Decentralized exchanges (DEXs) permit customers to commerce digital property straight from their wallets with out counting on centralized platforms. Not like conventional exchanges, DEXs depend on sensible contracts to automate buying and selling, giving customers full management over their funds whereas sustaining transparency and safety.

With dozens of DEXs out there throughout a number of blockchains, choosing the proper one may be overwhelming. On this article, we assessment the highest 10 decentralized exchanges, evaluate their options, charges, and supported networks, and supply insights to assist merchants make knowledgeable choices.

High Decentralized Crypto Exchanges In contrast

ExchangeSupported ChainsTypeTrading FeesBest ForHyperliquidNative Layer 1 solelyPerpetual Futures DEXLow charges and gas-free buying and sellingSuperior derivatives and leveraged buying and sellingUniswapEthereum, Arbitrum, Base, PolygonAMM spot buying and selling0.05 –0.30% Token swaps and liquidity provision0x ProtocolEthereum, Optimism, Arbitrum, AvalancheAggregator/InfrastructureVaries by integrating DEXAggregated liquiditydYdXEthereum L2 (dYdX Layer 2)Perpetual Futures DEX0–0.15% maker, 0.20% takerSuperior derivatives and margin buying and sellingSushiSwapEthereum, Polygon, Arbitrum, FantomAMM spot buying and selling0.25% per swapMulti-chain token swaps and decentralized finance (DeFi) optionsPancakeSwapBNB Chain, Avalanche, Fantom, PolygonAMM spot buying and selling0.25% per swapLow-cost swaps on a number of chainsCurve FinanceEthereum, Polygon, Optimism, AvalancheAMM Stablecoin DEX0.04%–0.50% relying on poolStablecoinsRaydiumSolanaAMM plus order ebook hybrid0.25%Quick Solana swaps and DeFi optionsKuma (IDEX)Ethereum, Polygon, ArbitrumHybrid DEX (Off-chain match, on-chain settlement)0.1%–0.35%ERC-20 spot buying and selling with superior order varietiesApeSwapBNB Chain, Polygon, AvalancheAMM spot buying and selling0.25%Multi-chain swaps, staking, and yield farming

10 Greatest Decentralized Exchanges (DEXs) in 2026 for Crypto Buying and selling

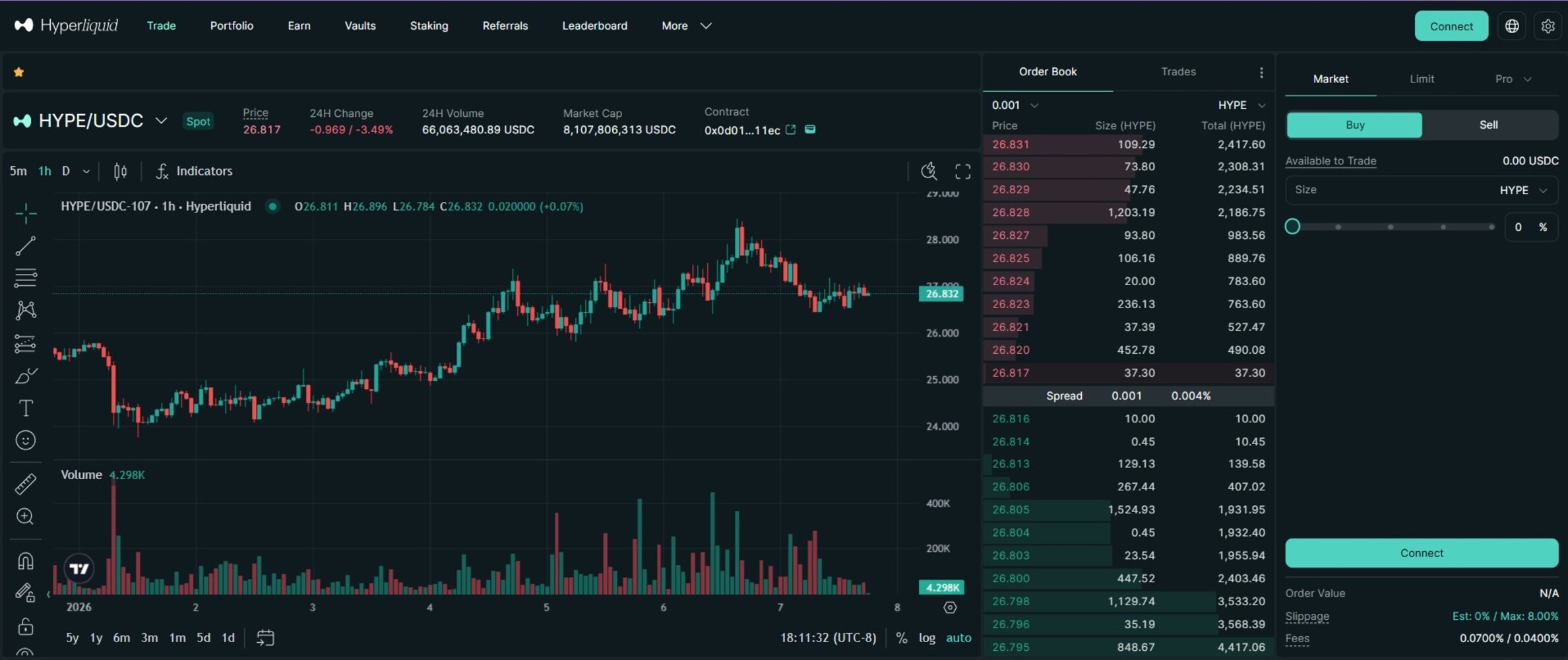

1. Hyperliquid – Greatest decentralized change for perpetual futures buying and selling

Hyperliquid is a decentralized change targeted on perpetual futures buying and selling. The protocol combines an on-chain order ebook with high-throughput infrastructure, enabling customers to commerce derivatives with out counting on a centralized authority or custodial accounts.

The platform operates completely on its native blockchain, which is optimized for low latency and quick transaction finality. This design allows real-time order matching and execution speeds akin to centralized buying and selling platforms whereas sustaining on-chain settlement and transparency.

Professionals of Hyperliquid

Totally on-chain order ebook with clear commerce executionPerpetual futures buying and selling with leverage as much as 50×No fuel charges for order placement or cancellationHelps superior order varieties and cross-margin buying and selling

Cons of Hyperliquid

Primarily targeted on derivatives, with restricted spot buying and selling choicesExcessive leverage will increase danger for inexperienced merchants

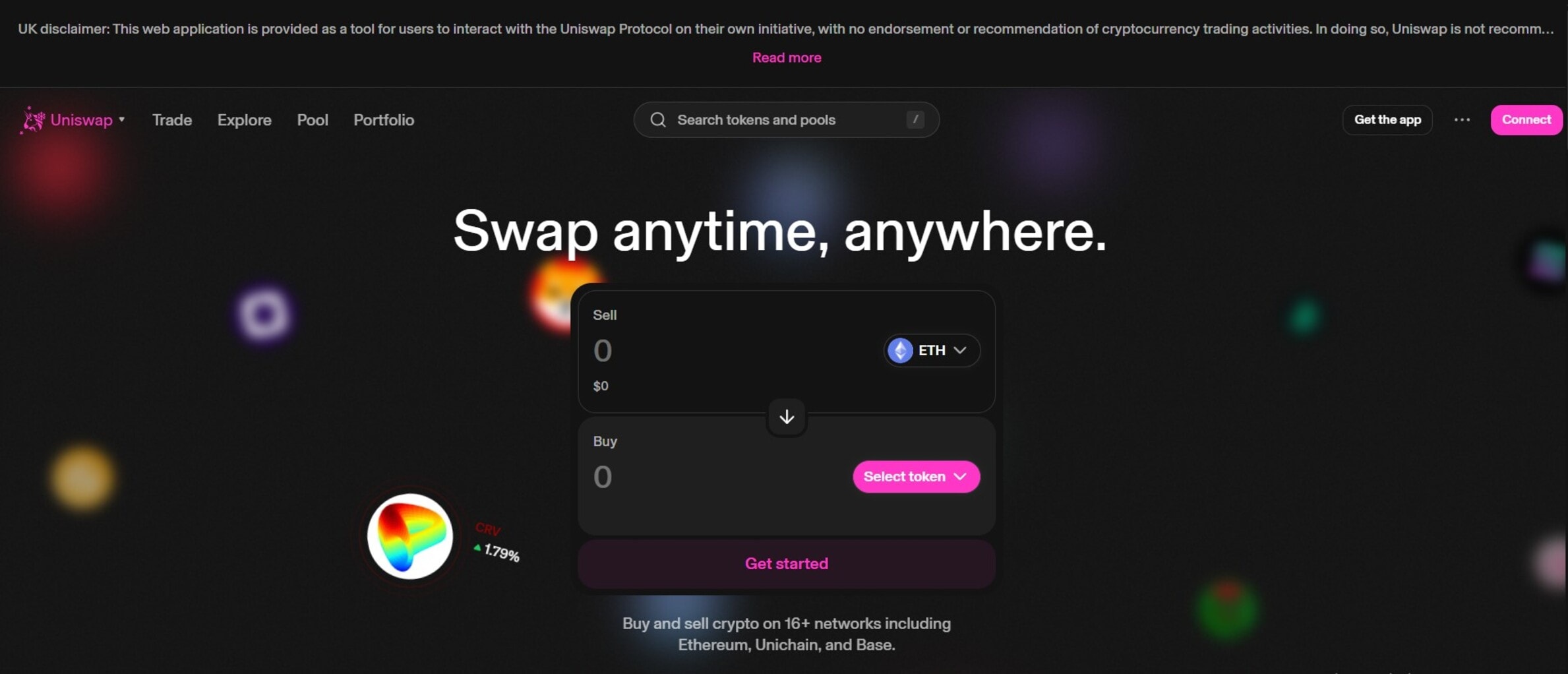

2. Uniswap – Greatest decentralized change for token swaps and liquidity provision

Uniswap is a decentralized cryptocurrency change designed for permissionless token swapping on Ethereum and different supported blockchains. It operates utilizing an automatic market maker (AMM) mannequin slightly than an order ebook, permitting customers to commerce straight in opposition to liquidity swimming pools equipped by different customers.

Along with token swaps, the protocol permits customers to supply liquidity to swimming pools and earn a share of transaction charges. Uniswap has additionally launched concentrated liquidity, which allows liquidity suppliers to allocate capital to particular value ranges to enhance capital effectivity.

Professionals of Uniswap

Helps numerous tokens and buying and selling pairsLiquidity suppliers can earn charges from buying and selling exerciseTotally non-custodial and open-source protocol

Cons of Uniswap

Liquidity suppliers are uncovered to impermanent lossFuel charges on the Ethereum mainnet may be excessive throughout congestion

3. 0x Protocol – Greatest decentralized change for aggregated liquidity

0x Protocol is an open-source decentralized change designed to facilitate token buying and selling throughout a number of liquidity sources. Slightly than working as a conventional DEX with a single interface, 0x supplies a set of sensible contracts and APIs that builders and purposes use to construct buying and selling experiences on prime of its protocol.

0x Protocol’s modular design permits builders to combine sensible order routing, value discovery, and transaction execution with out managing liquidity straight. This makes it a key piece of infrastructure inside the decentralized finance ecosystem slightly than a standalone shopper interface.

Professionals of 0x Protocol

Aggregates liquidity from a number of decentralized sourcesExtensively built-in into wallets and DeFi purposesDeveloper-friendly APIs and open-source structure

Cons of 0x Protocol

Not a consumer-facing change by itselfRestricted management over liquidity in comparison with native DEXs

4. dYdX – Greatest decentralized change for superior derivatives buying and selling

dYdX is a decentralized change targeted on perpetual futures and margin buying and selling. It’s constructed for merchants who want superior instruments with out counting on centralized custody. The protocol permits customers to commerce crypto derivatives straight from their wallets, with all positions and settlements dealt with on-chain.

