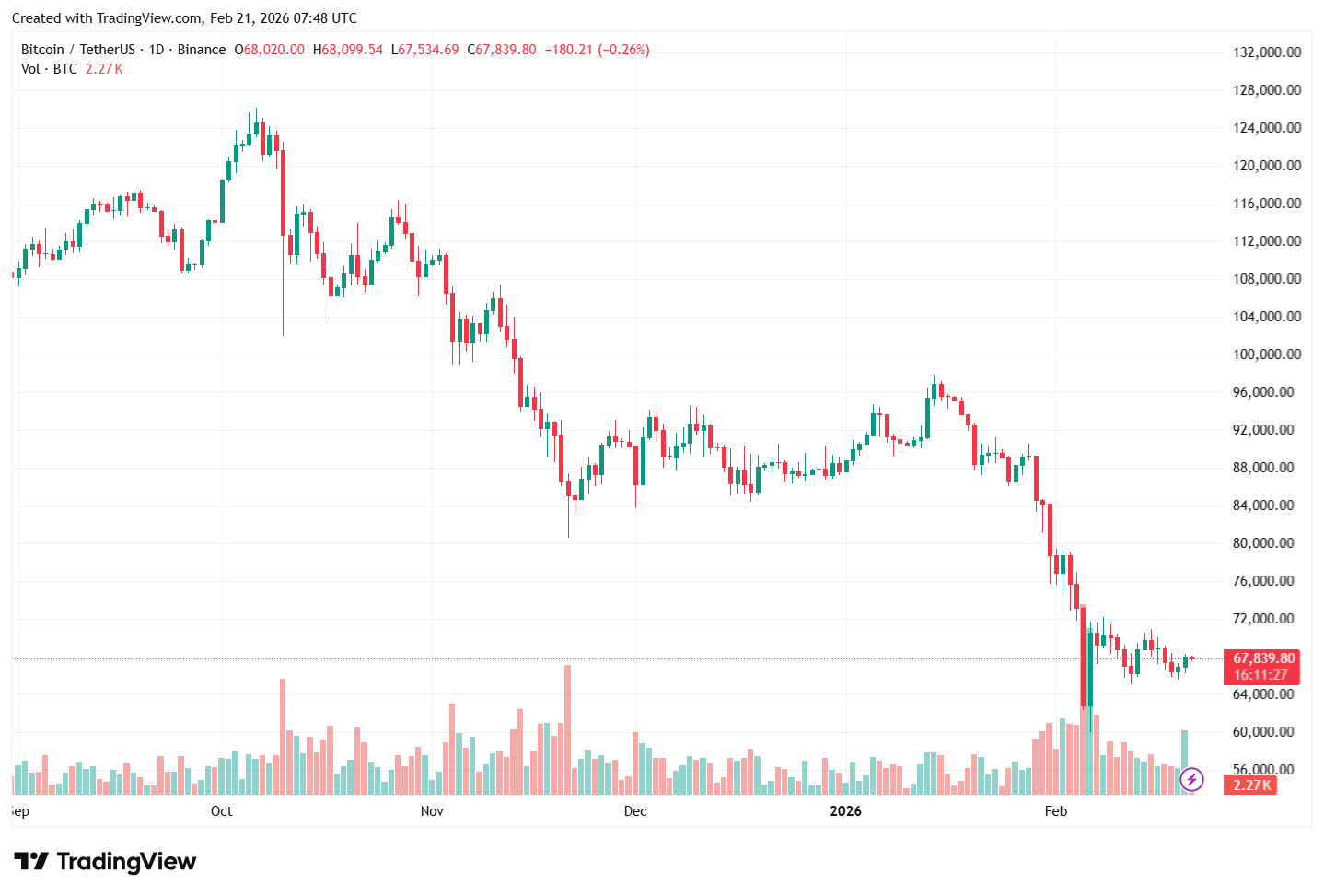

The value of Bitcoin has been caught in a consolidation vary beneath $70,000 to date this week, after spending a lot of the earlier weekend above it. Whereas the flagship cryptocurrency’s value motion has been largely — and painfully — sideways in current weeks, this represents a notable enchancment from how the month of February began.

The brand new month ushered in a recent low simply above the $61,000 stage for Bitcoin, confirming the beginning of the bear market. Amidst the relative stability in current weeks, a current on-chain analysis means that BTC and the broader cryptocurrency mark remains to be prone to additional draw back volatility.

BTC’s Future In The Arms Of Massive Traders: CryptoQuant

Within the final bull cycle, the worth motion of Bitcoin was closely influenced and impacted by the elevated inflow and exercise of institutional traders (primarily via the spot exchange-traded funds). Equally, it seems that the big investor cohort will nonetheless be on the wheel even in the course of the bear market.

In accordance with CryptoQuant’s newest market report, the Bitcoin trade inflows — and the speedy promoting stress — have normalized for the reason that capitulation spike in early February. This development might be seen within the decline in trade inflows from round 60,000 BTC at the beginning of the month to round 23,000 BTC now.

Whereas the acute sell-off section seems to be easing off, a troubling development appears to be brewing amongst Bitcoin’s largest traders. In its market report, CryptoQuant highlighted that the BTC trade whale ratio has climbed to 0.64, its highest stage since 2015, suggesting that whale inflows account for a good portion of the trade deposits being seen.

Supply: CryptoQuant

In the meantime, the common BTC deposit measurement has additionally reached a stage not seen since mid-2022, in the course of the warmth of the final bear market. This development additional reinforces the concept institutional or giant traders are behind the growing trade provide.

CryptoQuant famous that the altcoin market remains to be dealing with elevated distribution stress, with the common every day variety of altcoin trade deposits rising from 40,000 in This fall 2025 to 49,000 in 2026. This steady capital rotation out of riskier belongings displays weakened market confidence and will increase the danger of draw back volatility.

![[20 February 2026] Exchange Flow Redistribution: Whale Deposit Activity Grows Amid Declining Stablecoin Inflows](https://i0.wp.com/bucket.cryptoquant.com/research/vhKU3eAo_f9d6c7c031686bfd623832b4a9af0d3e55ed890a23e747cab76d866905521427.png?ssl=1)

Supply: CryptoQuant

In the meantime, the continuing stream of stablecoins out of exchanges factors to a decline in marginal shopping for energy (or “dry powder”) within the Bitcoin market. In accordance with CryptoQuant knowledge, net USDT flows into exchanges have fallen sharply from a one-year excessive of $616M in November 2025 to solely $27M, turning unfavourable at instances (-$469M in late January).

Finally, the mixture of the elevated promoting stress from Bitcoin’s giant holders, rising altcoin distribution, and constant stablecoin outflows means that the crypto market construction stays prone to additional draw back volatility.

Bitcoin Value At A Look

As of this writing, the worth of Bitcoin stands at round $67,580, reflecting a gentle 1% improve prior to now 24 hours.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.