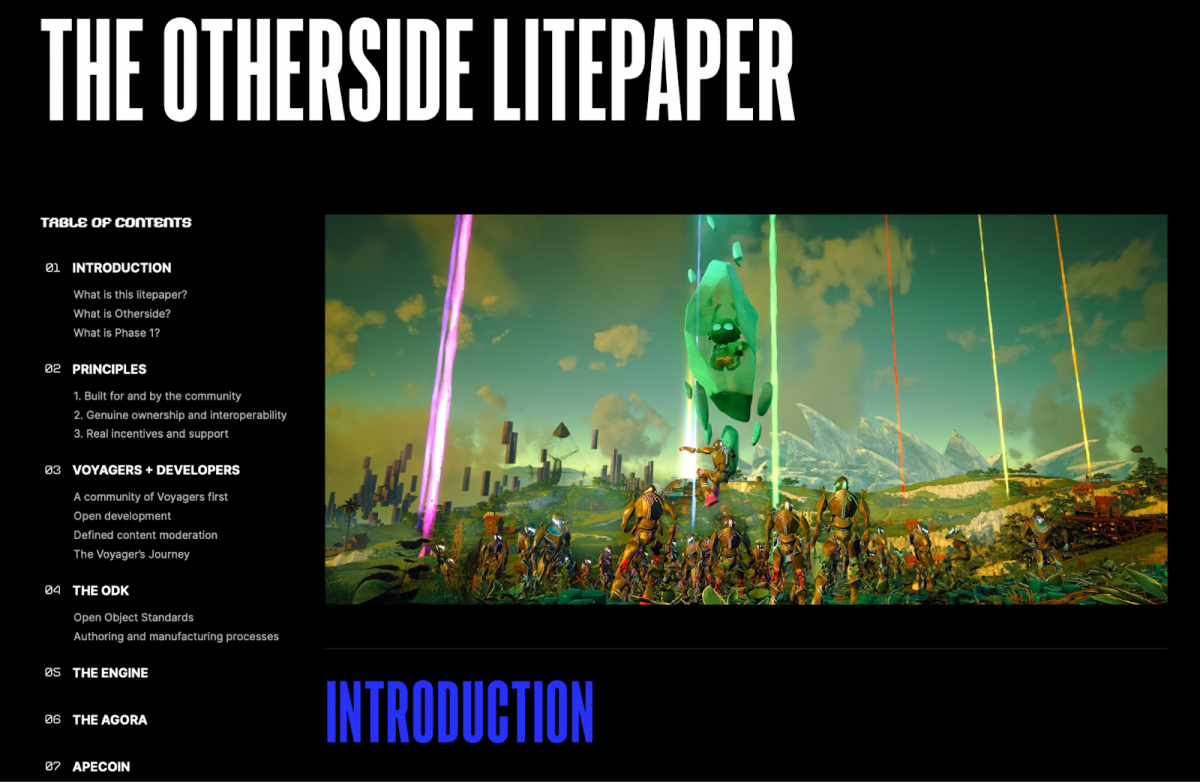

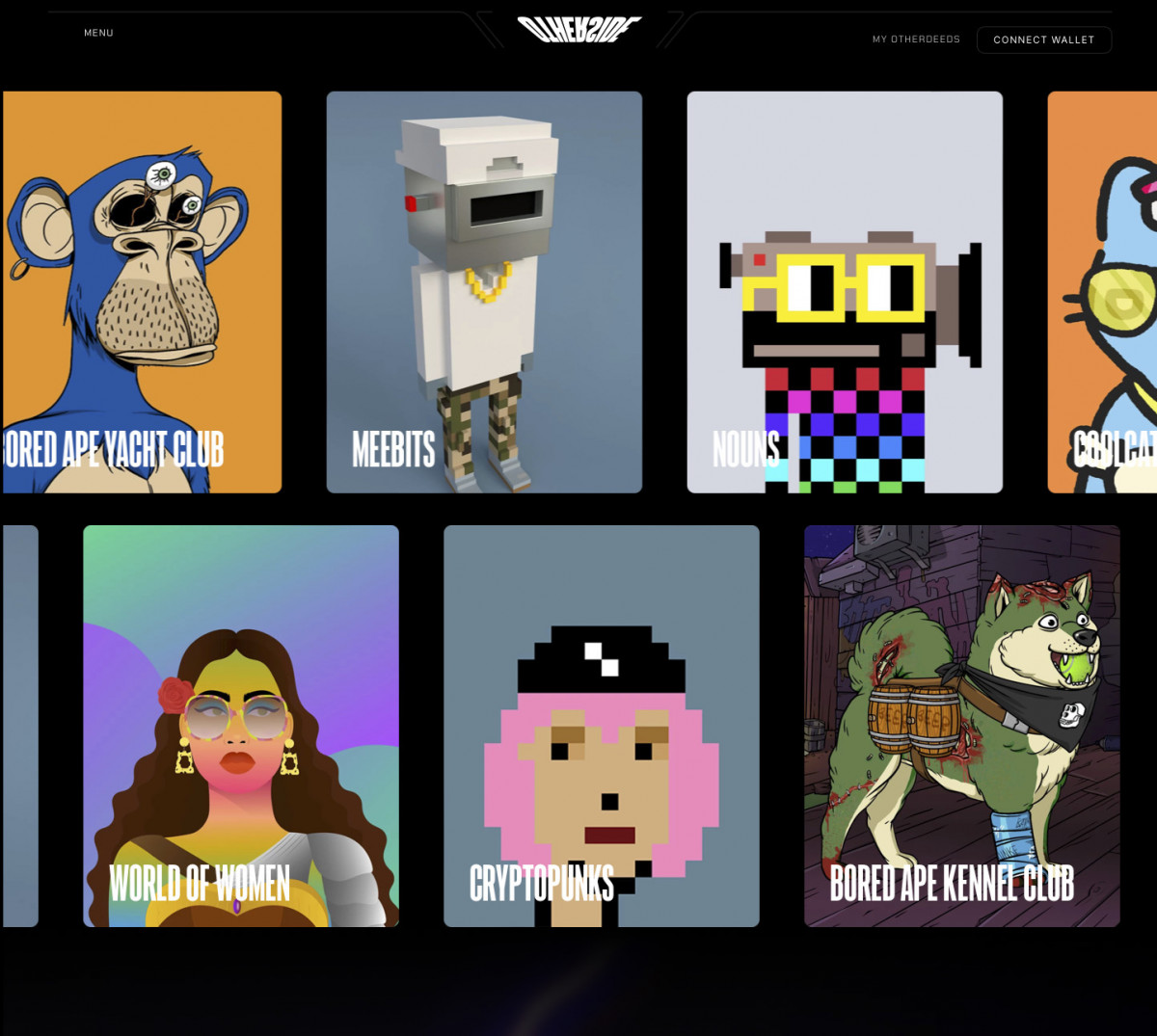

The metaverse narrative cooled off some time in the past – however this month, Otherside dragged it again into focus. Stay demos, a rising participant base, and a sluggish drip of precise improvement stored it within the highlight.

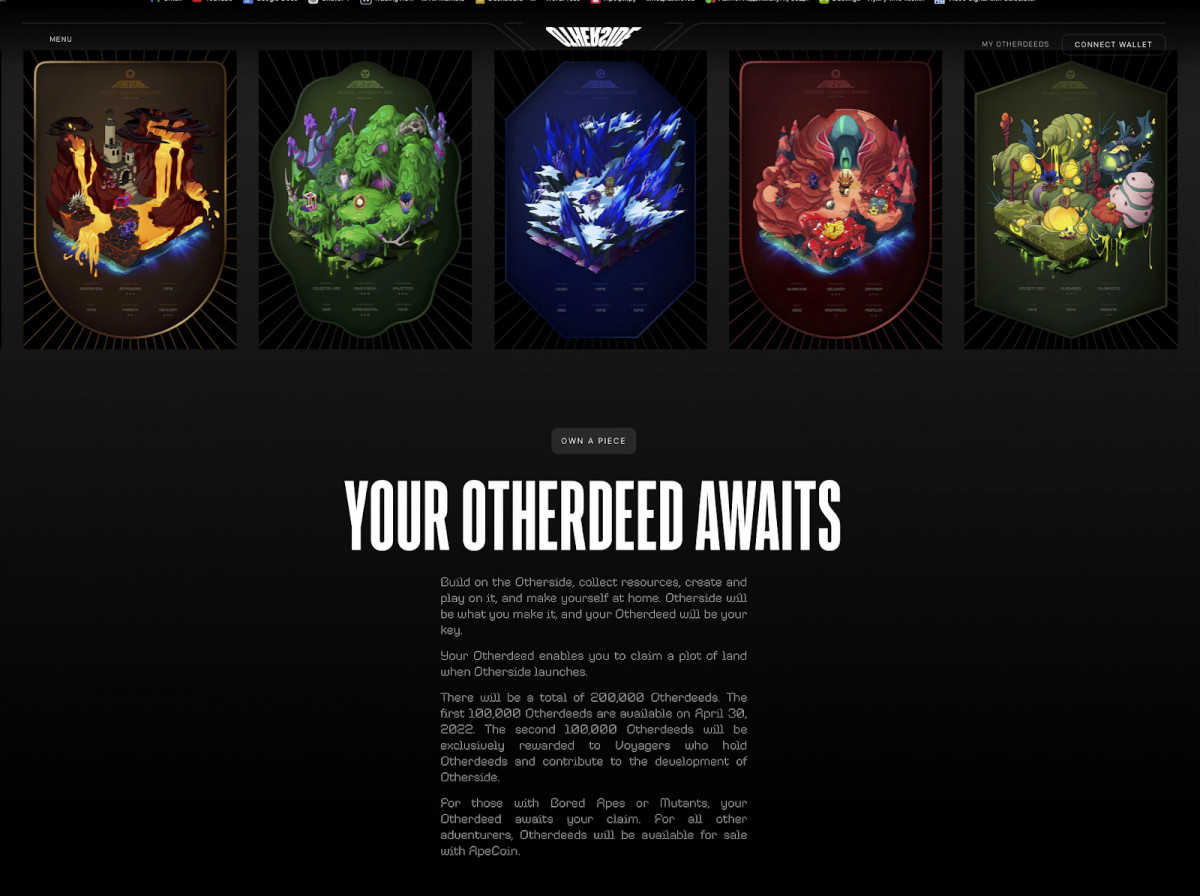

Supply: Otherside

We’ve seen the cycle earlier than: large metaverse guarantees, early land gross sales, then half-empty worlds. Decentraland, The Sandbox – they confirmed us how briskly consideration fades when the tech doesn’t hold individuals engaged.

Supply: Otherside

Yuga’s Otherside is making an attempt to interrupt that sample. It’s not simply idea artwork – they’ve already run dwell multiplayer demos utilizing Inconceivable’s M² engine, with hundreds of gamers interacting in actual time. That’s greater than most tasks ever pulled off.

Supply: Otherside

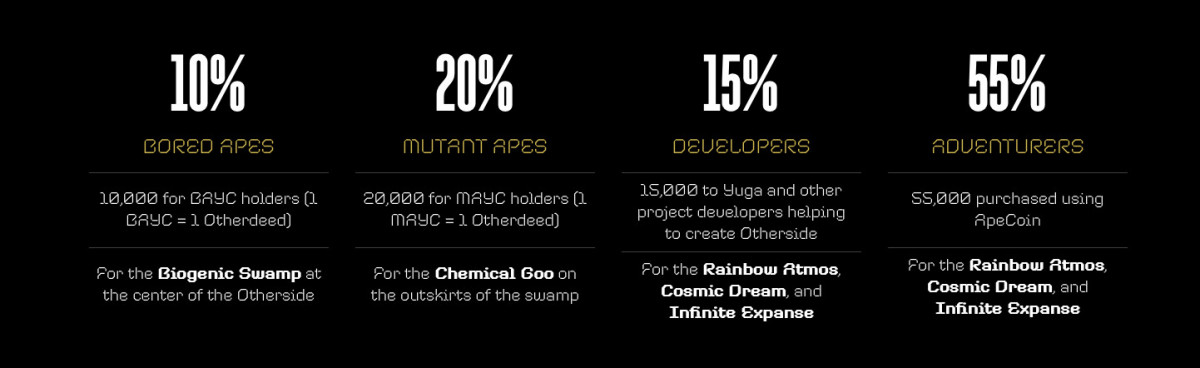

Possession runs by means of Otherdeeds NFTs, and all transactions use ApeCoin (APE). That’s necessary. If APE loses worth, all the in-game economic system shrinks with it. You’re not simply betting on the world – you’re betting on the token, too.

Supply: Otherside

Preliminary land went largely to the Yuga crowd: BAYC, MAYC, and APE patrons. A second batch of 100,000 plots is coming later, however just for lively contributors. So if you need in, you’ll have to indicate up – not simply purchase in.

What are you able to do now? A couple of guided occasions, early social areas, some mild fight exams. Full persistence, world-building, and the in-game economic system are nonetheless on the best way. So sure, it’s dwell – however not but lived-in.

Otherside is additional alongside than most Web3 gaming tasks, and Yuga’s really delivery. Nevertheless it’s nonetheless early. If they’ll hold customers engaged – and hold APE secure sufficient to assist an economic system – it might grow to be one thing actual. If not, we’ve seen the place these experiments have a tendency to finish up.

Disclaimer

In step with the Belief Challenge pointers, please be aware that the data supplied on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation you probably have any doubts. For additional info, we advise referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.