Professionals of dYdX

Order book-based perpetual futures buying and sellingSuperior buying and selling instruments appropriate for skilled merchantsCross-margin system for managing a number of positions

Cons of dYdX

Primarily targeted on derivatives slightly than spot buying and sellingThe interface could also be advanced for rookiesRestricted asset choice in comparison with spot-focused DEX crypto exchanges

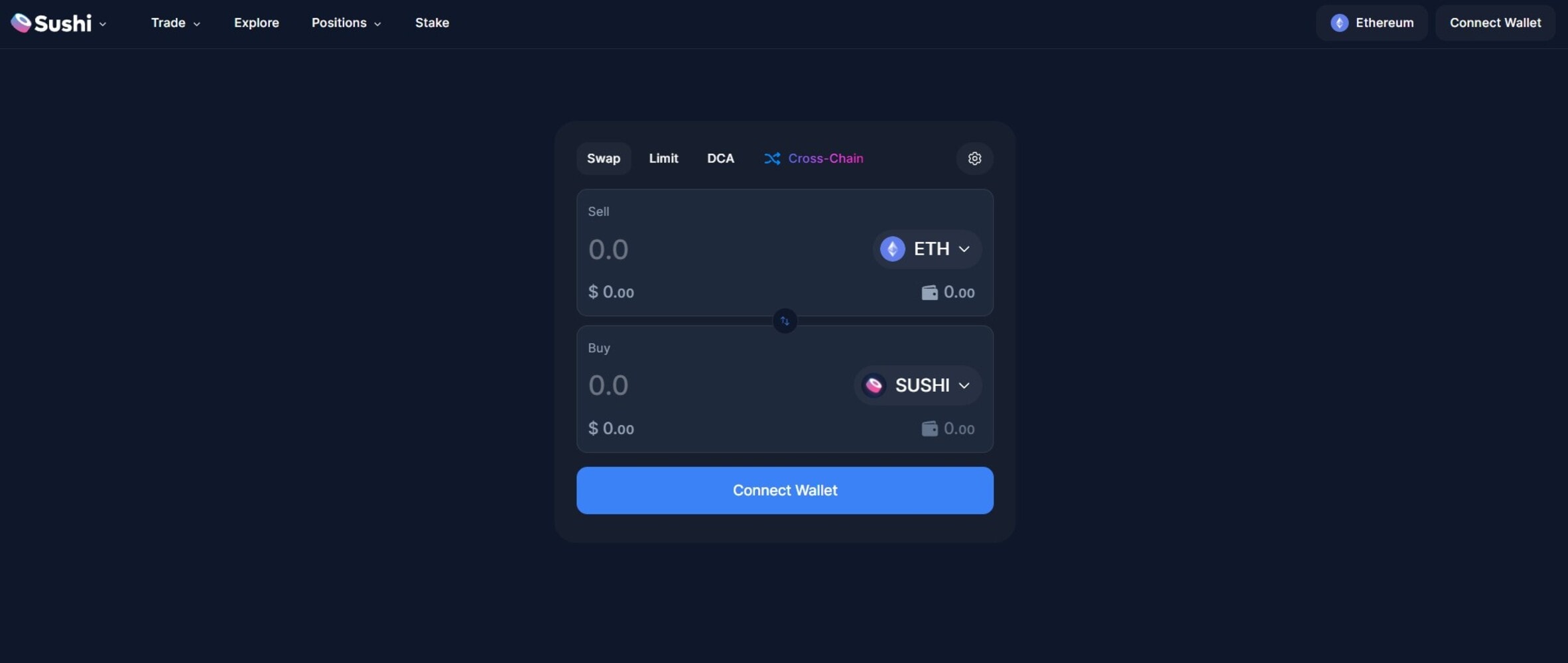

5. SushiSwap – Greatest decentralized change for multi-chain DeFi entry

SushiSwap is a decentralized change protocol that permits customers to swap digital property and supply liquidity throughout a number of blockchains. Initially constructed on Ethereum, the platform has expanded to assist a number of Layer 1 and Layer 2 ecosystems, permitting customers to entry decentralized finance providers past a single chain.

Professionals of SushiSwap

Helps a number of blockchains and Layer 2 networksLiquidity suppliers can earn charges and rewardsNeighborhood-driven governance mannequin

Cons of SushiSwap

Fuel charges could also be excessive on some supported chainsThe characteristic set might really feel fragmented in comparison with single-focus DEXs

6. PancakeSwap – Greatest decentralized change for low-cost buying and selling on BNB Chain

PancakeSwap is a decentralized change constructed totally on BNB Chain. It’s designed to supply quick, low-cost token swaps utilizing an automatic market maker mannequin. Along with commonplace token swaps, PancakeSwap presents options akin to liquidity provision, yield farming, and staking, which permit customers to earn rewards by contributing property to the protocol.

Professionals of PancakeSwap

Low transaction charges in comparison with Ethereum-based DEXsQuick commerce execution on BNB ChainBig selection of supported tokens inside the ecosystem

Cons of PancakeSwap

Primarily centered across the BNB Chain ecosystemFurther options might introduce complexity for brand new customers

