On-chain knowledge reveals the big Ethereum traders have been including to their holdings just lately, an indication that could possibly be bullish for the ETH worth.

Ethereum Giant Holders Netflow Has Turned Constructive Not too long ago

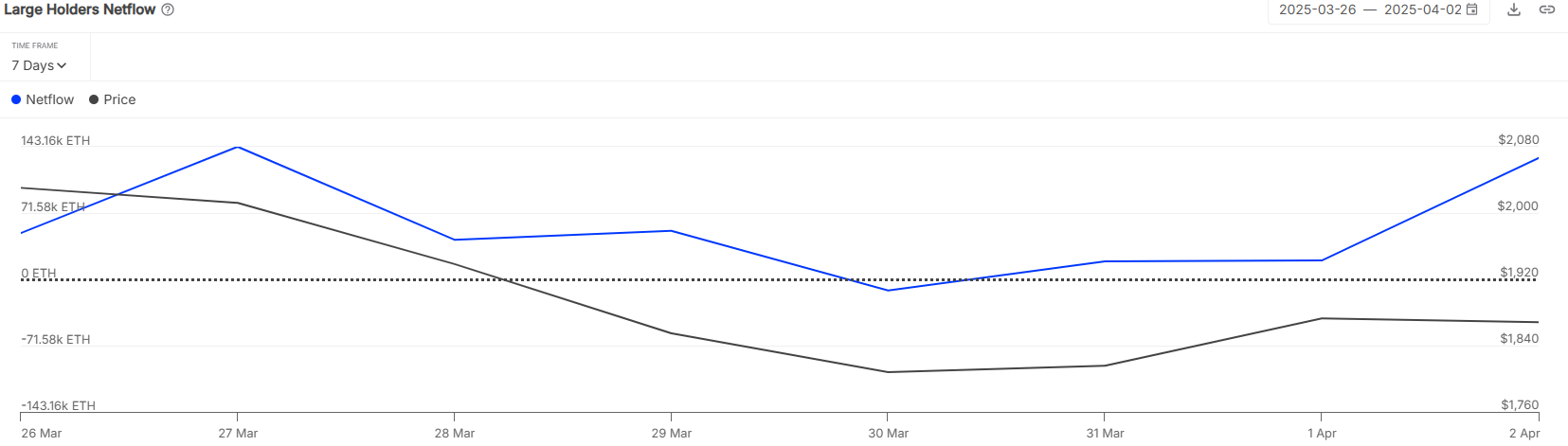

In a brand new put up on X, the market intelligence platform IntoTheBlock has talked concerning the pattern within the Giant Holders Netflow for Ethereum. This metric measures the online quantity of the cryptocurrency that’s shifting into or out of the wallets managed by the Giant Holders.

The analytics agency defines three classes for traders: Retail, Buyers, and Whales. Members of Retail maintain lower than 0.1% of the availability of their stability, that of Buyers between 0.1% and 1%, and that of Whales greater than 1%.

On the present alternate charge, 0.1% of the ETH provide, the cutoff between Retail and Buyers, is price over $214 million, a really substantial quantity. Which means that the addresses who’re capable of qualify for Buyers are already fairly giant, not to mention those that have made it to the Whales.

As such, the Giant Holders, the precise cohort of curiosity within the present dialogue, contains each of those teams. Thus, the Giant Holders Netflow retains monitor of the transactions associated to Buyers and Whales.

When the worth of this metric is optimistic, it means the big-money traders on the community are receiving a internet variety of deposits to their wallets. However, it being beneath the zero mark suggests these key holders are collaborating in internet promoting.

Now, right here is the chart shared by IntoTheBlock that reveals the pattern within the Ethereum Giant Holders Netflow over the previous week:

The worth of the metric seems to have been optimistic in latest days | Supply: IntoTheBlock on X

As is seen above, the Ethereum Giant Holders Netflow has remained virtually totally within the optimistic territory for the interval of the graph, which suggests that the Buyers and Whales have been accumulating. On the second of the month alone, these key entities loaded up on a internet 130,000 ETH (about $230 million).

The online inflows for the Giant Holders have come whereas the cryptocurrency has been declining, so it’s potential that this cohort believes the latest costs have been providing a worthwhile entry into the asset. It now stays to be seen whether or not this accumulation could be sufficient to assist ETH attain a backside or not.

In another information, the Ethereum payment is right down to the bottom stage since 2020 this quarter, because the analytics agency has identified in one other X put up.

The adjustments that occurred in key ETH metrics through the first quarter of 2025 | Supply: IntoTheBlock on X

Following a pointy drop of 59.6%, the Ethereum complete transaction charges is right down to $208 million. In line with IntoTheBlock, this pattern is “primarily pushed by the gasoline restrict enhance and transactions shifting to L2s.”

ETH Worth

Ethereum noticed restoration above $1,900 earlier within the week, however it appears bullish momentum has already run out because the coin’s again to $1,770.

Seems like the worth of the coin has plunged just lately | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.