After setting a brand new all-time excessive of $124,500, Bitcoin is now battling to carry the $115,000 degree as help. The bulls, who dominated simply days in the past, are struggling to spark a contemporary rally, leaving the market in a fragile part. Whereas fundamentals similar to institutional adoption and robust holder demand proceed to help the broader uptrend, capital flows recommend a brand new dynamic is at play.

A number of analysts observe indicators of capital rotation from Bitcoin into altcoins, a sample that always marks transitions between phases of the market cycle. Ethereum, specifically, is rising as a serious vacation spot for this shift.

Including to the intrigue, on-chain intelligence agency Lookonchain has been monitoring the actions of a long-dormant Bitcoin OG whale, who has reawakened with extraordinary exercise. On Friday, the whale deposited 300 BTC ($34.86 million) into Hyperliquid to promote for Ethereum. His daring technique is paying off: he’s now sitting on over $100 million in unrealized earnings.

The whale presently holds a 135,265 ETH ($581M) lengthy place at a $4,295 common entry, up $58 million, and in addition gathered 122,226 ETH ($535M) spot at a $4,377 common, up $42 million. This aggressive rotation underscores a pivotal second—one the place Bitcoin consolidates, however altcoins, led by Ethereum, might seize the highlight.

Bitcoin OG’s Daring Rotation Into Ethereum

Based on Lookonchain, the mysterious Bitcoin OG whale continues to dominate market headlines with aggressive on-chain strikes. Most not too long ago, he transferred one other 4,000 BTC (~$460 million) into exchanges, the place the funds had been transformed into Ethereum. This marks one more large-scale repositioning that has captured the eye of analysts and buyers alike.

Thus far, the whale has gathered a staggering 179,448 ETH (~$806 million) at a mean worth of $4,490, alongside a 135,265 ETH ($581 million) lengthy place that continues to be open. These daring allocations underscore a decisive rotation technique away from Bitcoin and into Ethereum, suggesting a guess on ETH’s outperformance within the coming part of the cycle.

The implications are important. On one hand, such a large capital shift highlights rising institutional-style conviction in Ethereum because it pushes by means of all-time highs and challenges Bitcoin’s dominance. However, it raises considerations about short-term volatility.

Analysts warn that regardless of the bullish outlook, a shakeout might happen earlier than sustained positive aspects materialize. With leverage in derivatives markets climbing and liquidity thinning in spot buying and selling, sharp pullbacks might simply flush out overextended positions.

Bitcoin Vs. Ethereum: Weekly Chart Evaluation

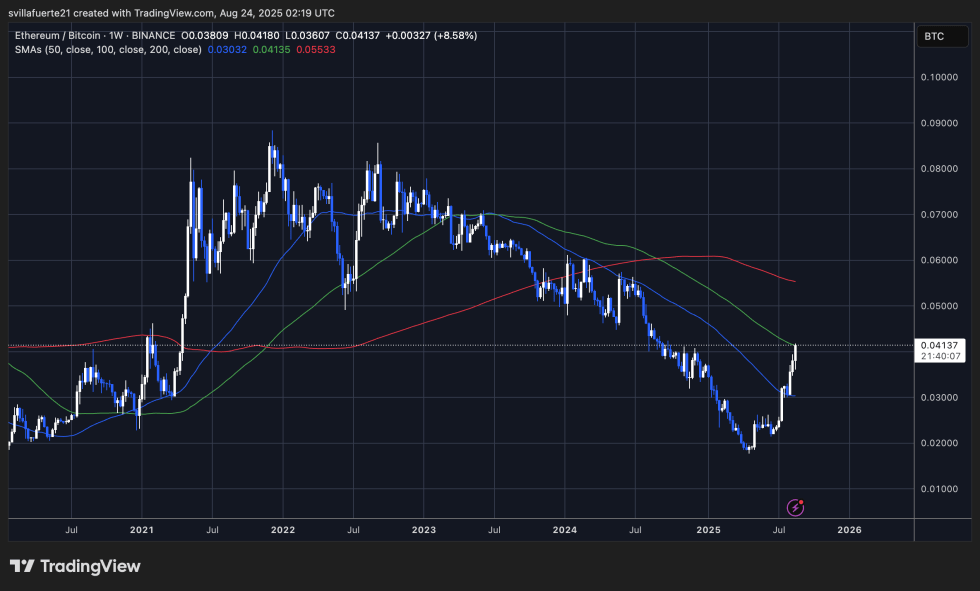

The ETH/BTC weekly chart exhibits Ethereum gaining important floor in opposition to Bitcoin after a protracted downtrend that lasted from mid-2022 to early 2025. ETH has now rallied to the 0.041 BTC degree, posting sturdy bullish candles and reclaiming key transferring averages. The 50-week SMA (blue) has simply been damaged to the upside, and worth is testing the 100-week SMA (inexperienced), an essential resistance zone. If ETH manages to maintain momentum above this degree, the following key goal lies close to the 200-week SMA (pink) round 0.055 BTC.

This rotation is particularly essential as a result of ETH has been underperforming Bitcoin for over two years. The current surge alerts a possible capital rotation from BTC into ETH, a development bolstered by massive institutional buys and whales shifting positions into Ethereum.

On the draw back, if ETH/BTC faces rejection on the present resistance, the pair might retest help round 0.035 BTC, which aligns with earlier consolidation. Nonetheless, momentum indicators recommend energy is presently with Ethereum.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.