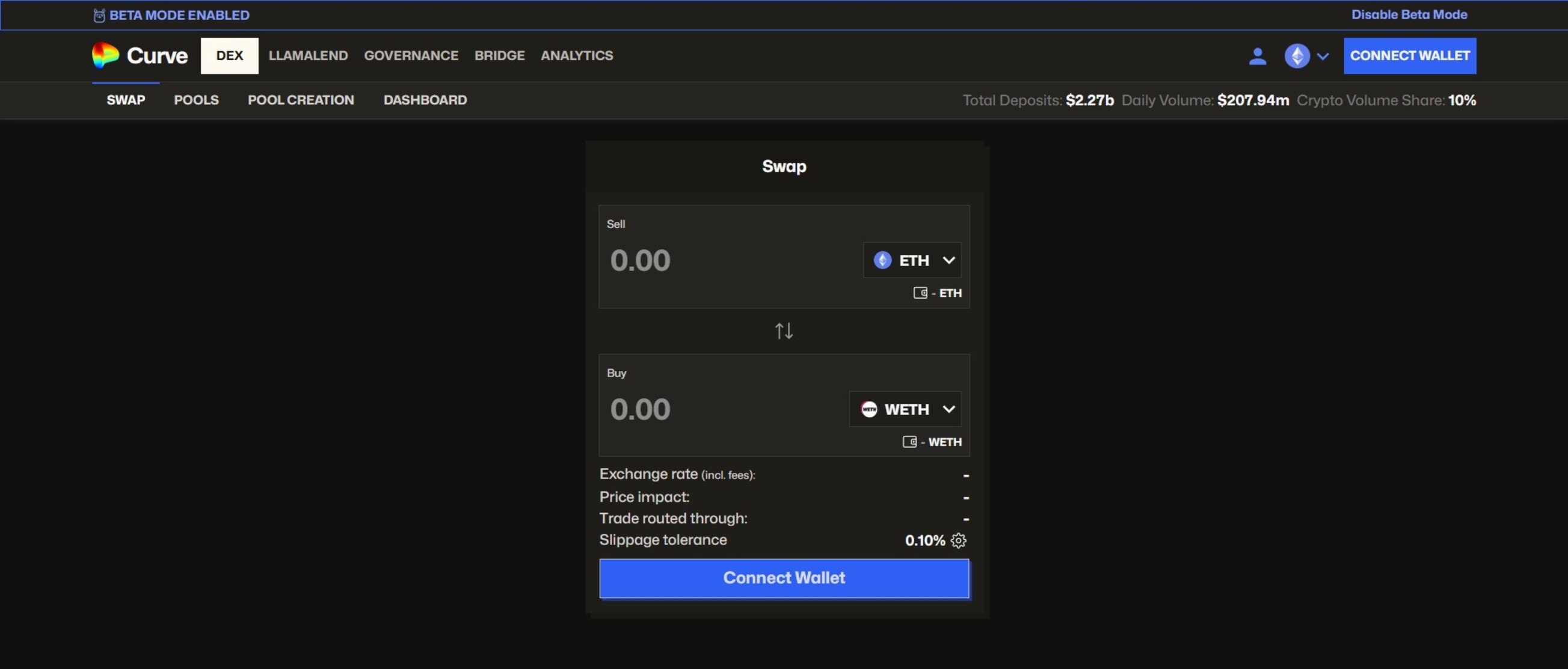

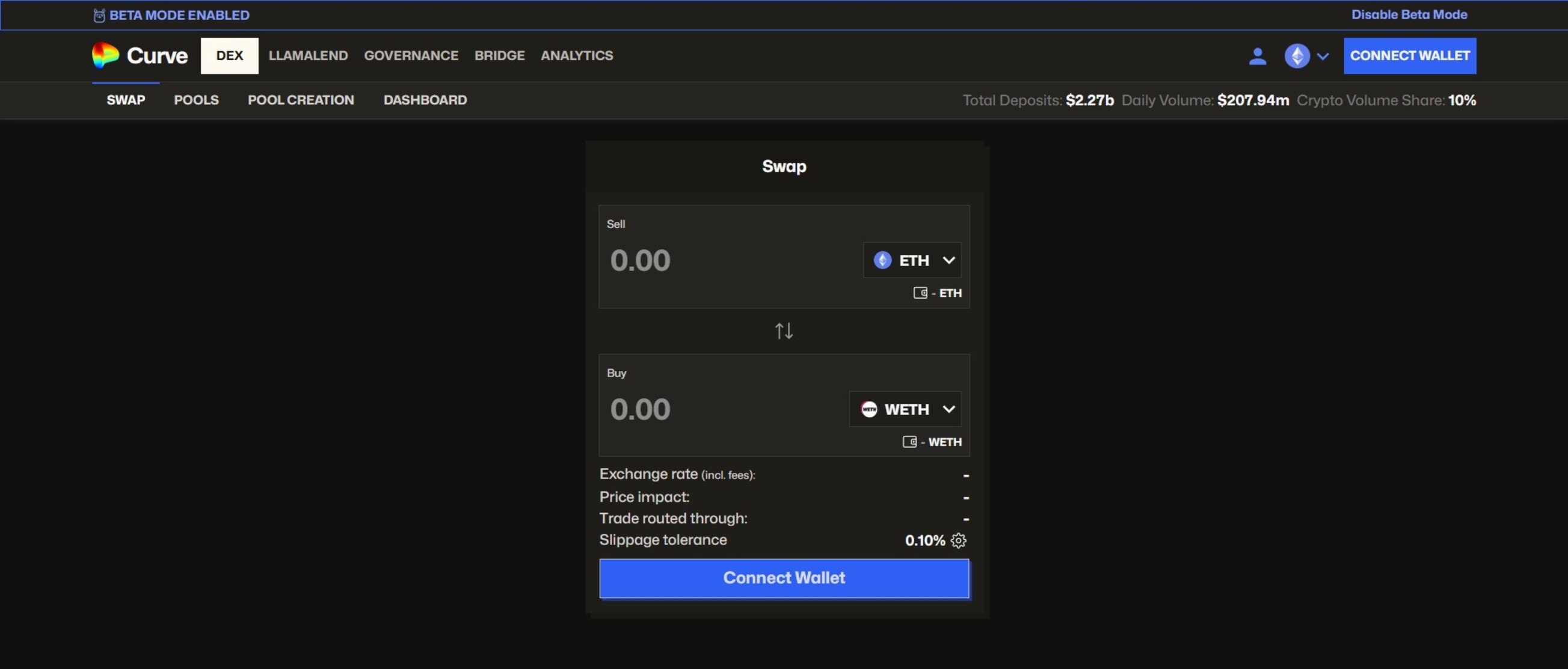

7. Curve Finance – Greatest decentralized change for stablecoins

Curve Finance is designed to effectively commerce property with comparable worth, akin to stablecoins and tokenized variations of the identical asset. The protocol makes use of a specialised automated market maker mannequin that minimizes slippage and value affect, making it appropriate for big trades involving stable-value tokens.

