Bitcoin has skilled a peaceful weekend, sustaining its momentum above the $100,000 mark after breaking this milestone on Wednesday and setting new highs. The crypto market is buzzing with anticipation as BTC consolidates close to its historic ranges, with merchants and traders eagerly awaiting its subsequent transfer.

Including to the thrill, CryptoQuant analyst Maartunn just lately highlighted compelling information on CME Choices Open Curiosity (USD) – Stacked by Place. This information factors to rising exercise amongst institutional merchants, suggesting {that a} important value motion could possibly be on the horizon. Traditionally, related spikes in open curiosity have preceded main volatility in Bitcoin’s value, making this metric one to observe carefully.

Whereas Bitcoin’s quiet weekend gives a second of respite for market contributors, the underlying indicators counsel that this calm might not final lengthy. Because the crypto king hovers close to its all-time highs, many are speculating whether or not it is going to proceed its upward trajectory or face a short lived pullback.

Both approach, the stage is about for an intriguing week forward, with key market metrics hinting at heightened exercise and potential fireworks within the coming days. Keep tuned as Bitcoin’s subsequent transfer might outline the narrative for the broader cryptocurrency market.

Bitcoin Open Curiosity: Calls Stacking Up

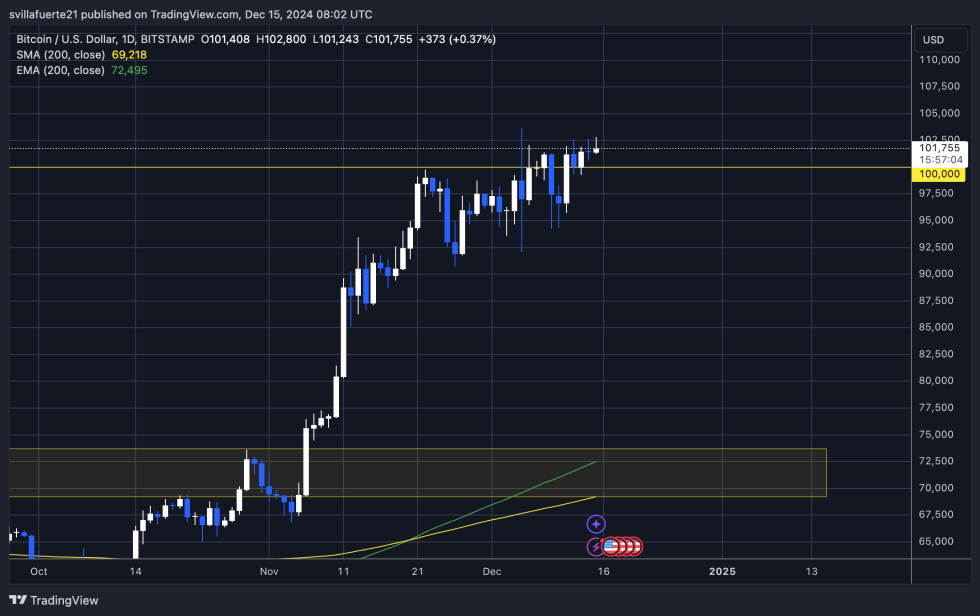

Bitcoin has been in an uptrending vary since late November, constantly making greater highs however failing to set an enormous breakout. The worth motion has remained regular, with Bitcoin persevering with to climb towards new ranges. Regardless of the constructive momentum, the market is ready for a decisive transfer to push the worth greater, and plenty of merchants are carefully monitoring Bitcoin’s means to interrupt above its all-time highs (ATH).

CryptoQuant analyst Maartunn just lately shared key insights on X, highlighting an attention-grabbing growth in Bitcoin’s market construction. In keeping with Maartunn, BTC stacked put positions have reached multi-year highs, which might sign a brewing storm.

In his evaluation, he presents a chart displaying the rising exercise in put choices, usually reflecting a build-up of high-leverage positions. The sort of market conduct tends to precede huge value actions, particularly when leveraged positions are liquidated.

Whereas Bitcoin continues its rise, the market is strolling a nice line. If Bitcoin fails to interrupt above its ATH and continues to commerce throughout the present vary, there’s a important danger of a retrace. A correction might comply with, particularly if high-leverage positions begin to unwind. With the rising open curiosity in put choices, this provides to the uncertainty.

BTC Testing Liquidity In Value Discovery

Bitcoin is buying and selling at $101,750 after days of being caught beneath the $102,000 mark. Whereas the worth has remained resilient, it has struggled to interrupt via key resistance ranges. For the bulls to keep up their momentum, the worth must decisively break above $103,600. A powerful push previous this degree would sign a continuation of the uptrend and probably result in new highs.

Nevertheless, if BTC fails to interrupt above $103,600, there’s a robust probability that it’ll retest decrease demand ranges. The subsequent important assist zone to observe is round $95,500. A failure to clear $103,600 would point out that the bears are beginning to achieve management, and BTC might face a deeper correction as merchants start to promote into weak point.

Within the coming days, merchants will likely be carefully waiting for any indicators of a breakout or breakdown. A decisive transfer above $103,600 might set off a rally, but when BTC falters and falls again towards $95,500, the market might expertise elevated volatility, and additional draw back might comply with.

Featured picture from Dall-E, chart from TradingView