Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin worth fell virtually $4,000 as Europe hinted at retaliatory measures towards US President Donald Trump, who threatened new commerce tariffs except negotiations may start over Greenland.

The BTC drop got here because the commerce battle additionally worn out about $110 billion, sending BTC down by over 2.5% to a market capitalization of $3.22 trillion.

Bitcoin costs dumped 2.5% within the final 24 hours, dropping to beneath $92,000. BTC is now buying and selling at $92,440 as of 1:16 a.m. EST, in accordance to a Coinbase chart on TradingView.

EU–US Commerce Conflict Shakes the Crypto Market

Because of the crypto market wiping over $110 billion within the final 24 hours, round $787 million in lengthy positions have been liquidated within the final day, bringing the entire 24-hour liquidations to over $870 million, in keeping with Coinglass knowledge. Over $223 million was BTC-related lengthy positions.

The drop comes after US President Donald Trump revived world fears of commerce tariffs by imposing duties on a number of main European nations over Greenland.

Trump had earlier threatened to impose as much as 25% tariffs on a number of European nations, stating that the duties would stay in place till a deal to promote Greenland to america was reached.

🇺🇸🇬🇱 Trump threatens new tariffs on nations against Greenland takeover.

Beginning on February 1, 2026, 10% tariffs could be imposed on the next nations, rising to 25% on June 1, 2026:

🇩🇰 Denmark🇳🇴 Norway🇸🇪 Sweden🇫🇷 France🇩🇪 Germany🇬🇧 UK🇫🇮 Finland🇳🇱 The… pic.twitter.com/ZbCAT3iB3A

— Mario Nawfal (@MarioNawfal) January 17, 2026

Nevertheless, European nations have constantly rejected Trump’s demand for the Danish territory, with France additionally seen getting ready retaliatory financial measures towards Washington.

Trump has repeatedly demanded that Greenland be ceded to the U.S., claiming that the island is of nice significance to U.S. nationwide safety.

Following the refusal to promote Greenland, Trump stated that Denmark has been unable to stave off a Russian risk from Greenland.

“NATO has been telling Denmark, for 20 years, that ‘you need to get the Russian risk away from Greenland…’ Denmark has been unable to do something about it,” Trump stated. “Now it’s time, and it is going to be finished.”

“NATO has been telling Denmark, for 20 years, that “you need to get the Russian risk away from Greenland.” Sadly, Denmark has been unable to do something about it. Now it’s time, and it is going to be finished!!!” – President Donald J. Trump pic.twitter.com/ZyFh9OsNsn

— The White Home (@WhiteHouse) January 19, 2026

Gold futures soared to document highs of $4,680 per ounce as markets reacted to the resumption of the US-EU commerce battle, in accordance to Google Finance. Silver futures additionally skyrocketed above $93 per ounce for the primary time in historical past.