Professionals of Curve Finance

Extraordinarily low slippage for stablecoin and similar-asset tradesHelps a number of networks and Layer 2 optionsHelps governance via its native token (CRV), permitting customers to take part in decision-making.

Cons of Curve Finance

The interface could also be much less intuitive for brand new customersReturns for liquidity suppliers depend upon pool demand

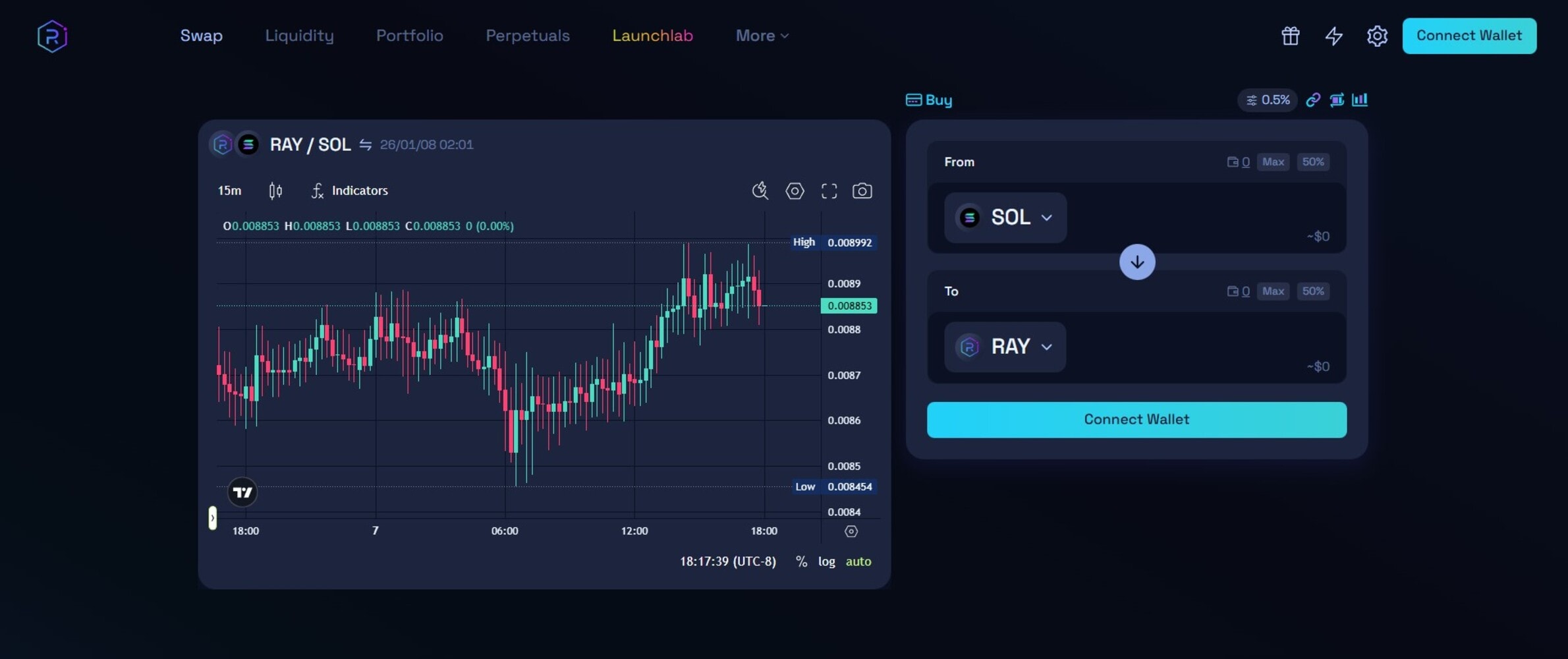

8. Raydium – Greatest decentralized change for Solana-based buying and selling

Raydium is a decentralized change constructed on the Solana blockchain that provides quick, low-cost token swaps. It integrates straight with Solana’s high-performance infrastructure to ship near-instant transaction confirmations and minimal charges.

The protocol helps buying and selling of SPL tokens and presents alternatives to supply liquidity, permitting customers to earn a share of transaction charges by contributing to liquidity swimming pools. Raydium additionally supplies entry to its order ebook through integration with the Serum decentralized change, combining AMM liquidity with on-chain order-book depth for extra environment friendly buying and selling.

Professionals of Raydium

Excessive-speed transactions and low charges on SolanaCombines AMM liquidity with order ebook depth through Serum integrationHelps yield farming and staking alternatives

Cons of Raydium

Restricted to the Solana ecosystem and SPL tokensAMM mechanics can lead to slippage for big trades

