Victoria d’Este

Printed: April 28, 2025 at 11:57 am Up to date: April 28, 2025 at 11:57 am

Edited and fact-checked:

April 28, 2025 at 11:57 am

In Transient

Bitcoin, Ethereum, and Toncoin rallied final week with BTC main on ETF inflows, ETH exhibiting quiet accumulation, and TON constructing real-world use instances, all whereas crypto markets reached key determination factors.

Bitcoin (BTC)

For those who had been watching Bitcoin final week, you in all probability felt that acquainted momentum begin to construct once more. We noticed a clear elevate from round $85,000 as much as $94,000 – and right this moment, we’re holding only a hair above $94,300 after touching $94,451. Not unhealthy for every week’s work, proper?

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

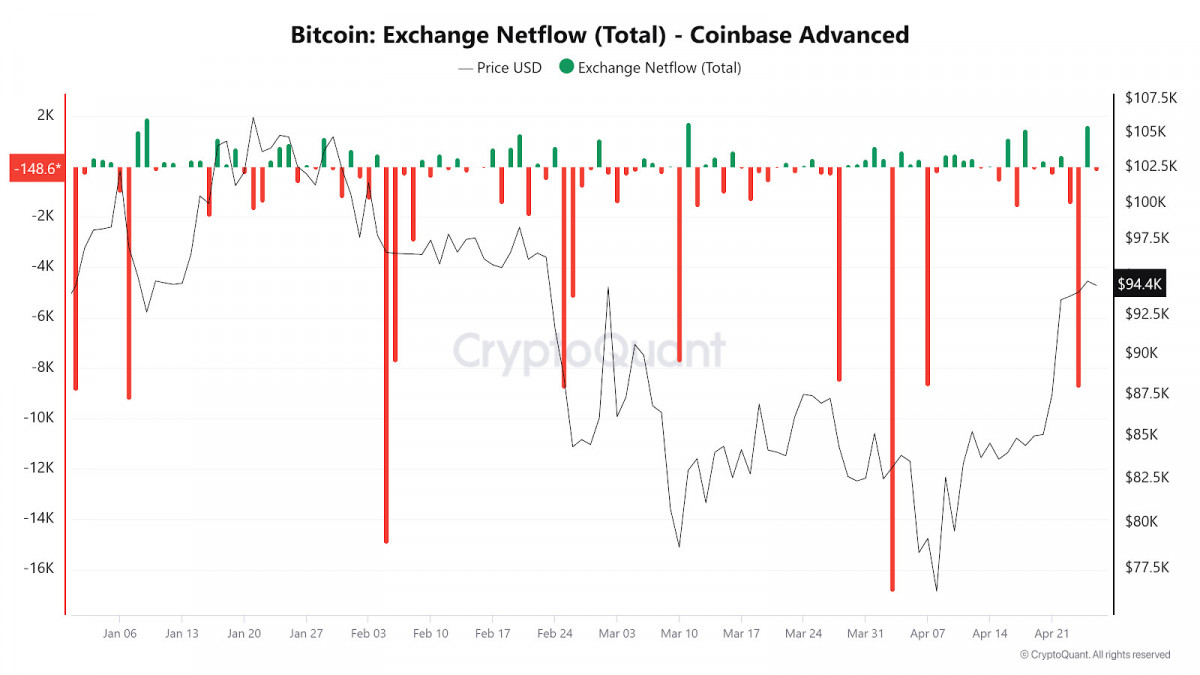

What’s extra fascinating, although, is how managed the transfer has been. The ETF inflows flipped constructive once more – roughly $3 billion final week – and you may see how worth responded. No frantic pumps, no blow-off spikes. Simply regular stress up.

Bitcoin trade netflows on Coinbase. Supply: CryptoQuant

It wasn’t simply ETF flows doing the heavy lifting both. The macro backdrop quietly improved: Trump’s push for tariff rollbacks and guarantees of slashing federal taxes helped threat urge for food throughout the board. Shares caught a bid, the greenback weakened, and Bitcoin leaned into that momentum prefer it ought to in a reflationary setup.

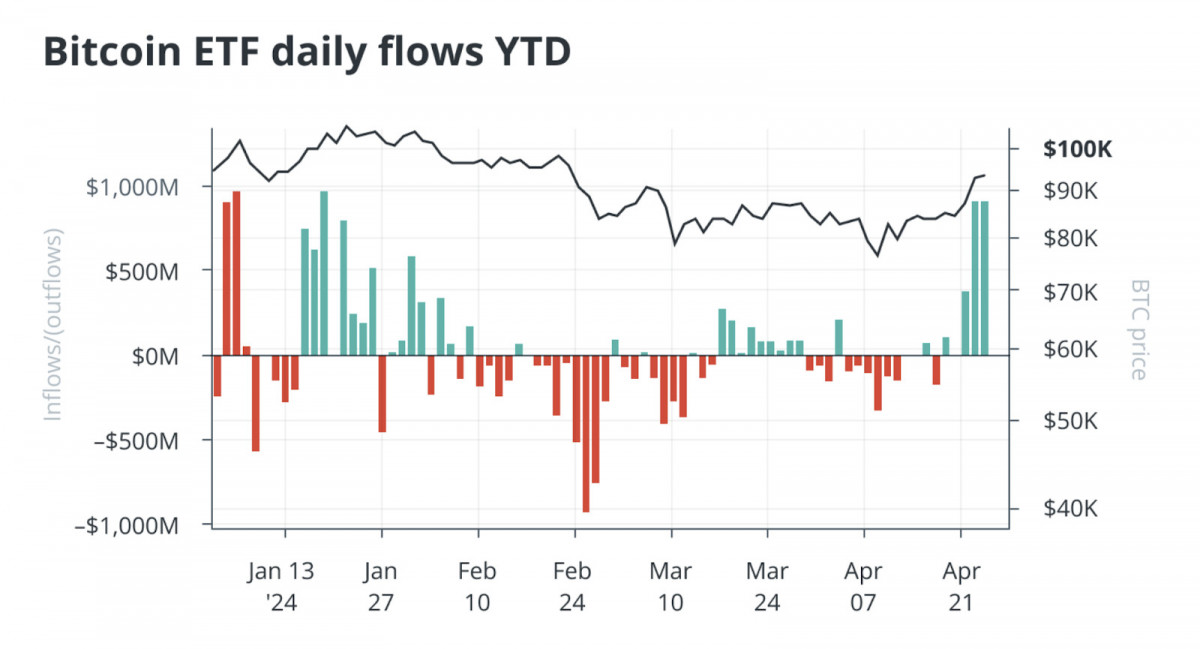

Supply: Bitcoin Journal Professional

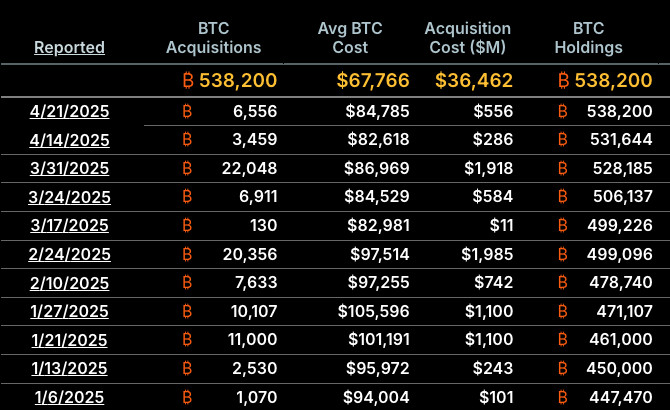

In the meantime, sentiment contained in the crypto market itself firmed up. Spot Bitcoin ETFs logged their strongest weekly inflows in over three months. Institutional shopping for wasn’t simply ticking up – it regarded aggressive. Technique’s recent $555 million Bitcoin purchase didn’t harm both, signaling that giant treasury allocators are nonetheless hungry for publicity even at elevated ranges.

Technique’s Bitcoin acquisitions in 2025 to this point. Supply: Technique

Even worldwide flows gave a bit of tailwind: companies like Metaplanet and a number of other Hong Kong gamers saved stacking BTC at tempo, including to the narrative that sovereign and company demand outdoors the U.S. is quietly constructing.

Supply: Simon Gerovich

That mentioned, we’re now seeing the primary indicators that patrons is perhaps getting a bit of winded. Worth motion has flattened out over the previous two days, and the RSI, which had been urgent close to the overbought zone, is beginning to drift decrease. For those who’re lengthy, it’s not a panic sign – however it’s one thing to respect. The straightforward cash on this leg appears to be made.

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

A clear break above $95,000 might re-ignite the rally towards six figures, no query. But when Bitcoin begins slipping underneath $93,000–92,500, that might sign that the pause is turning into a deeper pullback. Which method are the percentages leaning? Proper now, it’s mainly at a choice level – and it’s taking its candy time making up its thoughts.

Ethereum (ETH)

Ethereum tracked alongside Bitcoin final week, however not with the identical conviction. It rose from roughly $1,580 to right this moment’s $1,804, tagging a neighborhood excessive at $1,809. First rate, positive – but it surely’s fairly clear ETH isn’t main this market proper now.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

For those who’ve been watching the ETH/BTC pair, you’ll know precisely what I imply. Ethereum has been underperforming Bitcoin for weeks, and that pattern hasn’t flipped but. Even now, whereas ETH/USD appears to be like wholesome sufficient by itself, it’s not pushing more durable than Bitcoin.

Nonetheless, there are some things underneath the floor price listening to.

