Key Takeaways

Bitcoin might endure a interval of correction or sideways motion within the coming yr.

DeFi is going through a decline in 2025 as a consequence of regulatory and scalability challenges.

CryptoQuant CEO Ki Younger Ju introduced that Bitcoin’s bull cycle had ended and predicted that the value would decline or transfer sideways for the following 6 to 12 months. Beforehand, he had acknowledged that the market had not but entered a bearish part. So, what precipitated him to alter his view?

The Perspective

Beforehand, the CEO of CryptoQuant acknowledged that “it’s too early to name it a bear market,” and this attitude was mirrored within the CryptoQuant chart.

Bitcoin Value Actions Over Completely different Intervals

The chart reveals that Bitcoin’s worth (black line) has gone by a number of sturdy volatility cycles:

2021: Bitcoin BTC surged to its all-time excessive (~$69,000) within the first half of the yr earlier than experiencing a major correction towards the tip.2022: The market entered a downtrend, with BTC shedding over 60% of its worth, reaching a backside round $20,000.2023 – 2024: Bitcoin step by step recovered, reflecting an enchancment in market sentiment and new capital inflows.

Supply: TradingView

“Obvious Demand” – Market Demand Indicator

The chart highlights two key shade zones representing capital movement traits available in the market:

Inexperienced (Optimistic Obvious Demand): Signifies that BTC is being gathered or held, reflecting a optimistic market sentiment.Crimson (Unfavorable Obvious Demand): Represents BTC flowing out of the market, usually signaling sturdy promoting strain.

The Relationship Between “Obvious Demand” and Bitcoin Value

When the chart turns inexperienced for an prolonged interval, Bitcoin tends to both rise or consolidate. This can be a signal of accumulation, the place traders imagine in a long-term uptrend. Notable examples embody early 2021 and late 2023.When the chart turns crimson, the market usually undergoes corrections or sharp declines. This was evident from late 2021 to mid-2022, the place BTC’s worth dropped considerably from $60,000 to round $20,000.

Latest Developments and Market Alerts

In 2022, Bitcoin BTC skilled one among its steepest worth declines in historical past, coinciding with deep crimson zones on the chart, indicating huge promoting strain.Since early 2023, “Obvious Demand” has shifted again to inexperienced, signaling market accumulation. This has been one of many key elements supporting BTC’s restoration.

On-chain information means that the “Obvious Demand” index continues to replicate present market demand, institutional and Bitcoin ETF inflows stay current, and BTC’s worth remains to be holding at crucial help ranges.

Supply: X

Ki Younger Ju cited 4 fundamental causes for his change in outlook:

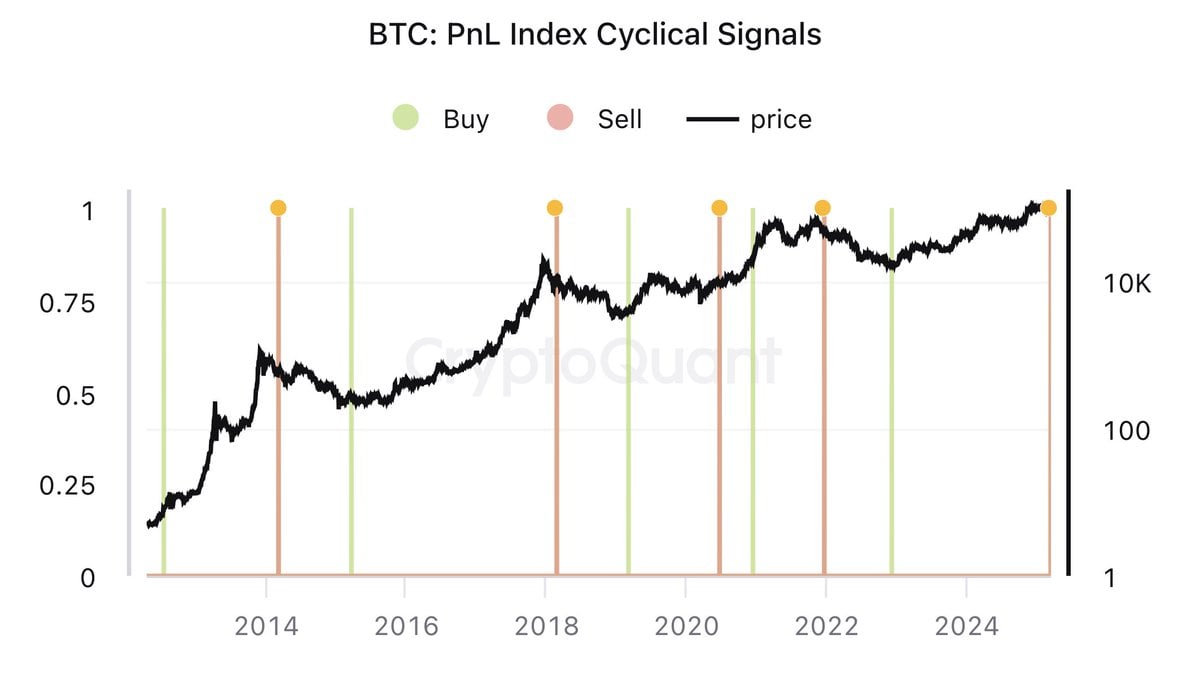

PnL Index Cyclical Alerts

Chart ConstructionBlack line: Represents Bitcoin’s worth over time (logarithmic scale).Inexperienced vertical strains: Purchase alerts – Point out durations when Bitcoin is taken into account to have sturdy progress potential.Crimson vertical strains: Promote alerts – Warn of Bitcoin reaching a peak and a possible worth correction.Yellow dots: Peaks based mostly on the PnL index, usually signaling the intense progress cycles of Bitcoin.Bitcoin’s Historic Developments Based on the PnL Index

The chart signifies that Bitcoin follows a transparent cycle of progress and correction, as mirrored within the following alerts:

2013-2014 Cycle: Bitcoin surged considerably earlier than a promote sign appeared round 2014, adopted by a pointy market decline.2017-2018 Cycle: Bitcoin reached a peak close to $20,000, after which a promote sign emerged, resulting in a steep worth drop.2021-2022 Cycle: Bitcoin hit a brand new all-time excessive above $60,000, then skilled a major decline following a promote sign in late 2021.2024-2025 Interval: The chart now reveals one other promote sign shut to the current, suggesting that Bitcoin BTC might have already peaked or is approaching the highest of this cycle.Latest Developments and ForecastThe most recent information reveals a promote sign showing in 2024-2025, much like earlier cycles.This means that the indicator has simply issued a promote sign, aligning with earlier peaks in 2013, 2017, and 2021. Traditionally, after every of those alerts, BTC has skilled a correction part lasting 6-12 months.Whereas this doesn’t essentially verify that Bitcoin has entered a bear market, it means that BTC may face a interval of correction or sideways motion within the close to future

Supply: X

On-chain metrics signaling a bear market:

Indicators reminiscent of MVRV, SOPR, and NUPL all present a downward pattern, reflecting damaging market sentiment and a possible entry right into a bear market.