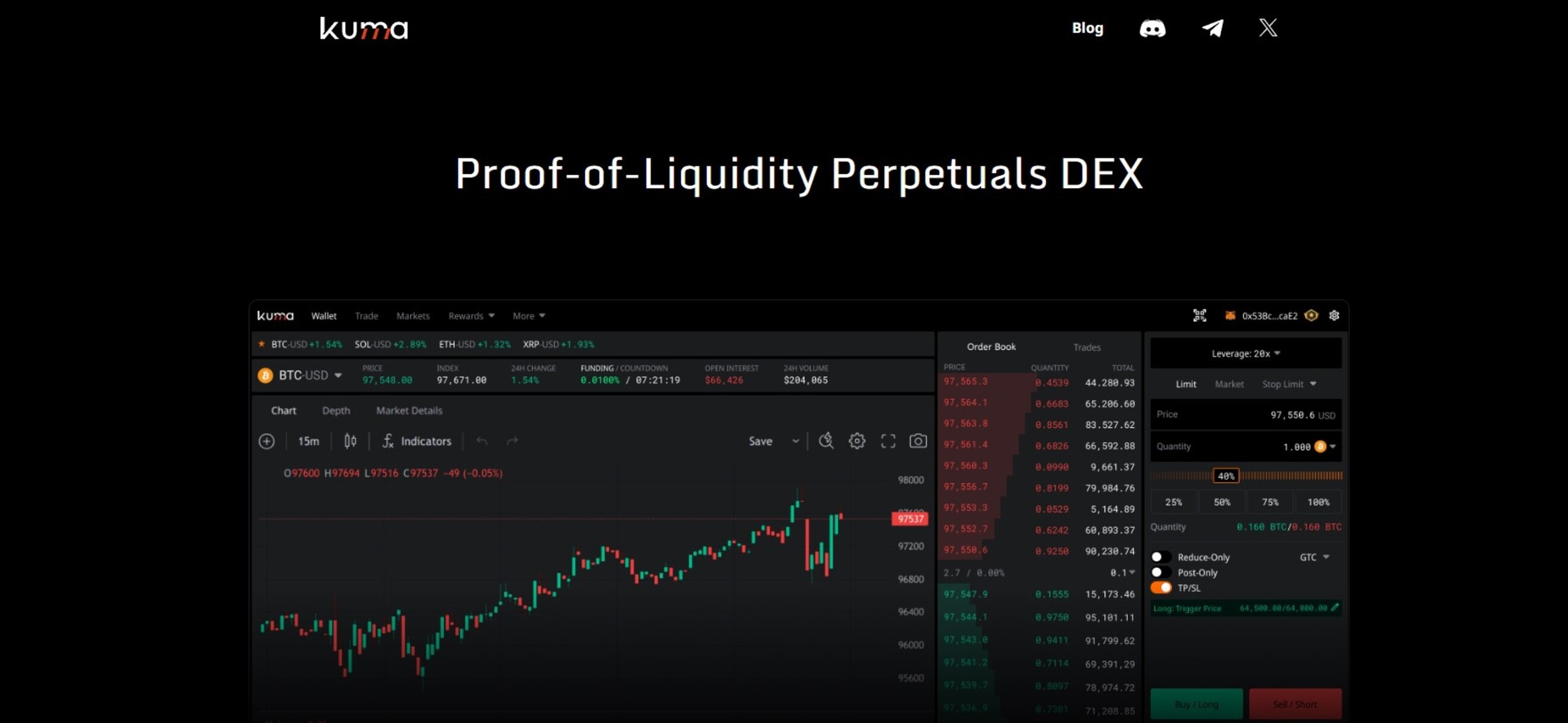

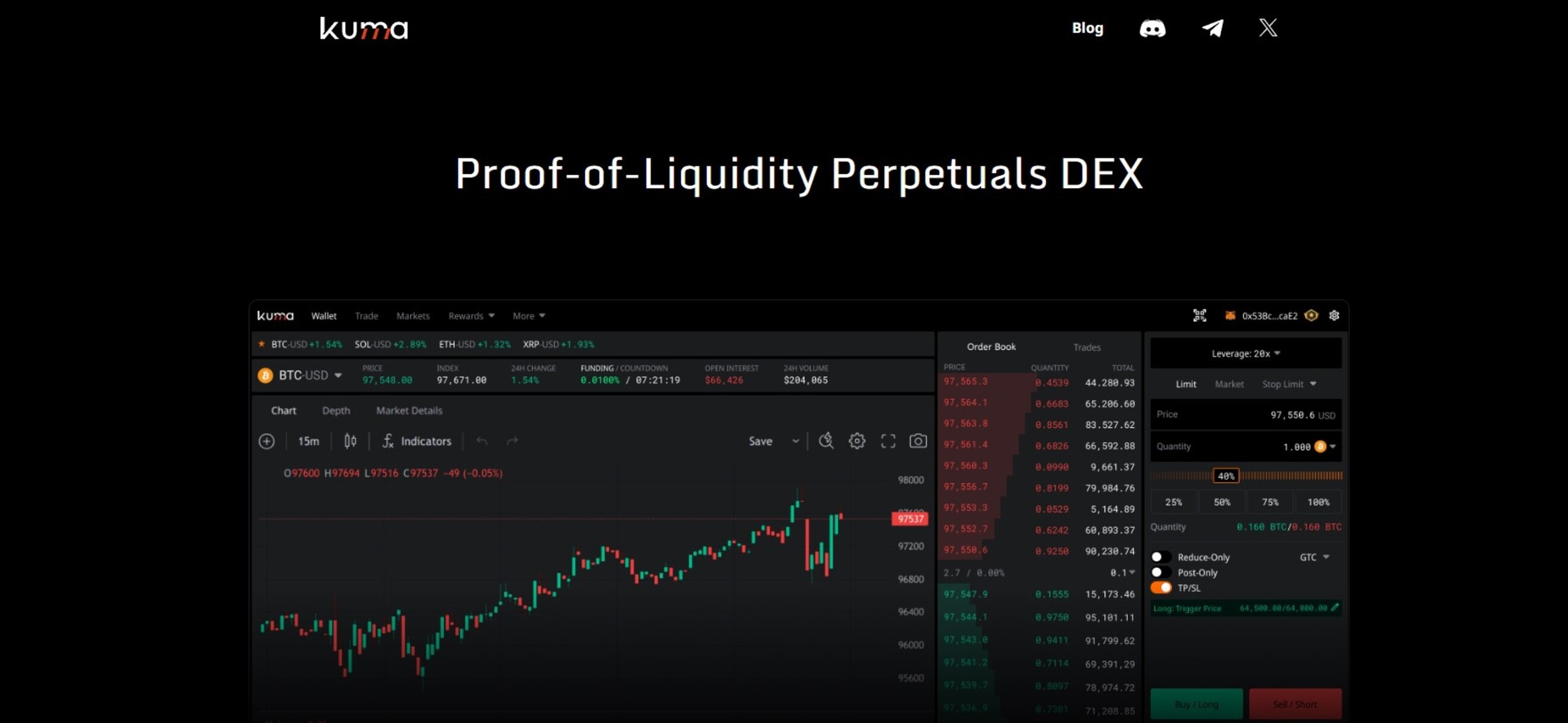

9. Kuma (previously IDEX) – Greatest hybrid decentralized change

Kuma combines on-chain settlement with an off-chain matching engine to allow quick, environment friendly buying and selling. This hybrid mannequin permits customers to commerce ERC-20 tokens with low latency whereas sustaining self-custodial management of their funds.

