Is Bitcoin poised to hit $110,000? With $16B in leveraged shorts vulnerable to liquidation and powerful institutional shopping for, BTCUSDT might surge to new all-time highs.

Earlier this week, Changpeng Zhao, the founding father of Binance, urged retail buyers to purchase Bitcoin now, stating they’ve had 15 years to speculate.

In an interview, Zhao predicted the coin might soar to $500,000 by year-end. Who is aware of? If momentum stays, by the top of subsequent yr, BTCUSDT may double from $500,000 to $1 million.

DISCOVER: High 20 Crypto to Purchase in Could 2025

Brief Squeeze to $110,000?

Alternate information suggests bulls are gearing up for this cycle. An analyst on X famous that $16 billion in leveraged shorts shall be forcibly liquidated if Bitcoin closes above $99,900.

(Supply)

That’s no small sum.

With bulls in management and Bitcoin surging, the anticipated quick squeeze might push costs previous $100,000 and, later, $110,000 in a continued bullish development. In flip, a few of the finest meme coin ICOs in Could 2025 may gain advantage.

This upward transfer may be the beginning. In Q1 2025, costs crashed after hitting $110,000, dropping to $74,500 and retesting 2021 highs. If BTCUSDT retests $110,000, bulls might drive the coin to new all-time highs, a step towards $500,000.

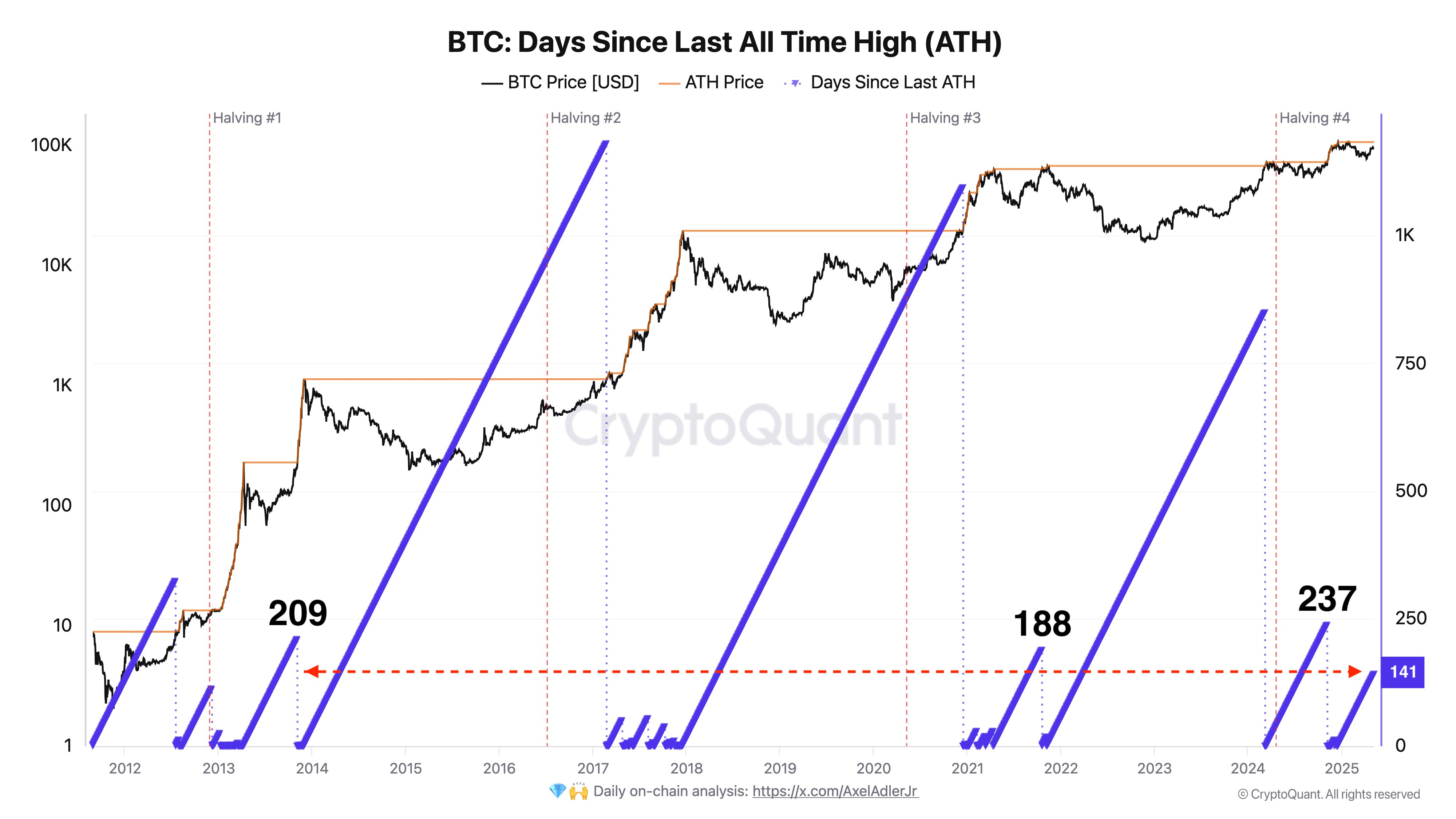

Historic information help this forecast. Bitcoin usually takes 211 days to reclaim a brand new all-time excessive after a earlier peak.

(Supply)

It’s been roughly 145 days because the final excessive in January, which means Bitcoin might hit new highs throughout the subsequent two months.

Bullish Case for Bitcoin

Some analysts count on BTCUSDT to interrupt out sooner, pumping the finest high-risk, high-reward cryptos.

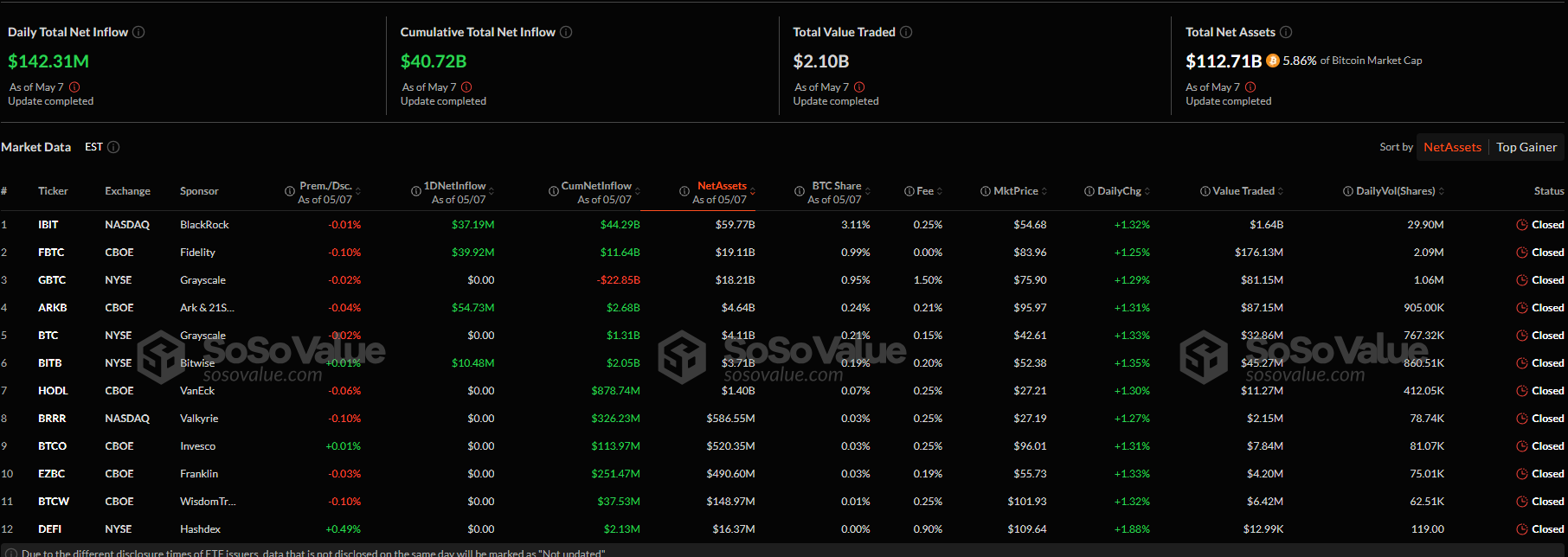

SosoValue information reveals U.S. establishments bought $142 million in spot Bitcoin ETFs, that are instantly backed by BTC. Regardless of uneven value motion, there have been no outflows. Most establishments favored Constancy’s FBTC spot Bitcoin ETFs.

(Supply)

As reported by 99Bitcoins, BlackRock, a worldwide asset administration large, elevated its Bitcoin publicity. In the meantime, extra U.S. states and public companies are allocating billions to build up Bitcoin.

Though the Federal Reserve didn’t minimize charges yesterday, economists count on a price drop on the June 2025 assembly. President Donald Trump has urged Jerome Powell and the FOMC to decrease charges, citing cooling inflation and lowered want for prime borrowing prices.

