Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

After falling from its Macro Vary, Aptos (APT) has confronted rejection from key ranges. Amid its 15% month-to-month decline, some analysts recommend that APT’s social gathering gained’t proceed till the $5 resistance is reclaimed.

Associated Studying

Aptos Trades In ‘No Man’s Land’

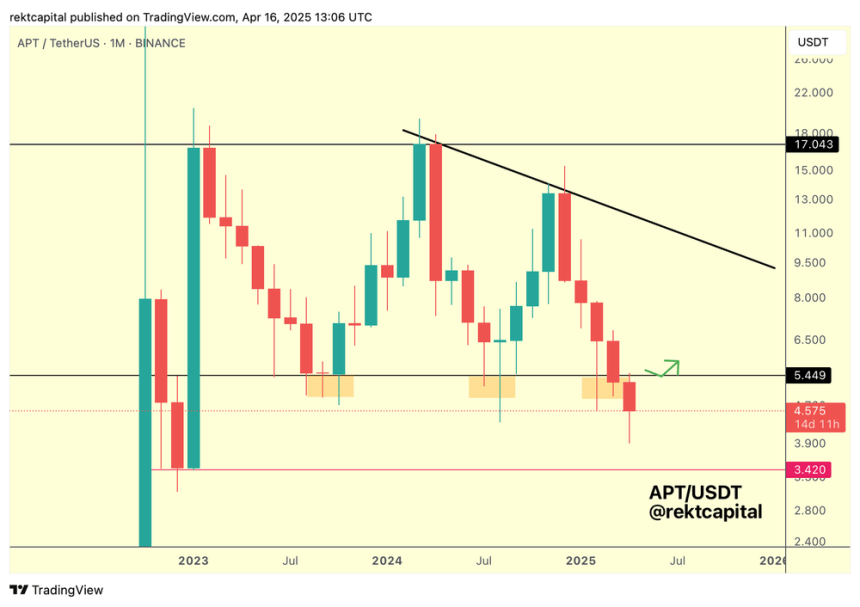

Over the previous two weeks, Aptos has seen its worth drop to its lowest ranges in two years, falling under the $4 mark for the primary time. The cryptocurrency has been buying and selling inside the $5.45-$17 worth vary since 2023, sustaining the Macro Vary lows till the March corrections.

Notably, APT had examined this key stage twice earlier than, however closed under its Macro Vary for the primary time final month. Analyst Rekt Capital famous that the cryptocurrency has traditionally developed bases round these ranges “within the type of draw back wicks for three-month intervals,” seemingly forming one for the third time with its present downtrend.

Amid the early April restoration, the analyst famous that Aptos was forming a decrease timeframe bullish divergence as its Relative Power Index (RSI) was forming Larger Lows regardless of the draw back deviation. Nonetheless, he warned about “the hazards of a better timeframe bearish retest for APT.”

Since then, Aptos has “adopted by means of on that bearish retest and rejected from the earlier Macro Vary Low, treating it as resistance.” After the rejection, APT’s worth retraced 26% to the $3.9 help, the place it “discovered some liquidity” and bounced to the $4.2-$4.5 vary.

“Nevertheless, nonetheless, the affirmation for a pattern reversal isn’t there simply but,” he defined, including that Aptos should reclaim the Macro Vary Lows or it will danger additional bleeding.

APT must reclaim the $5.44 Vary Low stage as help to verify that it is able to resynchronise with its prior vary and attempt to place itself to problem for larger costs. With out that affirmation, the chance is a little bit bit too steep as a result of APT is in the midst of no man’s land.

Till then, “it will likely be vital to be careful for indicators of mounting power within the meantime,” the analyst added.

APT Occasion Halted?

Equally, analyst Sjuul from AltCryptoGems considers that there might be “no social gathering on APT” till it reclaims the $5 resistance, which it has been unable to get well for the previous two weeks.

“So long as we keep under the $5 stage, sadly, it’s only a bearish retest,” he asserted. In the meantime, one other market watcher identified that APT has been transferring inside a falling wedge sample for the previous 5 months, with a breakout “imminent.”

Nevertheless, the analyst affirmed that this week’s efficiency might decide whether or not the sample will escape, because it must reclaim the $5 resistance and surge above $5.4.

Associated Studying

Rekt Capital famous that Aptos has revisited the 35 Relative Power Index (RSI) throughout its latest efficiency, “which has traditionally been a key area in facilitating basing intervals from which worth would reverse to the upside over time.”

With APT at this stage, the RSI would want to interrupt its multi-week RSI Downtrend to “affirm an indication of rising power in worth, constructing out a bottoming-out space right here. Till then, it’s a ready sport for probably the most half.”

As of this writing, APT trades at $4.5, a 1% decline within the each day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com