The DEX helps restrict, market, and superior order varieties, providing options just like conventional centralized exchanges. Kuma executes trades off-chain for pace after which settles them on-chain to make sure transparency and verifiability.

Professionals of Kuma (previously IDEX)

Hybrid mannequin combining off-chain matching with on-chain settlementSuperior order varieties, together with restrict and market ordersDecrease fuel prices on supported Layer 2 networks

Cons of Kuma (previously IDEX)

Primarily restricted to Ethereum and Layer 2 tokensOff-chain matching introduces dependency on Kuma infrastructure

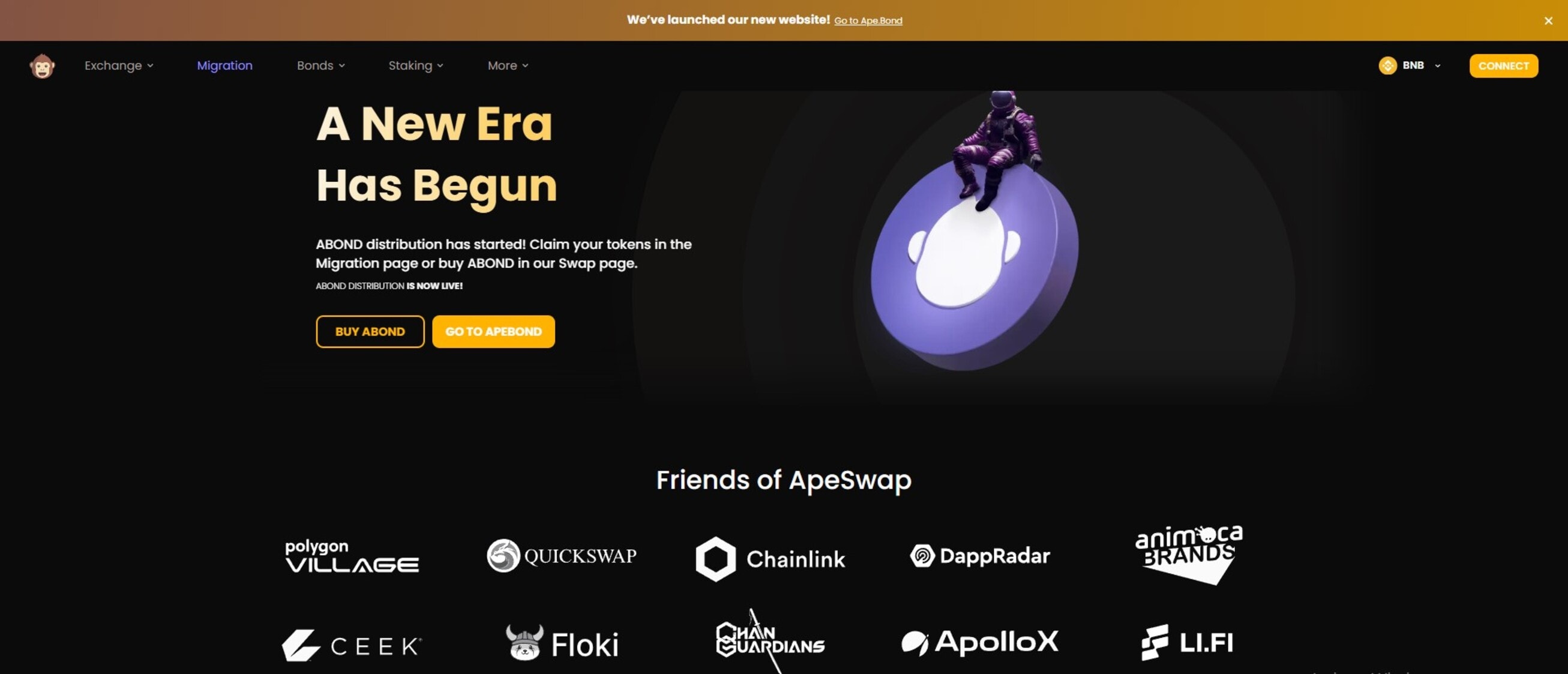

10. ApeSwap – Greatest decentralized change for multi-chain DeFi

ApeSwap is constructed on the BNB Chain and presents token swaps, liquidity provision, and yield farming via an AMM mannequin. The platform supplies quick and low-cost transactions for BEP-20 tokens and has expanded to assist different chains, enabling multi-chain DeFi entry.

Professionals of ApeSwap

Low-cost token swaps on BNB Chain and different supported networksAMM-based liquidity swimming pools with fee-earning alternativesStaking, yield farming, NFT, and launchpad options

Cons of ApeSwap

Primarily targeted on BNB Chain and BEP-20 tokensLiquidity depth varies throughout buying and selling pairs and chains

What Is a Decentralized Crypto Alternate (DEX)?

A decentralized crypto change is a peer-to-peer market that lets customers commerce cryptocurrencies straight from their wallets with out counting on intermediaries. Not like centralized exchanges (CEXs), which maintain consumer funds and match orders on their servers, DEX crypto exchanges use sensible contracts to automate swaps.

This non-custodial mannequin provides customers full management of their non-public keys, decreasing the danger of hacks or platform failures. Advantages of DEXs embrace enhanced privateness, since many don’t require Know Your Buyer (KYC) or Anti-money Laundering (AML) verification.

In addition they present censorship resistance and world entry, aligning with crypto’s decentralized ethos. Nevertheless, DEXs face challenges akin to excessive fuel charges on congested networks, decrease liquidity for area of interest tokens, and front-running dangers through MEV (Miner Extractable Worth).

DEX vs CEX: Key Variations Defined

DEXs and CEXs are two main methods to commerce cryptocurrencies, however they function in a different way. Right here’s a side-by-side comparability:

FeatureDEXCEXCustodyCustomers retain management of personal keysAlternate holds customers’ fundsOrder ExecutionAutomated through sensible contractsMatched off-chain by the platformLiquidityDepends upon liquidity swimming poolsNormally excessive, supported by the platformChargesCommunity/fuel charges; buying and selling charges might rangePlatform charges; no fuel for customersPrivatenessNo KYC requiredKYC verification requiredSafety DangersProtocol dangers, sensible contract vulnerabilitiesPlatform hacks, custodial dangerBuying and selling OptionsRestricted derivatives; principally spot buying and sellingSuperior instruments, together with margin, derivatives, and lending.AccessibilityInternational, permissionlessMight prohibit some international locationsExamplesCurve Finance, Uniswap, and dYdX.Binance, Bybit, and MEXC.