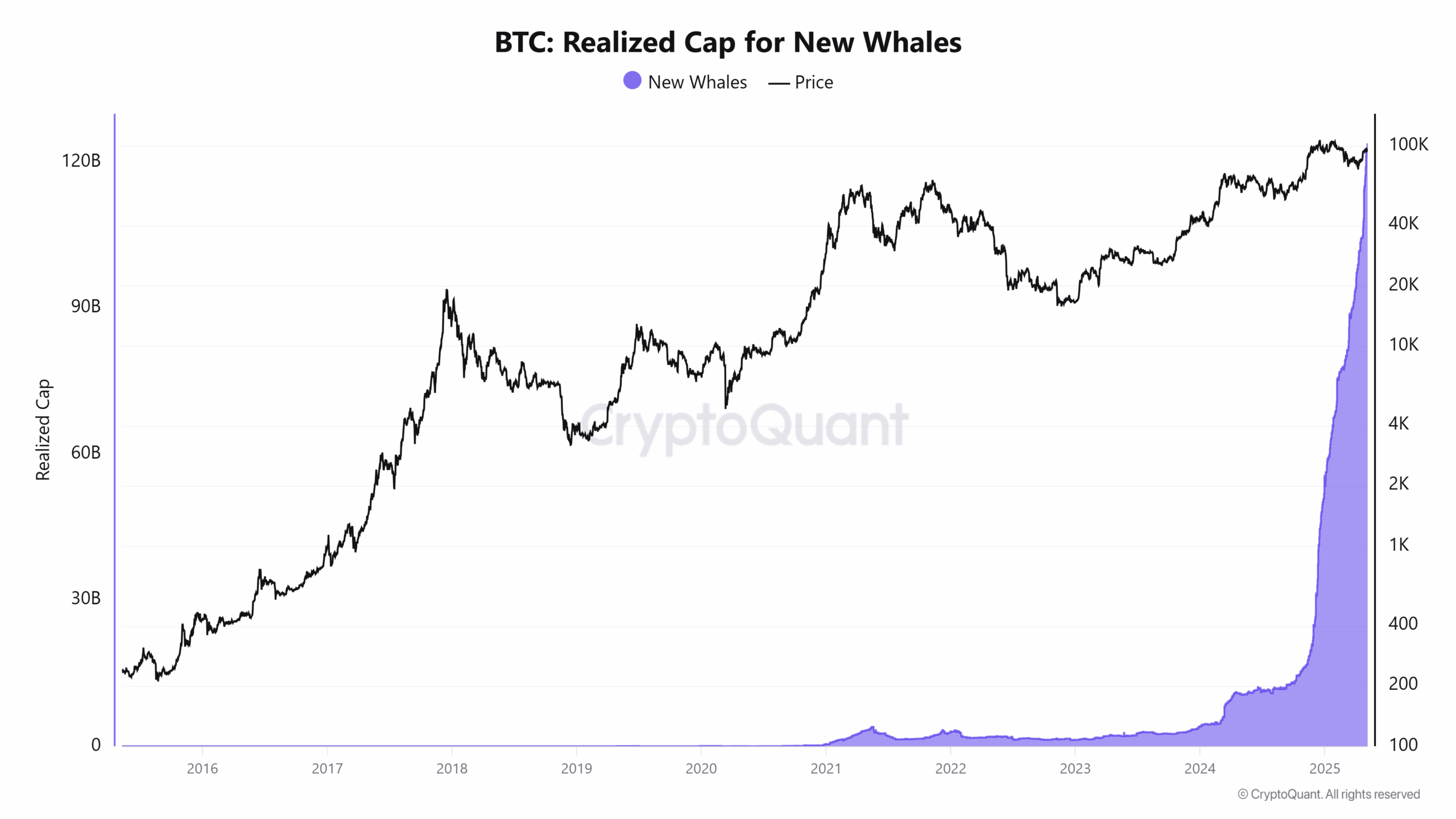

Onchain information additional bolsters the bullish case. New whales are quickly accumulating, holding extra BTC than long-term holders for the primary time.

In keeping with CryptoQuant, the realized cap of recent whales accounts for 52.4% of all whale-held cash. Their common entry value is $91,922, roughly 3 times that of older whales, who purchased at $31,765.

(Supply)

The rising dominance of recent whales indicators a large capital influx into Bitcoin.

DISCOVER: Subsequent 1000x Crypto – 12 Cash That May 1000x in 2025

Will Bitcoin Hit $110,000, $16B Shorts Face Liquidation

Over $16 billion in leveraged shorts might be liquidated if BTC breaks $99,900

U.S. establishments poured $142M into spot Bitcoin ETFs in 24 hours. BlackRock additionally shopping for

New Bitcoin whales are dominant as new capital pours

Will BTCUSDT print new all-time highs above $110,000?

The submit Bitcoin to $110,000 Inevitable? Over $16B in Leveraged Shorts Set to Be Liquidated at $99,900 appeared first on 99Bitcoins.