Galaxy dumps Ether, however not all of it. Supply: Arkham

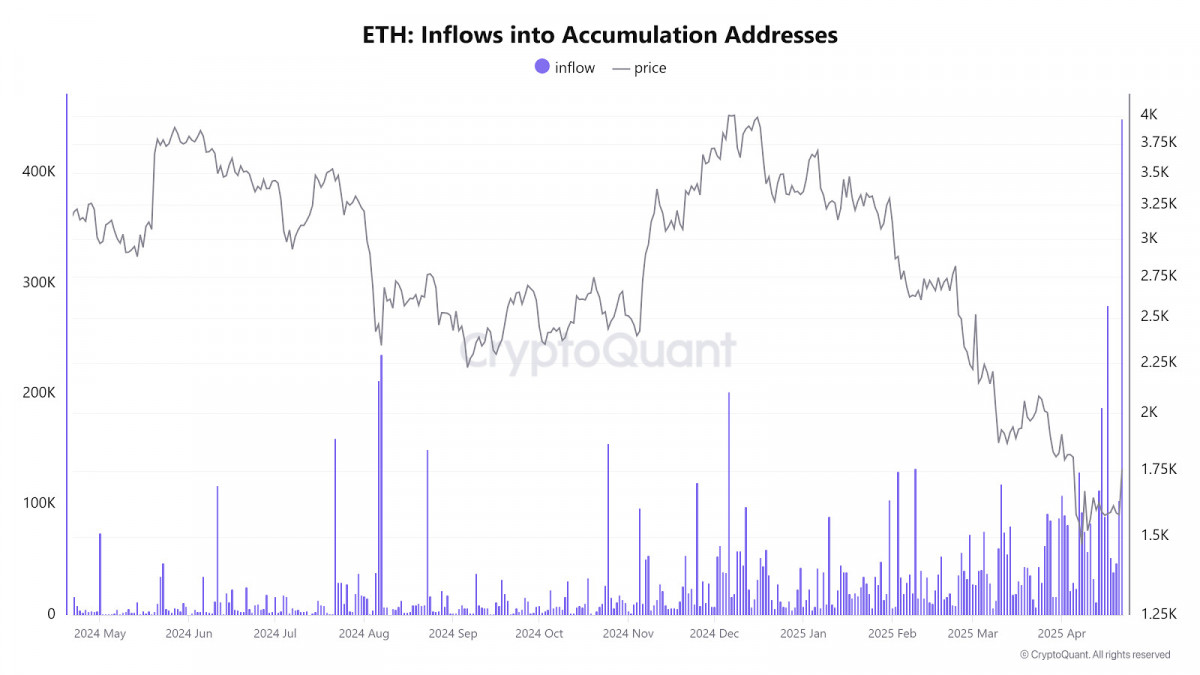

Alternate balances for ETH are dropping once more – a basic signal of accumulation. And simply final week, accumulation addresses pulled in over 449,000 ETH in a single day. That’s a critical quantity. It doesn’t assure an instantaneous breakout, however when large wallets begin rising like that, it often means somebody’s positioning for one thing down the road.

Ethereum inflows into accumulation addresses. Supply: CryptoQuant

On the event facet, Ethereum isn’t precisely sleeping both. Validators signed off on testing a 4x fuel restrict improve forward of the upcoming Fusaka laborious fork. If that sticks, Ethereum’s base layer might quickly deal with much more transactions – a essential transfer as competitors from sooner L2s and alt-L1s heats up.

Mantle’s mETH yields 3.78%. Supply: DeFILlama

In the meantime, establishments haven’t misplaced curiosity ither. Securitize and Mantle launched a brand new fund final week that particularly consists of ETH, together with BTC and SOL. It’s a reminder that even when merchants are chasing sooner returns elsewhere, Ethereum nonetheless holds a seat on the desk for larger cash.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

Technically, ETH is sitting in a slim band between $1,780 and $1,825. A clear breakout above $1,850 might open issues up for a stronger run – but when Bitcoin stumbles, ETH in all probability received’t be spared. For now, it’s nonetheless very a lot in Bitcoin’s orbit.

Toncoin (TON)

For those who regarded away from Bitcoin and Ethereum for a second final week, you might need caught what was brewing over in Toncoin – and when you didn’t, it’s in all probability price revisiting.

TON/USDT 4H Chart. Supply: TradingView

The information stream stayed busy by the week. For one, MyTonWallet introduced plans to roll out financial institution playing cards. It’s a small headline for now – but when it really occurs, it might make it simpler for on a regular basis customers to bridge between crypto and real-world spending. It’s yet another piece of infrastructure that would quietly push Toncoin from “speculative token” territory into one thing a bit of extra usable.

Management modifications additionally caught some consideration. The TON Basis appointed Maximilian Krain, a co-founder of MoonPay, as their new CEO. Management modifications don’t transfer worth charts in a single day – however they’ll form the tone and technique for months to return. MoonPay constructed a popularity for connecting conventional funds with crypto entry. May Krain convey a few of that very same pragmatism to TON? Regardless of the consequence, it’s one thing price watching.

Supply: Coindesk

Technically, Toncoin’s construction appears to be like clear. It climbed from about $2.85 final week to round $3.2455 right this moment, after briefly touching $3.25. Not a vertical moonshot – however regular, credible power. The RSI by no means overheated, and worth held effectively above the 50-period transferring common all through the transfer.

If Bitcoin stays secure or retains grinding increased, Toncoin appears to be like prefer it has room to stretch towards $3.50 or $3.70 with out an excessive amount of friction. However – and it’s price repeating – if Bitcoin stumbles, historical past says TON will doubtless really feel a few of that stress too. It’s nonetheless tethered to the broader market currents, regardless of how robust its fundamentals are getting.

Disclaimer

In keeping with the Belief Undertaking tips, please be aware that the knowledge supplied on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt impartial monetary recommendation when you’ve got any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Victoria is a author on a wide range of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.