The Bitcoin (BTC) market took a constructive flip prior to now week rising by 1.10% in response to knowledge from CoinMarketCap. Whereas there are nonetheless expectations of an additional worth correction, the consequences of macroeconomic developments as seen with latest statements from US President Donald Trump solid extra uncertainty over the premier cryptocurrency’s future trajectory.

Bitcoin Bulls Face A Showdown At $98K Resistance – Can They Break By means of?

Following an prolonged market correction, Bitcoin recorded spontaneous market good points within the final week reaching a neighborhood peak of spherical $95,000. At present, the crypto asset trades round $86,000 with little indication of its future motion.

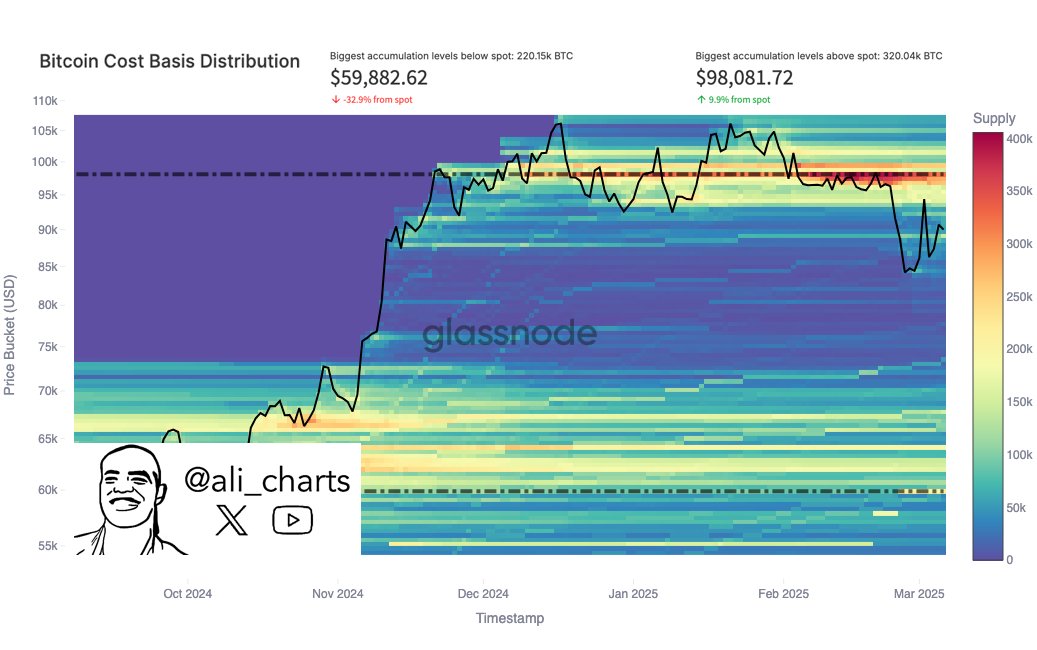

In response to prime market analyst Ali Martinez, Bitcoin’s worth motion is at present caught between two key accumulation ranges based mostly on its price foundation distribution (CBD) — the allocation of Bitcoin holdings in response to the value at which completely different buyers acquired their BTC. The CBD helps to establish main assist and resistance ranges by exhibiting the place important quantities of Bitcoin have been purchased or bought.

Primarily based on the CBD knowledge, Ali Martinez explains in making any additional good points, Bitcoin will face a key resistance at $98,081. This prediction stems from buyers beforehand buying 320,040 BTC at this worth area and are more likely to promote following a worth rebound to exit the market with little or zero losses. Nevertheless, if Bitcoin bulls can mount adequate shopping for stress to interrupt previous this resistance degree, it paves the best way for a return above $100,000 and maybe a brand new all-time excessive.

However, ought to BTC resume its correction development, Martinez highlights that the subsequent important assist degree based mostly on accumulation knowledge is at $59,882 at which 220,150 BTC have been beforehand accrued.

If Bitcoin declines towards these assist ranges, it’s more likely to expertise a powerful bounce as long-term holders are more likely to purchase extra BTC to defend their positions. Curiously, this evaluation aligns with different market insights that counsel BTC is more likely to endure additional correction. Nevertheless, it’s value noting that any decisive break under $59,882 would set off a large quantity of panic promoting.

BTC Value Outlook

On the time of writing, BTC trades at $85,995 following a minor 1.98% decline prior to now day. In the meantime, its each day buying and selling quantity is down by 6.38%, indicating a lower in market curiosity. Amidst constructive occasions just like the institution of a US Strategic Bitcoin Reserve, the BTC market stays in a reasonably risky state as indicated by the bigger market response to occasions of the previous week.

Featured picture from Morningstar, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.