Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value slumped 10% during the last week and a fraction of a % up to now 24 hours to commerce at $94,986 as of two:37 a.m. EST on buying and selling quantity that soared 59% to $78.2 billion.

This comes as Michael Saylor hinted at one other Bitcoin buy from Technique (MSTR) this week. Saylor posted on X with the phrases “Huge Week” and a portfolio chart, which normally signifies a plan to purchase extra BTC.

Within the publish, Saylor included a chart displaying that Technique now has round 641,692 BTC in its hoard valued at $61 billion.

₿ig Week pic.twitter.com/a27eg6Kw4v

— Michael Saylor (@saylor) November 16, 2025

The brand new buy would arrive at a time when the market goes by a unstable interval after falling under the psychologically necessary $100k stage.

Spot Bitcoin ETFs (exchange-traded funds) recorded a internet outflow of $1.11 billion final week, marking the third consecutive week of outflows, in line with SoSoValue information.

Peter Schiff Predicts Technique’s Chapter

In one other improvement, Bitcoin permabear Peter Schiff stated Technique is a ”fraud” that may finally go bankrupt.

Schiff’s stand comes from issues concerning the corporate’s monetary stability amid ongoing volatility.

MSTR’s total enterprise mannequin is a fraud. Saylor and I’ll each be talking at Binance Blockchain Week in Dubai in early December. I problem @saylor to debate this proposition with me. No matter what occurs to Bitcoin, I consider $MSTR will finally go bankrupt. Let’s go!

— Peter Schiff (@PeterSchiff) November 16, 2025

Schiff additionally continues to warn folks from shopping for BTC. ”I warn individuals who don’t personal Bitcoin to not purchase, and advise those that do personal it to get out earlier than the ultimate crash,” he stated.

Bitcoin Value Consolidating Round The $95,000 Zone – Breakout Incoming?

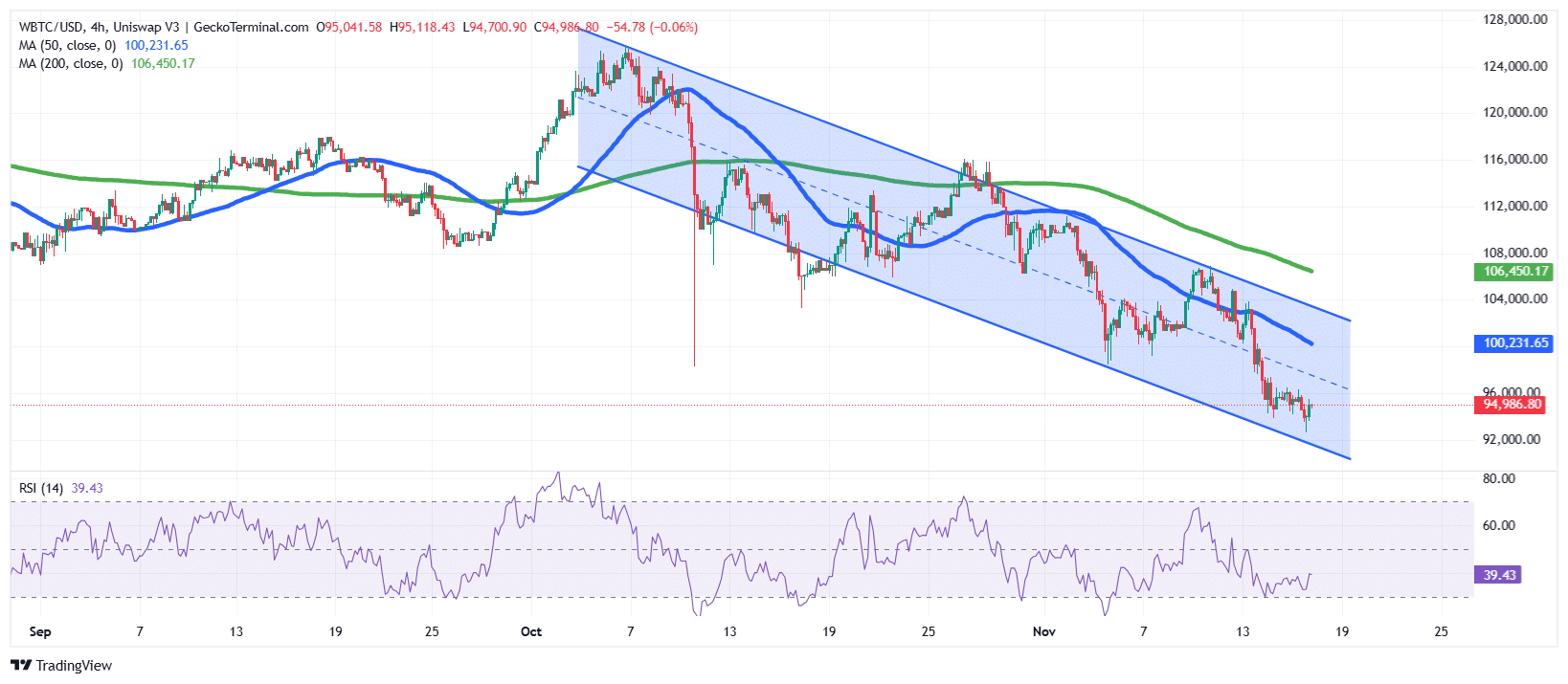

On the 4-hour timeframe, the BTC/USD chart evaluation reveals that the BTC value went by a sustained surge in October to the touch the $126,080 all-time excessive (ATH).

Nonetheless, bulls couldn’t maintain this stage, because the bears took cost, driving the value by a falling channel sample. The sustained drop noticed the Bitcoin value fall under the $100,000 stage, reaching round $93,000.

At present, the bulls are aiming for a breakout, with the value of Bitcoin now consolidating between $94,000 and $95,000, as they eye a restoration.

Because of the bearish pattern over latest weeks, BTC is now buying and selling under each the 50-day ($100,231) and 200-day ($106,450) Easy Transferring Averages (SMAs), supporting the general bearish stance.

In the meantime, the Relative Energy Index (RSI) after Bitcoin surged from under the $94,000 zone seems to be recovering from the 30-oversold stage to the present 39. This stage nonetheless reveals that BTC bulls want sustained shopping for stress to regain management and push the value again above $100,000.

In keeping with the evaluation, BTC appears to be consolidating inside the $95,000 stage. The surging RSI might sign renewed curiosity and bulls shopping for the underside.

If the value of Bitcoin recovers and breaks out of the $95,500 zone, the following key resistance ranges and targets might be the 50-day and 200-day SMAs, $100,231 and $106,450, respectively.

Conversely, if bearish stress persists inside the falling channel, Bitcoin might drop again to the channel’s decrease boundary, round $91,700, within the coming days.

This outlook is supported by analyst Scott Melker, with over 1 million followers, who notes that Bitcoin closed under the 50 MA on the weekly chart, which acts as a high bearish indicator.

Bitcoin closed under the 50 MA on the weekly chart.

This has at all times been a bear market indicator – each time for 15 years.

Possibly this time is totally different? https://t.co/GdEsyqIHu3

— The Wolf Of All Streets (@scottmelker) November 17, 2025

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection