Este artículo también está disponible en español.

Bitcoin consultants are buzzing as President-elect Donald Trump lashed out in opposition to present Federal Reserve coverage, calling rates of interest “far too excessive” regardless of persistent inflationary pressures. “We’re inheriting a troublesome state of affairs from the outgoing administration,” Trump mentioned at his Mar-a-Lago membership, including that officers appear to be “making an attempt every little thing they’ll to make it harder” for his incoming staff.

The blunt remarks, coming fewer than two weeks earlier than Trump’s inauguration, have stoked anticipation of a attainable shift in US financial coverage—and raised hypothesis a couple of increase for Bitcoin and different danger belongings within the new 12 months.

The 2017 Trump Playbook: Greenback “Too Sturdy”, Bitcoin Up?

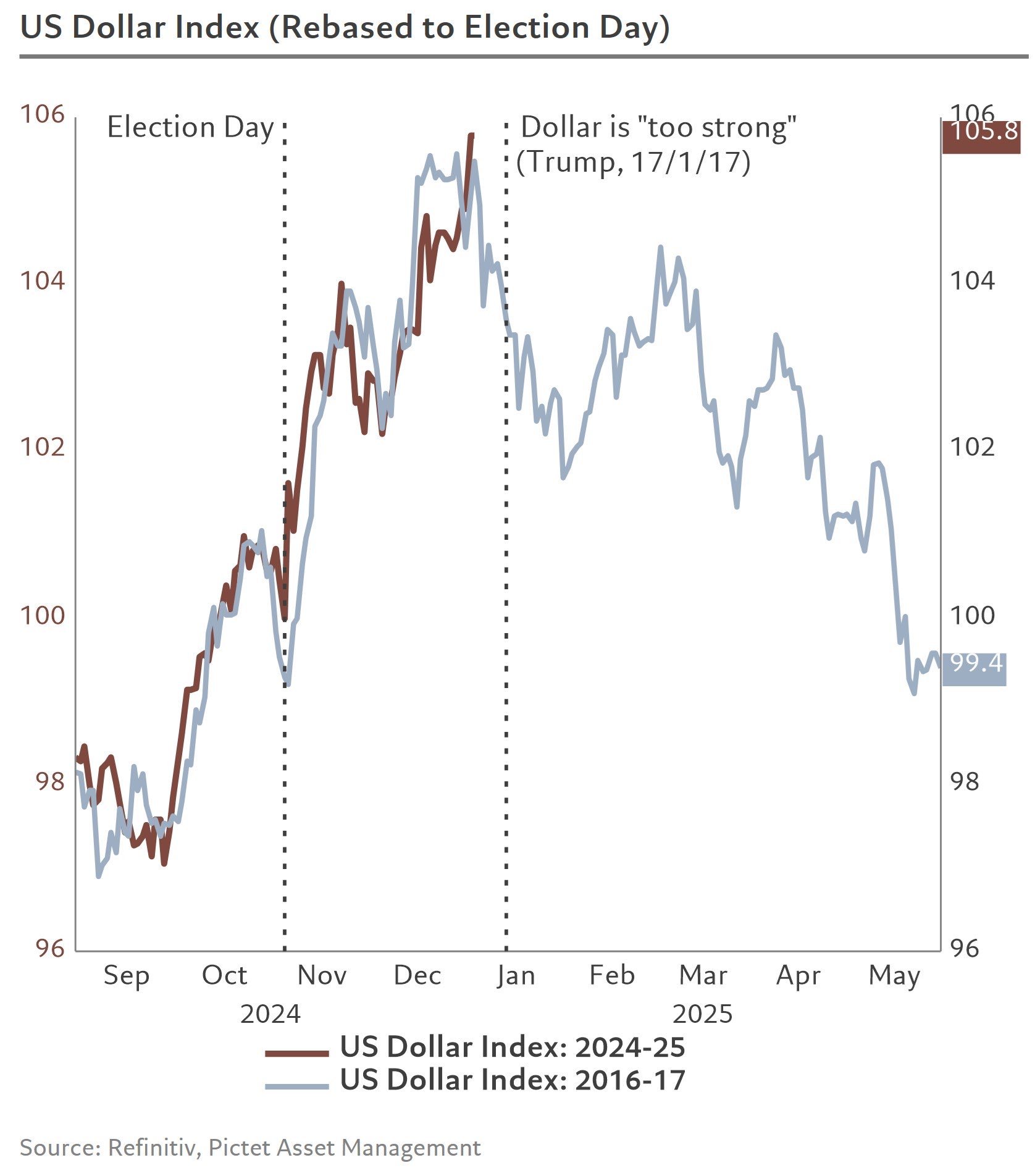

Though the financial and geopolitical panorama has modified since Trump’s first time period, some market watchers see parallels to his 2017 rhetoric. Again then, he lambasted a US greenback that he deemed “too sturdy,” a stance that preceded a notable decline within the foreign money. The US Greenback Index (DXY) peaked close to 104 in early January 2017 however started a downward pattern that prolonged into early 2018, bottoming out round 98.

Associated Studying

This sharp transfer within the greenback coincided with a broader risk-on surroundings, fueling rallies in equities in addition to the Bitcoin and crypto markets. Julien Bittel, Head of Macro Analysis at World Macro Investor (GMI), drew a direct comparability on X.

“The final time Trump mentioned one thing was ‘too excessive,’ it was the greenback – again in January 2017, simply days earlier than his inauguration,” Bittel said and recounted: “Right here’s what he mentioned: ‘Our firms can’t compete with them now as a result of our foreign money is just too sturdy. And it’s killing us.”

