Eko Founder and CEO Mart Vos doesn’t care for those who name his firm “echo” or “eco.” However what he does care about is making it simpler for neighborhood banks and credit score unions to supply easy-to-use funding options to their prospects and members—earlier than they change into enamored of the choices by the brand new crop of digital funding brokers and platforms.

“I’m from the Netherlands,” Vos stated to the FinovateFall 2025 viewers final month in New York. “Again within the Netherlands, all people invests their cash with their trusted financial institution. And perhaps it sounds bizarre. However to me, it’s very regular. If I need to make investments my cash, I’m going to go along with a spot that I do know and belief. I do know my financial institution. I belief my financial institution. So the place else am I going to go than my trusted financial institution?”

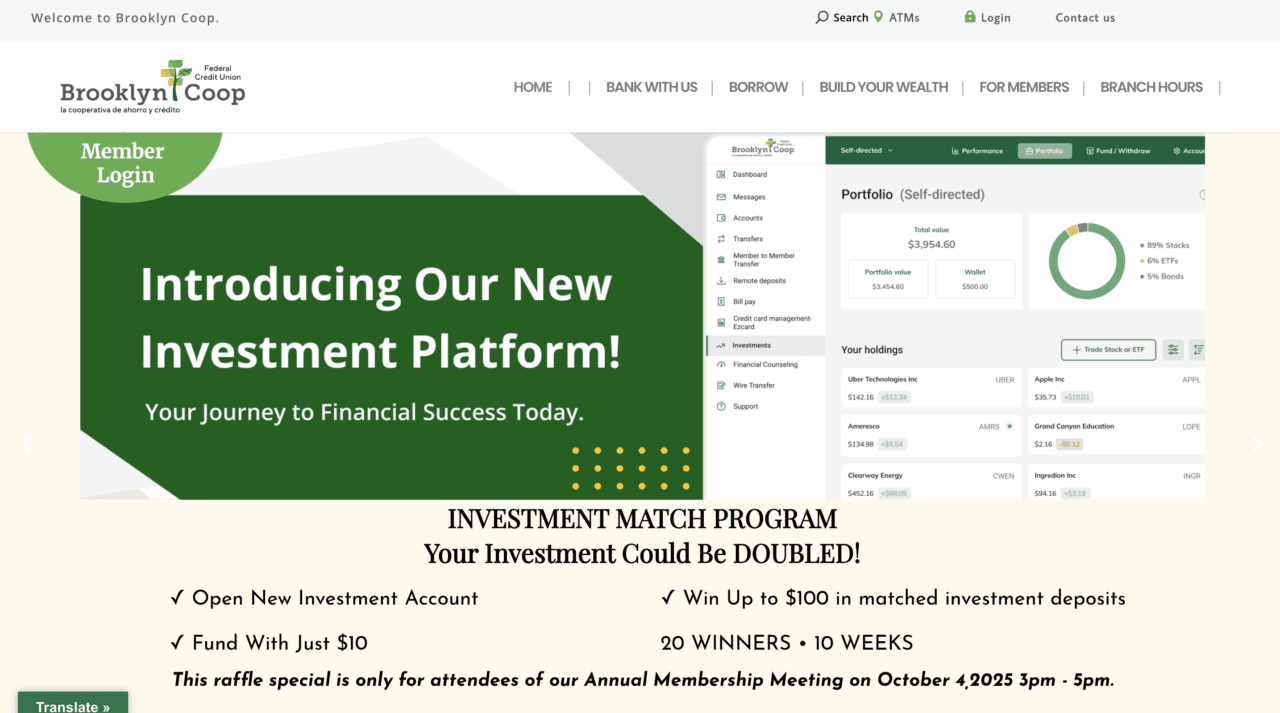

That is the lens via which to view Eko’s newest partnership announcement, teaming up with the Brooklyn Cooperative Federal Credit score Union. The partnership, introduced final week, will allow Coop members to take a position instantly from their credit score union’s platform. Members can begin with as little as $10 and funding companies can be found in each English and Spanish. A licensed CDFI (neighborhood growth monetary establishment) and a Minority Depository Establishment, Brooklyn FCU started operations in 2001 and serves central and jap Brooklyn communities comparable to Bushwick, Bedford-Stuyvesant, and Crown Heights. The credit score union is the third largest in its county, regardless of its relative youth, and at the moment has greater than 7,200 members and $50 million in belongings.

In an announcement on LinkedIn, Vos famous that the complete integration of Eko’s “one-stop investments store” was accomplished in three weeks. Coop members will profit from a seamless, built-in investing expertise that sits inside their present digital banking portal and/or app, versatile portfolio choices together with pre-built and hybrid funding pathways, and low boundaries to entry with a streamlined onboarding course of and the flexibility to begin investing with as little as $10. The partnership information follows Eko’s second consecutive Better of Present win at FinovateFall (the corporate received its first Better of Present award at FinovateFall 2024), in addition to recognition as “Greatest Fintech” on the Tennessee Credit score Union League annual convention.

“This launch feels additional particular to me personally: Brooklyn Coop is actually the credit score union subsequent door right here in New York! Actually proud to assist Brooklyn Coop in making investing easy, inexpensive, and accessible for all members,” Vos stated.

An embedded funding platform for banks and credit score unions, Eko received Better of Present in its Finovate debut at FinovateFall 2024 and received once more the next 12 months at FinovateFall 2025. Headquartered in New York and based in 2021, the corporate’s white-label answer integrates instantly into digital banking infrastructures to allow prospects and members to spend money on pre-built portfolios, IRAs, cryptocurrencies, and extra, in addition to interact in hybrid investing and self-directed buying and selling.

In its most up-to-date Finovate look, the corporate demonstrated how its embedded AI assistants assist traders by answering monetary planning questions, offering funding analysis, and serving to with duties like organising recurring deposits and rebalancing portfolios.

Photograph by Francesco Gallarotti on Unsplash

Views: 12