BitMine Immersion Applied sciences added extra ethereum final week, regardless that its current stash sits deep within the crimson. ETH slid to round $2,280 (-2.5%), effectively beneath the corporate’s common entry worth. This transfer lands as crypto markets wobble, with traders speeding to money and gold.

On paper, BitMine is down over $6 billion on its ETH place. That sounds reckless. Or it feels like long-term conviction. The distinction issues to your cash.

BREAKING: BitMine’s, $BMNR, unrealized ETH losses rise to -$6.6 billion, now on observe to develop into the fifth largest documented principal buying and selling loss in historical past if offered.

Unrealized losses at the moment are at ~66% of the dimensions of Archegos in 2021, the biggest loss ever recorded. pic.twitter.com/JLHqMDLL1M

— The Kobeissi Letter (@KobeissiLetter) February 2, 2026

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2026

Why Would Bitmine Purchase ETH Whereas Shedding Billions?

BitMine runs an Ethereum treasury technique. Consider it like an organization selecting to carry gold bars as an alternative of {dollars}. On this case, the “gold” is ETH.

Final week, BitMine picked up 41,788 ETH, pushing its whole holdings above 4.2 million tokens. The agency began shopping for in June when ETH traded close to $2,480. At this time’s worth sits decrease, which implies each new purchase averages down the price.

This mirrors what Michael Saylor did with Bitcoin years in the past. Purchase throughout ache. Maintain by way of noise. Guess that the asset issues long run.

Ethereum’s Value is Falling, However Utilization Tells a Totally different Story

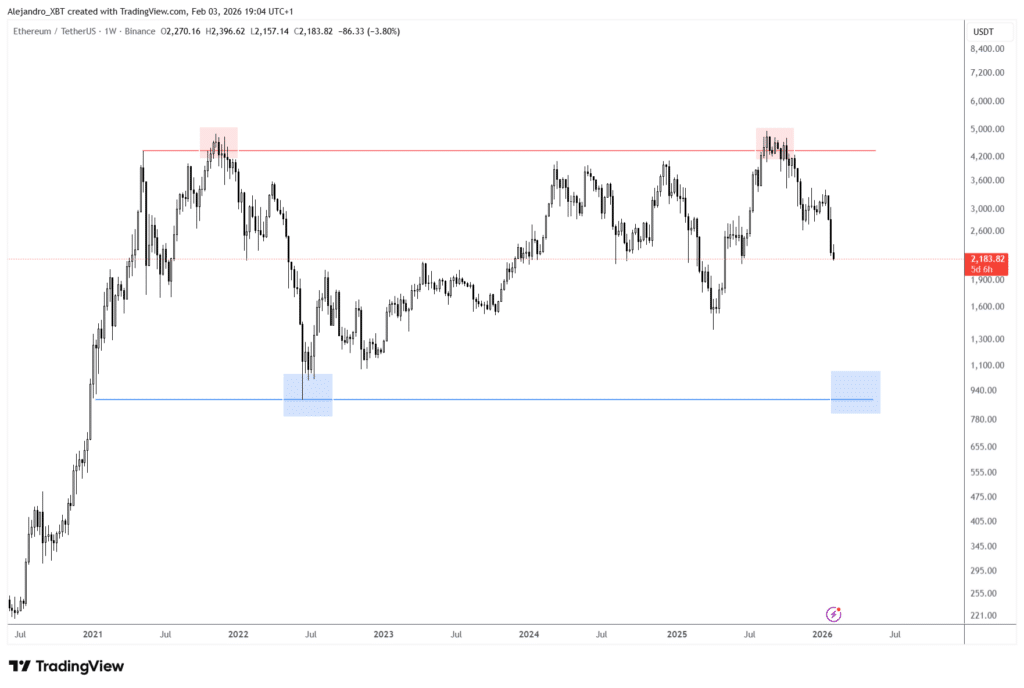

ETH has dropped by greater than 18% over the previous week. That appears like hazard. Value drops harm. Quick.

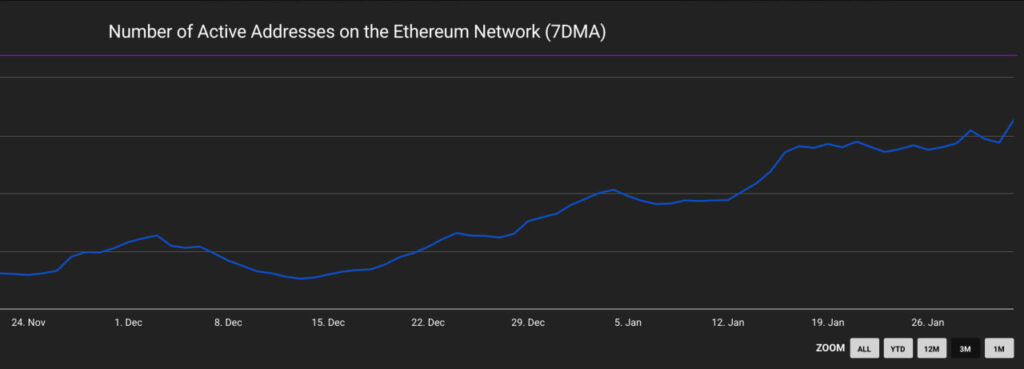

However Tom Lee factors to one thing most individuals miss. On-chain exercise retains climbing. Which means extra transactions and extra lively wallets. Consider it like a freeway. Even when toll costs fall, visitors retains rising.

(Supply: Variety of Lively Addresses on the Ethereum Community / The Block)

Throughout previous crypto winters, utilization dried up. This time, it hasn’t. That’s why BitMine frames the dip as a reset, not a collapse.

We coated the Ethereum worth decline earlier this month, and the identical pressure stays. Weak worth. Sturdy utilization.

DISCOVER: High 20 Crypto to Purchase in 2026

What this implies for on a regular basis traders watching ETH

BitMine’s guess sends a sign. Some establishments nonetheless see ETH as core monetary plumbing, not a meme commerce. Sensible contracts, stablecoins, and DeFi apps nonetheless run on it.

That doesn’t imply the worth will rebound tomorrow. Bitcoin simply dipped beneath $74,000, dragging the market with it. Danger-off conduct guidelines proper now.

(Supply: ETHUSD / TradingView)

For those who’re new, right here’s the interpretation. Large gamers’ shopping for doesn’t cancel volatility. It solely exhibits the time horizon. BitMine can wait years. Are you able to?

DISCOVER: High Solana Meme Cash to Purchase in 2026

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Knowledgeable Market Evaluation

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now