Notably, final 12 months, Trump additionally known as latest energy a “great burden on US companies.” Bittel additional argued: “Trump understands the affect of a robust greenback – and the identical logic applies to excessive rates of interest. They suppress exports, harm company earnings, and sluggish financial progress.”

Associated Studying

Talking on the affect on Bitcoin and the broader crypto market, Bittel concluded: “What occurred subsequent? Properly, the greenback started a major decline, setting the stage for one of the vital pivotal macro strikes we’ve seen in years – triggering a melt-up in danger belongings. Déjà vu? I believe so. Let’s see the way it performs out.”

Bittel will not be the one knowledgeable speculating that the DXY might have already got peaked, mirroring its 2017 topping sample. Steve Donzé, Deputy CIO for Multi Asset at Pictet Asset Administration Japan, shared a extensively mentioned chart on X, remarking “On time. Prepared for pushback,” whereas overlaying latest DXY actions with the foreign money’s trajectory in early 2017. The chart suggests an identical sample that might foreshadow renewed greenback weak point within the coming weeks.

In a separate submit, monetary analyst Silver Surfer (@SilverSurfer_23) pointed to an uncanny timing overlap: “DXY topped on January third, 2017—18 days earlier than Trump’s Inauguration. DXY appears to have topped on January 2nd, 2025—19 days earlier than Trump’s Inauguration.” He characterised the parallel as “loopy historical past repeating,” explaining that he sees a correlation between the trail of the DXY earlier than each inaugurations.

Such analogies are fueling hypothesis {that a} repeat greenback droop may usher in an surroundings favoring danger belongings. Ought to the greenback certainly enter a brand new downtrend—very like in 2017–2018—Bitcoin may trip a wave of renewed liquidity and speculative urge for food.

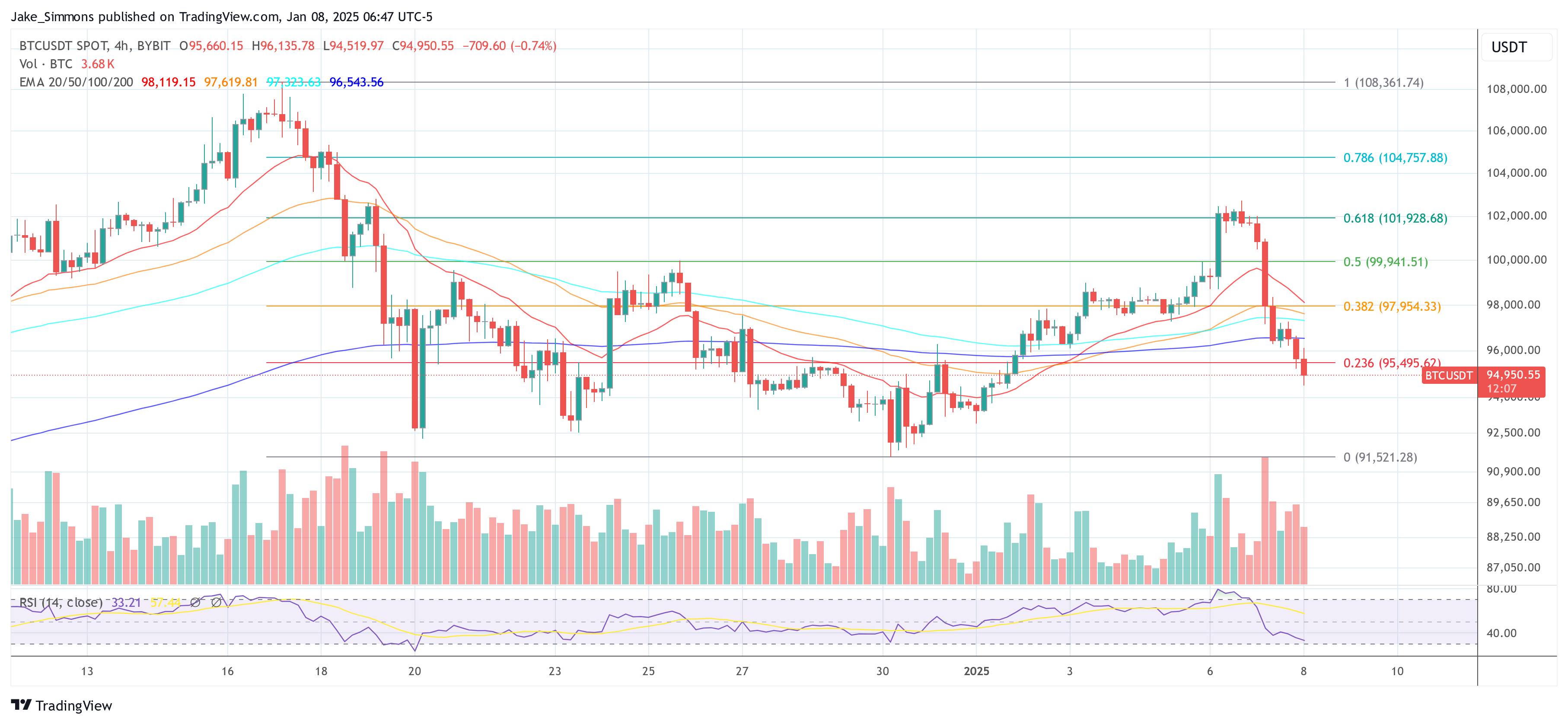

At press time, BTC traded at $94,950.

Featured picture created with DALL.E, chart from TradingView.com