Sadly, crypto hacks occur on a regular basis. Each time funds are stolen from a top-tier dApp, it turns into an enormous morale dent for customers and builders.

The Bybit hack garnered unfavorable press however subsided shortly when the alternate assured the group that it might proceed processing transactions whatever the $1.3 billion loss. Right this moment, nonetheless, is yet one more unhappy day for Balancer and DeFi.

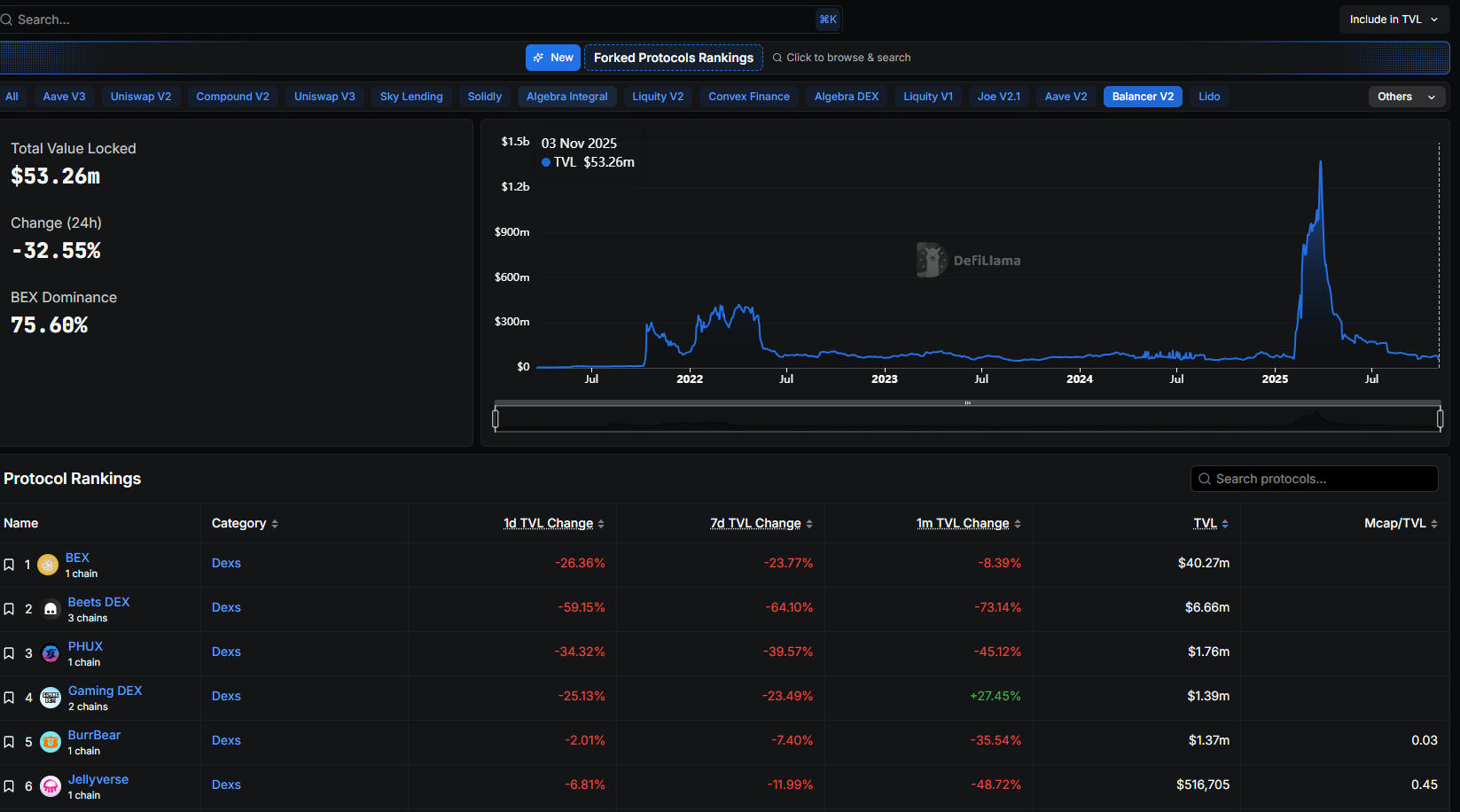

Earlier as we speak, Balancer, one of many OG DeFi protocols, was hit (once more), and the outcomes are dangerous, not for the dapp however for the complete DeFi scene and Ethereum layer-2s. Earlier than as we speak, Balancer managed over $775 million, however the protocol is shortly bleeding.

We’re conscious of a possible exploit impacting Balancer v2 swimming pools.

Our engineering and safety groups are investigating with excessive precedence.

We’ll share verified updates and subsequent steps as quickly as we now have extra info.

— Balancer (@Balancer) November 3, 2025

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

Balancer Hack: Over $120M And Rising Misplaced

To know what’s occurring, we should first know what Balancer does.

For freshmen, Balancer is a decentralized automated market maker (AMM) protocol on Ethereum. From the dapp, builders on different Ethereum-compatible chains may also construct programmable liquidity options.

You can fork Balancer V2’s code is a bonus. Should you don’t have liquidity, you may provide property and permit customers to commerce them whereas incomes a yield from any customized liquidity pool straight from Balancer.

However right here’s the issue: Balancer solely relied on a single core contract to handle all vaults. The design was supposed to spice up fuel effectivity, however this turned the one largest flaw, now affecting not solely Balancer but in addition all different deployments that relied on its code.

Right here's all the pieces it’s essential know in regards to the Balancer Hack:

1. The assault focused Balancer's V2 vaults and liquidity swimming pools, exploiting a vulnerability in sensible contract interactions. Preliminary evaluation from on-chain investigators factors to a maliciously deployed contract that… pic.twitter.com/udAM4hB0OD

— Adi (@AdiFlips) November 3, 2025

The hacker focused the “manageUserBalance” operate, successfully taking up vault withdrawals whereas bypassing sender validation. Up to now, over $128 million have been drained from vaults throughout a number of chains, together with Berachain.

Replace: @Balancer and its forks are underneath assault, with complete losses throughout a number of chains reaching ~$128.64M up to now. https://t.co/67XGX5RcRR pic.twitter.com/FIwx20ALSz

— PeckShieldAlert (@PeckShieldAlert) November 3, 2025

The loss will doubtless develop as a result of after the hacker drained Balancer swimming pools on Ethereum, the layer-1, the subsequent targets had been bridged equivalents on layer-2s, that’s, wrapped tokens. What that is creating is a “domino impact” the place a protocol utilizing Balancer v2 code, particularly if it’s a layer-2, has to pause operations till the flaw has been fastened.

Balancer v2 (+forks) exploited for over $100M+TLDR:

Balancer v2 and it's forks are affected:• ETH → balancer → 70m• Arbitrum → balancer → 6m• Base → balancer → 4m• @SonicLabs → beets → 3.4m• OP → beets → 283k• Polygon → balancer → 117k

Exploiter is… pic.twitter.com/yTTtrS5L3S

— Blub (@DeFi_Blub) November 3, 2025

DISCOVER: 9+ Greatest Memecoin to Purchase in 2025

Berachain Halts Chain

Out of warning, Berachain, which is meant to reflect the Ethereum mainnet and run 24/7, has been paused.

In a submit on X, the crew mentioned its validators have “coordinated” purposefully to halt the platform as they scramble to carry out an emergency exhausting fork with a purpose to deal with the Balancer hack.

The Berachain validators have coordinated to purposefully halt the Berachain community because the core crew performs an emergency exhausting fork to deal with Balancer V2 associated exploits on the BEX.

This halt has been executed purposefully, and the community can be operational shortly upon…

— Berachain Basis

(@berachain) November 3, 2025

They’re additionally conscious that some is probably not glad, however their major goal is to guard over $12M of person funds.

Beefy, a yield optimizer, has additionally paused all merchandise linked to Balancer.

Balancer V2 Exploit:

All Beefy Balancer V2 merchandise are paused. Our crew is monitoring the scenario intently.

We are going to cooperate to make sure all losses are correctly captured, and that Beefy customers take part totally in any restoration.

Our full help to the @Balancer crew. pic.twitter.com/eC2JCkldRz

— Beefy (@beefyfinance) November 3, 2025

In addition they promise to cooperate and be certain that all losses are correctly accounted for.

The query now’s: Will different protocols, most of them being DEXes, observe swimsuit? On Beets DEX, there are over $6.6M in complete worth locked (TVL), as an illustration, and that is simply one of many over 20 platforms which have forked Balancer V2’s code.

(Supply: DeFiLlama)

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Balancer Hack Over $128M Misplaced, Berachain Halts

Balancer is an DeFi OG

Protocol managed over $700M earlier than hack

Over $128M withdrawn after sensible contract exploit

Berachain validators take warning, pause chain

The submit Balancer Hacked AGAIN, Over $128M Stolen: Will Ethereum Layer-2s Shut Down? appeared first on 99Bitcoins.