Supply: X

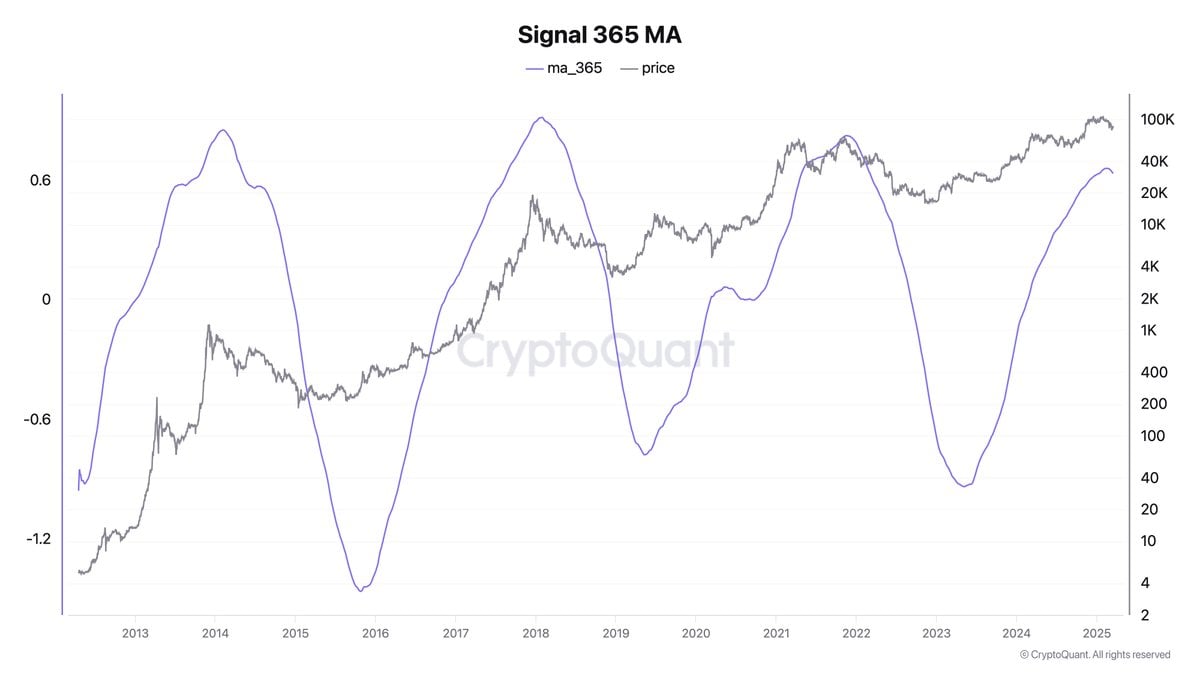

Chart ConstructionBlack line: Represents Bitcoin’s worth over time (logarithmic scale).Blue line (ma_365): The 365-day shifting common calculated from on-chain information, reflecting the market’s long-term momentum.Historic Developments and Forecast2013-2014: The ma_365 index peaked, resulting in Bitcoin reaching an all-time excessive of roughly $1,100, adopted by a pointy decline in 2015.2017-2018: The ma_365 index peaked once more, with Bitcoin reaching an all-time excessive of round $20,000, earlier than experiencing a major drop in 2018.2020-2021: The ma_365 index reached its highest stage ever, coinciding with Bitcoin’s all-time excessive of $69,000, adopted by a deep correction in 2022.2024: The ma_365 index is presently rising strongly, indicating that the market is in an enlargement part, however it has not but reached the height ranges seen in earlier cycles.Market Alerts for TradersThe MVRV Ratio (Market Worth to Realized Worth) is approaching a crucial zone, much like earlier market peaks. This means that Bitcoin could also be nearing an overheated part.The SOPR (Spent Output Revenue Ratio) signifies that many traders are promoting Bitcoin at a loss, signaling a shift away from profit-taking conduct.The NUPL (Web Unrealized Revenue/Loss) reveals a decline in unrealized income, a sample that has traditionally preceded market corrections.

These indicators have appeared in previous bear markets, suggesting that Bitcoin could also be coming into a part of elevated threat or potential market adjustment.

New liquidity drying up:

Institutional capital inflows and Bitcoin ETFs have declined, resulting in an absence of liquidity to help BTC costs. For instance, BlackRock’s Bitcoin ETF has recorded three consecutive weeks of outflows.

Whales promoting BTC at decrease costs:

Giant Bitcoin holders (Whales) are offloading their BTC at cheaper price ranges, including downward strain to the market.

