In response to the most recent on-chain information, Bitcoin miners refuse to dump their BTC holdings regardless of profitability being traditionally low.

BTC Transaction Charges At Lowest Stage Since 2012

In a brand new publish on X, blockchain analytics agency Alphractal revealed that Bitcoin miners are nonetheless holding on to their reserves regardless of the decline in income. The on-chain information platform mentioned the explanations behind this development and its potential implications on the BTC mining trade.

Firstly, Alphractal highlighted low on-chain exercise on this cycle as one of many causes behind the numerous decline in miner revenues. Because of the diminished exercise, the whole transaction charges paid on the Bitcoin community have dropped to their lowest ranges since 2012.

The market intelligence platform additionally talked about that the mining problem has remained excessive regardless that the hash price just lately witnessed a drop. Usually, there’s a direct relationship or constructive correlation between the hashrate and mining problem. Nevertheless, in accordance with Alphractal, this latest lag or dissociation additional strains miner profitability and delays community equilibrium.

Moreover, Alphractal revealed on X that the Bitcoin hash price volatility has reached new all-time highs. This mainly implies that the community is witnessing the best hash price fluctuations or adjustments in its historical past.

The blockchain analytics agency added:

That is seemingly brought on by giant mining operations shutting down ASIC machines, probably as a result of falling revenues and low community demand.

Supply: @Alphractal on X

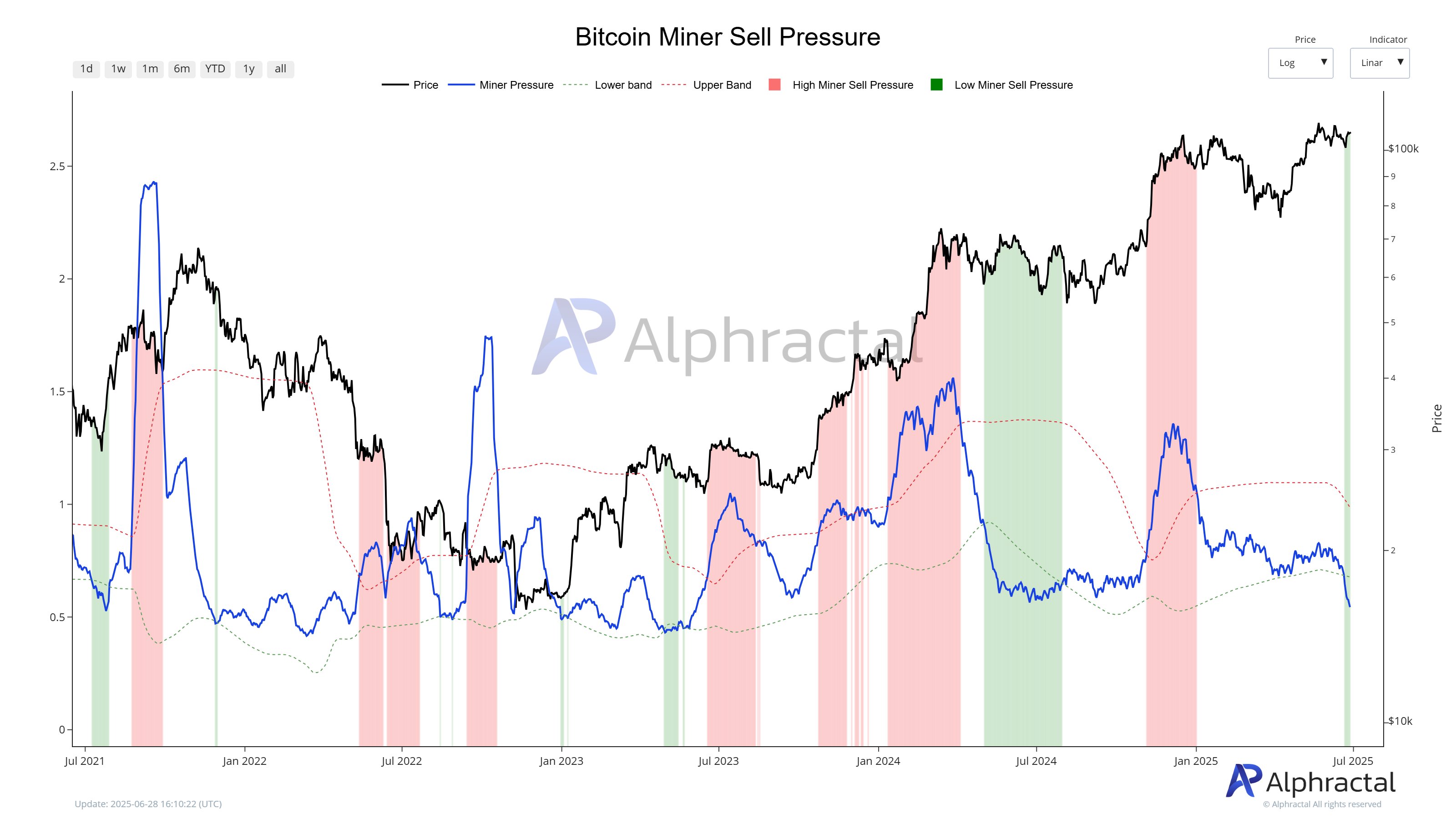

Regardless of the community revenues and the excessive mining problem, promoting stress from miners has remained at low ranges. As exhibited by the low Miner Promote Stress metric, this means that miners should not aggressively offloading their holdings for revenue.

Alphractal admitted that the low promoting stress from miners is a constructive signal, particularly for the value of Bitcoin. The blockchain agency famous the opportunity of some mining swimming pools cutting down their operations in response to the decreased exercise on the Bitcoin community. “As BTC trades above $107K, we could merely be witnessing miners reallocating their hash energy to adapt to the present demand,” Alphractal added.

Usually, BTC miners are inclined to promote their cash for revenue in periods of speedy value will increase and excessive blockchain exercise. Nevertheless, Alphractal believes the present absence of each suggests a interval of adjustment slightly than capitulation amongst the miners.

Bitcoin Worth At A Look

As of this writing, BTC is valued at round $107,375, persevering with its sideways motion with a mere 0.3% improve up to now 24 hours.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.