For the entire improvements on the planet of investing, fractional investing—which includes enabling buyers to purchase and promote parts of a single share of inventory—is among the many most vital. Fractional investing has helped democratize entry to investments that traditionally have been out of attain for a lot of particular person buyers. Fractional investing permits each decrease minimal funding necessities in addition to micro-investing to assist buyers with restricted capital create diversified portfolios.

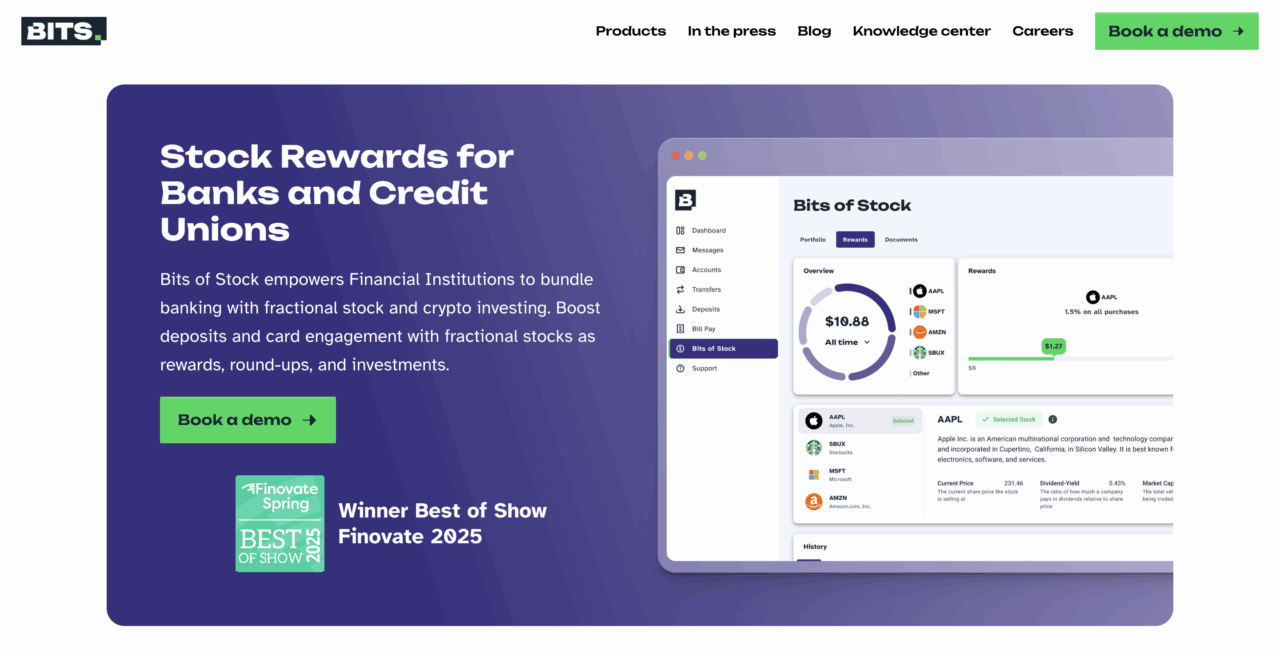

Bits of Inventory, a New York-based fintech that received Better of Present in its return to the Finovate stage earlier this yr at FinovateSpring in San Diego, is an instance of an organization that’s bringing the advantages of fractional investing to a wider vary of buyers, together with members of credit score unions like Cardinal Credit score Union. Final month, the not-for-profit cooperative introduced a partnership with Bits of Inventory to supply a brand new inventory rewards program for Cardinal CU checking account holders aged 18 to twenty-eight.

This system permits these younger grownup buyers to routinely earn inventory rewards with each Visa debit card buy. These rewards can then be redeemed into fractional shares in choose publicly-traded shares. This system leverages fractional inventory possession to assist younger adults start to construct wealth, develop good investing habits, and increase their understanding of finance.

This age vary could also be key to the profitable adoption of inventory rewards applications primarily based on fractional investing. Of their assertion, Cardinal CU cited business analysis that indicated that 67% of these in Era Z (people aged 13 to twenty-eight), imagine that the flexibility to speculate with smaller quantities is a significant component of their resolution to start investing.

“We’re serving to scholar and youthful members construct a robust basis whereas making investing accessible and rewarding,” Cardinal CU CEO Christine Blake mentioned. ” There’s large worth on this program because it encourages buyers to study accumulating belongings and constructing wealth in early maturity.”

Mentor, Ohio-based Cardinal CU has built-in Bits of Inventory into its digital banking platform, which is powered by Lumen Digital. Bits of Inventory’s dashboard gives a brokerage account-like expertise for customers, serving to them develop into extra conversant in the usual instruments utilized by merchants and buyers to purchase and promote shares available in the market.

“Bits of Inventory is redefining how folks take into consideration rewards and investing,” Bits of Inventory CEO Arash Asady defined. “This initiative is a game-changer for youthful buyers, permitting them to start out constructing wealth via on a regular basis spending and to observe their investments develop.”

Extra not too long ago, Bits of Inventory introduced that it had cast a strategic alliance with fellow Finovate alum Jack Henry. As with Cardinal CU, the partnership with fintech resolution supplier Jack Henry will contain embedding Bits of Inventory’s fractional share-based inventory rewards functionality right into a digital banking platform—on this case, Jack Henry’s Banno Digital Platform.

Of their alliance announcement, the businesses underscored the success that Credit score Union One in all Oklahoma skilled after launching a complete three-tier checking account with embedded Bits of Inventory capabilities. This enabled the establishment to check a wide range of choices, from free accounts with round-ups to premium accounts that offered 1% inventory rewards on all purchases.

“We had been so impressed with member response throughout testing that we built-in inventory investing capabilities into each checking account tier,” Credit score Union One in all Oklahoma President and CEO Tyrel McCain mentioned. “It creates a pure development the place members can begin with free entry factors and graduate to incomes inventory rewards as they deepen their relationship with us. It’s driving each new account openings and price revenue whereas serving to our members construct wealth via on a regular basis spending.”

Based in 1949 to serve workers working in a handful of state companies, Credit score Union One in all Oklahoma turned a neighborhood chartered credit score union in Could 2003. The establishment at this time boasts greater than 3,700 members and $48 million in belongings.

Picture by Hanna Pad

Views: 12