Is Bitcoin Actually Coming into a Bear Market?

Primarily based on these elements, Bitcoin BTC is going through sturdy downward strain and may very well be coming into a bear market. Nevertheless, the cryptocurrency market is inherently unstable and tough to foretell. Traders ought to stay cautious, intently monitor key market indicators, and keep knowledgeable to make sound funding choices.

DeFi’s Underperformance in 2025

Decentralized Finance (DeFi) was anticipated to be a key driver of the crypto bull cycle, offering decentralized monetary providers reminiscent of lending, borrowing, staking, and yield farming. Nevertheless, as of early 2025, DeFi has been underperforming and has not met preliminary expectations. Under is an in depth evaluation based mostly on current information and analysis, as of March 19, 2025.

Background and Preliminary Expectations

DeFi is a decentralized monetary ecosystem constructed on blockchain expertise, permitting customers to conduct monetary transactions with out intermediaries reminiscent of banks or conventional monetary establishments. Throughout the uptrend, DeFi was anticipated to draw extra capital by yield farming, staking, and revolutionary monetary merchandise.

Based on Exploding Subjects, in 2020, DeFi’s Complete Worth Locked (TVL) elevated 14 instances, and by 2021, TVL peaked at $112.07 billion, demonstrating its progress potential throughout bull markets. The expectation was that DeFi would proceed to drive the following uptrend, with TVL hovering as a consequence of new capital inflows from each retail and institutional traders.

Actuality: DeFi’s Underperformance

Nevertheless, current information means that DeFi has confronted a number of challenges, resulting in lower-than-expected efficiency. Key elements embody:

Declining Complete Worth Locked (TVL)

TVL is a vital indicator reflecting the well being and exercise of DeFi, measuring the entire worth of belongings locked in DeFi protocols. Based on DeFiLlama, in December 2024, TVL reached $140 billion, however by March 2025, it had dropped to $90 billion. This sharp decline alerts lowering liquidity and investor confidence. Potential causes embody:

Traders withdrawing funds as a consequence of safety issues, particularly following main hacks.The broader crypto market is present process a correction, affecting the worth of locked belongings.

Regulatory Challenges

Unclear regulatory frameworks, significantly in main markets just like the U.S., have change into important limitations. AML (Anti-Cash Laundering) and KYC (Know Your Buyer) laws impose compliance hurdles, discouraging massive monetary establishments from partaking with DeFi. This has restricted institutional capital inflows, which had been anticipated to propel DeFi progress throughout the bull run.

Moreover, regulatory uncertainty within the U.S. has compelled many DeFi initiatives to pause or modify their methods, slowing their total growth.

Scalability and Transaction Prices

Main blockchains like Ethereum—the first DeFi platform—nonetheless wrestle with scalability, processing solely round 15 transactions per second (TPS), a lot slower than blockchains like Solana.

Nevertheless, the Layer-2 ecosystem, together with Arbitrum and Optimism, has considerably improved scalability, rising the entire TPS to round 592 as of January 2025. Whereas this has helped speed up transactions for DeFi functions, it has not but absolutely resolved Ethereum’s limitations.

Based on L2Beat, TVL on Layer-2 options grew by 232% in a yr, surpassing $37 billion, however these options haven’t but fully changed the necessity for Ethereum mainnet transactions.

Conclusion

Bitcoin is exhibiting indicators of coming into a correction part, with on-chain indicators like PnL Index, 365 MA Sign, MVRV, SOPR, and NUPL reflecting elevated promoting strain and declining liquidity. Whereas not confirming a bear market, historic information suggests a 6-12 month interval of market consolidation or decline.

On the identical time, DeFi has underperformed in 2025, going through declining TVL, regulatory hurdles, safety issues, and scalability challenges. Regardless of the adoption of Layer-2 options, DeFi has but to fulfill expectations as a key progress driver.

Will the market view of the CryptoQuant CEO be right this time, and can there be any bullish waves in 2025?