Binance has introduced its plans to compensate some customers who misplaced funds through the market-wide crash on Friday, October 10. The world’s largest cryptocurrency alternate by buying and selling quantity acknowledged a worth depeg incident, which led to pressured liquidations for some merchants.

Affected Customers To Obtain Compensation In 3 Days: Binance

In an October 11 publish on the X platform, Binance co-founder and chief buyer assist officer Yi He confirmed that some customers encountered points with their transactions attributable to vital market fluctuations. Whereas apologizing to clients, the alternate govt requested the affected clients to succeed in out to the customer support to lodge their complaints.

After Friday’s market massacre, some customers took to the X platform to complain concerning the pressured closure of their commerce positions on the Binance alternate. In line with the cryptocurrency alternate’s rationalization, these points had been attributable to a worth depeg involving Ethena’s USDe, BNSOL, and WBETH, because the market fluctuated and customers flooded the buying and selling platform.

Binance’s He famous that account exercise of every consumer shall be reviewed individually earlier than the compensation shall be launched accordingly. Nonetheless, it was additionally acknowledged that losses attributable to market fluctuations and unrealized earnings should not eligible for compensation.

He wrote on X:

The explanation Binance is Binance is that we by no means draw back from issues. After we fall quick, we take duty—there are not any excuses or justifications. We’re dedicated to serving each consumer to one of the best of our capability, and we are going to handle what we’re accountable for.

Binance introduced on its web site that the affected customers will obtain their compensation inside 72 hours. This reimbursement will reportedly cowl the distinction between the liquidation worth and market worth at midnight on October 11.

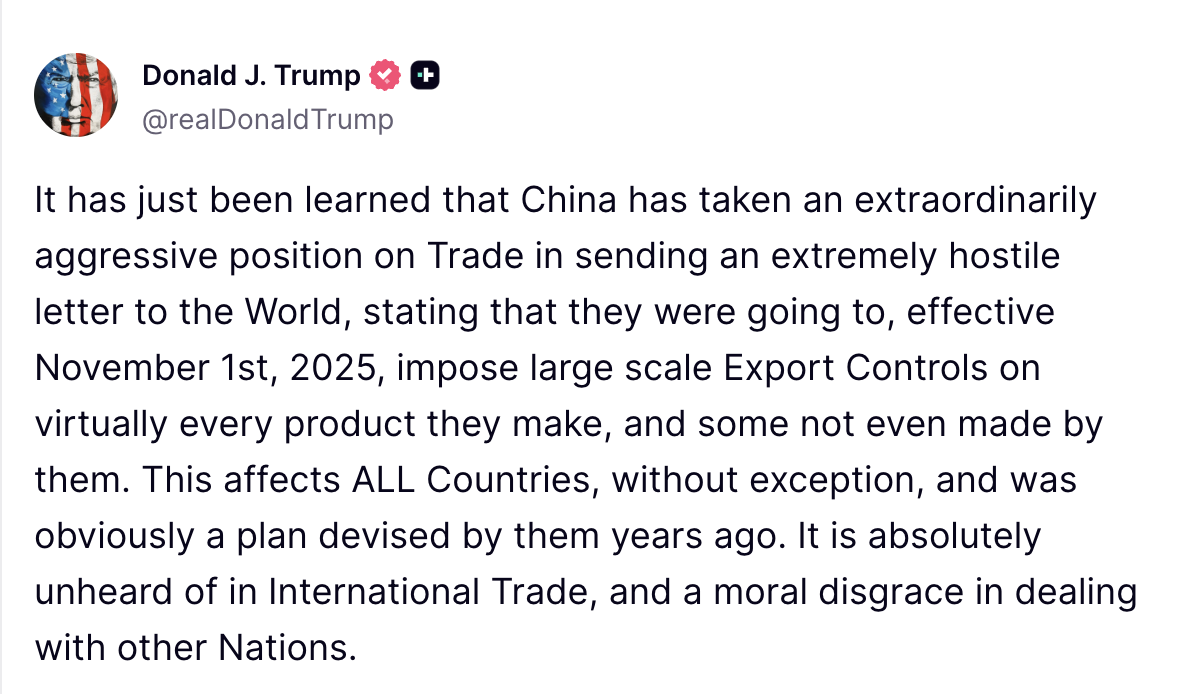

Trump Slaps China With 100% Tariff, Crypto Market Crashes

As already talked about, the Binance problem got here up attributable to extreme fluctuations within the cryptocurrency market. This elevated volatility got here after United States President Donald Trump declared plans to impose 100% tariffs on all Chinese language items by November 1.

Supply: @realDonaldTrump on Reality Social

On account of this determination, Bitcoin, the biggest cryptocurrency by market cap, witnessed a swift crash to round $101,500. In the meantime, the crypto market recorded practically $20 billion in lengthy liquidations—the biggest single-day liquidation occasion in historical past—following the declaration.

As of this writing, the worth of Bitcoin is hovering across the $111,000 mark, reflecting an virtually 10% decline prior to now seven days.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.