.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

Value

Quantity in 24h

<!–

?

–>

Value 7d

2025 worth surge shines in Google Traits, with ‘Bitcoin worth’ searches hovering, mirroring previous bull runs. Queries like ‘BTC worth prediction’ and ‘Bitcoin 2025’ are spiking, led by the U.S., South Korea, and Germany. ‘Bitcoin technical and market evaluation’ can be trending, hinting at a crypto chart-savvy crowd. Search quantity tracks rising media and X chatter, the place merchants analyse each transfer. Google Traits reveals Bitcoin dominating consideration, with information suggesting extra positive aspects forward.

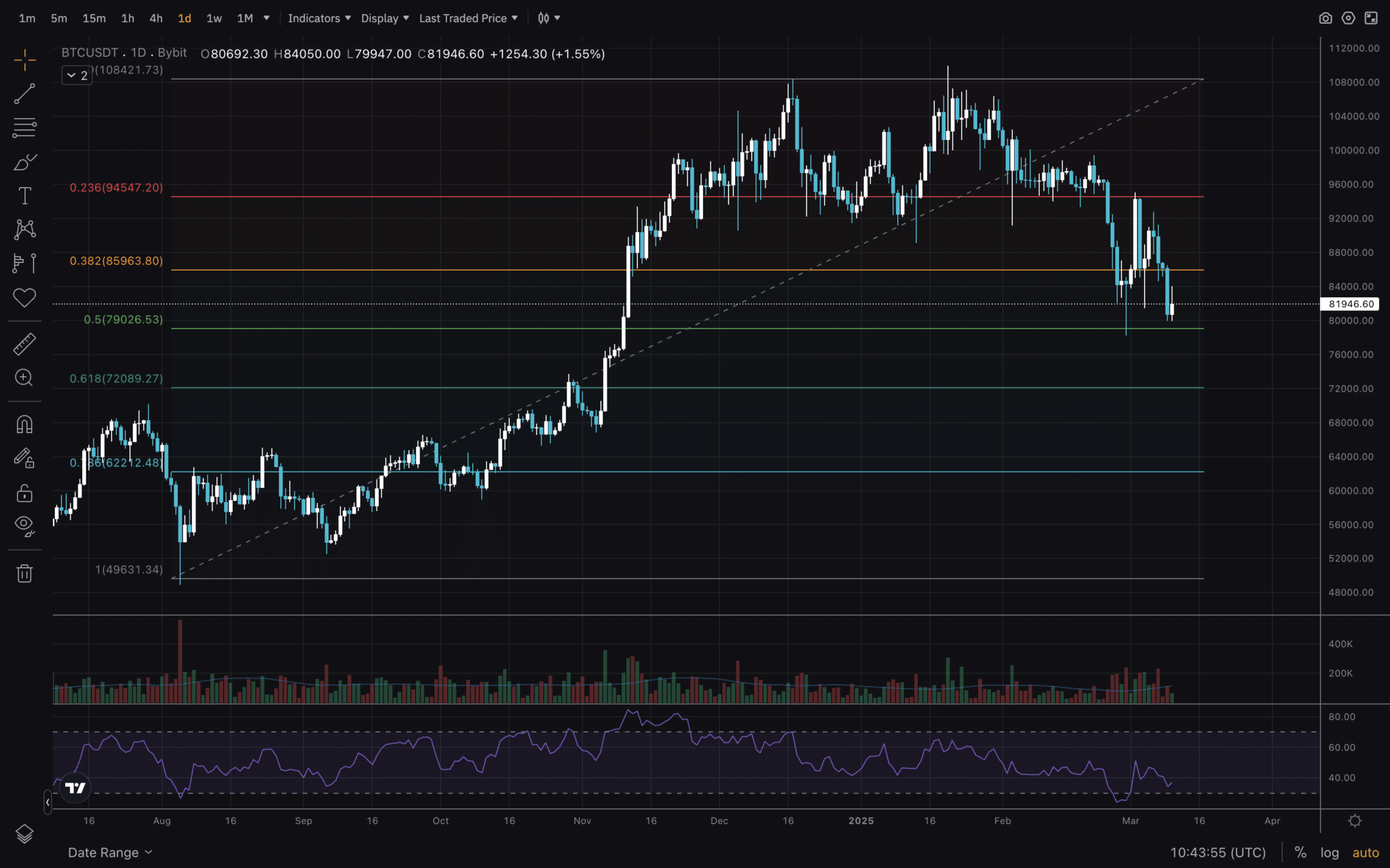

#Bitcoin is constructing a fats bullish divergence, bouncing from oversold territory. pic.twitter.com/q2GwMZVUWh

— Jelle (@CryptoJelleNL) March 10, 2025

Bitcoin Value Surge in 2025 – Technical Evaluation

Bitcoin Value Surge 2025: Traits and Evaluation

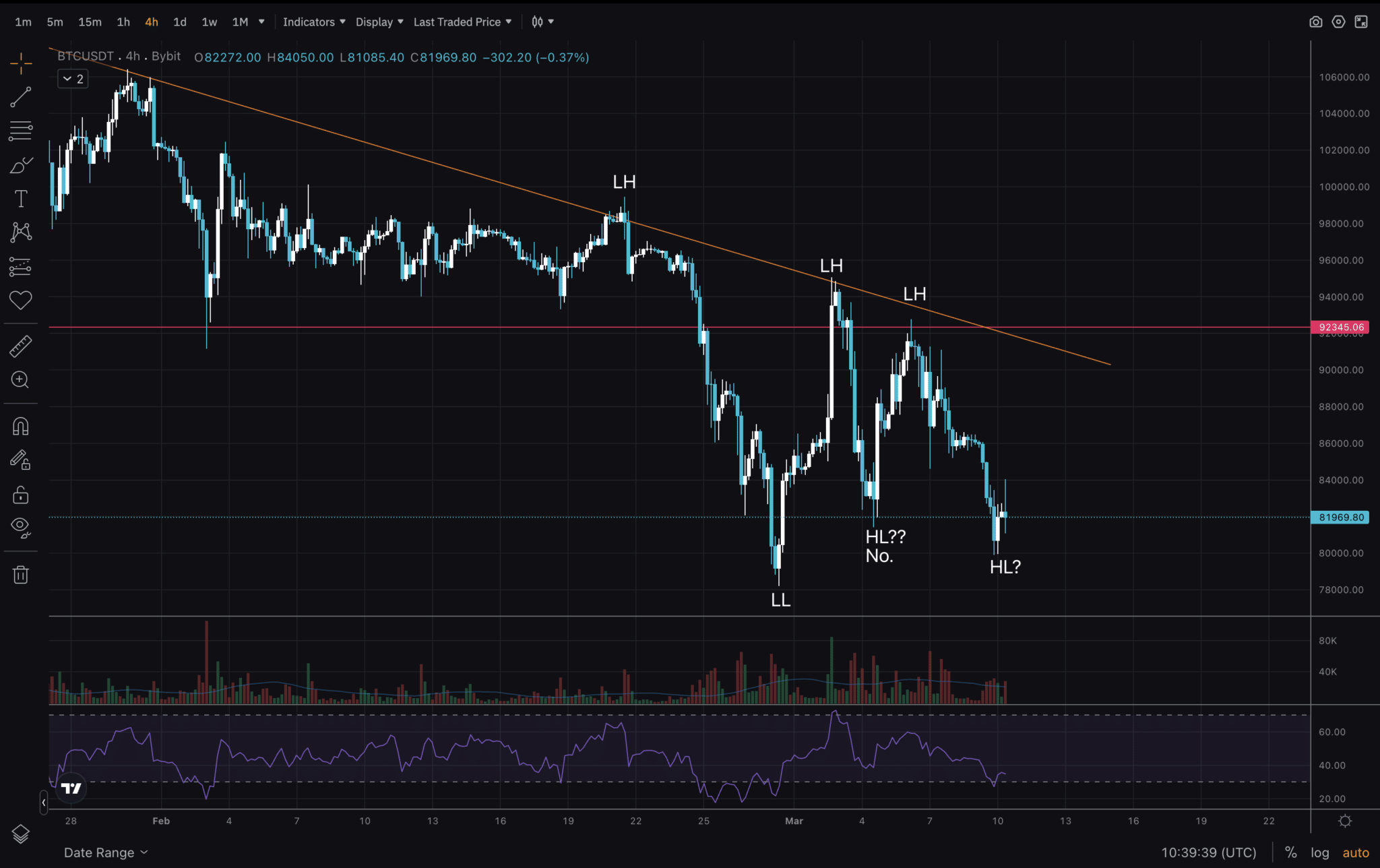

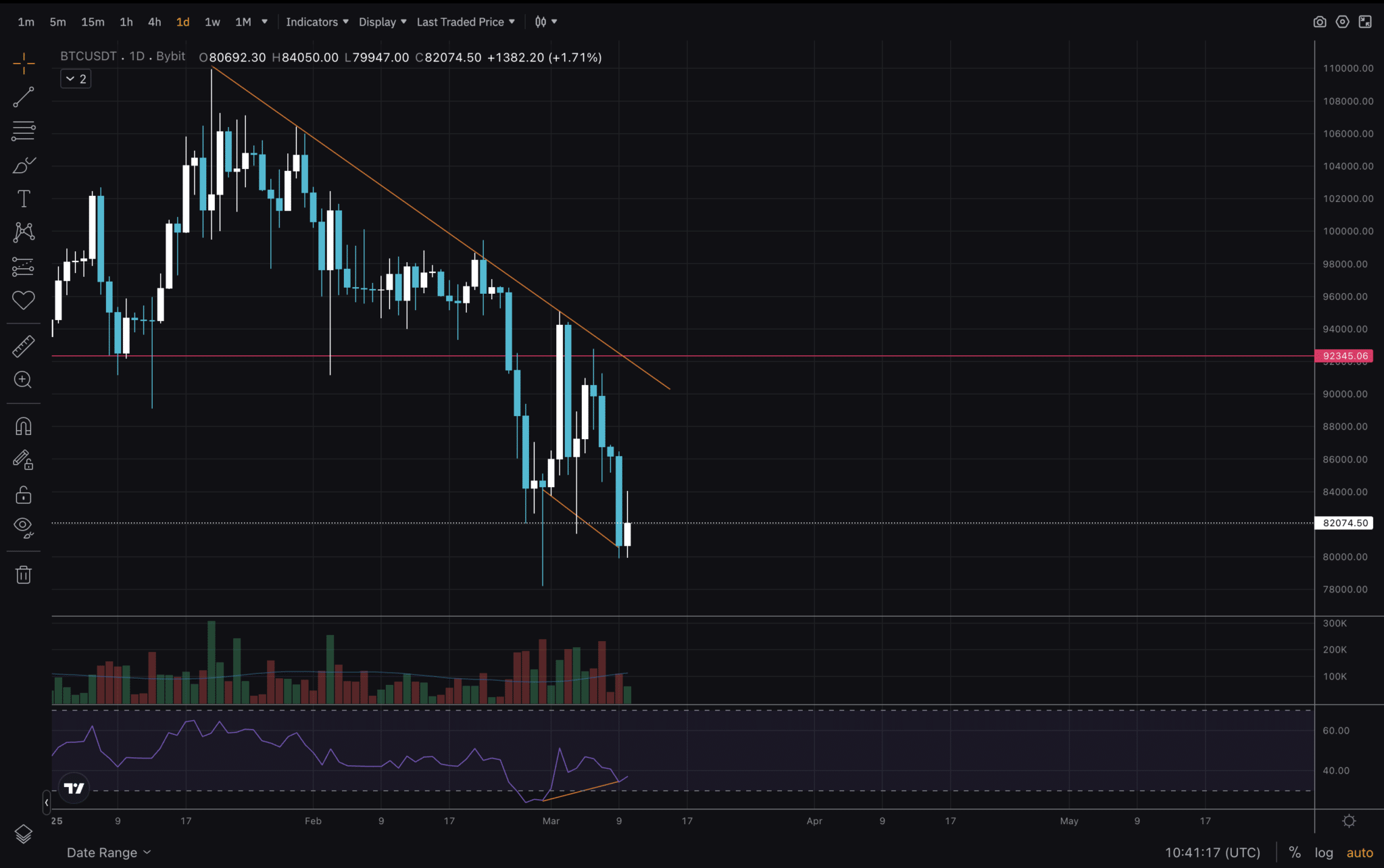

BTC remains to be searching for a backside.

RSI Bullish Divergence.

Goal to reclaim remains to be $92,000.

Google searches on bitcoin are rising.

The submit Bitcoin Value Surge 2025: Traits and Evaluation appeared first on 99Bitcoins.