Bitcoin Worth Pull Backs As Promoting Strain Intensifies

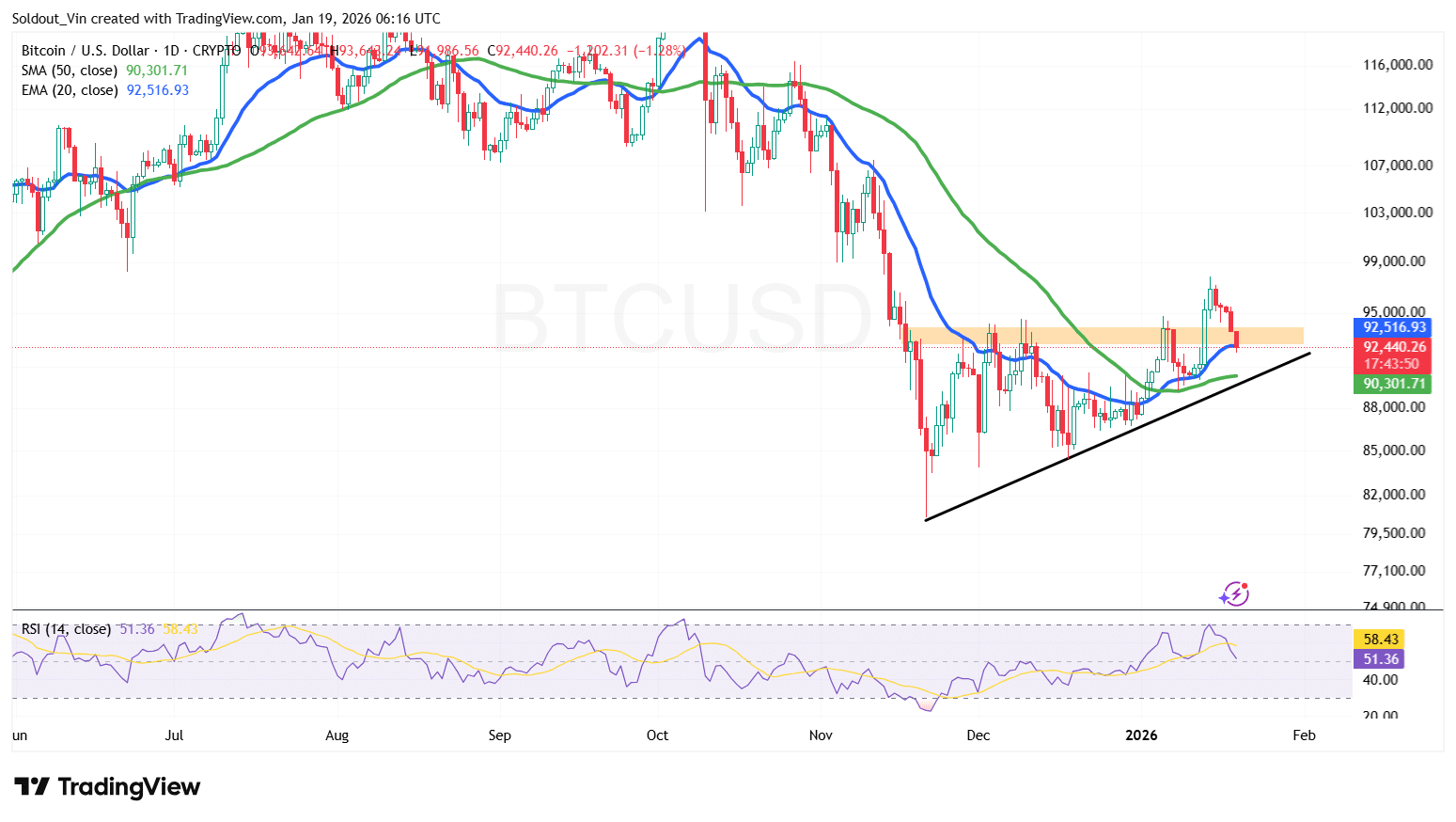

After breaking above the ascending triangle and rallying to over $97,000, the BTC worth has since confronted promoting strain at this resistance stage.

This has resulted within the Bitcoin worth dropping again into the triangle, now buying and selling across the higher boundary of the sample and the 20-day Exponential Shifting Common (EMA).

So as to add to the bearish strain, the Relative Energy has dropped from round 68 to 51.36 and continues to be plunging, indicating sustained promoting strain within the Bitcoin market.

BTC Worth Outlook: Is The Drop A Warning Signal?

Because of the commerce battle, the cryptocurrency market, particularly Bitcoin, is experiencing a sustained drop as merchants run to safe-haven property.

Based on the BTC/USD Chart evaluation, the Bitcoin worth continues to be buying and selling above the 50-day Easy Shifting Common (SMA), which is offering robust short-term assist at $90,301.

With commerce threats looming as BTC tries to carry above $90,000 during the last two weeks, Bitcoin may but drop additional. If Bitcoin’s worth continues to drop and breaches the 50-day SMA, the asset dangers a drop to the decrease boundary round $89,000.

Nevertheless, institutional shopping for may very well be a optimistic consider holding the value above this assist. Michael Saylor has hinted that Technique will quickly make one other BTC buy, because it pushes to carry over 3% of the asset’s complete provide.

Saylor posted “Larger Orange” on X, a phrase he has used earlier than saying new Bitcoin buys.

₿igger Orange. pic.twitter.com/HI47hMCnui

— Michael Saylor (@saylor) January 18, 2026

After shopping for 13,627 BTC final week, Technique now holds 687,410 BTC acquired for $51.8 billion at $75,353 per Bitcoin.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection