Bitcoin continues to commerce above the essential $100,000 stage, exhibiting resilience regardless of dealing with resistance close to $110,000. Bulls stay answerable for the broader development, however momentum seems to be slowing as macroeconomic tensions intensify. Ongoing world uncertainties, together with tariff disputes and bond market volatility, have launched a brand new wave of warning throughout risk-on belongings.

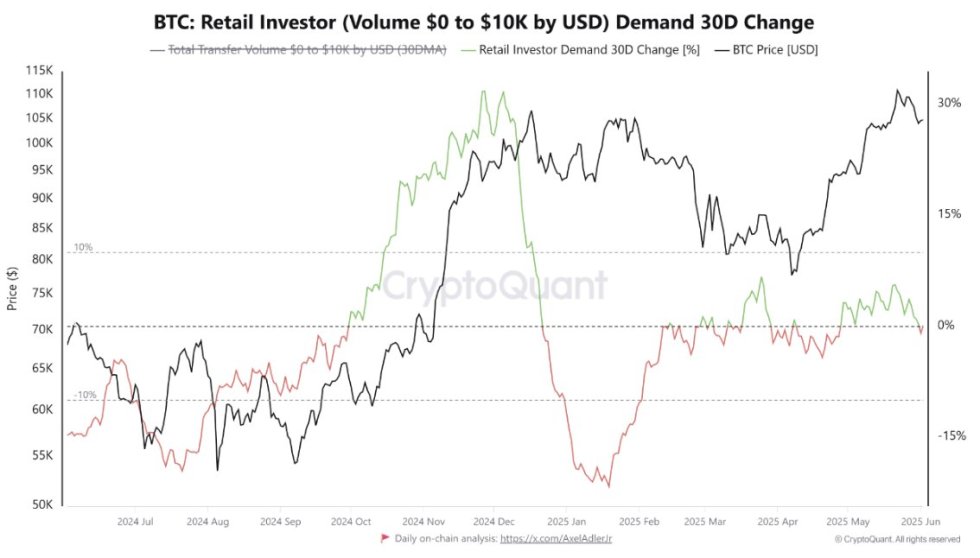

Whereas Bitcoin’s worth motion stays robust on the floor, undercurrents in on-chain exercise reveal a extra cautious tone. Based on CryptoQuant, retail demand—measured by on-chain transactions involving as much as $10,000—has declined by roughly 2.45% during the last 30 days. This drop means that smaller buyers haven’t but entered the market with the keenness usually seen throughout euphoric phases of a bull run.

Though many retail contributors could now be choosing oblique publicity via ETFs or institutional merchandise, the dearth of aggressive retail inflows on-chain is a notable sign. For now, the market construction stays wholesome, however a stronger wave of demand from smaller buyers could also be wanted to gas a sustainable push above all-time highs. Till then, Bitcoin could proceed consolidating close to present ranges whereas awaiting a decisive breakout catalyst.

Bitcoin Faces A Essential Check As Retail Demand Lags Behind

Bitcoin is now buying and selling at a essential juncture. After reaching an all-time excessive of $112,000, bulls are combating to reclaim upward momentum, whereas bears have but to set off a significant retrace. The value stays above $105,000, a powerful signal of resilience amid rising macroeconomic volatility. International tensions—significantly the continued U.S.-China tariff standoff and rising bond yields—proceed to shake markets and maintain buyers cautious.

Regardless of Bitcoin’s power, sentiment stays divided. Many analysts level to the unsure bond market and systemic dangers as key drivers of each alternative and concern. Whereas institutional flows and ETF exercise supply some help, on-chain knowledge suggests the market is much from euphoric.

CryptoQuant knowledge reveals a 2.45% decline in retail demand over the previous 30 days, measured by BTC transactions of $10,000 or much less. This metric displays smaller investor habits, and its downtrend implies that the retail crowd has not but jumped in with full confidence. Whereas a few of this capital could now circulate via ETFs and custodial platforms, the dearth of robust on-chain indicators from retail merchants tempers speedy bullish expectations.

Nonetheless, this will not be completely damaging. The absence of retail euphoria may imply the present construction has room to develop, with the potential for an additional wave of sustainable upside, if demand returns. For now, Bitcoin holds its floor, however the subsequent transfer will rely closely on exterior catalysts and broader market sentiment.

BTC Technical Evaluation: Value Stays Vary-Certain

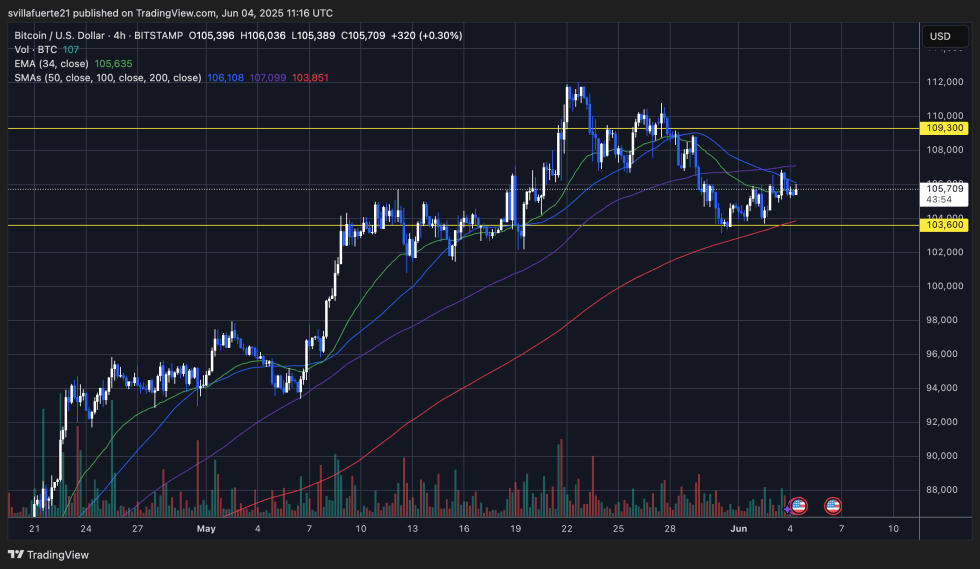

Bitcoin is buying and selling round $105,700, holding above the important thing help at $103,600 after bouncing off this stage a number of occasions. This space continues to behave as a stable demand zone, providing a base for potential upside if momentum builds. On the 4-hour chart, BTC stays range-bound between $103,600 and $109,300, with sideways motion dominating worth motion because the Might rejection at all-time highs.

The 34 EMA is offering short-term dynamic help close to $105,600, whereas the 100 and 200 SMAs sit barely above and under the present worth, compressing BTC inside a decent construction. This means {that a} decisive transfer could also be nearing. If Bitcoin breaks and closes above $106,900, the subsequent key resistance at $109,300 might be examined once more, with potential to increase greater.

Nonetheless, an in depth under $103,600 would break the bullish construction and open the door for additional draw back, presumably towards the $100,000 psychological stage. Quantity has remained low, which highlights market indecision, with contributors ready for a macro or technical catalyst.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.