Why put money into decentralized crypto exchanges?

Decentralized exchanges are extra non-public and safe than CEXs, making them excellent for long-term holding. Because you maintain and handle your non-public keys and your property, there isn’t any danger of dropping your stability to platform hacks. The one factor to be cautious of is protecting your keys secure as a result of anybody who has this key can use them to entry your account.

The best way to Use a Decentralized Alternate (Step-by-Step)

Step 1: Join Your Pockets

Open the DEX web site and join a appropriate self-custodial crypto pockets, akin to MetaMask, Belief Pockets, or Phantom. This lets you commerce straight out of your pockets with out giving up custody of your funds.

Step 2: Choose Token Pair and Community

Select the tokens you need to swap and the blockchain community you need to use. Ensure each tokens are supported on that community.

Step 3: Evaluate Fuel Charges and Slippage

Examine the community charges (fuel) for the transaction. Set your acceptable slippage tolerance to keep away from surprising value variations throughout execution, particularly for unstable or low-liquidity tokens.

Step 4: Affirm and Execute the Swap

Double-check the main points, then affirm the transaction in your pockets. As soon as authorized, the sensible contract executes the swap, and the tokens seem in your pockets after the transaction is finalized.

Advantages and Dangers of Utilizing Decentralized Exchanges

Advantages

Non-Custodial Management: On a DEX crypto change, customers maintain their non-public keys, decreasing the danger of hacks, theft, or insolvency that may happen on centralized buying and selling platforms.Privateness and Anonymity: Most decentralized cryptocurrency exchanges don’t require customers to finish KYC or present private data. This protects consumer identification, making buying and selling extra non-public, and is especially helpful for people in areas with restrictive monetary rules.International Accessibility: Anybody with an web connection and a appropriate pockets can entry a DEX. There aren’t any geographical restrictions, and customers from international locations excluded by CEXs can nonetheless commerce freely.Censorship Resistance: Transactions on a DEX are executed via sensible contracts on the blockchain. This implies no single entity can block trades, freeze accounts, or reverse transactions.Liquidity Provision Alternatives: Customers can contribute tokens to liquidity swimming pools and earn a portion of buying and selling charges. This permits for passive earnings whereas supporting the change’s operations. Some DEXs additionally supply incentives, akin to native token rewards for liquidity suppliers.

Dangers

Sensible Contract Vulnerabilities: Any bug, flaw, or exploit within the contract can doubtlessly end in lack of funds.Excessive Community Charges: Buying and selling on blockchain networks like Ethereum may be costly throughout congestion. Fuel charges might generally exceed the worth of small trades, decreasing profitability for frequent or small-scale merchants.Slippage and Worth Impression: When buying and selling low-liquidity tokens, the executed value can differ considerably from the anticipated value. Giant trades can transfer the market, inflicting slippage and doubtlessly increased prices.Restricted Buyer Help: There’s normally no centralized assist staff. If a commerce fails resulting from community errors or in case you ship tokens incorrectly, there’s little to no recourse.

Methodology: How We Selected the Greatest Decentralized Alternate

To establish the most effective decentralized exchanges, we reviewed 20 of the most well-liked decentralized exchanges throughout a number of blockchains. Our assessment targeted on the elements that affect consumer expertise, together with privateness, safety, liquidity, consumer expertise, and extra.

We thought-about liquidity as a result of increased liquidity not solely reduces slippage but in addition permits trades to execute quicker and extra effectively. On the similar time, we examined the vary of supported tokens and networks, as platforms that function throughout a number of chains present customers with larger flexibility and buying and selling alternatives.

As said earlier, safety is one other crucial issue. We examined whether or not every protocol had undergone skilled sensible contract audits and maintained a constant security document. Alongside this, we evaluated extra options, together with derivatives buying and selling, staking, yield farming alternatives, and liquidity provision, since these choices add worth past fundamental token swaps.

Conclusion

Decentralized exchanges (DEXs) supply a safe option to commerce cryptocurrencies straight out of your pockets. They mix privateness, self-custodial management, and world accessibility to ship easy and safe buying and selling experiences for crypto buyers.

Whereas they might not at all times match CEXs in liquidity or superior buying and selling options, DEXs excel in transparency, censorship resistance, and offering alternatives to discover the decentralized finance world.

Selecting the most effective decentralized change is dependent upon your buying and selling targets, the crypto property you need to commerce, and your consolation stage with blockchain networks and charges. However by understanding what every platform presents, you may navigate the decentralized ecosystem confidently and make knowledgeable choices.

FAQs

What’s the finest decentralized crypto change?

The most effective DEX is dependent upon your buying and selling wants. For spot buying and selling and token swaps, Uniswap or PancakeSwap are widespread decisions. For derivatives and perpetual futures, Hyperliquid or dYdX supply superior instruments and leverage. Take into account elements like supported property, charges, community, and consumer expertise when deciding.

Are Decentralized Exchanges Secure?

DEXs are usually secure as a result of they offer you extra management of your funds. Nevertheless, they depend on sensible contracts, which may have vulnerabilities. All the time test for audited protocols and keep away from unverified tokens to scale back danger.

What are fuel charges on DEXs?

Fuel charges are community transaction prices paid to blockchain validators. On networks like Ethereum, these charges may be excessive throughout congestion. Some DEXs on Layer 2 networks or various blockchains, like Binance Sensible Chain or Solana, supply a lot decrease charges.

Which decentralized change has the bottom charges?

DEXs constructed on low-cost blockchains normally have the bottom charges. PancakeSwap (BNB Chain) and Raydium (Solana) are identified for quick trades with minimal transaction prices in comparison with Ethereum-based DEXs.